This policy brief does not necessarily reflect the views of the National Bank of Belgium. It is based on the NBB working paper n° 474 “Long-Term Loans and Capital Requirements in Universal Banking: Sectoral Spillovers and Crowding Out Effects” (Lejeune and Mohimont, 2025).

Abstract

In this brief, we present the policy implications of a quantitative DSGE model where universal banks face credit default risks on their long-term corporate and mortgage loans, and must comply with capital requirements. Adding multi-period fixed-rate loans amplifies the propagation of default risks and strengthens the effectiveness of macroprudential policy. This amplification operates through a bank capital channel and a market timing effect that delays borrowing and investment when rates are expected to fall. The bank capital channel also propagates shocks across sectors via universal banks granting both corporate and mortgage loans. Moreover, sectoral prudential policy instruments can have unintended consequences on credit supply in the untreated sector. These crowding out effects increase with the loan duration in the treated sector and with the risk weight differential between the untreated and treated sectors. Finally, we apply our model to the mortgage risk weight add-on introduced in Belgium in 2013.

Since the global financial crisis, it has become evident that financial frictions significantly influence the propagation of macroeconomic shocks and that the financial sector itself can be a source of disturbances for the real economy. In reaction to this situation, macroprudential policies such as Basel III were implemented to enhance the resilience of the financial system.

The leading tool for analyzing macroeconomic policies, the New-Keynesian Dynamic Stochastic General Equilibrium (NK-DSGE) model, has been adapted in the literature to include macro-financial linkages and evaluate macroprudential policy. Among the ingredients added to the standard model, there are typically one-period loans and banks that specialize in specific credit segments. However, universal banking – according to which a bank lends to different credit segments – reflects the actual business model of most European banks. Moreover, long-term loans with fixed rates play a dominant role in advanced countries such as Belgium, France, Germany, the Netherlands, Canada, and the United States. In our research, we contribute to the literature by extending a NK-DSGE model to universal banks that face credit default risks on their long-term loans, and that must comply with capital requirements. The implications derived from this extension are presented in this policy brief.

Our results show that the addition of long-term fixed-rate loans amplifies the propagation of borrower default risks and strengthens the effects of macroprudential policy. These effects arise via two key mechanisms. Firstly, banks maintain precautionary capital buffers to avoid breaching regulatory requirements, passing the associated costs on to borrowers (bank capital channel). Secondly, borrowers postpone borrowing and investment to avoid locking in unfavorable rates when they expect interest rates to fall (market timing channel). Universal banks transmit shocks across sectors, and targeted prudential policies can unintentionally restrict credit in other sectors. These unintended consequences are especially strong when loan durations are long and risk weight differences across sectors are large.

In our model, banks conduct both mortgage and corporate lending activities. Inspired by Clerc et al. (2015), we assume that entrepreneurs and homeowners can default on their loans, opening a borrower leverage channel as originally proposed by Bernanke et al. (1999) and Aoki et al. (2004). To ensure that banks can manage the riskiness of their activities, regulators set minimum capital requirements (as in Basel III) and impose penalties on banks that fail to meet these rules. Following Benes and Kumhof (2015), banks hold precautionary buffers to mitigate the risk of minimum capital requirements being breached, and the resulting capital costs are passed on to their borrowers, opening a bank capital channel. The policies we consider include the Capital Adequacy Ratio (hereafter CAR), the Counter-cyclical Capital Buffer (hereafter CCyB), and the residential mortgages and corporate risk weights.

We explicitly incorporate the long maturities and fixed interest rates typically associated with corporate and mortgage loans. These model extensions significantly influence the bank capital channel and introduce a market timing effect, both of which play a crucial role in shaping the model dynamics. As in Benes and Lees (2010), we assume that bank loans are repaid in an infinite number of geometrically decaying payments, which allows us to easily calibrate the durations observed in bank balance sheets. The model is calibrated to Belgium,1 as this country serves as a particularly interesting case study: about 80% of assets are managed by universal banks, with an average maturity at origination close to 20 years for mortgage loans, and with three quarters of these loans being issued with a fixed interest rate (NBB, 2024).

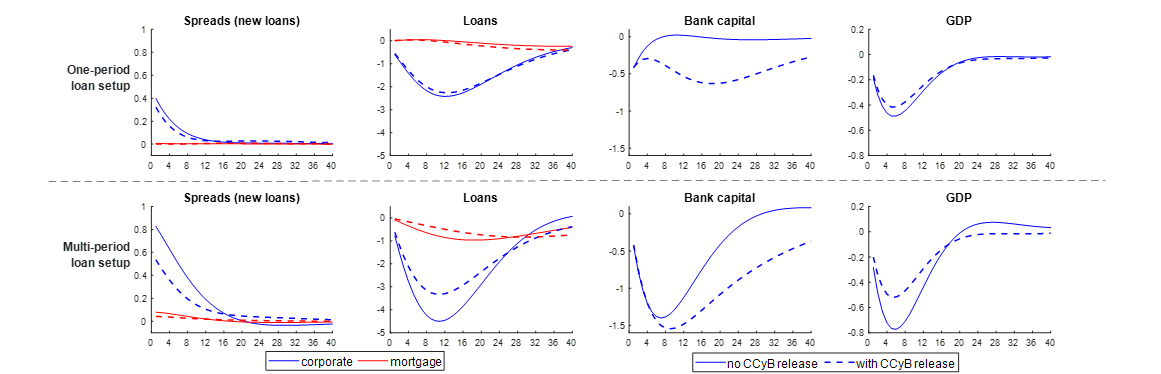

Our model offers important insights for modelers and policymakers. As reported in Figure 1, the empirically relevant addition of multi-period loans with fixed interest rates amplifies the effects of borrower risk shocks through the bank capital channel and the market timing effect. In a one-period loan model (upper panel of Figure 1), an unexpected increase in the default rate affects bank profitability for only one period – even if the shock is persistent – as banks quickly adjust their spreads to higher default risks. In the case of multi-period fixed-rate loans, banks can only adjust their spreads on new loans, not on the outstanding amount of previously issued loans. Banks thus incur losses over more than one period, which causes a more pronounced decline in bank capital adequacy ratio (see bank CAR in the lower panel of Figure 1) and amplifies the effect of borrower risk shocks. This bank capital channel results in a more pronounced – though temporary – increase in spreads on new loans. In a multi-period loan framework, borrowers are reluctant to lock in high current interest rates for extended periods, creating a market timing effect that further amplifies the initial shock. Anticipating a decline in lending rates as the economy returns to steady state, they delay borrowing and investment – and this adds to the decline in loan demand and GDP.

Moreover, in the presence of universal banks, spillovers across different credit segments (i.e., sectoral spillovers) are sizable. For example, an increase in mortgage defaults that affect banks’ capital ratios leads to an increase in the lending rate charged to non-financial corporations (NFCs) and a reduction in corporate lending and business investment. Our analysis indicates that these spillovers operate through the bank capital channel and increase with the loan duration.

This stronger bank capital channel with multi-period fixed-rate loans also reinforces the effects of macroprudential policy. Compared to models with one-period debt, it raises the transition costs of increasing capital requirements, as banks find it harder to adjust if they can only change interest rates on new loans, not on all outstanding amounts. However, easing capital requirements in times of financial stress mitigates the financial acceleration that operates through the bank capital channel more than in a model with one-period loans. In Figure 1, dashed lines show the effect of a release of countercyclical capital buffers (CCyB). In both the one-period and multi-period setups, the release eases the capital burden during adverse periods triggered by risk shocks. Because the capital channel is stronger in the multi-period case, the macroprudential intervention is more effective at mitigating the contraction in loan supply and, ultimately, the negative impact on GDP, compared to the one-period counterfactual.

Sector-specific capital requirements are relevant macroprudential tools to address the risks arising from specific sector exposures. Exposures to the mortgage sector have come under particular scrutiny by regulators, given the financial stability risks posed by excessive developments in the real estate market. For example, in 2013, the National Bank of Belgium decided to add five percentage points to the risk weight of residential real estate assets for several Belgian banks to strengthen their buffers against potential adverse developments in the real estate market. This risk weight add-on was applied to banks that calculate regulatory capital requirements using an Internal Ratings-Based approach, which held the largest share of residential real estate loans among Belgian financial institutions.

In the presence of universal banks, sectoral prudential policy instruments can have unintended consequences for the untargeted sector of the economy. Universal banks have the opportunity to comply with stricter sectoral regulations by reducing lending to the sector of their choice. In our framework, banks find it optimal to spread the burden of a sector-specific shock – such as an increase in mortgage risk weights – across the two credit segments.

That said, one should not overlook the fact that these measures also achieve their primary objective in our universal banking setup. For example, our model suggests that the mortgage risk weight add-on introduced in Belgium in 2013 encouraged banks to increase their capital buffers at the cost of a small response in new mortgage rates and loan volumes, in line with the empirical study by Ferrari et al. (2017). Releasing the buffers in the event of a shock to the mortgage segment would yield important gains compared to a situation where the policy space is not sufficient for such a release.

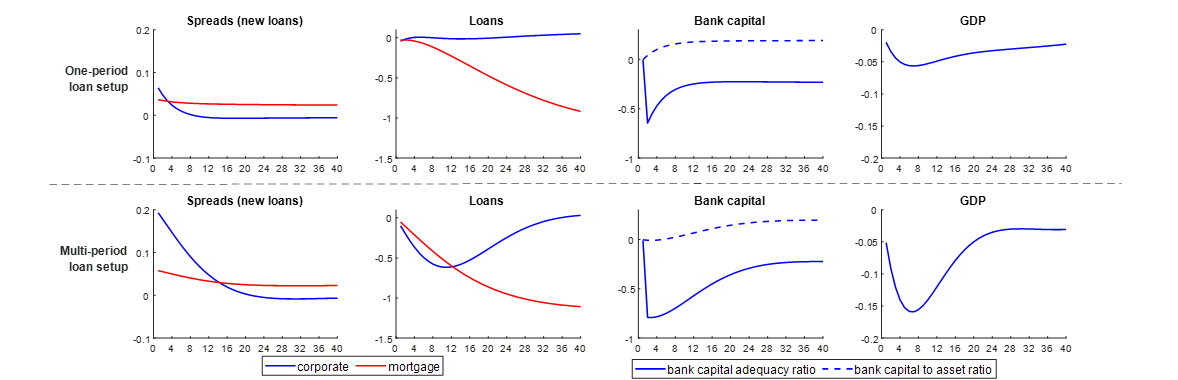

The transition costs of the five-percentage point increase in mortgage risk weights are assessed in more detail in Figure 2. It leads to an immediate decline in the ratio of bank capital to (new) risk-weighted assets (i.e., the capital adequacy ratio), while the bank capital to asset ratio starts to increase. The resulting increase in the probability of capital requirements being breached induces the bank to set higher spreads on NFC and mortgage loans. As a result, lending rates on new NFC and mortgage loans increase, and the profits are used to build up more bank capital.2

The costs of higher capital requirements are passed on to mortgage loans, with a predicted six-basis point increase in the interest rate applied to new mortgage loans in the short run. Our model also predicts that lending rates are persistently raised by two basis points to compensate for the fact that capital is more costly than other bank liabilities. This increase in mortgage rates deters credit and housing investment. Our model indicates that mortgage loan growth experiences a modest short-term slowdown. Over a ten-year horizon, mortgage credit volumes deviate from their pre-policy trend by up to 1%.

Interestingly, the model generates significant spillovers to the NFC segment in the short run, in the form of unintended crowding-out effects. In our setup, universal banks find it optimal to share the consequence of the change in mortgage regulation across the two loan segments. The NFC interest rate is thus affected by the stricter mortgage risk-weight policy. This would not be the case in a segmented banking structure, where banks specialize in one type of market (e.g., NFC or mortgage), as is the case in the 3D model of Mendicino et al. (2018).

The unintended fall in business investment is the main channel through which the shock affects output, given the low weight of residential investment relative to capital investment in Belgian GDP (0.06 vs. 0.18 respectively).3 In addition, the long maturity of bank loans – especially for mortgages – also amplifies the impact of this shock. As mentioned in the previous section, bank capital accumulation is slower when banks cannot adjust the interest rate on outstanding amounts of previously issued fixed-rate loans, and the market timing effect encourages borrowers to delay investment, as the increase in bank lending rates is stronger in the initial phase but gradually fades away.

These crowding out effects are limited to the short run. Once banks have built up their capital buffers and the probability of a breach has returned to its equilibrium level, the interest rate charged to NFCs also returns to its steady state. The overall impact on Belgian output is thus limited due to the low weight of residential investment in GDP, the small and short-lived response of capital investment, and the muted response of private consumption.

In our paper, we demonstrate that these crowding out effects increase with the risk weight in the untreated sector. Indeed, reducing exposures in a segment with a high initial risk weight buys relatively more space and is more effective in reducing the risk of capital requirements being violated. For a similar reason, the crowding out effects decrease in the initial risk weight of the treated sector. What matters is thus the risk weight gap, and we are more likely to observe unintended crowding out effects when the risk weight of the untreated sector is larger than that of the treated sector.

Crowding out effects also increase with the loan duration of the treated sector. Thus, increasing the risk weight in a segment that has long maturities – such as residential mortgages – has larger unintended consequences on the other sector. With longer maturities, there is a large outstanding amount of mortgage loans for which the bank must hold higher buffers without being able to raise the interest rate to match the increase in capital adequacy costs. At the same time, there is a limited number of new mortgage loans for which the lending rate can be increased. In such a context, the bank has a stronger incentive to raise the lending rate charged on all new loans, including in the untreated sector.

This policy brief examines how combining multi-period fixed-rate loans with universal banking and capital-requirement rules reshapes financial and macroeconomic dynamics in a DSGE model. The interaction of these features can significantly amplify the reaction of financial and macro variables to a borrower risk shock, increasing the value of macroprudential tools to temper such volatility.

Our findings further show that, in a universal banking environment, prudential measures aimed at a single credit segment can unintentionally crowd out lending in other segments. Universal banks find it optimal to spread the cost of higher, segment-specific capital requirements across their entire loan book. The spillover is strongest for longer-maturity loans and when sectoral risk-weight differentials are pronounced. Although these policies still achieve their stability goals with relatively modest output losses, policymakers must remain alert to these unintended consequences.

Figure 1. A borrower risk shock (non-financial corporates)

Note: variables in percentage deviation from a pre-shock state (steady state). Horizon in quarters. Corporate and mortgage spreads are annualized and apply to new multi-period loans. In the one-period setup, they represent the rates at which new multi-period loans would be granted. Spreads are expressed in terms of a risk-free loan of identical duration. Bank CAR stands for bank capital adequacy ratio. Loans are outstanding amounts. CCyB means countercyclical capital buffer.

Figure 2. An increase in mortgage risk weights

Note: variables in percentage deviation from a pre-shock state (steady state). Horizon in quarters. Corporate and mortgage spreads are annualized and apply to new multi-period loans. In the one-period setup, they represent the rates at which new multi-period loans would be granted. Spreads are expressed in terms of a risk-free loan of identical duration. Loans are outstanding amounts.

Aoki, Kosuke, Proudman, James and Vlieghe, Gertjan, 2004, “House prices, consumption, and monetary policy: a financial accelerator approach,” Journal of Financial Intermediation, Elsevier, vol. 13(4), pages 414-435, October.

Beneš, Jaromír and Kumhof, Michael, 2015, “Risky bank lending and countercyclical capital buffers,” Journal of Economic Dynamics and Control, Elsevier, vol. 58(C), pages 58-80.

Beneš, Jaromír and Lees, Kirdan, 2010, “Multi-period fixed-rate loans, housing and monetary policy in small open economies,” Reserve Bank of New Zealand Discussion Paper Series DP2010/03, Reserve Bank of New Zealand.

Bernanke, Ben S., Gertler, Mark and Gilchrist, Simon, 1999, “The financial accelerator in a quantitative business cycle framework,” Handbook of Macroeconomics, in: J. B. Taylor & M. Woodford (ed.), Handbook of Macroeconomics, edition 1, volume 1, chapter 21, pages 1341-1393, Elsevier.

Clerc, Laurent, Derviz, Alexis, Mendicino, Caterina, Moyen, Stephane, Nikolov, Kalin, Stracca, Livio, Suarez, Javier and Vardoulakis, Alexandros P., 2015, “Capital Regulation in a Macroeconomic Model with Three Layers of Default,” International Journal of Central Banking, International Journal of Central Banking, vol. 11(3), pages 9-63, June.

de Walque Gregory, Lejeune Thomas, Rannenberg Ansgar, Wouters Raf, 2023, “BEMGIE: Belgian Economy in a Macro General and International Equilibrium model,” Working Paper Research 435, National Bank of Belgium.

Ferrari Stijn, Pirovano, Mara and Rovira Kaltwasser, Pablo, 2017, “The impact of sectoral macroprudential capital requirements on mortgage lending: evidence from the Belgian risk weight add-on,” MPRA Paper 80821, University Library of Munich, Germany.

Kohlscheen, Emanuel, Mehrotra, Aaron, and Mihaljek, Dubravko, 2020, “Residential Investment and Economic Activity: Evidence from the Past Five Decades,” International Journal of Central Banking, International Journal of Central Banking, vol. 16(6), pages 287-329, December.

Lejeune, Thomas and Mohimont, Jolan, 2025, “Long-Term Loans and Capital Requirements in Universal Banking: Sectoral Spillovers and Crowding Out Effects,” Working Paper Research 474, National Bank of Belgium.

Mendicino, Caterina, Nikolov, Kalin, Suarez, Javier and Supera, Dominik, 2018, “Optimal Dynamic Capital Requirements,” Journal of Money, Credit and Banking, Blackwell Publishing, vol. 50(6), pages 1271-1297, September.

NBB, 2024, Financial stability report, National Bank of Belgium.

The calibration draws on the quantitative DSGE model of de Walque et al. (2023).

It is also interesting to note that while banks accumulate more capital, there is a long-run decline in capital ratios in terms of new risk-weighted assets. In fact, the decline in borrower riskiness and credit volume and the increase in bank capital bring the probability of violating official capital requirements towards its steady state – in line with banks’ risk appetite – without the need to restore the initial capital buffer ratio to risk-weighted assets.

The small share of residential investment in GDP is common in advanced countries. It is reported to be on average 4.7% for a sample of fifteen advanced economies (including the US and the big four euro area countries) after the global financial crisis.