References

Cevik, Serhan and João Tovar Jalles, 2023. “Eye of the Storm: The Impact of Climate Shocks on Inflation and Growth,” Working Papers REM 2023/0276, ISEG – Lisbon School of Economics and Management, REM, Universidade de Lisboa.

Ciccarelli, Matteo, Friderike Kuik and Catalina Martínez Hernández, 2023. “The asymmetric effects of weather shocks on euro area inflation,” Working Paper Series 2798, European Central Bank.

Felbermayr, Gabriel and Jasmin Gröschl 2014. “Naturally negative: the growth effects of natural disasters”, Journal of Development Economics, 111(2014), 92-106.

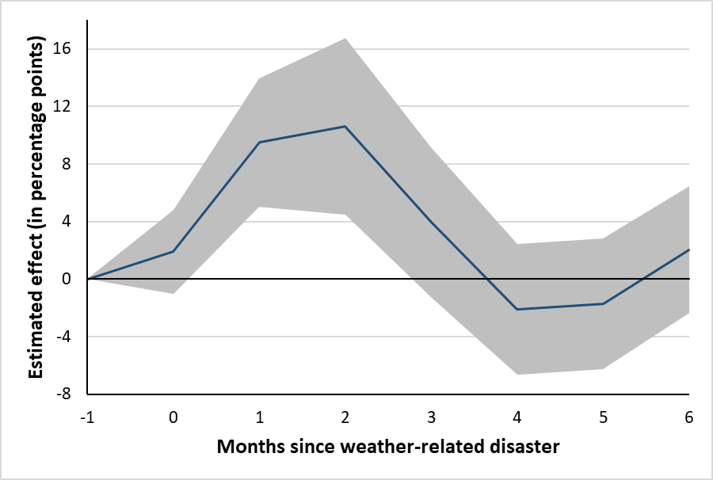

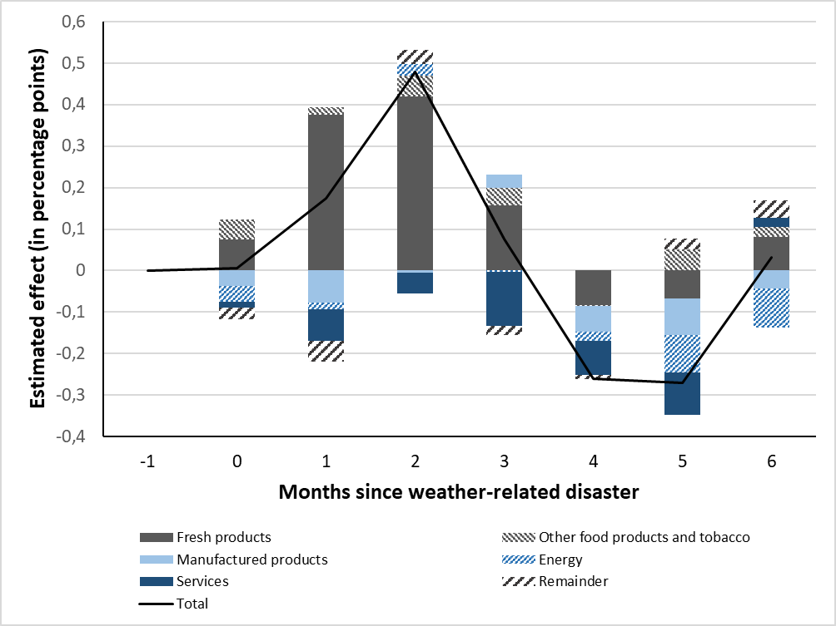

Gautier, Erwan, Christoph Grosse-Steffen, Magali Marx and Paul Vertier, 2023. “Decomposing the Inflation Response to Weather-Related Disasters,” Working Paper 935, Banque de France.

Grislain-Letrémy, Céline, 2022. “Natural disasters: exposure and underinsurance”, Banque de France blog 294, December 2022.

Kotz, Maximilian, Friderike Kuik, Eliza Lis and Christiane Nickel, 2023. “The impact of global warming on inflation: averages, seasonality and extremes,” Working Paper Series 2821, European Central Bank.