This Policy Brief is based on Sveriges Riksbank Working Paper Series No. 430.The opinions expressed are the sole responsibility of the author(s) and should not be interpreted as reflecting the views of Sveriges Riksbank.

Bank branch networks are shrinking rapidly throughout Europe. Significant changes in the use of cash and growing use of digital distribution for retail banking services have reduced foot traffic to bank branches and even the need for bank branches. A smaller branch network may impair banks’ ability to lend to small and medium sized firms (SMEs), where technology has not (yet) created the same possibilities for replacing physical interactions with digital solutions. We investigate this hypothesis using the closing of two thirds of Swedish branches as a laboratory. We find that corporate lending declines following branch closures, mainly via reduced lending to small and young firms. The reduced credit supply has real effects: local firms experience a decline in employment and sales and an increase in exit risk after branch closures. Our results thus suggest that the disappearance of bank branches, while allowing substantial cost-savings, also has negative implications for the SME credit, and that adequate substitutes have not yet developed.

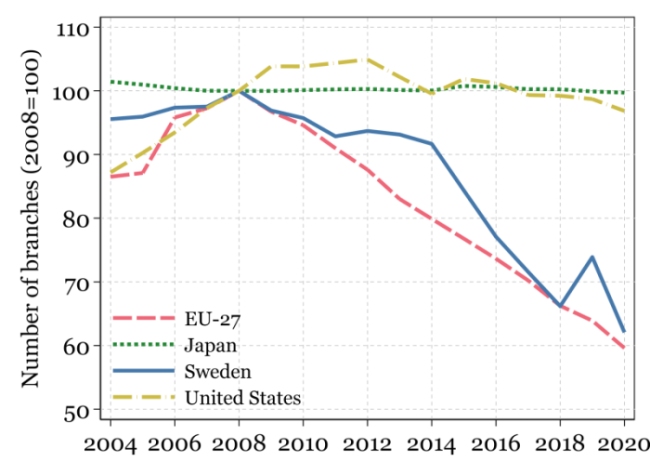

According to a recent Eurostat survey, 60 percent of European households used internet banking services in 2022, up from 24 percent in 2007 (Eurostat, 2022); in some countries, such as Norway, nearly every household uses internet banking. The rise of digital banking has changed the economics of maintaining a branch network, which has led banks to close branches at an unprecedented rate: the total number of bank branches in the OECD countries, for example, fell by 30 percent from the 2008 peak to 2022, according to the IMF’s Financial Access Survey. The development differs across countries and regions, however: European countries have seen sharp declines in the number of bank branches, whereas the branch networks of American and Japanese banks still remain intact (Figure 1). Given the persistence and magnitude of the underlying technological changes, the trend away from bank branches towards digital distribution of bank services is likely to continue in the countries where the shift is already underway, as well as to start spreading to other places, including, perhaps, developing markets.

Figure 1: Bank branches are disappearing, but not (yet) everywhere

While the shift towards digital banking has generated large efficiency gains in the delivery of retail banking services, there are also reasons for concern. One particular worry is that the disappearance of physical bank branches will reduce banks’ willingness and ability to lend to small- and medium-sized firms (SMEs). The reason is that physical proximity between banks and borrowers seems to remain important for SME lending, despite recent technological developments; hence, SMEs risk seeing their access to credit deteriorate when branches close and the distance to their nearest bank branches increase.1

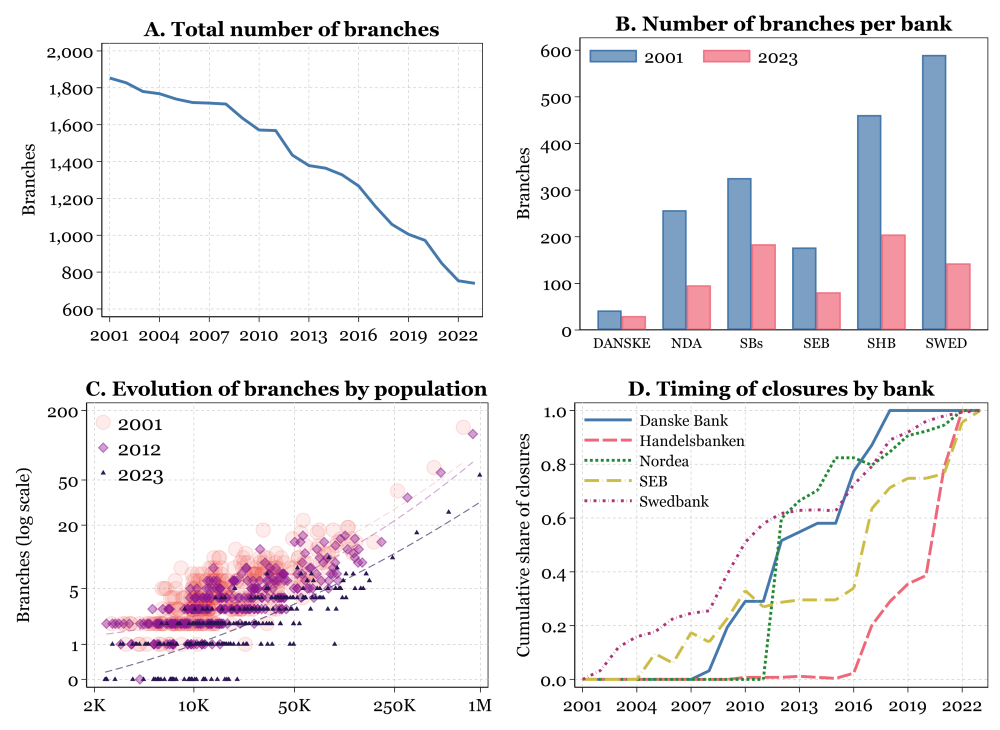

In a recent working paper (Amberg and Becker, 2024), we examine the real and financial effects of bank branch closures on firms using the dramatic decline of physical bank branches in Sweden between 2001 and 2023 as a laboratory. Figure 2 shows that nearly two thirds of all Swedish bank branches have disappeared since 2001 (Panel A), that all major banks have contributed to the development (Panel B), and that the decline has taken place in small and large municipalities alike (Panel C). As of 2023, 43 out of Sweden’s 290 municipalities no longer have a single bank branch.

Figure 2: The great bank branch closure wave in Sweden

Notes: Panel A plots the total number of bank branches in Sweden over the period 2001–2023 and Panel B the number of branches per bank in 2001 and 2023. The banks included in the data are Danske Bank (DANSKE), Nordea (NDA), SEB (SEB), Handelsbanken (SHB), Swedbank (SWED), and all savings banks grouped together (SBs). Panel C plots the evolution of the number of bank branches by municipality between 2001 and 2023 against the adult population of each municipality (each dot in the figure corresponds to a municipality-year). Panel D plots the timing of the branch closures that each bank undertook between its peak year and 2023. The cumulative share is the share of closures that took place up to and including a given year (it is zero before the peak year).

Notes: Panel A plots the total number of bank branches in Sweden over the period 2001–2023 and Panel B the number of branches per bank in 2001 and 2023. The banks included in the data are Danske Bank (DANSKE), Nordea (NDA), SEB (SEB), Handelsbanken (SHB), Swedbank (SWED), and all savings banks grouped together (SBs). Panel C plots the evolution of the number of bank branches by municipality between 2001 and 2023 against the adult population of each municipality (each dot in the figure corresponds to a municipality-year). Panel D plots the timing of the branch closures that each bank undertook between its peak year and 2023. The cumulative share is the share of closures that took place up to and including a given year (it is zero before the peak year).

Our study is based on detailed firm-level data and bank-branch data comprising the location of nearly every bank branch in Sweden over the period 2001–2023. To identify the causal effect of branch closures on firms, we employ a shift-share instrumental variables (SSIV) strategy, which uses the fact that the large Swedish banks concentrated most of their branch closures to specific time periods, which differ across banks (Figure 2, Panel D). Hence, when a given Swedish municipality was affected by large-scale branch closures depends on when the banks with large market shares in that municipality implemented their nationwide branch-closure programs. These timing differences in branch closures across banks—and consequently across municipalities—are what we use to identify the effects of branch closures.

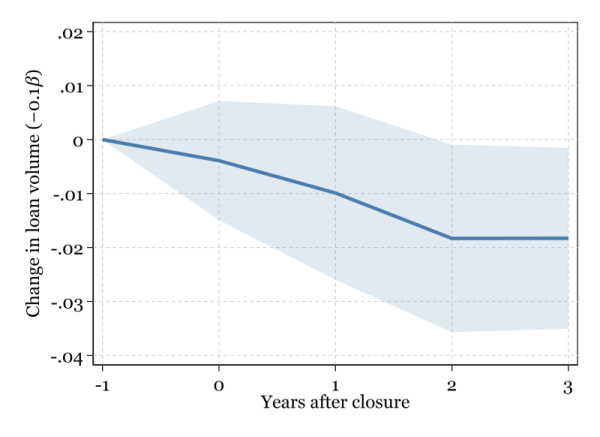

Our primary outcome variable for assessing credit-supply effects is loan balances. We estimate that local firms’ loan balances decline by 1.8 percent following the closure of 10 percent of the bank branches in a municipality. Figure 3 shows that the decline takes place over the first three years following the closures, and then stabilizes at the new, lower level. The effects are concentrated in short-term loans, such as credit lines, which may reflect both that they have faster turnaround (many long-term loans secured with real estate will not mature within our time window) and that secured lending is easier for banks to maintain without a local presence.

Figure 3: Closing 10 percent of the bank branches in a municipality leads to a 2 percent decline in bank lending

We also compare local firms along several dimensions. Firms with fewer than 100 full-time employees, those with less than €15 m in assets, less than €25 m in sales, and younger than 15 years are all more affected by branch closures. Large, old, mature firms often exhibit effects that are statistically poorly estimated and not significantly different from zero. Young firms are twice as affected as the average firm in our treatment group.

Most important, perhaps, firms with many tangible assets are least affected by branch closures, suggesting that they may have more resilient access to funding without local bank branches. This is consistent with theories of soft information (Aretz, Campello and Marchica, 2020; Black and Strahan, 2002).

We examine real effects using local firm employment, sales, assets and exit rates. Branch closures are associated with significant negative effects on the employment, sales, and working capital of local firms, but have no (detectable) effect on fixed assets. Firm exits increase: the probability that a firm exits increases by around 0.6 percentage points over a three-year period if 10 percent of local bank branches are closed. Hence, local firms are not able to offset the decline in credit supply with funding from other sources when banks close branches.

Our findings have implications in several areas. First, our results confirm that branches are economically important through their connection to local firms (Petersen and Rajan, 1994). The evidence is consistent with a key role of bank branches in collecting soft information, and a correspondingly larger effect of branch closures for firms and loan types where soft information matters most (e.g., Agarwal and Hauswald, 2010; Almeida and Campello, 2007; Chodorow-Reich et al., 2022; Ivashina, Laeven and Moral-Benito, 2022).

Another implication is that while the spread of digital banking in advanced economies generates large efficiency gains (e.g., Berger, 2003), there are also potential concerns, including for SME lending. Our results suggest that the accelerating trend toward digital delivery of retail bank services—visible across the OECD and beyond—may harm credit supply to small and medium-sized firms, where lending decisions traditionally involve soft information collected through branches. Without branches, the credit supply may tilt toward asset-backed loans (Lian and Ma, 2020) and secured credit contracts (Benmelech, Kumar and Rajan, 2022), potentially restricting new firm formation and entrepreneurship (Black and Strahan, 2002). Accelerated growth in the fintech sector may compensate (Gopal and Schnabl, 2022), perhaps by using new information sources (Liberti and Petersen, 2018), but to what extent remains unclear.

Finally, more broadly, our results point to the mixed blessings of technological disruption: large gains often come at the expense of some losses (e.g., Becker and Ivashina, 2023).

Agarwal, Sumit, and Robert Hauswald. 2010. “Distance and Private Information in Lending.” Review of Financial Studies, 23(7): 2757–2788.

Almeida, Heitor, and Murillo Campello. 2007. “Financial Constraints, Asset Tangibility, and Corporate Investment.” Review of Financial Studies, 20(5): 1429–1460.

Amberg, Niklas, and Bo Becker. 2024. “Banking Without Branches.” Sveriges Riksbank Working Paper No. 430.

Aretz, Kevin, Murillo Campello, and Maria-Teresa Marchica. 2020. “Access to collateral and the democratization of credit: France’s reform of the Napoleonic Security Code.” The Journal of Finance, 75(1): 45–90.

Becker, Bo, and Victoria Ivashina. 2023. “Disruption and Credit Markets.” The Journal of Finance, 78(1): 105–139.

Benmelech, Efraim, Nitish Kumar, and Raghuram Rajan. 2022. “The secured credit premium and the issuance of secured debt.” Journal of Financial Economics, 146(1): 143–171.

Berger, Allen. 2003. “The Economic Effects of Technological Progress: Evidence from the Banking Industry.” Journal of Money, Credit and Banking, 35(2): 141–76.

Black, Sandra E, and Philip E Strahan. 2002. “Entrepreneurship and bank credit availability.” The Journal of Finance, 57(6): 2807–2833.

Chodorow-Reich, Gabriel, Olivier Darmouni, Stephan Luck, and Matthew Plosser. 2022. “Bank liquidity provision across the firm size distribution.” Journal of Financial Economics, 144(3): 908–932.

Eurostat. 2022. “Individuals who used the internet, frequency of use and activities. Internet use: internet banking.” Digital Society Statistics at the Regional Level.

Gopal, Manasa, and Philipp Schnabl. 2022. “The Rise of Finance Companies and FinTech Lenders in Small Business Lending.” The Review of Financial Studies, 35(11): 4859–4901.

Ivashina, Victoria, Luc Laeven, and Enrique Moral-Benito. 2022. “Loan types and the bank lending channel.” Journal of Monetary Economics, 126: 171–187.

Lian, Chen, and Yueran Ma. 2020. “Anatomy of Corporate Borrowing Constraints.” The Quarterly Journal of Economics, 136(1): 229–291.

Liberti, José María, and Mitchell A Petersen. 2018. “Information: Hard and Soft.” Review of Corporate Finance Studies, 8(1): 1–41.

Petersen, Mitchell A., and Raghuram G. Rajan. 1994. “The Benefits of Lending Relationships: Evidence from Small Business Data.” Journal of Finance, 49(1): 3–37.

Petersen, Mitchell A., and Raghuram G. Rajan. 2002. “Does Distance Still Matter? The Information Revolution in Small Business Lending.” Journal of Finance, 57(6): 2533–2570.

A large literature has documented the importance of proximity between banks and borrowers (see especially Petersen and Rajan, 1994, 2002).