This policy brief is based on BIS Working Papers No. 1263. The views expressed are those of the authors and not necessarily those of the institutions the authors are affiliated with.

Abstract

This policy brief examines how redemption shocks in investment funds can transmit to bank lending conditions through the withdrawal of wholesale deposits. Using granular Colombian data during the COVID-19 turmoil, we quantify funding losses and their impact on loan maturities, volumes, and rates. Results highlight the bank–fund nexus as a channel of systemic risk, with central bank liquidity facilities playing a key mitigating role.

When investment funds meet banking balance sheets, stability risks can emerge in unexpected ways. In many financial systems – advanced and emerging alike – banks rely on wholesale deposits and other short-term funding from investment funds to manage their liquidity needs. This creates a subtle but powerful nexus between two very different parts of the financial system: banks, which intermediate credit to households and firms, and funds, which manage portfolios for investors seeking market returns.

The connection works smoothly in normal times. Funds place substantial cash with banks, often in the form of large, concentrated deposits, and banks channel these resources into loans and other earning assets. But when funds face sudden redemption pressures – whether triggered by market shocks, interest rate movements, or investor panic – they may rapidly withdraw these deposits to meet outflows (Sarmiento, 2025). If the banks receiving these withdrawals have limited alternative funding sources, they may be forced to cut lending, sell assets, or scramble for expensive emergency liquidity (Pérignon et al., 2018).

The experience of Colombia, as documented in a recent BIS Working Paper (Müller et al., 2025), offers a clear view of how the bank–fund nexus operates under stress. While the institutional set-up is country-specific, the underlying mechanism is not (Fecht and Goldberg, 2025). Episodes such as the 2023 US regional banking turmoil – where uninsured deposit withdrawals played a central role – highlight that liquidity stress in one segment of the financial system can swiftly translate into funding pressure for banks (Acharya et al., 2023; Jiang et al., 2024). Understanding and monitoring this nexus is therefore a priority for supervisors and central banks worldwide. Yet doing so remains analytically and operationally challenging, requiring granular, timely data and an integrated approach to banking and NBFI oversight – capabilities that many jurisdictions are only beginning to develop.

While the idea that investment fund redemptions can affect bank funding is widely acknowledged in supervisory discussions, it is rarely quantified. The difficulty lies in the fact that the relevant flows are fast-moving, cross-sectoral, and often hidden in aggregate banking statistics. Our study on Colombia breaks new ground by developing an empirical design that directly measures the impact of fund redemptions on bank liquidity and credit supply.

The approach combines detailed supervisory datasets from both banks and investment funds, allowing linking each bank’s wholesale deposit funding to specific fund counterparties. This level of granularity is unusual – in most jurisdictions, supervisory data on NBFIs and banks are collected separately and cannot be matched at the entity level. Here, the matched dataset provides a near real-time map of who funds whom.

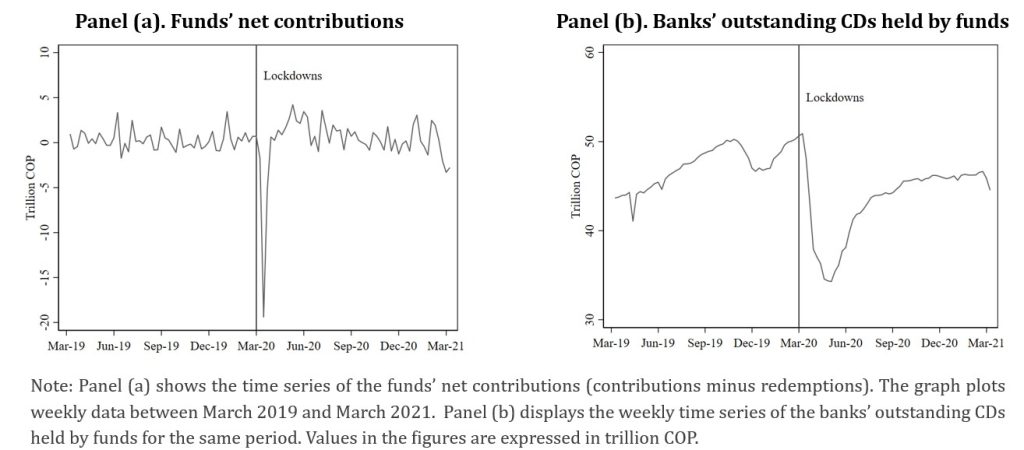

The identification strategy has two stages, addressing omitted variable bias and the endogeneity of fund redemptions. In the first stage, we estimate the weekly effect of fund-specific redemptions on the volume of negotiable certificates of deposit (CDs) a fund holds at a bank. The COVID-19 outbreak in early 2020 provides an exogenous shock, triggering unprecedented redemptions (about 9% of assets under management in two weeks). Figure 1 shows the sharp reversal in funds’ net contributions and the corresponding drop in banks’ outstanding CDs during this period. Bank–time fixed effects ensure that changes in CD holdings reflect fund liquidations to meet redemptions, rather than shifts in banks’ funding strategies.

Figure 1. Redemptions and outstanding certificates of deposit

In the second stage, the analysis focuses on how these funding shocks affected the terms of loans granted to non-financial firms. Using detailed credit registry data at the bank–firm level, we examine how banks’ pre-dated exposure to affected funds shaped subsequent lending conditions. The regression is saturated with borrower–time fixed effects to focus on supply-side adjustments in loan terms. This design allows the study to capture how the sudden materialization of liquidity risk in wholesale deposits influenced loan size, pricing, and maturity structures. The results provide rare, direct evidence that stress in the investment fund sector can translate into tighter credit terms for firms.

The results from the first stage confirm a clear and economically significant link between fund redemptions and the withdrawal of wholesale deposits. During the COVID-19 shock, investment funds reduced their holdings of negotiable certificates of deposit (CDs) in the Colombian banking system by an average of 16% following large redemption episodes, with the impact concentrated in the two weeks of most intense outflows. The effect is robust across a wide range of specifications, including alternative liquidity measures and different definitions of “affected” funds, and remains when excluding funds that were already reducing their bank exposures prior to the shock.

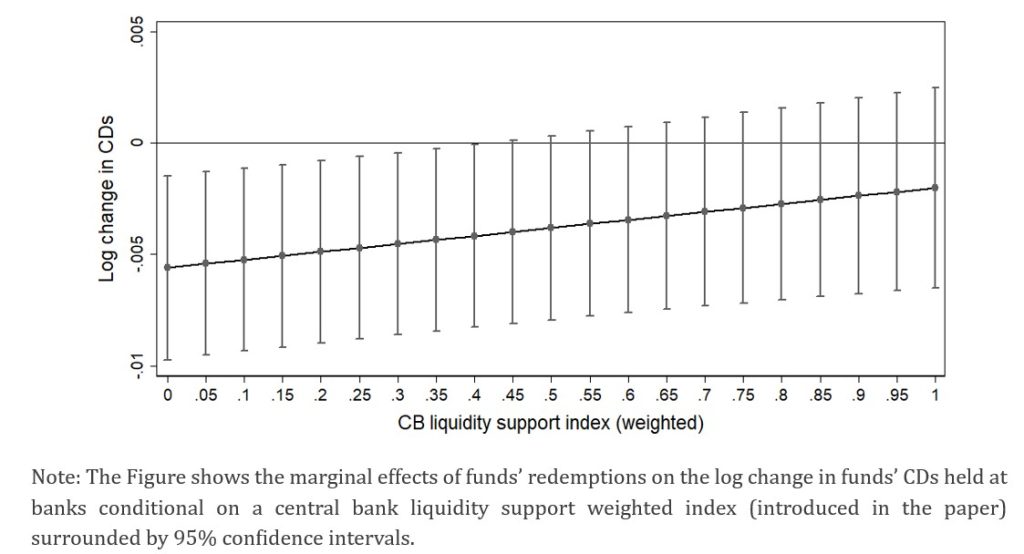

The first-stage estimates also reveal a mitigating role of the Colombian central bank’s liquidity operations. In the wake of the COVID-19 redemption shock, the Banco de la República launched facilities to stabilize wholesale funding markets, including direct purchases of CDs from banks. In spirit, these interventions were similar to those in advanced economies during episodes of market turmoil – for example, the Federal Reserve’s Money Market Mutual Fund Liquidity Facility (MMLF) in 2020 or the European Central Bank’s refinancing operations – providing banks with immediate term funding to offset the withdrawal of deposits by non-bank financial intermediaries.

This cushioning effect is illustrated in Figure 2, which plots the marginal effect of fund redemptions on the percentage change in CDs conditional on the degree of central bank liquidity support. The negative impact of redemptions on bank funding diminishes as liquidity support increases, with confidence intervals suggesting a statistically significant attenuation at higher levels of intervention. In other words, when banks had greater access to the central bank’s facilities, the link between fund withdrawals and wholesale funding stress was markedly weaker.

The second-stage results show that banks more reliant on vulnerable funds before the shock responded by curtailing credit volumes, shortening loan maturities, and raising lending rates. The maturity effect is particularly pronounced: moving from the lower to the upper quartile of pre-shock exposure is linked to loans 9.2–13.3 months shorter, with the largest impact in the first six months. This effect fades over 12 months as liquidity conditions improve. Because exposure is measured ex ante, estimates avoid contamination from endogenous withdrawals, though they may overstate effects if offset by policy support. Indeed, a higher share of CD trades with the central bank in the first three months significantly lengthened maturities, in some cases fully offsetting the negative impact of exposure.

Figure 2. Marginal Effects of Funds’ Redemptions on the Percentage Change in CDs

While the effect of fragile wholesale deposit funding on loan maturities is pronounced, its impact on loan volumes is comparatively modest. Estimates show no evidence of an outright credit crunch; in fact, in some cases, the post-shock interaction term is positive and significant, particularly over a 6–12 month horizon. Moving from the 25th to the 75th percentile of exposure to the redemption shock corresponds to an increase in lending of between COP 343 and COP 668 billion – only 2.3–4.5% of a standard deviation in loan volumes. These results are consistent with the view that timely central bank interventions – including targeted liquidity provision in the CD market – cushioned the shock and prevented a sustained contraction in credit. Indeed, whenever the post-shock exposure effect is insignificant, the share of central bank CD trades is typically positive and significant.

Turning to pricing effects, we find that banks with higher exposure to affected funds charged higher rates on new loans to non-financial firms: loan rates were around 1 percentage point higher for banks in the top quartile of exposure relative to the bottom quartile – an economically significant change amounting to roughly 95% of a standard deviation in loan rates. In this case, we find the effect of central bank liquidity support to be generally insignificant except over longer horizons, where it appears to dampen rates. Overall, while credit volumes held up, borrowers in the real sector faced tighter loan terms through shorter maturities and higher interest rates in the wake of wholesale funding stress.

The Colombian experience underscores how stress in non-bank funding markets can translate quickly into changes in the terms of bank credit (see also Aldasoro et al., 2025). Even in a banking system that avoided a collapse in lending volumes, the shortening of maturities and higher interest rates for real-sector firms point to a tightening of credit conditions with potentially lasting effects on investment and working capital decisions. This mechanism – the bank–funds nexus – is not unique to Colombia. In many jurisdictions, money market funds, investment funds, and other non-bank financial intermediaries hold large volumes of wholesale deposits at banks, often in the form of certificates of deposit (Kleopatra, 2025). When these funds face sudden redemption pressures, they may liquidate bank deposits to meet withdrawals, triggering a funding shock for the affected banks.

The COVID-19 episode in Colombia, with its abrupt wave of fund redemptions, offers an unusually clean identification of this channel. Because the redemption shock was largely exogenous to pre-existing vulnerabilities in individual funds or banks, it provides rare empirical evidence on how this nexus operates in practice – evidence that is often missing in policy debates and instead inferred from theory or anecdotal cases.

Similar dynamics were visible in other contexts. The US regional banking turmoil in March 2023 showed how concentrated and uninsured deposit bases can evaporate under stress, with rapid spillovers to lending behavior. In Europe, episodes of stress in investment funds – such as the 2019 UK property fund suspensions or volatility in European money market funds during March 2020 – similarly raised concerns about bank funding resilience. In each case, the challenge for central banks and supervisors is twofold: first, to understand the scale and structure of banks’ wholesale funding links to NBFIs; and second, to design liquidity backstops and prudential tools that prevent these linkages from amplifying shocks to the real economy.

From a policy perspective, three lessons emerge:

In short, the Colombian evidence adds weight to the view that the resilience of bank funding cannot be assessed by looking only at deposit volumes or capital ratios. Understanding the fragility of wholesale deposits from NBFIs, and how quickly such funding can vanish under stress, is central to safeguarding the stability of credit supply to the real economy.

Acharya, V.V., Richardson, M. P., Schoenholtz, K.L., and B. Tuckman. (2023). SVB and Beyond: The Banking Stress of 2023, Rapid Response Economics Series CEPR, London.

Aldasoro, I., C. Müller, A. Murcia, C. Quicazán, and M. Sarmiento (2025). Funding dry-ups, interest rate risk, and bank lending. Mimeo, Banco de la República.

Fecht, F., and Goldberg, L. S. (2025, August 5). Transmission of liquidity shocks through non-bank financial intermediaries: Evidence from the International Banking Research Network. VoxEU.org. Source: https://cepr.org/voxeu/columns/transmission-liquidity-shocks-through-non-bank-financial-intermediaries-evidence

Jiang, E. X., Matvos, G., Piskorski, T., and A. Seru. (2024). Monetary tightening and U.S. bank fragility in 2023: Mark-to-market losses and uninsured depositor runs? Journal of Financial Economics, 159, 103899.

Kleopatra, N. (2025). Money Market Fund Growth During Hiking Cycles: A Global Analysis, IMF Working Papers 25/150.

Müller, C., M. Ossandon Busch, M. Sarmiento, and F. Pinzon-Puerto (2025). Fragile wholesale deposits, liquidity risk, and banks’ maturity transformation. BIS Working Papers No. 1263, Bank for International Settlements.

Pérignon, C., Thesmar, D., Vuillemey, G. (2018). Wholesale funding dry-ups. Journal of Finance 73, 575–617.

Sarmiento, M. (2025). The transmission of non-banking liquidity shocks to the banking sector. Latin American Journal of Central Banking, 6(2), 100139.