We analyze the impact of the introduction of a Loan-to-Value (LTV) limit in The Netherlands on the probability for first time buyers to become homeowner using a duration model. Our research design is underpinned by a theoretical model that shows that a lower LTV limit results in suspending or renouncing home ownership, but only for liquidity constrained individuals. We use this finding to construct a treatment and control group with parents’ financial wealth as a proxy for being liquidity constrained. We disentangle the effects of the LTV limit on the timing of the transition to first time home ownership from other market developments. We show that the effect of the LTV limit on this transition is approximately 6%. This finding suggests that other developments, notably rapidly increasing house prices, are more important in achieving homeownership than the LTV limit.

The financial crisis has shown that supervising individual financial institutions is not enough to maintain financial stability. Macroprudential policy is needed as well to limit system-wide financial risks. Examples of macroprudential instruments are regulatory capital requirements for systemic risks and Loan-to-Value (LTV) limits (Galati and Moessner, 2011).

However, macroprudential policies often imply a trade-off between more financial resilience in the long run and short-term macroeconomic costs such as lower credit and output growth (Bank for International Settlements, 2019). This also holds for the introduction of an LTV limit, which may enhance bank stability but may also make it more difficult to buy a house, notably for entrants at the housing market.

The Dutch example is a point in case. An LTV limit was introduced in the Netherlands in 2012. The average LTV ratio at origination of buyers aged below 35 – a proxy for housing market entrants – slightly decreased from 93% in 2012 to 90% in 2018. In the same period, average house prices increased by 27% (CBS, 2021). Existing research shows that housing prices would have increased even stronger in the absence of macroprudential policy tools (De Nederlandsche Bank, 2015; Elbourne et al., 2020). A potential side effect of enhanced stability is a reduced demand for owner-occupied housing. Simulations show that the majority of first-time home buyers postpone the transition to homeownership to save for the required down payment (De Nederlandsche Bank, 2015).

We analyze the impact of the introduction of an LTV limit in the Netherlands on the probability for first time buyers to become homeowner. It is difficult to identify the LTV effect, as the probability and timing of the transition to home ownership are also affected by housing market conditions. For instance, rising house prices impact the probability to become homeowner as shown by Boehm and Schlottmann (2011, 2014).

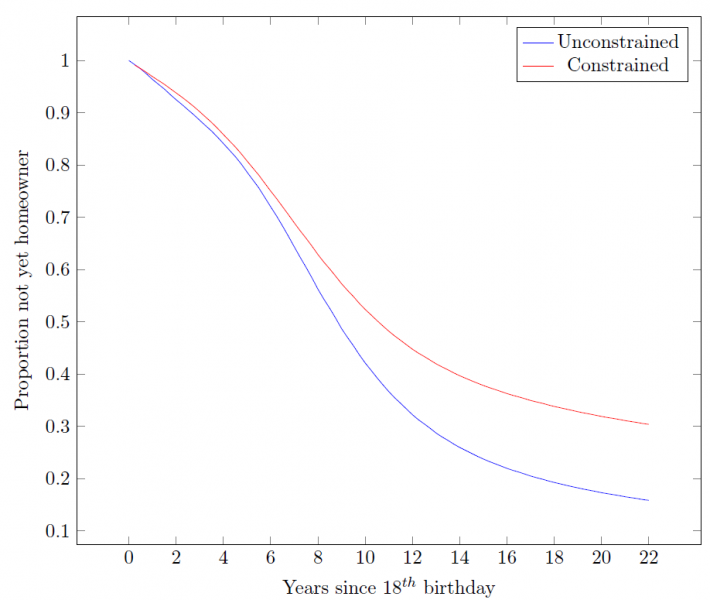

Our theoretical model confirms that both house price increases and a reduction of the LTV limit reduce the probability to become homeowner. The model compares the utility functions for renters and homeowners, a methodology proposed by Brueckner (1986). The model also shows that the effect of the LTV limit is only binding for liquidity constrained individuals. We use this finding to isolate the effect of the LTV limit from housing market conditions by constructing a treatment and control group. The treatment group consists of individuals whose parents have less than a given amount of financial wealth (50.000 in our baseline specification). The control group consists of individuals with wealthy parents who could therefore (potentially) make the required down payment. We exploit exogenous variation of LTV limits for liquidity constrained and unconstrained households to identify the effect of this macroprudential instrument on the timing of home purchases using a duration model. Figure 1 shows the survivor function that underlies our duration model. The survivor function plots the fraction of the sample that has not made the transition to homeownership after turning 18, without controlling for individual characteristics.

Figure 1: Share of liquidity constrained and unconstrained individuals that has not yet made the transition to homeownership

This graph plots the Kaplan-Meier survivor function for the unconstrained and constrained individuals in our sample. It is the proportion of the sample that has not yet made the transition from renting or living at parents to homeownership.

The average duration between an individual’s 18th birthday and first-time home ownership has increased since the introduction of the LTV limit. However, the effect of a reduction of the LTV limit on the probability for first-time home buyers to become homeowner is limited, as the difference between the treatment and the control group is approximately 6%. This finding suggests that other developments, notably rapidly increasing house prices, are more important.

Our results are robust in a variety of dimensions. First, a comparison of parametric and semi-parametric models indicates a low risk of misspecification of our baseline model. Second, we control for unobserved heterogeneity by including individual random effects. Third, our results are robust for alternative definitions of the treatment and the control group. We assumed in the baseline model that individuals are not financially constrained if their parents’ wealth is at least 50.000 euro. Since this threshold is arbitrary, we test a threshold value of 100.000 euro of financial wealth as well. The key results do not change. We control the level of parents’ financial wealth by the number of children, with little effect on the hazard ratio. When we use parents’ housing wealth less mortgage instead of financial wealth, the hazard ratio gets close to one, but we believe housing wealth is an inferior proxy compared to financial wealth due to its illiquid nature.

Detractors of LTV-limit reductions are often worried about potential borrowers needing to save longer, before being able to purchase their first home. So we contribute to the discussion about further tightening the LTV limit. We cannot say whether a further cut will have greater effects, but we show that the effect of the earlier cut is limited and entails a modest slowdown in the timing of purchases. We also show that the growth of house prices has a leverage effect on the down payment, as the LTV limit is procyclical (when prices increase, borrowers can obtain more debt if their income allows). This may be a reason to implement policies that oppose this leverage cycle, such as phasing out tax incentives to debt.

The average duration between an individual’s 18th birthday and first-time home ownership has increased since the introduction of the LTV limit, but not because of it. We find little difference between the treatment and control group. This finding suggests that the increase in duration until home ownership is mainly caused by housing market developments, notably rapidly increasing house prices, and not by the LTV policy. A potential explanation for the limited effect of the LTV limit on the transition to home ownership could be that Debt-Service-to-Income limits bind first and that LTV limits simply impose a choice of what to buy and when, given the maximum amount of potential debt. Alternatively, the effect could be local, as the reduction from 106% to 100% in 7 years was small and slow; we cannot exclude that further reduction could entail larger side effects.

Bank for International Settlements. (2019). Examining macroprudential policy and its macroeconomic effects – some new evidence (Working Paper No. 825). Bank for International Settlements.

Boehm, T. P., and Schlottmann, A. M. (2014). The dynamics of housing tenure choice: Lessons from Germany and the United States. Journal of Housing Economics, 25, 1.

Brueckner, J. K. (1986). The downpayment constraint and housing tenure choice: A simplified exposition. Regional Science and Urban Economics, 16 (4), 519-525.

De Nederlandsche Bank. (2015). Effects of further reductions in the ltv limit (DNB Occasional Study No. 1302). Dutch Central Bank, Research Department.

Elbourne, A., Soederhuizen, B., and Teulings, R. (2020). De effecten van macroprudentieel beleid op de woningmarkt. Centraal Planbureau.

Galati, G., and Moessner, R. (2011). Macroprudential policy – a literature review (Working Paper No. 337). Bank for International Settlements.

Statistics Netherlands. (2021). Bestaande koopwoningen; verkoopprijzen prijsindex 2015=100.