The authors would like to thank Massimiliano Affinito, Alessio De Vincenzo, Silvia Fabiani, Silvia Magri, Roberto Torrini and Valerio Vacca for their suggestions. Simona Arcuti, Giuseppe Agnello, Giovanna Giuliani, Luca Mignogna, and Valentina Romano also contributed to the processing of data on bank and post office branches, a project which was coordinated by Daniele Marangoni and Andrea Orame. This policy brief is based on Note di stabilità finanziaria e vigilanza N. 47. The views expressed are those of the authors and not necessarily those of the institutions the authors are affiliated with.

Abstract

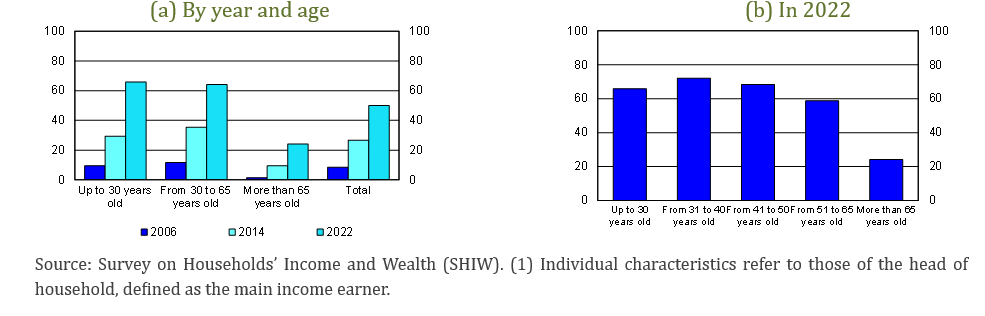

Between 2008 and 2022, the number of bank branches in Italy decreased by about 40 per cent. The decline was more pronounced in the North of the country and has intensified since 2015. However, this reduction was not accompanied by a deterioration in households’ access to financial services. According to Banca d’Italia’s Survey on Household Income and Wealth, the share of households with at least one bank or post office deposit account rose to over 97 per cent in 2022 (based on the latest available data). Initially, this increase was supported by postal services; subsequently, greater reliance on digital banking services fuelled a further rise. Significant differences remain in the way households use digital services in the financial industry. According to the survey, in 2022 the share of remote users was 25 per cent among households whose head was over 65 years of age, compared with 66 per cent among younger households. These differences are likely to diminish in the future: almost 60 per cent of households whose head is aged 51-64 years have used digital channels to access financial services.

The distribution network of Italian banks has changed significantly over time, reflecting shifts in business models, consumer habits, and technological developments. Since the beginning of the last decade, banks have progressively reduced their physical presence across the country, while expanding their range of remote services.

This note examines the evolution of bank and post office branches, alongside households’ use of digital channels, by measuring access to financial services through deposit accounts. The analysis draws on data from supervisory reports and registers, the Survey on Household Income and Wealth (SHIW), and the Regional Bank Lending Survey (RBLS).

The evidence collected shows that the reduction in bank branches, which began in 2009 and intensified after 2015, was not accompanied by a deterioration in households’ access to the financial system.1 According to SHIW data, between 2006 and 2016 the share of households with at least one deposit account with an intermediary increased, supported by the expansion of postal services, which more than offset lower recourse to bank deposits. Since 2016, the share of households with a bank deposit account continued to increase; differently from the previous period, bank digital services supported this trend. The use of digital channels is lower among older households (where the head of household is over 65).

This note is organized as follows: Section 2 describes the dynamics underlying the gradual downsizing of the branch network in Italy. Section 3 discusses the increasing role of remote financial services, while Section 4 measures households’ access to the financial system in light of the reconfiguration of distribution channels.

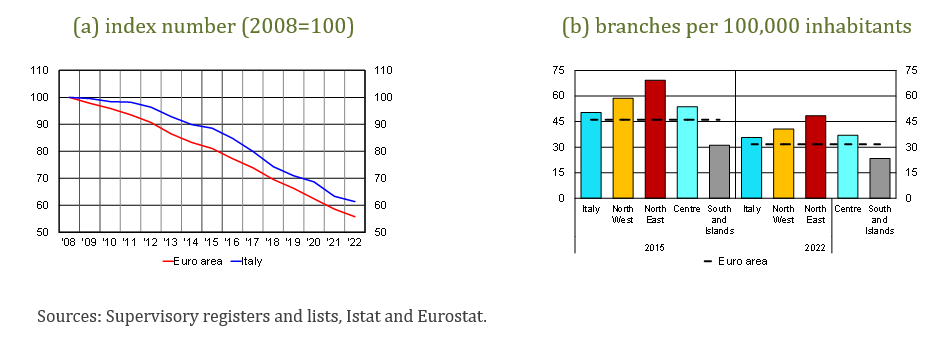

Over the past 15 years, the bank network has undergone significant change. The expansion in the number of bank branches came to a halt in 2009, after which their number began to decline — driven both by intermediaries’ efforts to improve operational efficiency and by major restructuring within the sector (Figure 1.a). The decline then intensified, reflecting technological innovations and changes in customers’ purchasing and payment behaviour: between 2015 and 2022, the number of bank branches fell by 30.7 per cent,2 to 35.7 per 100,000 inhabitants, still above the euro-area average (Figure 1.b).3

The decline was smaller in the South and Islands (27.5 per cent), where physical branches were already less widespread. While the gap between geographical areas has narrowed compared with 2015, it still remains large: at the end of 2022, the number of bank branches per 100,000 inhabitants ranged from 48 in the North-East to 23 in the South and Islands.

Figure 1. Changes in bank branches

According to reports from intermediaries, over 60 per cent of branch closures originates from consolidation processes within the sector and the resulting rationalization of distribution networks. Within this reconfiguration, some intermediaries have actually increased their total number of branches:4 among these, cooperative banks are the most numerous.5

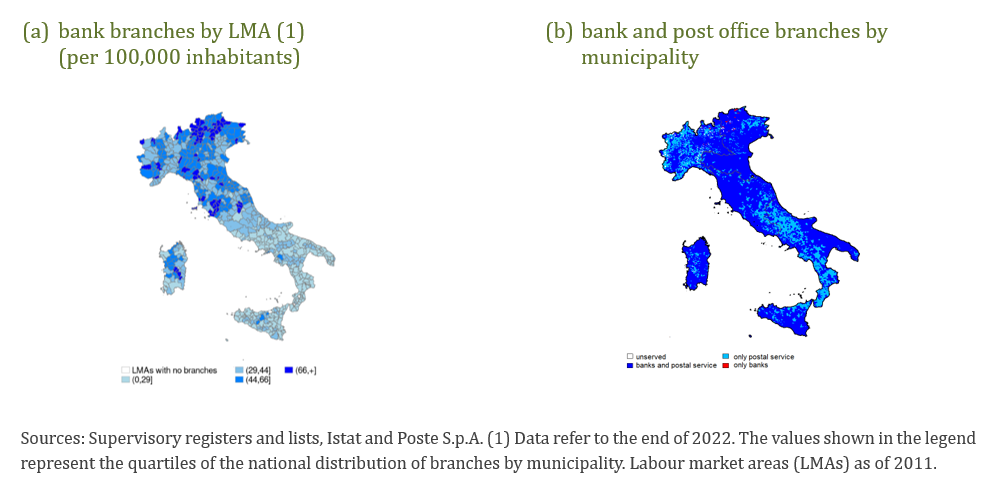

Despite the generally sharp drop, at the end of 2022 almost every labour market area (LMA)6 – i.e. sub-regional geographical clusters based on commuting flows, grouping communities where most of the labour force lives and works – was served by at least one bank branch (Figure 2.a). The only exceptions are four LMAs in the South: three in Calabria and one in Sicily. Three of these are made up of a particularly small number of municipalities (one includes just two, and the others four) while the fourth, in the hinterland of Calabria, comprises eight municipalities. Overall, Southern Italy is the area with the lowest concentration of bank branches.

The same analysis based on administrative boundaries – commonly used in various studies – presents some limitations due to the heterogeneity in the size of municipalities. However, further analyses yield results similar to those obtained using LMAs when post office branches are also taken into account, as their decline has been much more limited7 and they are able to offer services comparable to those provided by bank branches. In 2022, 39.9 per cent of Italian municipalities had no bank branch, although these areas accounted for only 6.8 per cent of the resident population; this share was higher in the South and Islands (48.5 per cent of municipalities). However, when post office branches are included, the share of municipalities without any branch falls significantly, to 2.7 per cent overall (5.9 per cent in the North-West and 0.5 per cent in the South and Islands; Figure 2.b). The population living in these municipalities accounts for 0.2 per cent of the total. Post office branches have played a crucial role in maintaining physical access to financial services, especially in the South and Islands. Municipalities without a bank or post office branch often also lack other essential services. For example, three out of five municipalities have no convenience stores (“tabacchi”)8; one in four has no school; only one in ten has an active pharmacy; a railway station is rarely present. However, travel times by car to reach municipalities served by a bank or post office branch remain relatively short: for the most remote areas (those in the last quartile of the distribution), the average travel time is less than ten minutes. In municipalities without branches, over 70 per cent of households also have access to high-speed fixed broadband internet.

Figure 2. Intermediary branches across the country

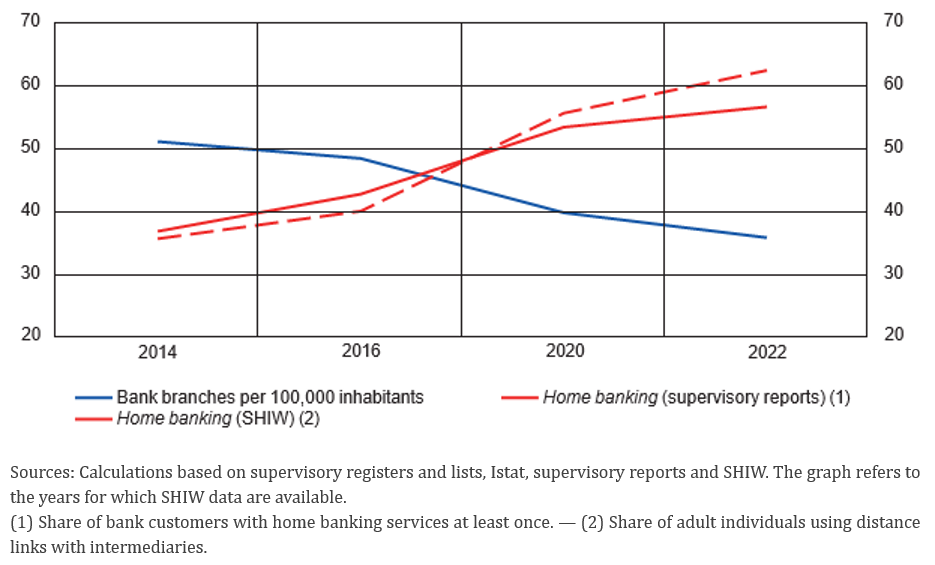

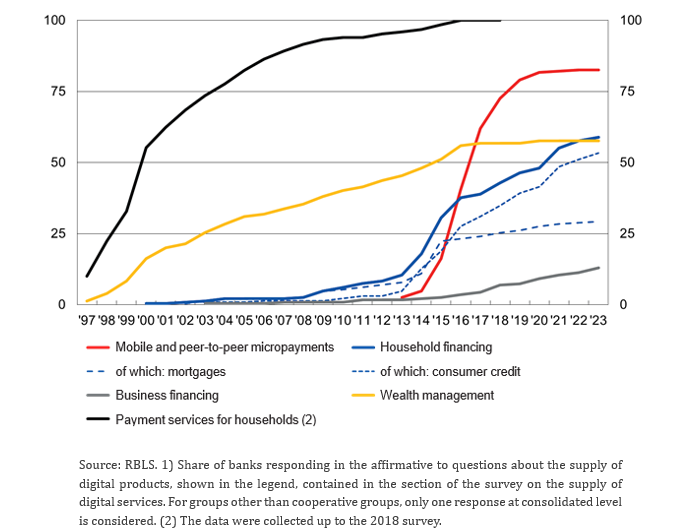

The downsizing of the physical banking network was accompanied by an expansion in the provision of digital financial services.9 Supervisory reports and the Survey on Household Income and Wealth (SHIW) provide useful insights into households’ remote access to these services.

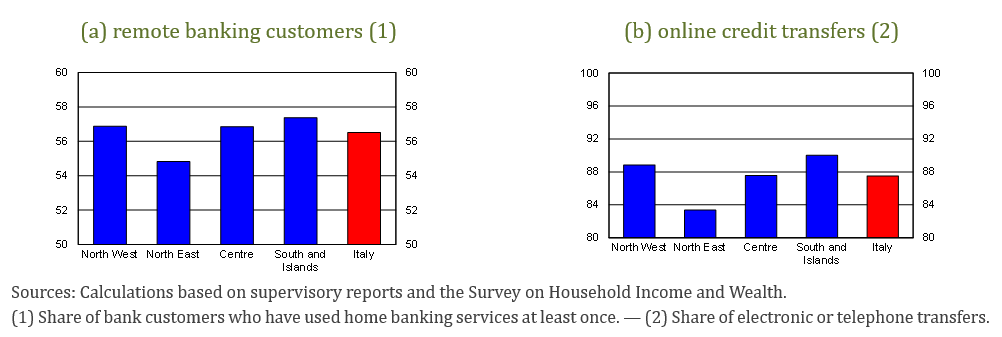

According to the reports, 57 per cent of customers used banking services via digital channels at least once in 2022 (Figure 3.a).10 This source also provides insights into the geographical patterns of this trend, which was relatively more widespread in the South than in other parts of the country. Based on SHIW data, 62 per cent of adults accessed banking services remotely in 2022.11

Figure 3. Use of digital financial services by geographical area in 2022

(per cent)

Both sources show that remote access to financial services has spread rapidly since the second half of the last decade (Figure 4). According to bank-reported data, online and telephone bank transfers have grown substantially in recent years, accounting for 88 per cent of all bank transfers in 2022 (from 54 per cent in 2012); again, these are more widespread in the South and Islands, and less so in the North-East (Figure 3.b).

Figure 4. Physical and digital access to banking services

(units; per cent)

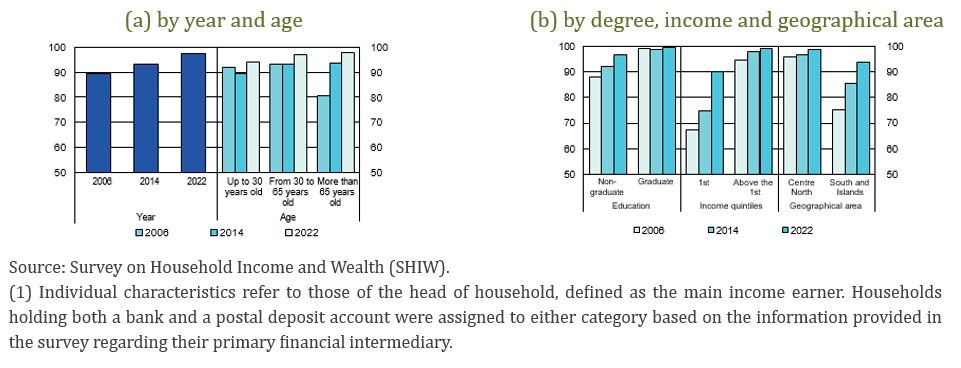

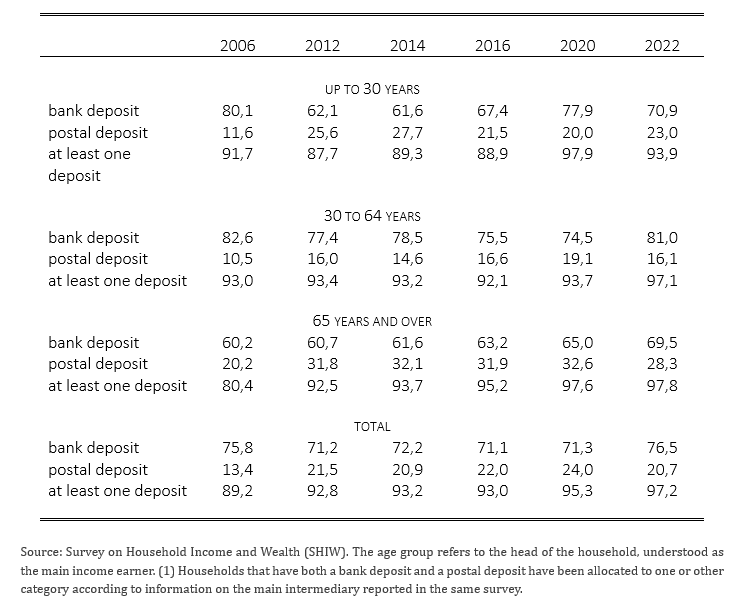

The gradual shrinking of the branch network has not significantly affected Italian households’ access to financial services. According to SHIW data, the share of households with bank or postal deposit accounts rose from 89 per cent in 2006 to 93 per cent in 2016, reaching 97 per cent in 2022 (see Table a1; Figure 5a).12

This was supported by changes in consumption and payment behaviour, as consumers have increasingly turned to online purchases and digital payment methods.13 Initially, the expansion in postal services contributed to this trend and the share of households with a deposit account increased between 2006 and 2016. Since 2016, alongside the progressive spread of digital channels offered by an increasing number of banks, the share of households with a deposit account has also grown.14 The increase in the share of households with bank or postal deposit accounts was also significant among financially vulnerable segments of the population, especially those with low income levels. Growth was markedly higher in the South and Islands than in the Centre and North, where financial services were already widespread (Figure 5b).

Figure 5. Share of households holding bank or postal deposit accounts (1)

(per cent)

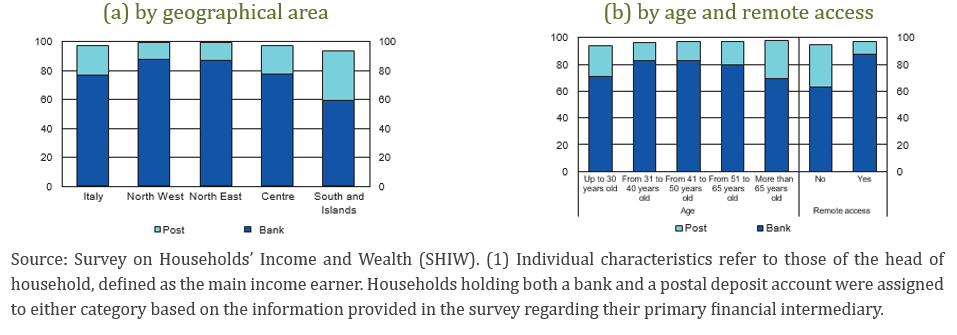

Postal services play an important role for some segments of the population. According to the latest available data, their use is greater among households in the South, whose head is aged over 65 and those not using remote access to financial services (Figure 6).

Although the risks to accessing financial services stemming from changes in banks’ distribution channels appear to be limited overall, there are still significant differences in how Italian households engage with digitalization. In 2022, the share of households reporting remote connections with financial intermediaries was almost 25 per cent among those with a head of household aged over 65, compared with 66 per cent among younger households. Among the least well-off households, the use of these channels is considerably lower (18 per cent). It is plausible to assume that age-related differences will diminish in the future as the use of digital tools becomes more widespread: almost 60 per cent of households whose head is aged between 51 and 64 used digital channels to access to financial services (Figure 7).

Figure 6. Share of households holding bank or postal deposit accounts in 2022 (1)

(per cent)

Figure 7. Share of households with remote access to financial services (1)

(per cent)

Figure a1. Dissemination of the supply of financial services through digital channels (1)

(annual data; percentage shares)

Table a1. Households with bank or postal deposits by age group (1)

(percentage shares)

Throughout this note, we refer to financial services associated with deposit accounts, excluding those relating to access to credit.

At the end of 2015, the decline compared with 2008 was 11.4 per cent; it stood at 38.6 per cent over the entire period under review.

A similar trend was observed in the other euro-area countries, where the number of branches averaged 32 per 100,000 inhabitants at the end of 2022, the latest year for which data are available.

Mergers and acquisitions are taken into account and branches of foreign banks are not considered.

These include banche di credito cooperativo and banche popolari cooperative.

We use labour market areas computed by Istat using daily commuting patterns in 2011.

Post office branch data are available starting from 2009. Between 2009 and 2022, the number of post office branches fell from 13,802 to 12,755 (‑7.6 per cent). There are currently around three post office branches for every five bank branches.

Retail establishments authorized to offer state lottery services, process utility payments, and provide access to postal products, public transportation tickets, periodicals, stationery, and gift items.

See D. Arnaudo, S. Del Prete, C. Demma, M. Manile, A. Orame, M. Pagnini, C. Rossi, P. Rossi and G. Soggia, ‘The Digital Trasformation in the Italian Banking Sector’, Banca d’Italia, Questioni di Economia e Finanza (Occasional Papers), 682, 2022.

This share is calculated as the ratio between the number of home banking contracts and the number of household deposit accounts, adjusted for the different treatment of joint accounts. The numerator is the number of bank customers with a personal home banking contract, while the denominator is the number of deposit accounts (with joint accounts counted as a single customer). The unadjusted figure – 78 per cent in 2022 – therefore tends to overestimate the extent of remote access. The Survey on Household Income and Wealth makes it possible to calculate the average number of joint holders per deposit account (1.38 in 2022), which can be applied to the denominator to provide a more accurate representation of remote access to financial services. As the survey does not provide a breakdown of current accounts by individual holders within a household, the adjustment factor was calculated by restricting the analysis to households that have only one deposit account with a single bank. In 2022, these accounted for 63 per cent of the sample of households with a bank deposit account.

The unadjusted figure, equal to 50 per cent in 2022 and referring to the household as the unit of analysis, is adjusted by considering only households holding a bank deposit account and by weighting the sample according to the number of adults in each household, which serves as a proxy for the number of individual bank customers.

Latest available data. In this section, unlike in Section 3, we refer to the share of households using digital services, irrepsective of whether they hold a bank or postal deposit account.

According to data from Politecnico di Milano, B2c eCommerce purchases in Italy almost doubled between 2019 and 2024 (from €31 billion to €59 billion); see the report L’eCommerce B2c in Italia nel 2024, October 2024. According to the 2022 SPACE Survey, the use of cash at physical points of sale decreased to 69 per cent of total payments in Italy (from 86 per cent in 2016); the share of online payments has increased significantly over time, reaching 16 per cent of total non-recurring payments (6 per cent in 2019; see Banca d’Italia, Report on the payment attitudes of consumers in Italy: results from the ECB SPACE 2022 survey, Markets, Infrastructures and Payment Systems, November 2023). The strongly expansionary stance of monetary policy in the years leading up to 2022, which lowered interest rates on financial assets other than deposits (such as bonds), led depositors to increase their share of deposits in financial assets; it is less likely that these policies played a major role in the rise in the share of deposit-holding households.

The reduction in the cost of opening online current accounts may also have contributed to this trend. According to data from Banca d’Italia’s Survey on the cost of bank accounts for 2023, the cost of operating an online current account was €28.9, compared with just over €100 for a traditional current account.