We provide evidence that the European Central Bank’s targeted longer-term refinancing operations (TLTROs) increased not only bank lending but also lowered overall financing costs and stimulated the macroeconomy. Using an identification technique that utilises Google search intensity, we show that liquidity injections through TLTROs transmitted to the economy directly via bank lending and indirectly by easing credit conditions in financial markets.

With interest rates close to their effective lower bound in the 2010s, central banks around the world responded with a variety of monetary policy measures to stabilise financial markets and stimulate their economies. Among other unconventional tools, credit easing policies were used to promote bank lending directly. Notably, European Central Bank (ECB) launched its targeted longer-term refinancing operations (TLTROs) in 2014 to enhance the bank transmission channel of monetary policy.1 The key idea of these operations is that the central bank rewards banks which grant more loans to specific sectors, most importantly to non-financial corporations.

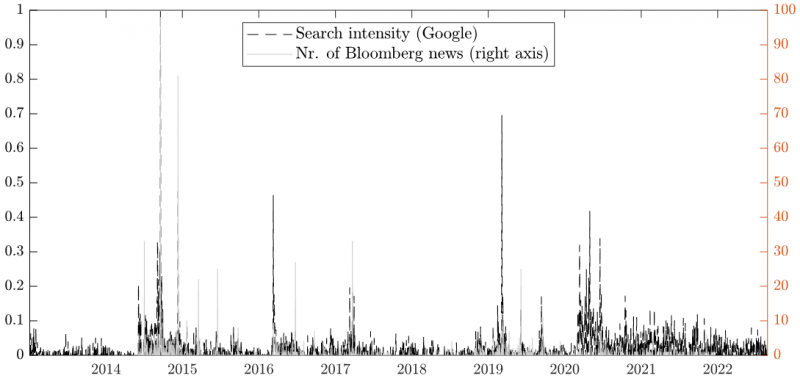

In our recent discussion paper (Laine and Nelimarkka, 2023), we develop a novel method to examine the effects of TLTROs. Our analysis is based on the intensity of TLTRO-related Google searches (Figure 1). The measured intensity is high when relevant information about TLTROs has emerged. Using financial market variation on these dates allows us to track market expectations on how credit conditions are affected by the TLTROs. Furthermore, we may derive the aggregate effects of TLTROs on various financial market and macroeconomic variables.

Figure 1: Google Trends TLTRO search intensity (black dashed line) and the number of Bloomberg news on TLTRO (grey solid line) that strongly correlates with the former.

Earlier literature has shown that the operations have accelerated bank lending and reduced lending rates (Benetton and Fantino, 2021; Andreeva and García-Posada, 2021; Laine, 2021; Afonso and Sousa-Leite, 2020). The results based on our novel measure for TLTRO surprise readjustments show that these operations indeed reduced lending rates and increased firms’ investments.

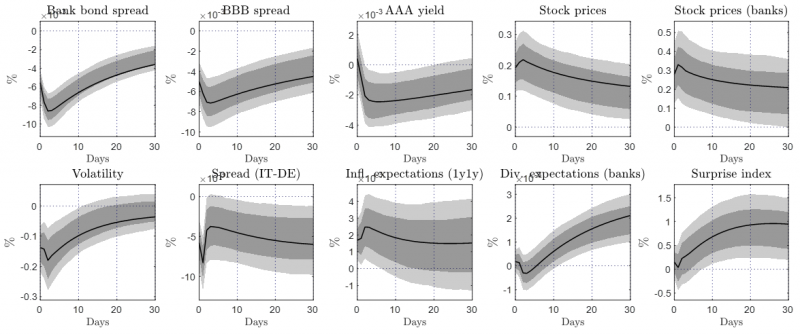

However, the impact of TLTROs was not limited to the direct effects through the banks. TLTROs also eased aggregate credit conditions and provided overall stimulus to the economy. Figure 2 shows the impulse responses of the financial market variables to a credit easing shock stemming from surprise change in the TLTRO lending conditions affected, for instance, by the borrowing rate, loan amounts and maturity.

In general, our results suggest that TLTROs had their desired macroeconomic effects of easing overall credit conditions by lowering interest rates and suppressing risk premia. A surprise easing in the TLTRO parameters decreases bank bond yields more than other corporate bond yields, reflected in the declining bank bond spread. Hence, TLTROs allow banks to finance themselves at lower costs from the central bank as well as from the financial markets.

Importantly, the introduction of TLTROs generally depresses risk premia. Corporate bond yields (especially the yields of riskier BBB-rated bonds) decrease. Similarly, the sovereign bond spread (measured as the spread between Italian and German 10-year bond yields) decreases.2 The credit easing effects may also be observed as increasing stock prices and falling volatility.

The TLTRO-induced credit easing also leads to changes in the market expectations and in revisions regarding economic data. Dividend expectations gradually start to rise, consistent with increasing bank profits from favourable bank lending. With similar dynamics, the shock induces positive surprises in economic indicators. Credit easing policies also increase inflation expectations on impact, suggesting that the public expects the operations to have macroeconomic implications by creating price pressures.

Figure 2: The effects of TLTROs on financial market variables.

Notes: Solid lines depict the ordinary least squares estimates. The light-shaded and dark-shaded regions border, respectively, the 90 and 68 percent pointwise confidence intervals of the estimates. See Laine and Nelimarkka (2023) for details.

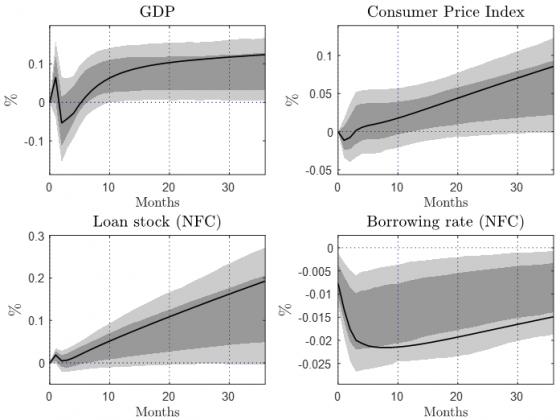

We also document that the TLTROs had macroeconomic impact, potentially reinforced by the decline in the aggregate financing costs and risk premia. Figure 3 shows the impulse responses to a TLTRO-induced credit easing surprise, estimated using our novel identification strategy. In response to credit easing, GDP and prices start to increase. The increases occur simultaneously with a growing stock of bank loans to non-financial corporations.

The effects of credit easing statistically significantly materialise in GDP and prices after approximately a year. Output responds somewhat more strongly than prices, albeit uncertainty surrounding the estimates is relatively high. The more muted response of prices may be due to several reasons. For example, the cost channel of monetary policy (Ravenna and Walsh, 2006; Drechsler et al., 2023) can be particularly relevant in the case of TLTROs as they directly affect the costs of credit.

One broad way to assess the total impact of TLTROs is first to consider the effects of the credit programme on the borrowing rate faced by the non-financial corporations. Rostagno et al. (2021) argue that, up to 2019, TLTROs reduced lending rates on loans to non-financial corporations by approximately 0.2 percentage points. According to our impulse responses, a one-time 0.2-percentage-point cut in the lending rate results in a 0.9 and 0.4 increase of GDP and prices, respectively over the next 18 months. Hence, TLTROs had macroeconomic relevance.

Figure 3: Macroeconomic effects of TLTROs.

Notes: Solid lines depict the ordinary least squares estimates. The light-shaded and dark-shaded regions border, respectively, the 90 and 68 percent pointwise confidence intervals of the estimates. See Laine and Nelimarkka (2023) for details.

In conclusion, targeted lending programmes are useful complementary instruments when conventional monetary policy is restricted by the effective lower bound. Whereas quantitative easing decreases the overall funding costs by lowering the long-term yields, the targeted lending operations promote directly bank lending and narrow the wedge between market-based and bank lending rates. By targeted credit injections, the central bank may enhance monetary policy transmission and increase borrowing of the non-financial sector, especially in the bank-based economies such as in the euro area. Hence, TLTROs can fill important dead spaces in the transmission of monetary policy.

Afonso, A. and J. Sousa-Leite (2020). The transmission of unconventional monetary policy to bank credit supply: Evidence from the TLTRO. Manchester School 88 (S1), 151–171.

Andreeva, D. C. and M. García-Posada (2021). The impact of the ECB’s targeted long-term refinancing operations on banks’ lending policies: The role of competition. Journal of Banking & Finance 122, 105992.

Benetton, M. and D. Fantino (2021). Targeted monetary policy and bank lending behavior. Journal of Financial Economics 142.

Crosignani, M., M. Faria-e-Castro, and L. Fonseca (2020). The (unintended?) consequences of the largest liquidity injection ever. Journal of Monetary Economics 112, 97–112.

Drechsler, I., A. Savov, and P. Schnabl (2023). Credit crunches and the great stagflation. Manuscript.

Laine, O.-M. (2021). The effect of targeted monetary policy on bank lending. Journal of Banking and Financial Economics 1 (15), 25–43.

Laine, O. -M., & Nelimarkka, J. (2023). Assessing targeted longer-term refinancing operations: Identification through search intensity. Bank of Finland Research Discussion Papers, 13.

Ravenna, F. and C. E. Walsh (2006). Optimal monetary policy with the cost channel. Journal of Monetary Economics 53 (2), 199–216.

Rostagno, M., C. Altavilla, G. Carboni, W. Lemke, R. Motto, A. Saint Guilhem, and J. Yiangou (2021). Monetary policy in times of crisis: A tale of two decades of the European Central Bank. Oxford University Press.

TLTROs were also similar to the Funding for Lending Scheme, introduced by the Bank of England (BoE) in 2012.

The observed decrease in the sovereign bond spread can be a consequence of general decline in the risk premia in the face of credit easing. The observation is also consistent with collateral trade explanation provided by Crosignani et al. (2020) for non-targeted LTROs. They find evidence that banks hoard government bonds to use them as collateral for obtaining central bank liquidity.