The views in this policy brief are those of the authors and do not necessarily reflect the views of the Bank for International Settlements or of the Financial Stability Board.

Abstract

Non-bank financial intermediation (NBFI) has grown substantially over the past two decades, becoming an integral part of the global financial system. With its rising significance, the leverage used by non-bank investors has drawn greater scrutiny from regulators and policymakers. Building on the existing literature, and insights from policy work on non-banks at the Financial Stability Board (FSB), this policy brief focuses on the behaviour of hedge fund leverage. Episodes of market stress, such as in March 2020 and April 2025, have been recurrent reminders of how leverage can create vulnerabilities through fire sales. While prior work has often focused on liquidity demand as the main driver of fire sales, this brief highlights how hedge funds’ leverage targeting strategies can also force a sudden unwinding of positions, thereby amplifying stress.

The non-bank financial intermediation (NBFI) sector has grown rapidly over the past two decades and now accounts for about half of global financial system assets, surpassing banks in several jurisdictions (Financial Stability Board (FSB), 2024). This growth has contributed to diversifying financial market activity, supporting market liquidity and credit intermediation. However, not least because of the sheer size of NBFI intermediation, it has also introduced new sources of systemic risk (see e.g. FSB 2023, 2025).

Leverage in the NBFI sector has been a significant factor in several episodes of market stress in recent years. Notwithstanding distinct circumstances and triggers, pressure on non-bank investors to deleverage by winding down positions quickly played an important role during the March 2020 dash for cash, February 2022 commodity market volatility, September 2022 UK gilt market dislocation, August 2024 volatility episode, and the April 2025 tariff tantrum.

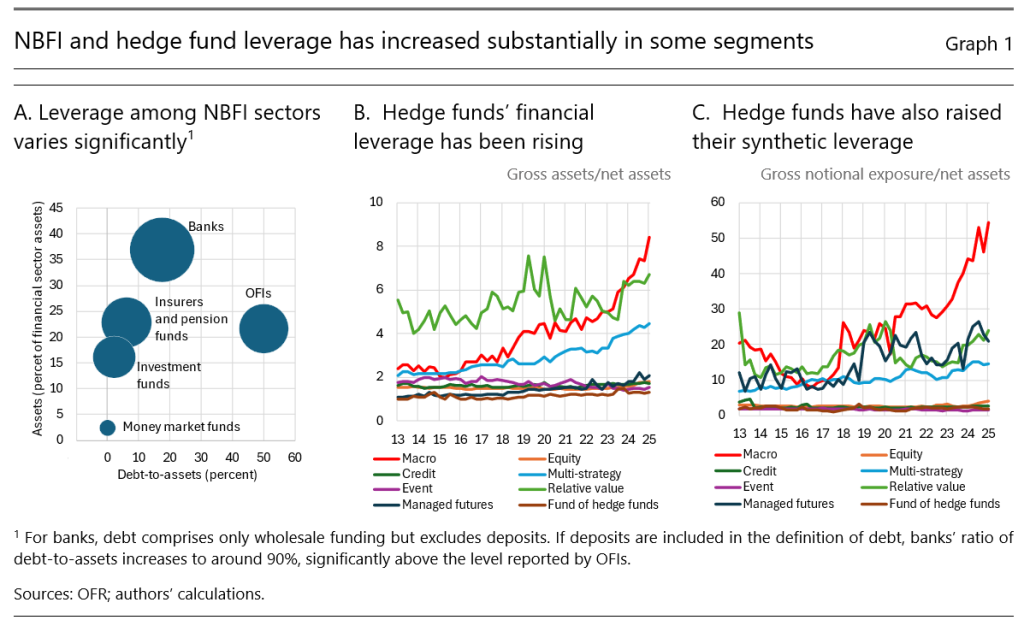

However, the NBFI sector is diverse (see e.g. Aramonte et al, 2022; FSB, 2024), and the use of leverage differs widely across the sector (Graph 1.A). In fact, some of the largest segments in the NBFI sector, such as investment funds, pension funds and insurance companies, report very little financial leverage on aggregate. Financial leverage is highest in a group of NBFIs categorised as “other financial intermediaries” (OFIs). On aggregate, OFIs are more leveraged than banks, if bank debt is measured on a similar basis (i.e. deposits are excluded; see Graph 1.A). Hedge funds represent a key subset of this group.

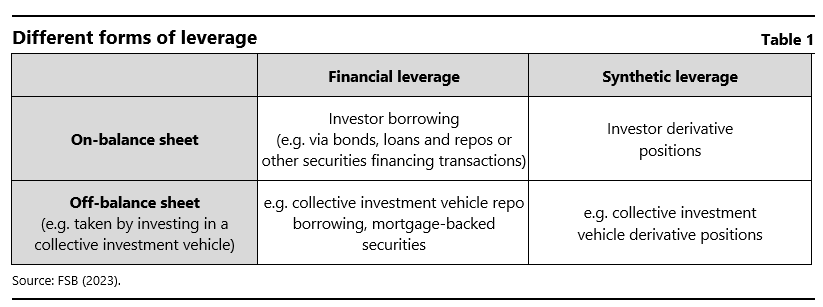

Leverage is a financial technique used to increase exposure and boost returns (FSB, 2023). It can be divided into four main types, depending on whether it is financial or synthetic, and whether it is on- or off-balance-sheet (Table 1).

Financial leverage involves borrowing to acquire more assets, for instance through short-term funding (such as repos) or via bond issuance. Synthetic leverage is achieved through derivatives, allowing investors to gain exposure with less commitment of capital upfront. Moreover, leverage may be undertaken directly on the balance sheet, for instance through the issuance of bonds or borrowing through loans. Alternatively, leverage can be accessed off-balance sheet, such as by holding shares in collective investment vehicles that employ strategies involving financial and/or synthetic leverage.

Hedge funds employ financial and synthetic leverage, both of which have been rising among certain types of strategies in recent years (Graphs 1.B and 1.C). The strategies with highest levels of leverage include macro (which base investments on the expected impact of economic outcomes on asset prices), relative value (which arbitrage price differences between similar securities), multi-strategy (which combine a variety of trading approaches) and managed futures (which primarily involve positions in futures markets).

Leverage generates systemic vulnerabilities through two primary mechanisms: counterparty defaults and fire sales (FSB, 2023). When losses near or exceed a leveraged investor’s equity, defaults may occur and create losses for broker-dealers, banks and others that have lent to those investors. This was seen in the collapses of Long-Term Capital Management in 1998 or Archegos in 2021. Such events can also trigger collateral liquidation and disrupt market functioning.

Fire sales can stem from sudden shifts in liquidity demand or supply, as emphasised by the existing literature (e.g. Schrimpf et al, 2020, FSB, 2022, Aquilina et al, 2024, Pinter et al, 2024). Margin calls may force leveraged investors to sell assets to raise cash, while reductions in funding from banks and broker-dealers can prompt asset liquidations to repay borrowing. Such dynamics were evident during the “dash for cash” in March 2020, the UK gilt market dislocation and the carry trade unwind of August 2024, where both margin calls and constrained funding contributed to market stress.

Another key channel for fire sales is the leverage targeting channel. This channel, though less frequently discussed, can act as a trigger of deleveraging episodes. Non-bank investors often aim to maintain a specific level of financial leverage, either through a target leverage ratio or a procyclical strategy that adjusts leverage based on financial conditions, increasing leverage in favourable environments and reducing it during downturns. When these investors actively reduce leverage during periods of stress, such strategies can amplify market volatility, particularly when implemented widely.

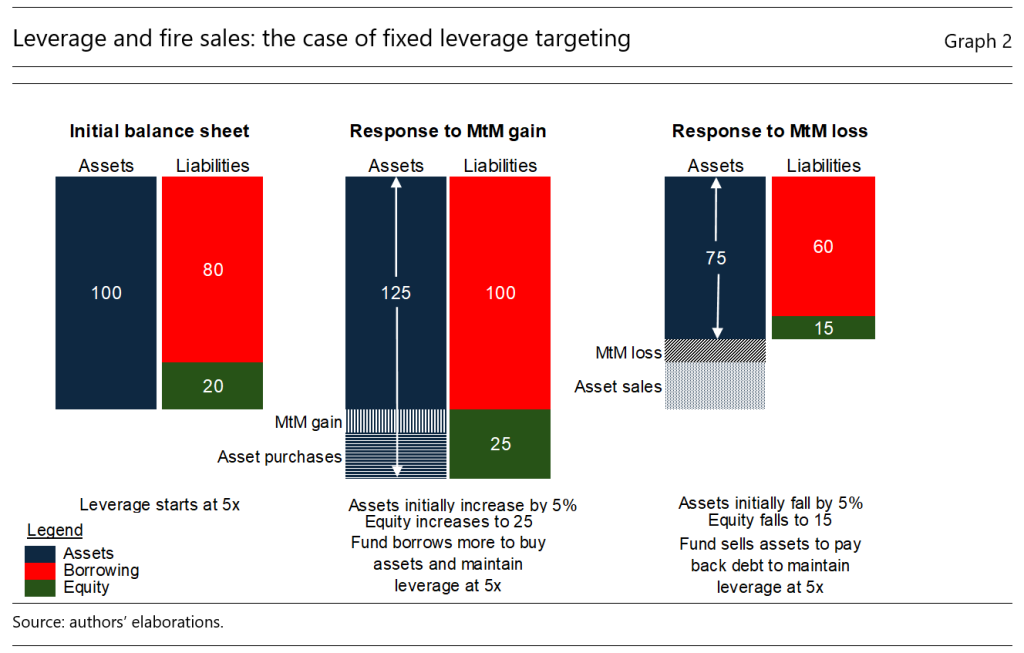

Building upon Adrian and Shin (2010), we consider an illustrative example of a hedge fund using a simple asset-to-debt-based leverage metric, starting with 20 units of equity and a fixed leverage target of 5 times. To achieve its target, the fund borrows 80 units in order to purchase 100 units of assets in total (Graph 2, left-hand balance sheet). A mark-to-market gain on its assets of 5% raises equity to 25, which – all else equal – would imply a reduction in leverage to 4.2 times. To reestablish its target, the fund purchases 20 additional units of assets funded by additional borrowing (centre balance sheet). A 5% loss, by contrast, forces asset sales of 20 units to keep the fund’s financial leverage at 5 times (right-hand balance sheet). A procyclical leverage strategy would further exacerbate asset sales as the fund would look to cut its financial leverage below 5 times in the event of a loss on its assets. A similar logic applies to synthetic leverage, where hedge funds actively adjust exposures in response to market moves, increasing synthetic leverage in good times and cutting exposures in market downturns.

Internal risk management often also relies on value-at-risk (VaR) frameworks alongside basic balance sheet metrics (e.g. Shin, 2010). Similar to the example above, if a hedge fund’s exposure exceeds its VaR target, losses may force it to sell assets to remain within risk limits. Evidence for VaR adding to fire sale dynamics has been documented in prior research. Kruttli et al (2025), for example, find that in March 2020, hedge funds were not primarily affected by a reduction in liquidity supply from broker-dealers. Rather, internal risk limits – as proxied by the VaR reported by hedge funds – seemed to have been a binding constraint during the episode, forcing hedge funds to unwind exposures despite the continued availability of funding.

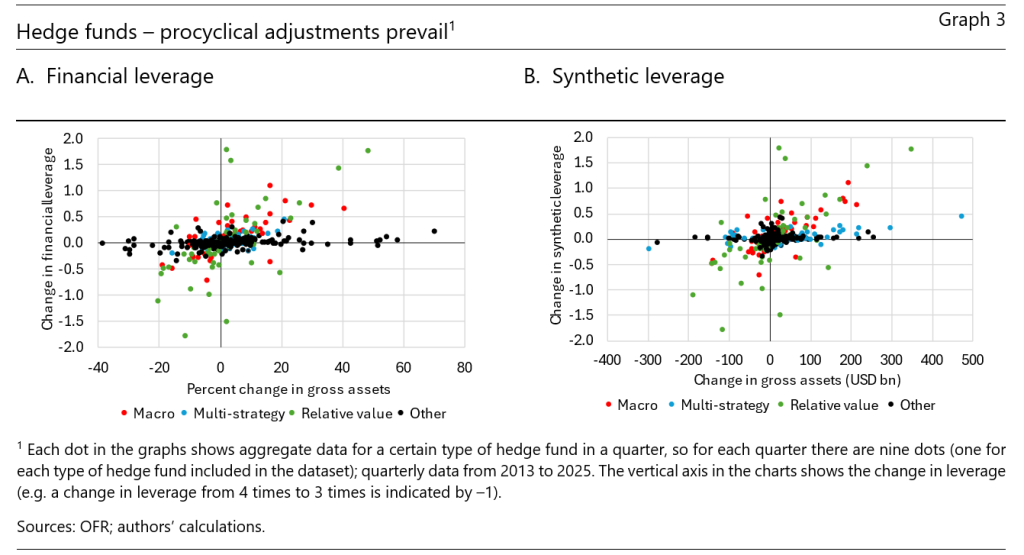

How pervasive is leverage targeting? Quarterly data from the US Office of Financial Research (OFR) on hedge funds filing Form PF provide insights into the leverage strategies adopted by hedge funds. In line with the approach taken by Adrian and Shin (2010) for broker-dealers, the analysis follows the logic of Graph 2 and examines the change in hedge fund financial leverage against the percentage change in assets (Graph 3.A) or the change in synthetic leverage against the percentage change in notional exposure (Graph 3.B). A procyclical strategy is characterised by a positive correlation between changes in financial (synthetic) leverage and assets (gross notional exposure). In contrast, a fixed leverage strategy is indicated by little or no change in financial (synthetic) leverage despite substantial changes in assets (exposure). The charts reveal that, in most cases, hedge funds’ adjustment patterns are consistent with either procyclical leverage strategies (dots in the upper-right or lower-left quadrants) or fixed leverage targets (dots close to the horizontal axis), with few observations in the upper-left or lower-right quadrants of the charts. The comparison also confirms that hedge funds engage in fire sales – periods marked by significant reductions in assets (exposure).

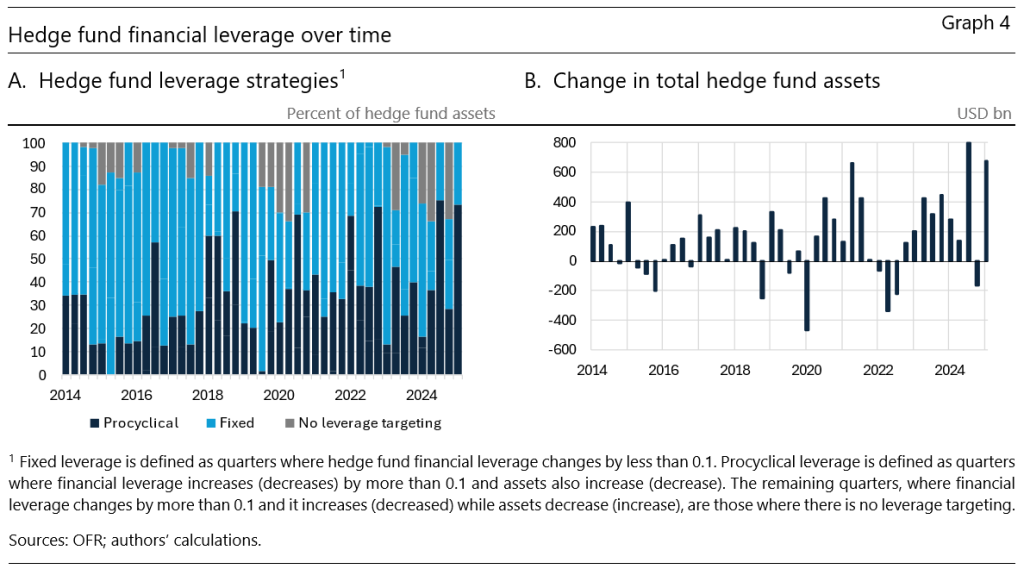

The OFR data also allow an examination of the composition of hedge fund leverage strategies over time (Graph 4.A). In the majority of cases, hedge funds follow some form of leverage targeting strategy, whether procyclical or fixed. However, the data further show that, within the same quarter, some types of hedge funds may be deleveraging while others are releveraging, highlighting the heterogeneity within the hedge fund sector.

A few large deleveraging episodes are visible in aggregate quarterly data on changes in hedge fund assets (Graph 4.B), notably Q4 2018, the dash for cash in Q1 2020 and mid-2022. Yet their contribution to broader market stress – the ultimate question – remains difficult to quantify. While such sales were likely prompted by initial volatility and losses, they may have been only one contributing factor to the spiral of additional sales and escalating market instability that takes place in a stress episode. The impact of fire sales on market conditions is partly a function of the nominal amount of assets being sold but also depends on the prevailing liquidity environment. Evidence from recent stress episodes (e.g. FSB, 2020) indicates that amplification often operates through procyclical margining and leverage: rising margins in volatile periods force leveraged funds to liquidate, transmitting price pressure across assets even when initial sales volumes are moderate. The price impact of hedge fund fire sales also depends on market depth and dealer balance-sheet constraints. In March 2020, Treasury market depth fell sharply relative to trade sizes, reducing the capacity to absorb even routine flows. When intermediation capacity erodes, the same sales volumes generate disproportionately larger price moves, especially in markets reliant on dealer inventories.

Moreover, as the data on hedge fund assets are reported on a quarterly basis, yet fire sale events typically unfold over just a few days, more frequent data would be needed to properly assess the impact of the sales on markets. Regulatory-type assessments (e.g. Kruttli et al, 2025) note that quarterly disclosures can obscure rapid deleveraging, as intra-quarter swings are substantial and position-level reports often net out gross reductions. This hinders real-time identification of the role of hedge funds liquidations in disorderly dynamics. Spillovers can also arise when multiple leveraged actors face similar constraints or share risk models, creating cross-market feedback loops (Adrian and Shin, 2010). That said, system-wide deleveraging episodes large enough to be visible in aggregate data are relatively rare, consistent with findings that most liquidity stresses remain localised unless several large funds unwind simultaneously.

This policy brief discusses how hedge funds’ leverage targeting strategies can precipitate fire sales and intensify market volatility during periods of stress. These findings complement earlier work on the adverse effects of procyclical deleveraging and leverage spirals in financial markets. Given the potential impact of deleveraging on the financial system, authorities may wish to consider a range of measures to address underlying vulnerabilities (also see FSB, 2025). Enhanced data collection and monitoring are essential for a comprehensive assessment of leveraged NBFIs, including their exposures, borrowing and cross-border activities. Tailored stress testing frameworks could help evaluate the interplay between leverage, volatility and asset prices under stress. Consideration might also be given to countercyclical limits on leverage, either at the entity level or for groups employing similar strategies. This could help constrain the build-up of leverage during booms without adding to deleveraging pressures during busts. Of course, more work would be needed to compare design options and evaluate effectiveness before such measures could be implemented. In this context, appropriately designed VaR frameworks (e.g. stressed or through-the-cycle VaR calibrations with liquidity horizons and concentration limits) could strengthen measures to mitigate the procyclicality inherent in leverage targeting. Finally, enhanced cross-border coordination, through harmonised definitions and reporting standards, would help to reduce regulatory arbitrage and support consistent oversight.

Adrian, T and HS Shin (2010): “Liquidity and leverage”, Journal of Financial Intermediation, vol 19, no 3, pp 418–437.

Aquilina, M, M Lombardi, A Schrimpf and V Sushko (2024): “The market turbulence and carry trade unwind of August 2024”, BIS Bulletin, no 90, August.

Aramonte, S, A Schrimpf and HS Shin (2022): “Non-bank financial intermediaries and financial stability”, BIS Quarterly Review.

Financial Stability Board (2020): Holistic Review of the March Market Turmoil. Financial Stability Board, November.

——— (2022): Enhancing the resilience of non-bank financial intermediation: progress report, November.

——— (2023): The financial stability implications of leverage in non-bank financial intermediation, September.

——— (2024): Global monitoring report on non-bank financial intermediation 2024, December.

——— (2025): Leverage in non-bank financial intermediation: final report, July.

Kruttli, M, P Monin, L Petrasek and S Watugala (2025): “LTCM redux? Hedge fund Treasury trading, funding fragility and risk constrains”, Journal of Financial Economics, vol 169, 104017.

Pinter, G, E Siriwardane, and D Walker (2024): Fire sales of safe assets, BIS Working Papers, no 1233, December.

Schrimpf, A, HS Shin and V Sushko (2020): “Leverage and margin spirals in fixed income markets”, BIS Bulletin, no 2, April.

Shin, HS (2010): “Risk and Liquidity”, 2008 Clarendon Lectures in Finance, Oxford University Press.