This non-technical note is based on NBER Working Paper No. 34099, “When is Less More? Bank Arrangements for Liquidity vs Central Bank Support.”

Abstract

In spite of substantial central bank intervention, the frequency of financial crises has not fallen, and by some measures, have in fact grown in magnitude. We explain this conundrum by revisiting the theory of fire-sale externalities and the optimal design of public liquidity infusions aimed at addressing these. We show that the existence of a private market for insurance such as contingent capital – which existed prior to central banking and deposit insurance – can lead to efficient outcomes by eliminating the incentives for banks to overinvest and issue excessive money-like deposit liabilities. However, it does not eliminate fire sales. A central bank that can infuse liquidity cheaply may be motivated to intervene in the face of fire sales. If so, it can crowd out the private market and, if liquidity intervention is not priced at higher-than-breakeven rates, induce overinvestment and excessive financial fragility.

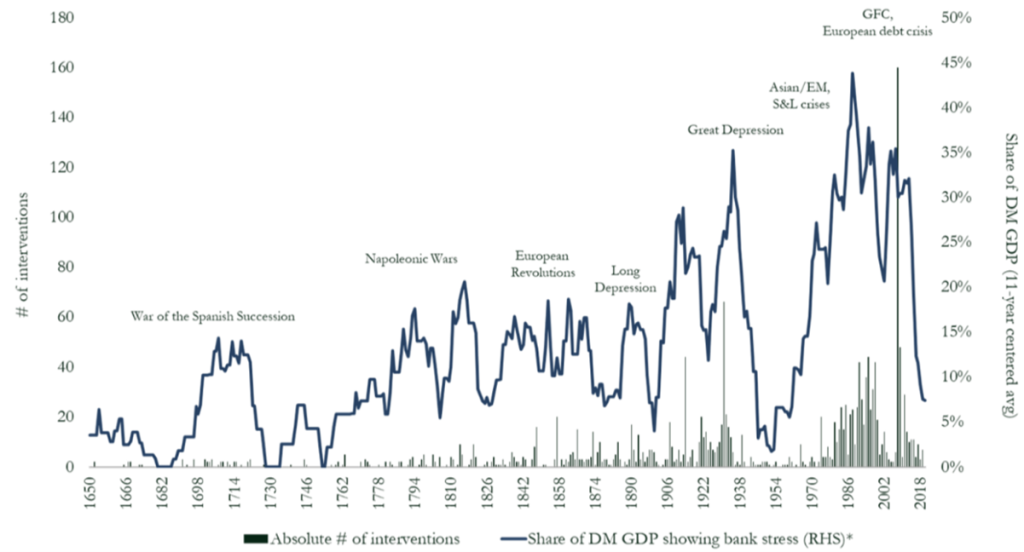

Over the past century, there has been a significant increase in the scale and scope of central bank interventions in response to banking crises, alongside the introduction of public insurance schemes such as deposit insurance (Bordo and Siklos, 2018; Metrick and Schmelzing, 2021, especially Figure 1 reproduced below). In particular, since World War II, central bank policy responses to financial crises have become “close to systematic” (Ferguson et al., 2023). Puzzlingly, despite the presence of ex-ante public backstops and large-scale public liquidity provision ex post, significant banking crises continue to occur across the world (for example, as shown in Figure 2 from Reinhart and Rogoff (2013) below), including in advanced economies with comprehensive regulatory frameworks (as evidenced by the widespread recent banking stress around the failure of Silicon Valley Bank in 2023). Why?

Figure 1. Central Bank Intervention Over Time

Source: Metrick and Schmelzing (2021).

Figure 2. Proportion of Countries with Banking Crises, 1900-2008

Source: Reinhart and Rogoff (2013). The countries are weighted by their share of world income.

At the heart of banking crises lies the fundamental nature of liquidity transformation: banks borrow short to lend or invest long in illiquid assets. Occasionally, accidents happen, and banks fall short of liquidity, forcing them to liquidate assets in a fire sale. Contingent liquidity or capital can be helpful under such circumstances in reducing costly fire sales. While central bank interventions have become a familiar response, a fundamental question arises: what form should that contingent liquidity take? Should it be in the form of private insurance arrangements such as private sector promises to provide transfers in exchange for a pre-committed fee (callable or contingent equity)? Or should it be public liquidity support in the form of central bank bailouts or loans at a high rate (à la Bagehot, 1873) after the need arises? Or should it be pre-positioned liquidity arrangements with the central bank (see Tuckman, 2012; King, 2016; Nelson, 2023; Hanson et al, 2024), and if so, what fee should the central bank charge? In this paper, we analyze all these mechanisms and how they influence each other.

In Stein (2012), the influential and tractable model we will base our analysis on, a banking sector raises funds from households by issuing a mix of money-like short-term liabilities and long-term bonds, and investing the funds in long-term projects (the banking sector in his model is clubbed together with the project managers for simplicity). Money-like liabilities are cheaper funding than bond funding because holders are willing to pay a liquidity premium for them, so long as they stay risk-free. However, at a future date, the projects may be hit by an adverse shock in some state of the world, in which case holders of short-term liabilities will come for their funds. Each (symmetric) bank will have to sell projects in the market to raise funds to repay short-term liability holders, possibly at fire-sale prices. Importantly, the amount of money-like liabilities the bank can issue initially can be constrained by the need to have enough saleable assets at that future date to pay off all the money-like liabilities – a kind of “collateral constraint” on initial money issuance.

The buyers of fire-sold assets in Stein’s model are private (in his language, “patient”) investors with a limited endowment of funds – and the fire-sale discount is because they will have to buy “fire-sold” projects instead of investing in their own opportunities so there is an opportunity cost of purchases.

In the Stein model, the bank may overinvest in projects in order to alleviate the collateral constraint on financing with cheap money-like liabilities. The bank does not internalize the fact that while its own collateral constraint is getting loosened, the additional investment and fire sales increase the size of the fire sale discount for all, tightening other banks’ collateral constraint. Stein (2012) then examines supervisory and monetary actions that could limit the bank’s incentive to overinvest in projects and overissue money.

In this paper, we start with a different question. First, is there a private fix to the problem? Can banks arrange insurance privately to relax the collateral constraint? Second, what can the central bank do to augment private sector efforts, and does it help or hurt? In particular, how does the public provision of (contingent) liquidity affect the private provision of (contingent) capital or liquidity?

We show that there is indeed a simple private solution to the potential problem of overinvestment when money creation is collateral constrained: allow the bank to arrange for committed fund inflows from the private investor conditional on an adverse shock hitting, for which the bank will pay in future normal states. Such an arrangement ensures the collateral constraint never binds because a bank that wants to issue more money-like deposits simply buys more contingent capital insurance. Outcomes are once again socially optimal. Of course, the banking system may issue more money-like liabilities than in the Stein model where such contingent capital is not available. Indeed, under some conditions, it may even fund itself entirely with money-like liabilities, investing in both bonds and projects. In other words, if the premium that investors are willing to pay to hold money-like bank liabilities is high, the bank may take on more liquidity risk than strictly required by project financing in order to fully exhaust the benefit of issuing money-like assets. Nevertheless, the contingent capital inflows mitigate fire sales, ensuring that the collateral constraint is not binding and private outcomes are socially optimal.

Such privately arranged contingent funding is not merely a theoretical curiosity. Banks in the past had unlimited liability in a number of countries (Hickson and Turner, 2003; Kenny and Ogren, 2021) and double liability in the United States till the Great Depression (Macey and Miller, 1992; Bodenhorn, 2015; Aldunate et al., 2019). Another version of greater liability was where bank shareholders paid in capital less than the par value of shares and were liable for the remainder on call (see, for example, the discussion in White (1995) on free banking in Scotland before 1844). All these are situations where the bank had a call on the capital/wealth of shareholders, and the call would come in distressed times.

More recently, contingent convertible bonds (see Flannery, 2005; Kashyap, Rajan, and Stein, 2008; French et al., 2010; Flannery, 2014) have been proposed to reduce bank debt and enhance equity in distressed times, potentially allowing banks to raise funding. Vallee (2019) and Avdjiev et al. (2020) present empirical evidence that such contingent convertible capital securities can reduce bank fragility. The historical evidence, which we will discuss in detail later, also suggests such instruments helped bolster bank stability.

Of course, one can make assumptions that make contingent funding contractually difficult, thus recovering the spirit of overinvestment due to fire-sale externalities. We do believe, however, that such contracting difficulties should not be overstated. The absence of private contingent funding in recent times may have more to do with the scale and scope of central bank interventions than the contractual difficulties associated with such instruments. Indeed, we show that this is theoretically the case regardless of whether there are such contractual difficulties or not.

Let us elaborate. What happens if we add an interventionist central bank that can infuse liquidity more cheaply than the private sector into the mix (a possibility that became more realistic as countries left the gold standard and final settlement became possible in central bank issued fiat money)? The welfare implications turn on three issues. First, can the central bank commit to a policy of specific intervention, or does it react according to the needs of the moment? Second, does the central bank charge the needy bank for its intervention, and under what circumstances does it recover the appropriate charge? Third, is there a cost to the central bank of intervening, and what form does it take?

While we examine a variety of cases in the paper, for this policy brief we will focus on two cases for illustrative purposes, assuming all players can game out the reactions of others so that we can restrict the analysis to subgame perfect equilibria. The first case is a “bailout” central bank, which seeks only to reduce fire sales ex post by infusing funds into distressed banks, without seeking to recover the funds later from the banks.

This is certainly the case if the central bank has no additional powers of obtaining repayment than the private sector. Given that a bank knows fire sales will be reduced ex post through central bank intervention, it has the incentive to increase up front financing through money-like liabilities – in the model, this exactly offsets central bank intervention. Moreover, if the extent of the bailout is proportional to the investment (or bank size), the bank has the incentive to increase investment since it does not bear bail out costs. The net effect is that realized fire-sale costs do not change since banks take on more illiquidity risks up front to offset central bank intervention. And because banks do not pay the cost of central bank intervention, they also overinvest.

Importantly, the anticipation of central bank intervention could crowd out private insurance arrangements such as contingent capital support. In other words, as shown in Figure 3 (where Planner denotes outcomes that are socially desirable and feasible while Bailout indicates outcomes when the central bank bails the system out), the market for private contingent capital may disappear endogenously. This is because the bailout central bank induces higher real investments (the asset-side of bank activity) as the (inefficient) way to support money issuance in preference to arranging contingent capital (the liability-side of bank activity). Clearly, the latter is the preferred outcome. The crowding-out of private insurance via the liability side is evidenced by the disappearance of additional or even unlimited shareholder liability, as well as the secular decline in banks’ capital ratios in the past 140 years (see, e.g., Alessandri and Haldane, 2009).

Figure 3. Model Outcomes Under a Bailout Central Bank

Note: The figure illustrates banks’ choices of investments, money creation, private insurance, and the central bank’s ex-post liquidity provision in the fire-sale state. Dashed lines show outcomes under a bailout central bank, and solid lines show outcomes under a social planner.

In the second case, the central bank pre-commits to lend conditional on stress (think of these as resembling proposals for banks to pre-position assets with the central bank that they can borrow against in times of liquidity stress). By charging a premium for the liquidity support, the central bank can reduce the bank’s incentive to overinvest. However, shielded from market forces and subject to political pressures, it is all to easy for the central bank to charge the wrong price for support to market participants. For instance, we argue the actuarially fair price (the price at which the central bank breaks even on the support) is too low a price to charge for pre-committed liquidity; the right price is one that reflects the private costs of fire sales even though central bank intervention potentially alleviates fire sales.

Yet at this price the central bank will not help boost asset prices relative to what would prevail in the private market and would end up making money in a systematic way – a red rag for bankers paying fees. Therefore, the actuarially fair price may limit what is politically possible. Overall, we conclude that increasing anticipated interventions by central banks in stress situations without their adequately charging for public liquidity infusions can help explain the continuing incidence of banking stresses.

Worse still is if there is central bank moral hazard – that the central banker’s personal costs of intervention may be quite different from societal costs – for instance, the central banker may worry about the cost of bank failures to their career, while society may pay a larger price in terms of enhanced moral hazard or higher taxes. The augmented Stein model allows us to examine all such possibilities and their effects on welfare.

In the Stein (2012) model, the returns to taking on liquidity risk are capped by a constant money-financing premium. We extend the model in yet another direction by allowing the returns to taking liquidity risk to increase without bound. Specifically, in addition to real investments, we examine the effects of central bank intervention on speculative financial investments that are ultimately funded by banks (for example, via prime-brokerage services). One example is the financing of the Treasury cash-futures basis trade (undertaken by hedge funds) that has raised significant concerns with regards to financial stability. Although it is not socially beneficial in the model, banks engage in such lending because the profits earned (carry or prime brokerage fees) are privately attractive and increase with leverage. We assume that in the crisis state, speculation is subject to margin calls, that is calls on bank liquidity, which add to depositor demands. A bailout central bank not only continues to distort bank choices towards real investments rather than private liquidity insurance, but also over-intervenes ex post. The availability of easy public liquidity induces greater financial speculation ex ante and amplifies liquidity demand during crises, resulting in a larger welfare loss compared to its effects in the baseline model.

Cheap prospective liquidity can increase bank incentives to take advantage of that cheap liquidity. Asset-side actions of overinvestment and financial speculation can be even more distortionary than liability-side actions such as issuing demand deposits, though the two are interrelated. Of course, if central bank intervention is structured right, it can improve matters in states with fire sales. However, it is a tall order to design and price such intervention without distorting bank behavior significantly and without crowding out private markets for insurance.

In summary, our paper makes three fundamental contributions. First, the literature on financial fragility typically presumes away private insurance markets, a premise at odds with historical episodes in which contingent liquidity was privately arranged. As these episodes were prevalent at least a century earlier, it is hard to reconcile the disappearance of private insurance markets with the contracting advances of modern times. Second, and related to the first point, our analysis offers the alternative explanation that the market may be endogenously incomplete because the expanding scale and scope of central-bank interventions crowd out privately supplied contingent capital and liquidity markets. Last but not the least, our framework reconciles the evidence that fragility episodes have increased in scale with virtually no decline in incidence, especially explaining how intervention expectations in the era of modern banking can amplify speculative balance-sheet positions (via repo and derivatives markets) and attendant fragility.

Aldunate, Felipe, Dirk Jenter, Arthur G. Korteweg, and Peter Koudijs. 2019. “Shareholder Liability and Bank Failure.” Working paper, SSRN.

Alessandri, Piergiorgio and Andrew G. Haldane. 2009. “Banking on the State.” Tech. rep., Bank of England.

Avdjiev, Stefan, Bilyana Bogdanova, Patrick Bolton, Wei Jiang, and Anastasia Kartasheva. 2020. “CoCo issuance and bank fragility.” Journal of Financial Economics 138 (3): 593–613.

Bagehot, Walter. 1873. Lombard Street: A Description of the Money Market.

Bodenhorn, Howard. 2015. “Double Liability at Early American Banks.” Working Paper 21494, National Bureau of Economic Research.

Bordo, Michael D. and Pierre L. Siklos. 2018. “Central Banks: Evolution and Innovation in Historical Perspective.” In Sveriges Riksbank and the History of Central Banking, edited by Rodney Edvinsson, Tor Jacobson, and Daniel Waldenstrom, Studies in Macroeconomic History. Cambridge University Press, 26–89.

Ferguson, Niall, Martin Kornejew, Paul Schmelzing, and Moritz Schularick. 2023. “The Safety Net: Central Bank Balance Sheets and Financial Crises, 1587-2020.” Working Paper 17858, CEPR.

Flannery, Mark J. 2005. “No Pain, No Gain? Effecting Market Discipline via “Reverse Convertible Debentures”.” In Capital Adequacy beyond Basel: Banking, Securities, and Insurance. Oxford University Press.

———. 2014. “Contingent Capital Instruments for Large Financial Institutions: A Review of the Literature.” Annual Review of Financial Economics 6: 225–240.

French, Kenneth R., Martin N. Baily, John Y. Campbell, John H. Cochrane, Douglas W. Diamond, Darrell Duffie, Anil K Kashyap, Frederic S. Mishkin, Raghuram G. Rajan, David S. Scharfstein, Robert J. Shiller, Hyun Song Shin, Matthew J. Slaughter, Jeremy C. Stein, and Rene M. Stulz. 2010. The Squam Lake Report: Fixing the Financial System. Princeton University Press.

Hanson, Samuel G., Victoria Ivashina, Laura Nicolae, Jeremy C. Stein, Adi Sunderam, and Daniel K. Tarullo. 2024. “The Evolution of Banking in the 21st Century: Evidence and Regulatory Implications.” Brookings Paper on Economic Activity: 343–389.

Hickson, Charles R. and John D. Turner. 2003. “The Trading of Unlimited Liability Bank Shares in Nineteenth-Century Ireland: The Bagehot Hypothesis.” The Journal of Economic History 63 (4):931–958.

Kashyap, Anil, Raghuram Rajan, and Jeremy Stein. 2008. “Rethinking capital regulation.” Proceedings – Economic Policy Symposium – Jackson Hole: 431–471.

Kenny, Sean and Anders Ogren. 2021. “Unlimiting Unlimited Liability: Legal Equality for Swedish Banks with Alternative Shareholder Liability Regimes, 1897-1903.” Business History Review 95 (2):193–218.

King, M.A. 2016. The End of Alchemy: Money, Banking and the Future of the Global Economy. W. W. Norton & Company.

Macey, Jonathan and Geoffrey Miller. 1992. “Double Liability of Bank Shareholders: History and Implications.” Wake Forest Law Review.

Metrick, Andrew and Paul Schmelzing. 2021. “Banking-Crisis Interventions Across Time and Space.” Working Paper 29281, National Bureau of Economic Research.

Nelson, Bill. 2023. “CLF Notes – What is a Committed Liquidity Facility?” Tech. rep., Bank Policy Institute.

Reinhart, Carmen M. and Kenneth S. Rogoff. 2013. “Banking crises: An equal opportunity menace.” Journal of Banking and Finance 37 (11): 4557–4573.

Stein, Jeremy C. 2012. “Monetary Policy as Financial Stability Regulation.” The Quarterly Journal of Economics 127 (1): 57–95.

Tuckman, Bruce. 2012. “Federal Liquidity Options: Containing Runs on Deposit-Like Assets Without Bailouts and Moral Hazard.” Journal of Applied Finance 22 (2):20–38.

Vallee, Boris. 2019. “Contingent Capital Trigger Effects: Evidence from Liability Management Exercises.” The Review of Corporate Finance Studies 8 (2):235–259.

White, Lawrence H. 1995. Free Banking in Britain: Theory, Experience, and Debate, 1800- 1845. Institute of Economic Affairs, second ed.