The findings and exposition in this SUERF Policy Brief are based on Herbst, T., Lang, J. H., and Rusnák, M. “The impact of monetary policy and macroprudential policy on corporate lending rates in the Euro area”, ECB Working Paper Series No. 3057, European Central Bank, May 2025. The views expressed in this paper are those of the authors and do not necessarily reflect those of the European Central Bank, the Eurosystem, or the Deutsche Bundesbank.

Abstract

What is the differential impact of monetary policy and macroprudential policy on bank lending rates in the euro area? We answer this question using granular corporate loan-level data for the period 2019-2023. We document three results: First, consistent with the predictions of a stylized theoretical model of bank lending rates, monetary policy exerts an order of magnitude larger impact on lending rates than macroprudential policy. Second, the effectiveness of monetary policy transmission weakens when interest rates are close to or below zero. Third, the impact of macroprudential policy on lending rates increases when banks have limited capital headroom above capital buffer requirements, indicating cautious lending behaviour when banks get close to regulatory constraints. Our findings have important implications for the interactions of monetary and macroprudential policy.

Understanding how monetary and macroprudential policies affect bank lending rates, especially when implemented simultaneously, is crucial for policymakers. Between 2022 and 2023, the ECB raised its deposit facility rate from 0.5% to 4%, marking the most significant monetary tightening cycle in decades. At the same time, many euro area countries announced increases in countercyclical capital buffer (CCyB) requirements for banks as part of macroprudential policy measures. The simultaneous policy tightening coincided with a significant rise in bank lending rates and tightening in credit standards resulting in a sharp deceleration in bank loan growth. Using granular loan-level data from the euro area, we shed more light on the relative contributions of monetary and macroprudential policies. In particular, we examine how monetary policy, and macroprudential capital buffer requirements influence bank lending rates during periods of simultaneous tightening, with a focus on the recent tightening cycle. Understanding these dynamics is critical for informing the calibration of future policy measures to ensure financial and price stability.

A simple theoretical model illustrates the expected impact of monetary and macroprudential policies on bank lending rates. In the model, lending rates are determined by bank funding costs and a mark-up to cover operating expenses and expected credit risk. Bank funding costs in turn are given by the weighted average of the cost of equity and the cost of debt, where the relative weight depends on bank capitalisation, i.e. the ratio of equity over assets. For simplicity, the equity premium and pass-through of monetary policy rates to the cost of debt are assumed to be constant over time. Moreover, the risk-weights of loans are assumed to be constant and banks always maintain the same distance between their risk-weighted capital ratio and the capital buffer requirement. Under these assumptions it is easy to show that a pass-through parameter will determine the impact of monetary policy on lending rates and the equity premium multiplied by the risk-weight will determine the impact of capital-based macroprudential policy measures. For example, a pass-through coefficient of 75% would imply that a 100 basis points (bps) increase in the monetary policy rate would lead to an increase in bank lending rates of 75 bps. Moreover, an equity premium of 8% and a risk-weight of 50%, would imply that a 100 bps increase in capital buffer requirements would lead to an increase in bank lending rates of 4 bps. The magnitudes implied by this arguably simple but realistic model help us to interpret the empirical results of our study.

To quantify the relative effects of monetary and macroprudential policies on bank lending rates, we estimate loan‑level pricing regressions using a granular dataset that combines three main data sources. First, we use AnaCredit, the harmonized euro area corporate credit register, which provides us with all new euro‑denominated loans to non‑financial firms in 15 euro‑area countries between 2019 Q1 and 2023 Q1 (16.6 million observations). Second, we merge this data with confidential bank‑level balance sheet and income statement data lagged by one quarter. Third, we add macro-financial variables such as the 3‑month OIS rate, the 10‑year government bond yield, projected GDP growth and inflation, and an index of financial stress. We use a bank’s capital‑to‑assets ratio as a proxy for macroprudential policy, and we refer to this measure as bank capitalisation.1 As our measure of monetary policy we use the 3-month OIS rate on the date of the loan inception. Our baseline regression explains the interest rate on a new loan as a function of the contemporaneous OIS rate, lagged bank capitalisation, loan data (amount, maturity, collateral, rate type), bank data (bank size, the NPL ratio, profitability, and the provisioning ratio) and macro-financial controls, plus firm‑quarter fixed effects to proxy for loan demand (Khwaja and Mian, 2008). This granular setup isolates credit supply effects. In robustness checks, we instrument monetary policy with high-frequency surprises to isolate the exogenous effect of monetary policy.

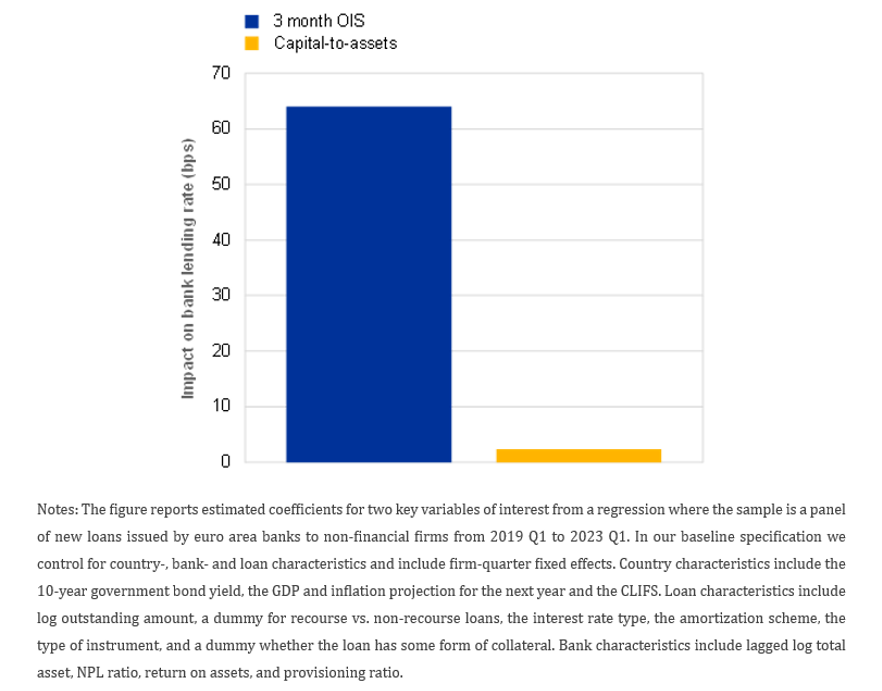

Our empirical results highlight that the monetary policy impact on bank lending rates is an order of magnitude larger than the impact of macroprudential policy measures. Using our benchmark regression specification, we find that a 100 bps increase in monetary policy rates raises bank lending rates by approximately 64 bps, reflecting a strong pass-through (Figure 1). In contrast, a 100 bps increase in the capital-to-assets ratio is associated with only a 2.4 bps rise in lending rates. This implies that the impact on bank lending rates of a standard 25 bps monetary policy rate hike is equivalent to the effect of a substantial 6.7 pp increase in the capital-to-assets ratio – an increase of around 2.8 standard deviations. Under typical regulatory assumptions1, this corresponds to a 9 pp increase in risk-weighted capital requirements. Overall, the influence of bank capitalisation is an order of magnitude smaller, highlighting the predominant role of monetary policy in shaping bank loan pricing. This finding is robust across various regression specifications and is consistent with the simple theoretical framework described above.

Figure 1. Estimated impact of monetary policy and bank capitalisation on the lending rates

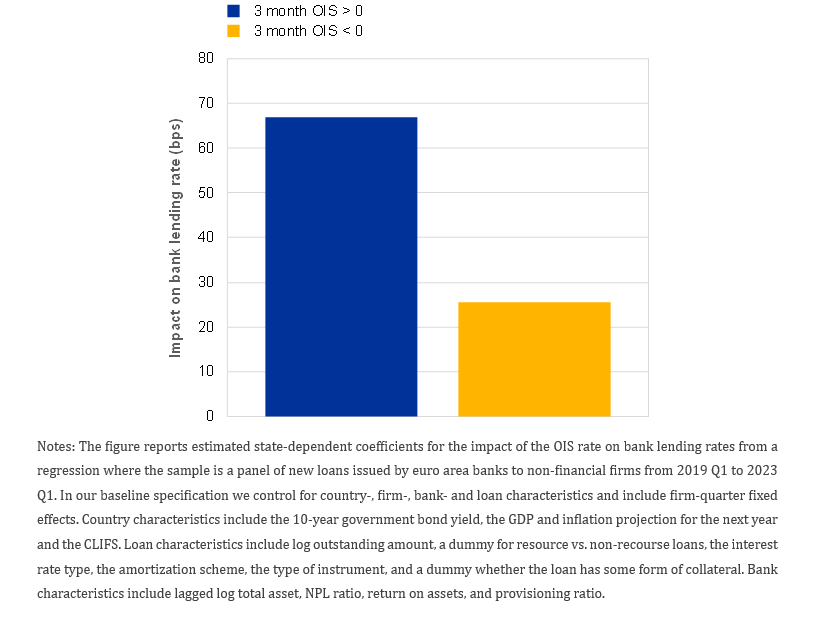

In addition, we find that the pass‑through of monetary policy to bank lending rates weakens substantially once short‑term interest rates approach the zero lower bound. In state‑dependent model specifications, a 100 bps increase in the 3‑month OIS rate is associated with a 67 bps rise in loan rates when the OIS rate is greater than zero. In contrast, the same monetary policy shock lifts lending rates by only 26 bps when the OIS rate is smaller than zero, indicating a muted transmission at the zero lower bound (Figure 2). This non‑linearity underscores the constraints on conventional monetary policy near the lower bound and highlights the diminished potency of rate cuts once policy is close to negative territory, increasing the relative importance of non-standard monetary policy measures.

Figure 2. State-dependent impact of monetary policy on bank lending rates

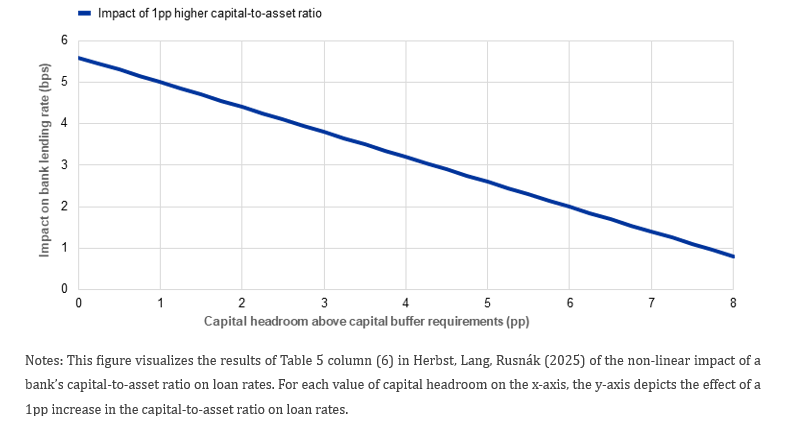

We also find that the impact of capital-based macroprudential policy measures on bank lending rates increases when banks have limited capital headroom above capital buffer requirements. In state-dependent model specifications, a 1pp higher capital-to-asset ratio is associated with a 5.6 bps higher bank lending rate if banks do not have any capital headroom above macroprudential capital buffer requirements (See Figure 3). While for a bank with capital headroom of 3pp (the median), the same increase in bank capitalisation is associated with only a 3.8 bps higher lending rate, which is around one third lower. These findings indicate that banks could be reluctant to breach macroprudential buffer requirements and reduce loan supply when their capital ratios get close to them, which is in line with the findings in Mathur, Naylor, and Rajan (2023) and Couaillier, Lo Duca, Reghezza, and Rodriguez d’Acri (2022). Moreover, these findings suggest that changes in bank capitalisation have a limited impact on loan supply and loan pricing when banks have comfortable capital headroom. This underscores the importance of building buffers early on before any adverse shock leads to binding capital requirements.

Figure 3: State-dependent impact of bank capitalisation on bank lending rates

Our findings have important policy implications. First, monetary policy tightening seems to have been the major driver behind the increases in bank lending rates and tightening of bank credit supply observed in the euro area between 2022 and 2024. Second, given comfortable capital headroom of euro area banks and solid profitability at the current juncture, which allows banks to increase capital via retained earnings, a potential further tightening of macroprudential buffer requirements is unlikely to have a big impact on bank loan supply and bank lending rates. Third, a potential release of macroprudential buffer requirements at the current juncture where banks have ample capital headroom would not have a material impact on bank loan supply and lending rates and therefore does not seem to be advisable given the presence of financial stability risks (See e.g. the May 2025 ECB Financial Stability Review). More generally, the results show that it can be beneficial to build up macroprudential capital buffers early on so that these buffers can be released, if capital requirements are at risk of becoming binding, to support bank credit supply and cushion a potential spike in bank lending rates.

Couaillier, C. (2021): “What are banks’ actual capital targets?,” Working Paper Series 2618, European Central Bank.

Couaillier, C., Lo Duca, M., Reghezza, A. and Rodriguez d’Acri, C. (2022): “Caution: do not cross! Capital buffers and lending in Covid-19 times“, Working Paper Series 2644, European Central Bank.

Herbst, T., Lang, J. H., and Rusnák, M. (2025): “The impact of monetary policy and macroprudential policy on corporate lending rates in the Euro area”, Working Paper Series 3057, European Central Bank.

Khwaja, A. I., and A. Mian (2008): “Tracing the impact of bank liquidity shocks: Evidence from an emerging market”, American Economic Review, 98(4), 1413–1442.Mathur, A., Naylor, M. & A. Rajan (2023): “Useful, usable, and used? Buffer usability during the Covid-19 crisis“, Bank of England working papers 1011, Bank of England.

The main reason for using bank capitalisation in our regressions is that the impact of higher macroprudential capital buffer requirements on lending rates should ultimately depend on how much additional equity funding per unit of asset the bank decides to use. This in turn depends on how much the bank’s capital ratio target increases in response to higher capital buffer requirements, which can be less than one-for-one and differ over time (Couaillier, 2021), and on the average risk-weight of the bank, which can differ considerably across banks as well as time. Using bank capitalisation in our regressions instead of the risk-weighted capital buffer requirement accounts for both of these channels and is therefore a good indirect proxy for the impact of higher macroprudential capital buffer requirements on lending rates.

We assume a 75% risk weight, as the average risk weight for exposures to corporates in the euro area are around 85% and 45% under standardized approach and the internal ratings-based approach respectively. We also assume one-for-one movements between bank capitalization and bank capital requirements for the illustration.