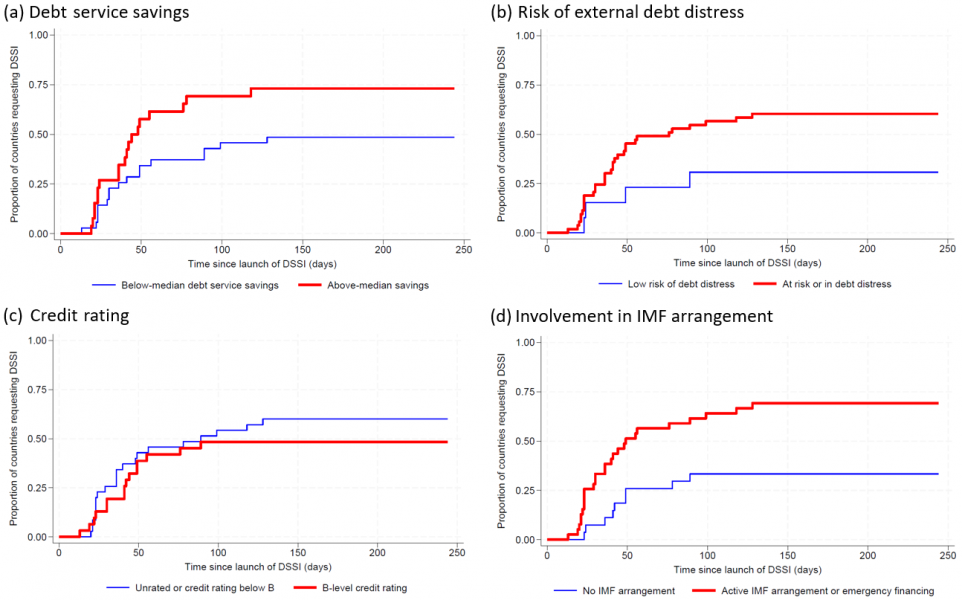

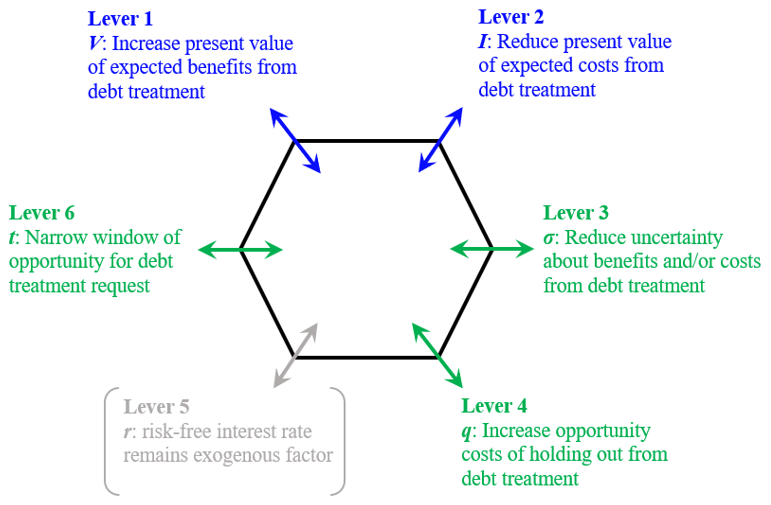

Developing countries have recently proved reluctant to participate in sovereign debt moratoria and debt relief initiatives. We argue that debtors’ (non-)participation can be understood through the lens of real options. Eligible countries compare the net benefits of participating in a debt relief initiative now with the value of waiting and potentially execute their participation option later, when they may have more information on the benefits and costs. Anecdotal evidence and a survival analysis of participation in the Debt Service Suspension Initiative (DSSI) support our real option framing. The real option framework suggest different ways in which participation in debt relief initiatives can be made more attractive to debtor countries.