This SUERF policy note is based on the authors’ ECB working paper. The views expressed in this note are those of the authors and do not necessarily reflect those of the European Central Bank (ECB).

Abstract

Effective communication strategies with several audiences are essential for central banks to maintain price stability and ensure the smooth transmission of monetary policy measures. This policy brief reports the findings from a field experiment conducted between 2022 and 2025 at the ECB Visitor Centre in Frankfurt. It demonstrates that the ECB’s direct communication contributes to the anchoring of inflation expectations of non-experts by enhancing their monetary knowledge and employing trust-building strategies such as speaking in their national language.

In central banking, a “quiet revolution” refers to the growing recognition that central banks need to communicate clearly, consistently and transparently about how they conduct monetary policy (Blinder, 2004; Issing, 2005; Yellen, 2012). Yet central banks continue to face challenges in directly reaching wider audiences that include non-experts. ECB Press Conferences are particularly important for effective communication as they clarify policy intentions and reduce market uncertainty (Lane, 2025). At regular press conferences, central banks not only explain their monetary policy decisions and their strategy to maintain price stability, but they also educate the public about how their policies work. These messages are scrutinized by professional observers and the media. However, they may not reach the broader public, particularly because many citizens have limited knowledge about how monetary policy influences inflation.

According to the ECB’s Knowledge & Attitudes Survey most people in the euro area trust the ECB, although many are unsure about its primary objective. The ECB’s 2025 Strategy Assessment found that the adoption of a symmetric two per cent inflation target in 2021 has supported clearer communication to the public. Despite this progress, public expectations of euro area inflation have remained widely dispersed. Reducing such dispersion through clearer communication could lead to more informed spending and saving decisions, contribute to economic stability, and help ensure a smoother transmission of monetary policy.

Academic research on direct central bank communication with non-experts is still in its early stages (de Guindos, 2019). Yet such knowledge is of policy relevance, since citizens’ decisions and behaviours strongly influence the transmission of monetary policy to the real economy. People’s attention to economic and financial news is generally low and more influenced by media coverage than by central bank statements. As ECB President Lagarde (2023) emphasised, the primary challenge for central bank communication today is to capture the attention of the public in an “ever-increasing competition for attention”, amid a rapidly changing communications landscape and an “overarching decline in trust” (see also Ehrmann, 2025). Recent event studies suggest that, in contrast to the predictions of the rational inattention hypothesis, individuals may still have an incentive to pay attention to economic and monetary news when forming their inflation expectations (Lewis et al., 2020; Jung and Kühl, 2022). Coibion and Gorodnichenko (2025) argue that direct central bank communication can successfully anchor public inflation expectations if they break the “cycle of selective inattention”, in which citizens tend to ignore inflation news when inflation is near the target but pay attention when it overshoots it. Because direct contact between the public and central banks is relatively rare, it is challenging to identify the influence monetary policy communication has on non-experts in real-world settings.

Several studies have examined the response to information treatments in randomised survey experiments, by making use of the ECB’s Consumer Expectations Survey (Blinder et al., 2024). These studies suggest that consumers may respond positively to central bank communication. For example, providing people with information about the ECB’s inflation target can help to reduce the dispersion of their inflation expectations around the target (Ehrmann et al., 2025). However, such survey experiments may fail to accurately capture real-world behaviour, as responses to online surveys may be biased towards the researchers’ hypotheses. Under these circumstances, field experiments provide a practical way to study the effects of central bank communication on non-experts’ knowledge and behaviour (Harrison and List, 2004).

Our field experiment investigates how knowledge and trust influence the economic expectations of non-experts. The key finding is that direct communication with non-experts can bring their medium-term inflation expectations substantially closer to the ECB’s inflation target. This conclusion is based on 117 experiment sessions involving diverse international groups of 5,000 individuals who visited the ECB headquarters in Frankfurt between December 2022 and May 2025 and volunteered to participate in the field experiment.

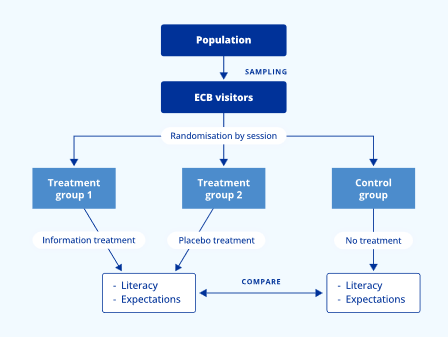

The ECB frequently offers on-site lectures at its headquarter in Frankfurt for visitor groups and individuals. Participants are non-experts but usually have some interest in and knowledge of economics. The sessions are interactive and start with a one-hour presentation by an ECB staff expert followed by questions and answers. Visitor groups were randomly assigned to one of three categories (see Figure 1 above). During these lectures, they were exposed to different information treatments, creating exogenous variation in the monetary policy information they received:

Figure 1. The field experiment: an overview

Note: The figure schematically illustrates the sampling process and the different treatment ECB visitor groups received during the experiment. Average treatment effects were computed for three outcome variables – monetary literacy, inflation expectations and growth expectations – by comparing the outcomes for participants receiving treatment with those for participants receiving no treatment.

A survey showed that participants had varying levels of monetary policy knowledge. At the beginning of each session, we invited all participating visitors to answer a set of nine initial questions on their smartphones. This allowed us: 1) to test each visitor’s existing knowledge of monetary policy, for example whether they knew what the ECB’s main objective is; 2) to gather individual perceptions of current euro area inflation and growth, such as what they assumed the current inflation rate to be; and 3) to collect information about individual demographics, such as gender, education and age.

After the lecture, we asked visitors from the treatment groups a second set of five questions. These measured the effect of the treatment on participants’ expectations for growth and inflation, their understanding of the inflation target, the ECB’s monetary policy instruments and our monetary policy decision-making process. The control groups also attended lectures, but the process differed in one important aspect: unlike the other groups they completed the second set of five extra questions before the lecture and not after.

Comparing outcomes between the treatment and control groups allowed us to estimate the average treatment effect. This allowed us to measure whether directly communicating information on the ECB’s monetary policy affects participants’ knowledge and their inflation and growth expectations.

We find that individuals receiving treatment – i.e., information about the monetary policy of the ECB – robustly improved their monetary policy knowledge and developed a better understanding of the ECB’s inflation target. However, the treatment effects varied across demographics, notably gender, age and education. Females, older participants (above 30 years old), and those without a university degree benefitted the most from the expert presentations. This suggests that direct communication with non-experts can noticeably improve individual monetary policy knowledge, especially for those less knowledgeable. It also addresses broader societal concerns about inequality in monetary literacy among those groups. This is important given the persistence of imbalances for gender, age, and education categories over decades (Lusardi and Mitchell, 2023).

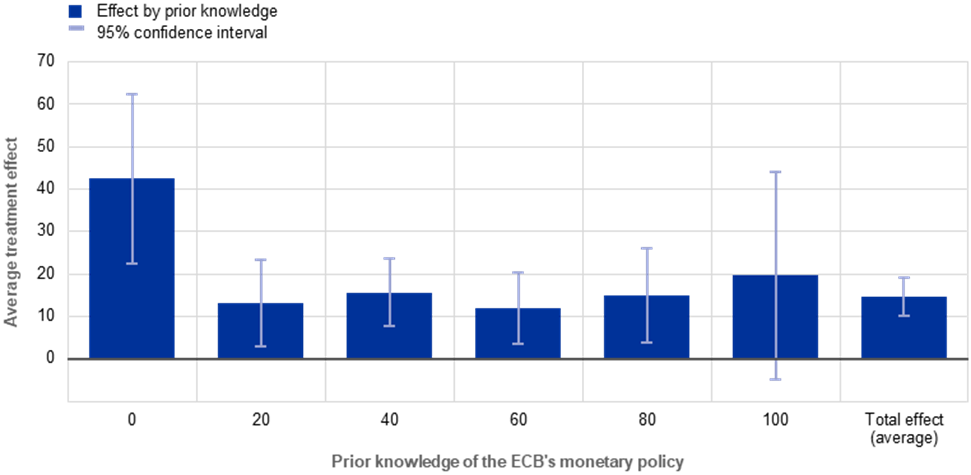

Improved knowledge (i.e., a higher level of the monetary literacy score) was a key factor explaining why a significant share of non-experts receiving treatment better aligned their medium-term inflation expectations with the target (see Figure 2). While a large share of participants with no knowledge (42%) revised their medium-term inflation expectations towards the ECB’s inflation target, the effects for participants with full knowledge were instead not significant. On average, 15% of the participants being exposed to the communication treatment showed a better anchoring of their inflation expectations. This finding highlights the key role that monetary literacy plays in enabling the public to engage meaningfully with central bank communication. However, the improved understanding of monetary policy did not lead to systematic revisions in their economic growth expectations, suggesting that participants perceived growth forecasts as more uncertain or less directly influenced by monetary policy.

Figure 2. Monetary policy knowledge and impact of treatment on inflation expectations

Note: The figure shows the breakdown of average treatment effects (ATE) for the total population and sub-groups with different levels of prior knowledge of the ECB’s monetary policy, notably the treatment group relative to the control group. ATE estimates, with regression adjustment, include controls for individual demographics such as age, gender, origin and education, for individual inflation and economic growth perceptions, and for prior knowledge.

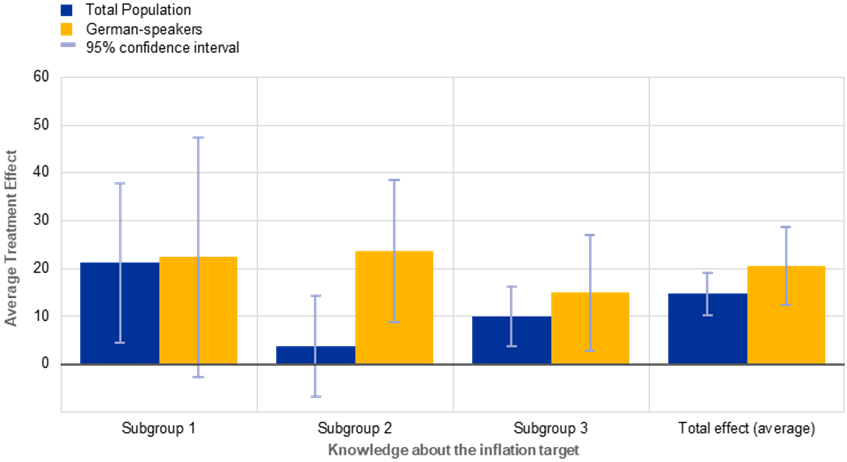

Given the prominence of the inflation target in the ECB’s official communication since its 2021 strategy review – and its role as a medium-term anchor of inflation expectations – the study examined whether participants’ knowledge of the target is a key factor influencing revisions of their medium-term inflation expectations. Participants were categorized into three subgroups based on their prior knowledge of the ECB’s mandate, as assessed in the monetary literacy survey: participants not familiar with either the ECB’s mandate or the inflation target (subgroup 1); participants aware of the ECB’s mandate but not the precise inflation target (subgroup 2); and participants with an understanding of both the ECB’s mandate and its specific inflation target (subgroup 3).

Figure 3. Impact of treatment on inflation expectations depending on prior knowledge of the inflation target

Note: The figure shows the breakdown of average treatment effects (ATE) for the total sample (blue bars) and the German-speaking sample (yellow bars), notably the treatment group relative to the control group by knowledge of the ECB’s inflation target. ATE estimates, with regression adjustment, include controls for individual demographics such as age, gender, origin and education, and for individual perceptions of inflation and economic growth.

The findings show that learning about the ECB’s policy objectives and the symmetric 2% inflation target enabled a substantial share of non-experts to revise their medium-term inflation expectations towards the target (see Figure 3, blue bars), especially when addressed in their native language (see Figure 3, yellow bars). Addressing participants in their native language is important for building trust. When individuals feel confident in their ability to comprehend central bank messages, they are more likely to trust the institution and its policies. This trust, in turn, strengthens the effectiveness of central bank communication and helps align public expectations with policy objectives.

In summary, the study identifies two distinct channels of transmission (see Chart 3) that contribute to better anchored of inflation expectations:

The findings from the field experiment answer the pertinent question posed by Blinder et al. (2024) of whether central bank communication with the public is a promising avenue for steering inflation expectations, or a false hope. We show that direct communication can have a substantial impact on aligning non-experts’ medium-term inflation expectations with the ECB’s inflation target. The ECB can enhance the effectiveness of its communication by tailoring strategies to diverse audiences and making efforts to improve public knowledge of the ECB’s monetary policy. This could be supported by targeted educational programmes in schools and universities to improve people’s knowledge of monetary policy over time. Complementary and intensified use of indirect channels, not tested in the study, – such as social media, traditional media and accessible resources, like the ECB’s website and visitor centre, or this blog – should also ensure messages reach broader audiences beyond expert circles. Finally, these findings indicate that trust-building efforts and multilingual communication in different EU languages are essential to fostering public engagement and ensuring the effectiveness of monetary policy communication.

Blinder, A., 2004. The Quiet Revolution: Central Banking Goes Modern. New Haven, CT: Yale University Press.

Blinder, A.S., Ehrmann, M., Fratzscher, M., De Haan, J. and Jansen, D., 2024. Central bank communication with the general public: Promise or false hope? Journal of Economic Literature 62(2), 425–4547.

Coibion, O., Gorodnichenko, Y., 2025. Inflation, Expectations and Monetary Policy: What Have We Learned and to What End? NBER Working Paper No. 33858.

De Guindos, L., 2019. Communication, expectations and monetary policy. Intervention at the ECB policy panel of the Annual Congress of the European Economic Association, Manchester, on 27 August 2019.

ECB, 2021. ECB Knowledge & Attitudes Survey 2021. ECB: Frankfurt.

ECB, 2025. An overview of the ECB’s monetary policy strategy. ECB: Frankfurt.

Ehrmann, M., 2025. Trust in central banks. Journal of Economic Surveys, 1-13.

Ehrmann, M., Georgarakos, D. and Kenny, G., 2025. Credibility gains from central bank communication with the public. European Economic Review 177(C).

Harrison, G., List, J.A., 2004. Field experiments. Journal of Economic Literature, 42(4), 1009-1055.

Issing, O., 2005. Communication, transparency, accountability: Monetary policy in the twenty-first century. Federal Reserve Bank of St. Louis Review, 87, 65-83.

Jung, A. and Kühl, P., 2021. Can central bank communication help to stabilise inflation expectations? Scottish Journal of Political Economy, 68(3), 298-321.

Jung, A. and Mongelli, F.P., 2025. Central bank communication with non-experts: insights from a randomized field experiment. ECB Working Paper Series No. 3103.

Lagarde, C., 2023. Communication and monetary policy. Speech at the Distinguished Speakers Seminar organised by the European Economics & Financial Centre, on 4 September 2023.

Lane, P., 2025. The communication of monetary policy decisions: incorporating risks and uncertainty. Remarks at the Second Thomas Laubach Research Conference, on 16 May 2025.

Lewis, D.J., Makridis, C., Mertens, K., 2020. Do Monetary Policy Announcements Shift Household Expectations? Federal Reserve Bank of New York Staff Reports No. 897.

Lusardi, A., Mitchell, O., 2023. The importance of financial literacy: Opening a new field. Journal of Economic Perspectives 37(4), 137-154.

Yellen, J., 2012. Revolution and Evolution in Central Bank Communications. Speech delivered at the Haas School of Business, University of California, Berkeley, on 13 November 2012.