A growing literature explores structural fund sector vulnerabilities in the form of fire sale externalities. In this policy brief, we uncover a previously neglected, yet very important source of fund sector vulnerabilities that arises because funds increasingly invest in other funds. Such cross-holdings can serve as a means to transmit and amplify shocks through a network of fund-to-fund connections. We propose an integrated framework to quantify fund sector vulnerabilities due to both indirect (overlapping asset portfolios) and direct connections (cross-holdings). In our empirical application, we first show that funds’ cross-holdings harbour vulnerabilities. Secondly, we highlight contagion risks to the broader financial system.

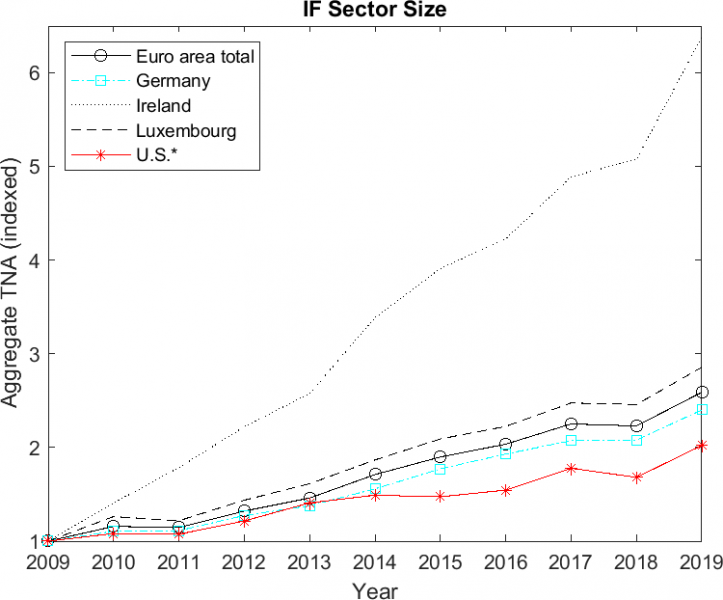

The connectedness of the financial system can be a source of financial instability. Ever since the global financial crisis of 2007-08, much research has been devoted to the role of banks (Glasserman and Young (2016)), but over recent years the focus has shifted towards non-bank financial intermediaries. In this regard, open-ended investment funds have received particular attention both due to their strong growth (left panel of Figure 1) and due to the presence of liquidity and run risks (e.g., Goldstein, Jiang, and Ng (2017)). A growing literature explores structural fund sector vulnerabilities in the form of fire sale externalities and there is substantial evidence that funds’ fire sales have persistent effects on asset prices and their comovement (e.g. Antón and Polk (2014)).

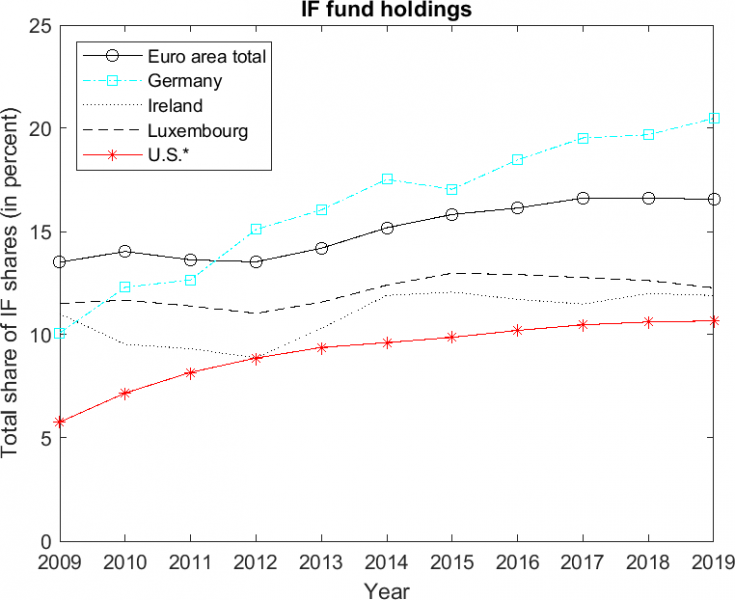

Figure 1: Growth and direct connectedness of funds in major fund domiciles around the world. Left: aggregate total net assets under management (indexed to December 2009 = 1). Right: aggregate portfolio share of fund shares in funds’ asset portfolios (in percent).

|

|

Source: Fricke and Wilke (2020).

This policy brief summarizes recent research (Fricke and Wilke (2020)) that uncovers a previously neglected, yet very important source of fund sector vulnerabilities that arises because funds increasingly invest in the shares of other funds. Such direct fund-to-fund connections (or cross-holdings) have the potential to amplify vulnerabilities from funds’ fire sales, since these connections serve as a means to transmit losses through a network of linkages. For example, when a given fund A invests in another fund B, losses of fund B will also affect fund A. If other funds now invest in fund A, losses of fund B (and of fund A) will propagate further through the cross-holdings network. While such direct institution-to-institution connections and their financial stability implications have been studied extensively in the case of banks (e.g., Elliott, Golub, and Jackson (2014)), we are the first to investigate similar aspects in the context of funds’ cross-holdings.

As an illustration of their potential economic importance, the right panel of Figure 1 shows that in many jurisdictions fund cross-holdings increased quite dramatically over recent years. For example, the aggregate share of fund shares in German investment funds’ asset portfolios has increased from around 10% to more than 20% since 2009.

We develop a macroprudential framework to quantify (ex-ante) fund sector vulnerabilities. Specifically, we add funds’ cross-holdings to the framework of Greenwood, Landier, and Thesmar (2015) and Fricke and Fricke (2020). The basic steps of the model are as follows:

Step 0: We impose an initial shock on funds’ asset portfolios (bonds and equities).

Step 1: The initial portfolio losses lead to further losses due to funds’ cross-holdings.

Step 2: Fund managers may need to liquidate assets:

a) In response to the initial shock, fund investors redeem some of their fund shares (flow-performance relationship, FPR).

b) Fund managers have fixed financial leverage targets (LT). For funds that make use of leverage, asset sales may be necessary to de-lever.

Step 3: Funds’ asset liquidations negatively affect market prices. This leads to:

a) Losses on funds’ bond and equity holdings.

b) Losses on funds’ cross-holdings (as in Step 1).

Compared with prior work, our main modelling contribution is to also incorporate losses due to fund cross-holdings (Steps 1 and 3b). The fund sector’s aggregate vulnerability (AV) is defined as the sum of funds’ portfolio losses due to their common asset liquidations (Step 3a) and due to their cross-holdings (Steps 1 and 3b), normalized by the aggregated pre-shock total net assets (TNA). The AV measures systemic risks from funds’ connectedness and combines information from a number of commonly used macroprudential fund sector risk indicators, such as funding instability and leverage.

In our empirical application, we use a unique dataset on the German investment fund sector, which is the third-largest in the euro area.2 The dataset provides us with highly granular information on funds’ assets and liabilities, in particular on the time-varying ownership structure of funds. In addition, we take a more system-wide view on fund sector vulnerabilities, since we incorporate a broad range of fund types in our model application (equity funds, bond funds, mixed funds, and fund-of-funds). This is in stark contrast with previous work on fire-sale related fund sector vulnerabilities, which focused exclusively on specific fund types in isolation (in particular, corporate bond funds due to their illiquid asset portfolios).

Our empirical analysis shows that the fund sector’s connectedness indeed harbours vulnerabilities, with cross-holdings playing an important role. We assume a stress scenario that roughly matches the price dynamics around the collapse of Lehman Brothers in September 2008, resulting in average initial losses of -6.6% to the fund sector’s TNA.

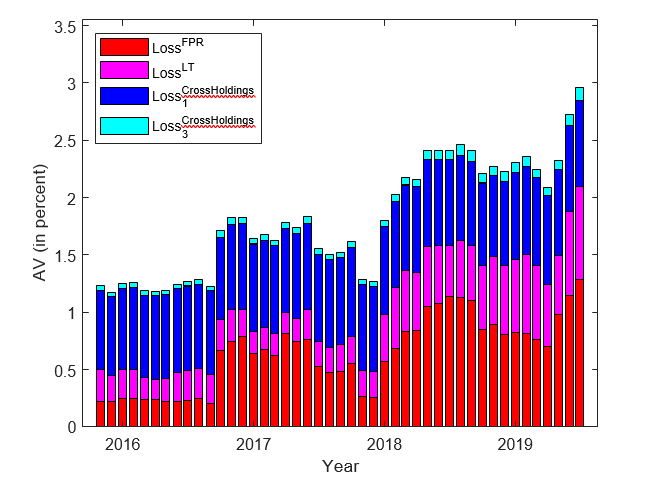

Figure 2: Relative contribution of the different channels to the AV, over time. We apply the model separately for each month. The asset-level initial shock is -4.5% for bonds and -14.2% for equities. LossFPR contains losses due to fund investors redeeming their fund shares, LossLT losses resulting from funds’ leverage targeting. Finally, LossCrossHoldings quantifies additional losses due to fund cross-holdings.

Source: Fricke and Wilke (2020).

The average AV over the period from November 2015 to July 2019 is 1.8%, indicating that the connectedness of the fund sector can indeed amplify stress events. In fact, the second-round losses can amount to up to 44% of the initial shock. Moreover, the AV displays a strong positive time trend as it rose by 140% over our relatively short sample period (Figure 2), leaving the fund sector increasingly vulnerable to asset price shocks. Importantly, we find that direct fund-to-fund connections matter, since nearly half of the AV is due to cross-holdings (the blue components in Figure 2).

We also document marked contagion risks to the broader financial system. Given that German investment funds are predominantly held by financial intermediaries outside the fund sector, these actors would bear the vast majority of fund sector losses. These contagion risks can indeed be substantial: for example, pension funds receive second-round losses on their fund investments of up to 70% of their initial losses. Overall, while economically large, we should stress that our approach likely underestimates the vulnerability of the financial sector to fund sector losses, since we only include (German) investment funds in our application.

Our empirical analysis highlights that direct fund-to-fund connections contribute substantially to vulnerabilities emerging within the fund sector. These cross-holdings must therefore be taken into account to accurately assess the sector’s overall vulnerability. In fact, our results indicate that prior work, which focused exclusively on funds’ overlapping asset portfolios, substantially underestimated fund sector vulnerabilities. We therefore propose that funds’ cross-holdings should deserve further attention in the future. In this regard, our framework serves a useful starting point. Crucially, the framework also allows for including non-fund financial intermediaries (such as banks) which would be important to assess financial system-wide vulnerabilities in the future.

Antón, M. and C. Polk (2014). Connected stocks. Journal of Finance 69, 1099–1127.

Elliott, M., B. Golub, and M. O. Jackson (2014). Financial networks and contagion. American Economic Review 104 (10), 3115–3153.

Fricke, C. and D. Fricke (2020). Vulnerable asset management? The case of mutual funds. Journal of Financial Stability (forthcoming).

Fricke, D. and H. Wilke (2020). Connected funds. Deutsche Bundesbank Discussion Paper 48/2020.

Glasserman, P. and H. Young (2016). Contagion in financial networks. Journal of Economic Literature 54 (3), 779–831.

Goldstein, I., H. Jiang, and D. Ng (2017). Investor flows and fragility in corporate bond funds. Journal of Financial Economics 126 (3), 592–613.

Greenwood, R., A. Landier, and D. Thesmar (2015). Vulnerable banks. Journal of Financial Economics 115, 471–485.

Daniel Fricke: Deutsche Bundesbank, Directorate General Markets, Wilhelm-Epstein Str.14, 60431 Frankfurt am Main. Phone: +49 (0)69 9566 1279. E-Mail: daniel.fricke@bundesbank.de; Hannes Wilke: Deutsche Bundesbank, Directorate General Financial Stability, Wilhelm-Epstein Str. 14, 60431 Frankfurt am Main. Phone: +49 (0)69 9566 7492. E-Mail: hannes.wilke@bundesbank.de. The views expressed represent the author’s personal opinions and do not necessarily reflect the views of the Deutsche Bundesbank or the Eurosystem.

The dataset combines information from the investment fund statistics of the Deutsche Bundesbank, the Eurosystem’s Centralised Securities Database, and the German Securities Holdings Statistics. See Fricke and Wilke (2020) for details.