This policy brief is based on The Social Cost of Greenwashing, Working Paper. The views expressed are those of the authors and not necessarily those of the institutions the authors are affiliated with.

Abstract

Corporate greenwashing—the deliberate manipulation of environmental information—imposes economic costs that add to the costs of carbon emissions themselves. Our research quantifies these hidden costs at 2.2-2.5% of GDP annually. We uncover three critical realities for policymakers. First, information markets can become locked into self-reinforcing “greenwashing traps,” where superior, cheaper technologies cannot gain traction because public trust has been systematically eroded. Second, and counterintuitively, competition can worsen the problem by triggering costly and wasteful “information arms races” between firms. Third, because trust is slow to build but quick to collapse, restoration costs vastly exceed prevention costs. This is not just an environmental issue; greenwashing threatens market efficiency across all sectors, providing a direct, non-environmental rationale for financial regulators to intervene.

A fundamental puzzle confronts global energy markets. Between 2010 and 2022, the costs of solar and wind power decreased by 89% and 69%, respectively, making renewables cheaper than fossil fuels in most parts of the world. Yet, during this same period, the market share of fossil fuels remained high, hovering around 80%. This persistence defies standard economic models of substitution and suggests market failures that extend beyond simple price competition.

Our research posits that this failure stems from the strategic degradation of the information environment. We find that when firms can profit more from shaping perceptions than from improving products, they will invest heavily in doing so. This “information pollution” imposes a hidden but massive cost on the economy. We term this the Social Cost of Greenwashing (SCG), and our analysis quantifies its annual impact at a staggering 2.2-2.5% of GDP. This damage is distinct from and additional to the direct environmental damages captured by the Social Cost of Carbon (SCC).

Greenwashing is not a series of isolated incidents but a systemic process that can trap markets in inefficient equilibria. This occurs through a self-reinforcing cycle where the degradation of information makes future manipulation both easier and more profitable.

Our simulations indicate that a sustained greenwashing campaign can lead to a significant decline in public trust, from 95% to 40%. The result is that an inferior “brown” technology can lock in a 75% market share when an efficient, well-informed market would have allocated it only 18%.

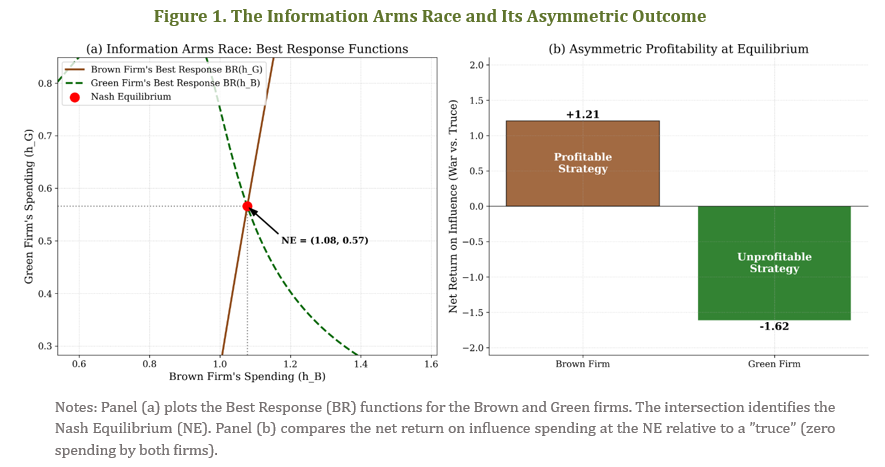

Conventional antitrust logic suggests that promoting competition is always welfare-enhancing. Our findings reveal that in information markets, this logic can be dangerously reversed. Introducing a “green” firm to counter the incumbent’s manipulation does not necessarily lead to a better outcome; instead, it can trigger a destructive “information arms race.”

In this scenario, the incumbent escalates its manipulation to defend its market share, forcing the green entrant to burn cash on clarification campaigns. The result is that society bears the cost of both firms’ wasteful spending, while the information environment becomes even more polluted. Our model reveals a stark asymmetry: under plausible parameters, the brown firm earns a net return of +1.21 for every dollar spent on manipulation, whereas the green firm loses 1.62 for every dollar spent on clarification. As shown in Figure 1, the entry of a competitor can lead to a higher total social cost than a manipulative monopoly.

The unique dynamics of information markets necessitate a new regulatory approach that treats information integrity as a critical component of economic infrastructure.