References

Aghion, Philippe, Céline Antonin, and Simon Bunel. 2021. The Power of Creative Destruction: Economic Upheaval and the Wealth of Nations. Translated by Jodie Cohen-Tanugi. Harvard University Press.

Balogh, Jeremiás Máté, and Tamás Mizik. 2021. “Trade–Climate Nexus: A Systematic Review of the Literature.” Economies 9 (3): 99. https://doi.org/10.3390/economies9030099.

Brenton, Paul, and Vicky Chemutai. 2021. The Trade and Climate Change Nexus: The Urgency and Opportunities for Developing Countries. Washington, DC: World Bank. https://doi.org/10.1596/978-1-4648-1770-1.

Cobham, Alex, and Petr Janský. 2018. “Global Distribution of Revenue Loss from Corporate Tax Avoidance: Re-Estimation and Country Results.” Journal of International Development 30 (2): 206–32. https://doi.org/10.1002/jid.3348.

European Commission. 2021. “Carbon Border Adjustment Mechanism.” European Commission – European Commission. 2021. https://ec.europa.eu/commission/presscorner/detail/en/qanda_21_3661.

European Council. 2022. “Council Agrees on the Carbon Border Adjustment Mechanism (CBAM).” 2022. https://www.consilium.europa.eu/en/press/press-releases/2022/03/15/carbon-border-adjustment-mechanism-cbam-council-agrees-its-negotiating-mandate/.

Green, Jessica F. 2021. “Follow the Money,” December 3, 2021. https://www.foreignaffairs.com/articles/world/2021-11-12/follow-money.

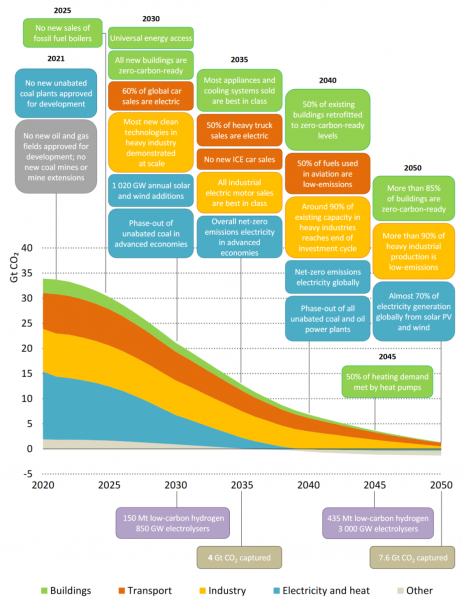

International Energy Agency. 2021. “Net Zero Emissions by 2050 Scenario (NZE).” IEA. 2021. https://www.iea.org/reports/world-energy-model/net-zero-emissions-by-2050-scenario-nze.

———. 2022a. “A 10-Point Plan to Cut Oil Use.” IEA. 2022. https://www.iea.org/reports/a-10-point-plan-to-cut-oil-use.

———. 2022b. “A 10-Point Plan to Reduce the European Union’s Reliance on Russian Natural Gas.” IEA. 2022. https://www.iea.org/reports/a-10-point-plan-to-reduce-the-european-unions-reliance-on-russian-natural-gas.

IPCC. 2022. “Climate Change 2022: Mitigation of Climate Change.” 2022. https://www.ipcc.ch/report/ar6/wg3/.

Köppl, Angela, and Stefan P. Schleicher. 2018. “What Will Make Energy Systems Sustainable?” Sustainability 10 (7): 2537. https://doi.org/10.3390/su10072537.

Laurens, Noémie, Clara Brandi, and Jean-Frédéric Morin. 2022. “Climate and Trade Policies: From Silos to Integration.” Climate Policy 22 (2): 248–53. https://doi.org/10.1080/14693062.2021.2009433.

Mazzucato, Mariana. 2021. Mission Economy: A Moonshot Guide to Changing Capitalism. Penguin.

Nordhaus, William. 2021. “Why Climate Policy Has Failed.” Foreign Affairs. 2021. https://www.foreignaffairs.com/articles/world/2021-10-12/why-climate-policy-has-failed.

Reed Smith LLP. 2021. “Five Key Things about the EU’s Carbon Border Adjustment Mechanism | Perspectives | Reed Smith LLP.” 2021. https://www.reedsmith.com/en/perspectives/2021/12/five-key-things-about-the-eus-carbon-border-adjustment-mechanism.

Rodrik, Dani. 2022. “A Better Globalization Might Rise from Hyper-Globalization’s Ashes | by Dani Rodrik.” Project Syndicate. 2022. https://www.project-syndicate.org/commentary/after-hyperglobalization-national-interests-open-economy-by-dani-rodrik-2022-05.

About the author

Stefan P. Schleicher is a professor at the Wegener Center for Climate and Global Change at the University of Graz. In addition, he serves as a scientific consultant at the Austrian Institute for Economic Research. He received his academic qualifications at the Institute of Technology in Graz and the University of Vienna. His academic career has taken him from the Institute for Advanced Studies in Vienna to the University of Bonn, the University of Pennsylvania, and several times to Stanford University. He has been accompanying Austrian and international energy and climate policy for years. His research focuses on sustainable economic structures, especially in energy and climate, and in the context of the unfolding disruptive developments. Current research includes the transformation of the Austrian energy system, the associated EU policies, and innovative concepts for long-term economic transitions. |