This policy brief is based on Bank of Finland Research Discussion Papers 14/2023. The opinions expressed are those of the authors and do not necessarily reflect the views of the Bank of Finland.

In this study, we examine private investors’ attitudes and behavior towards sustainable investing. Our analysis is based on a survey of 5,030 Finnish private investors. We compare traditional, ethical and sustainable investment strategies. We find that 60 percent of all survey respondents consider environmental, social, and governance (ESG) factors when making their investment decisions. According to our results, women and millennials are more likely to follow sustainable investment strategies than investors on average. Language background, location, and education levels also tend to influence investment behavior. Both sustainable and traditional investors are willing to take risks in their investment strategy. In this study, we also report on the effects of the COVID pandemic on investor behavior. We find that investors who started investing during the COVID pandemic are less likely to choose traditional investment strategies.

Private investors are an increasingly important voice in sustainability challenges. Sustainability encompasses “development that meets the needs of the present without compromising the ability of future generations to meet their own needs” (Brundtland Report, 1987). Whilst sustainable investing incorporates environmental, social and governance (ESG) factors, it is considered a different strategy to traditional investing or ethical investing. Traditional investors do not usually consider values like ESG, nor are they willing to compromise returns. Ethical investors tend to be willing to compromise returns to invest according to their conscience (or values). What differentiates sustainable investors is they are not willing to compromise their returns, whereas ethical investors are (Haber et al., 2022; Silvola and Landau, 2021; Michelson et al., 2004).

Regarding private investors, there tends to be a lack of empirical evidence on two key issues:

This is surprising given that private investors hold investments equivalent to $42 trillion globally (World Economic Forum, 2022). Given that private investors represent significant wealth, they have the potential to be important change agents regarding sustainability challenges. Furthermore, the private investor perspective is important because they have latitude in how their capital is deployed. Nor are they accountable to others in the same way as fund managers might be.

In this study, our central research question is based around private investors’ attitudes towards sustainable investment. We empirically examine private investors’ profiles and their attitudes to sustainable, ethical, and traditional investing. We examine the most frequently applied decisions by private investors, as well as the main factors driving their decision to invest sustainably. Finally, we report on the effects of the COVID-19 pandemic on private investor behavior and how sustainable investing is expected to develop in the five-year post-survey period.

The data that we used for our study was collected through an online survey in Finland in collaboration with Nordnet. Nordnet assisted the research team by sharing information about the client survey. The survey contains thirty-one questions across five categories. The survey questions capture whether and how individuals make investment decisions that include ESG considerations. We also include questions about the materiality and impact of the COVID-19 pandemic on private investor decisions. The data was collected between December 14, 2020 – January 31, 2021. The final sample consists of 5,030 survey responses from private investors.

In this study, we address five specific questions:

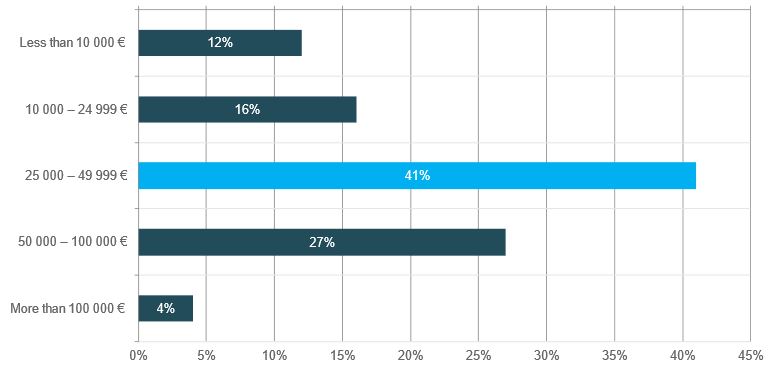

It is worth clarifying that in this study the term “private investor” refers to an individual who chooses to invest their own private money into financial markets. It is not limited to high-net-worth individuals. In fact, as Figure One displays, investing is not just for wealthy individuals. Figure One indicates that 41 percent of investors have an income between €25,000- €49,999, and only 4 percent of respondents have an income of more than €100,000. This appears representative of the overall Finnish population where the average annual salary is €44,808.1

Figure 1: Income distribution among the survey respondents

(Y-axis denotes salary level of respondents; X-axis denotes respondent percentage)

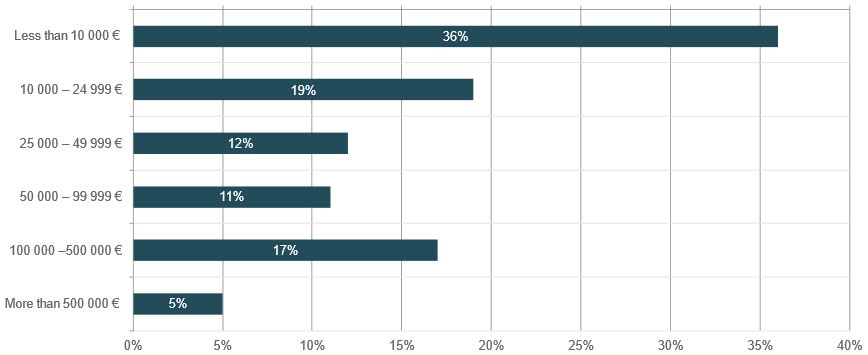

We also observe in Figure Two that investing can start with relatively little money. Figure Two indicates that only 5 percent of private Finnish investors whom we survey have assets of more than €500,000 ($531,000). Thus, the final sample in this study comprises a diverse mix of wealthy private investors as well as investors with relatively small investment portfolios.

Figure 2: Value of the respondents’ investment portfolio

(Y-axis denotes value of invested assets (excl. home and debt); X-axis denotes percentage of respondents)

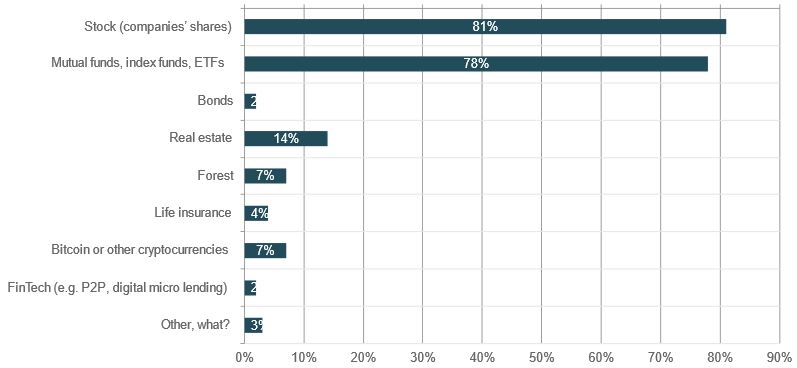

So where do Finnish private investors tend to invest? From Figure Three we observe that stocks (81 percent) and mutual funds, index funds and ETFs (78 percent) are popular investment classes. This is followed by real estate (14 percent), forest (7 percent) and cryptocurrencies (7 percent). In separate results, we also find that survey respondents have a relatively long investment horizon, with 63 percent of respondents having over a 10-year investment horizon.

Figure 3: Asset classes chosen by respondents

(The Y-axis displays asset class; X-axis denotes percentage of respondents)

We now summarize the findings from the five research questions listed above. The results are based on extensive regressions and robustness tests.

We find that sustainable investing is becoming more common in Finland. Specifically, 60% of all survey respondents consider ESG information when making investment decisions. We estimate that survey respondents invest, on average, 45% of their investment portfolios using sustainable investment strategies. Respondents expect that share to grow to 57% within the next five years.

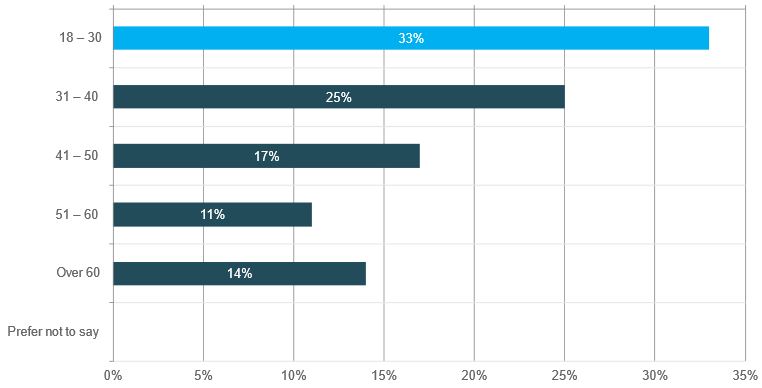

Our empirical results indicate that women and millennials (40-year-olds and younger) tend to invest more sustainably. More specifically, we find that women are more likely to invest sustainably and ethically, whereas men are more likely to follow traditional investment styles. The age distribution of the survey sample is displayed in Figure Four.

We also find that investor characteristics other than gender and age tend to have an impact on investment decisions. For example, we find investors with Finnish as their first language are more likely to invest according to traditional investment strategies. Non-native Finnish speakers are more likely to follow sustainable and ethical investment strategies than investors on average. Location and lifestyle also have an impact on private investor behavior. Specifically, investors who live in larger Finnish cities tend to invest more ethically and sustainably than investors who reside in smaller towns or in the countryside. Investors who own their house or apartment tend to invest less ethically and sustainably than investors on average. Parents and investors who are in a relationship tend to invest more sustainably and ethically than their peers.

Figure 4: Age distribution of the survey respondents

(The Y-axis indicates age group; X-axis denotes respondent percentage)

From the regressions, education level and discipline are also significant variables affecting private investor behavior. Investors with a higher education invest ethically and sustainably more often than investors with lower education levels. According to our results, also the educational discipline also impacts investment decisions. Investors with a business or engineering degree tend to follow traditional investment strategies more often. Interestingly, pay level or employment situation does not affect the chosen investment strategy.

Investment portfolio size also impacts chosen investment strategies. Private investors with a larger investment portfolio are more likely to follow traditional investment strategies and, on average, tend not follow ethical or sustainable investment styles.

Our findings suggest that both sustainable and traditional investors are willing to take risks in their investments, thereby indicating that sustainable investors have similar risk-taking preferences to traditional investors. Both are willing to take risks in their investments when the risk-taking is associated with high expected returns.

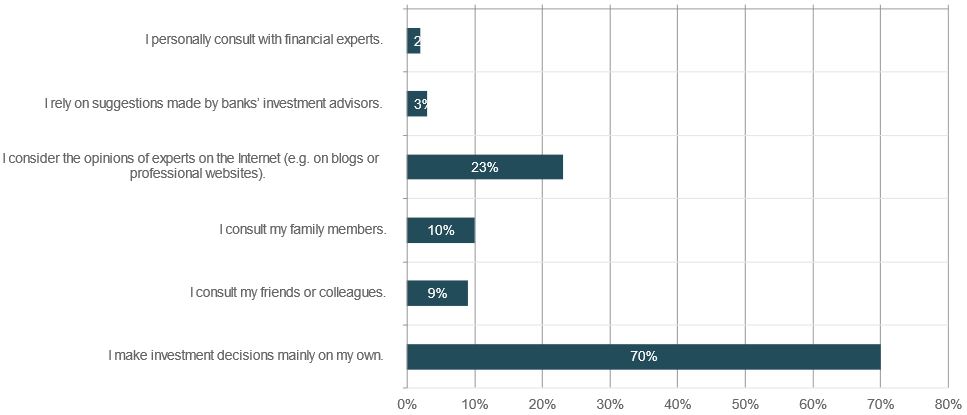

Our tabulated results suggest that Finnish investors are not keen on asking for advice when making investment decisions. We find that on average 70 percent of Finnish private investors prefer to make their own investment decisions. We summarise this in Figure Five.

Figure 5: Who do private investors consult?

(Y-axis denotes who respondents consult for financial advice; X-axis denotes respondent percentage)

We examine private investor behavior regarding future investment plans, as well as preferences on investment advice, and the possible effect of the COVID pandemic on investment behavior. We document that the investors who follow sustainable or ethical investment strategies plan to increase their investments to sustainable investment objectives during the post-survey five-year period (i.e. 2021-2026). However, investors following traditional investment strategies plan to decrease the share of sustainable investments in their portfolios over the next five years.

Finally, whilst our results indicate that millennials invest more sustainably than older investors, it remains interesting to see if they will also invest any inheritance money they will eventually receive into sustainable financial products. This type of re-allocation of money on a large scale may well change the market dynamics in the long term, thereby helping achieve sustainable development targets.

Brundtland, G. H. (1987). Our common future—Call for action. Environmental Conservation, 14(4), 291-294.

Haber, S., Kepler, J. D., Larcker, D. F., Seru, A., & Tayan, B. (2022). ESG Investing: What Shareholders Do Fund Managers Represent?. Rock Center for Corporate Governance at Stanford University Working Paper Forthcoming.

Michelson, G., Wailes, N., Van Der Laan, S., & Frost, G. (2004). Ethical investment processes and outcomes. Journal of Business Ethics, 52, 1-10.

Silvola, H., and T. Landau. (2021) Sustainable Investing. Palgrave Macmillan.

World Economic Forum (2022). The Davos Agenda: Private equity and ESG. World Economic Forum. https://www.weforum.org/events/the-davos-agenda-2022.

Source: https://stat.fi/en/statistics/pra.