This brief is based on Kubitza, Grochola, and Gründl (2023). The views in this contribution are the authors’ and do not necessarily represent those of the European Central Bank or the Eurosystem.

Life insurers sell savings contracts with surrender options, which allow policyholders to prematurely receive guaranteed surrender values. These surrender options move toward the money when interest rates rise. Hence, higher interest rates raise surrender rates, as we document empirically by exploiting plausibly exogenous variation in monetary policy. Using a calibrated model, we then estimate that surrender options would force insurers to sell up to 2% of their investments during an enduring interest rate rise of 25 bps per year. We show that these fire sales are fueled by surrender value guarantees and insurers’ long-term investments. To mitigate surrender-driven risks in the life insurance sector, we propose the use of market value adjustments that adjust surrender payouts to interest rate changes.

Life insurers are significant financial intermediaries, as they hold 20% of outstanding bonds (IMF, 2021) and their products account for more than 20% of households’ assets.1 An important role of life insurers is to facilitate household saving by offering long-term savings contracts. These contracts typically entail surrender options, which allow policyholders to terminate a contract before its maturity and receive an ex-ante guaranteed redemption value, termed surrender value.

Policymakers have only recently started to consider the liquidity risk driven by surrender options, sparked by the (risk of) rising interest rates (e.g., ECB, 2017; EIOPA, 2019; NAIC, 2021).2,3 For example, in early 2023, the Italian life insurer Eurovita was placed under special administration and its surrender payouts were halted by the regulator as rising interest rates amplified the risk of high surrender rates (Fitch Wire, 2023). Despite policymakers’ increasing awareness, research on liquidity risk in life insurance is still scarce.

Three motivating facts emphasize the importance of surrender-driven liquidity risk. First, surrender payouts are economically significant. European life insurers paid out EUR 362 billion for surrendered contracts in 2019, which corresponds to more than 40% of their premium income. Second, insurers are important investors. For instance, in euro-area debt markets, insurers account for roughly 20% of outstanding government and corporate bonds (ECB, 2022). Given the importance of bond prices for economic activity (Gilchrist and Zakrajšek, 2012; Kubitza, 2023), it is important to understand the determinants of insurers’ investment behavior. In the most extreme case that European insurers financed the surrender payouts of 2019 entirely by selling assets, the associated price impact would be in the order of 3.6% (= 362/10 000), assuming that prices decline by 10 bps per EUR 10 billion of assets sold as in Greenwood et al. (2015). Thus, surrender-driven asset sales have the potential to significantly impact financial markets and, thereby, financial stability. Third, past historical episodes provide anecdotal evidence that interest rate hikes impair life insurers’ liquidity (Kubitza et al., 2023). Nonetheless, little is known about the impact of surrenders on life insurers’ liquidity risk and asset sales across the financial cycle.

In Kubitza et al. (2023), we address this void using the German life insurance market as a laboratory. German life insurers hold more than EUR 1 trillion in life insurance reserves, corresponding to roughly one third of German GDP. The most popular life insurance product in Germany is a participating contract, whose cash an insurer invests in a single portfolio pooled across policyholders. Participating contracts account for 90% of life insurance reserves and, by regulation, include surrender options with ex-ante guaranteed surrender values. Because life insurers mostly invest in long-term bonds, rising interest rates depress the market value of their assets, but not surrender values. Thus, surrender becomes more attractive for policyholders as it allows them to exchange their claim on the depreciated assets for the guaranteed surrender value, e.g., to invest in alternative assets or substitute debt.

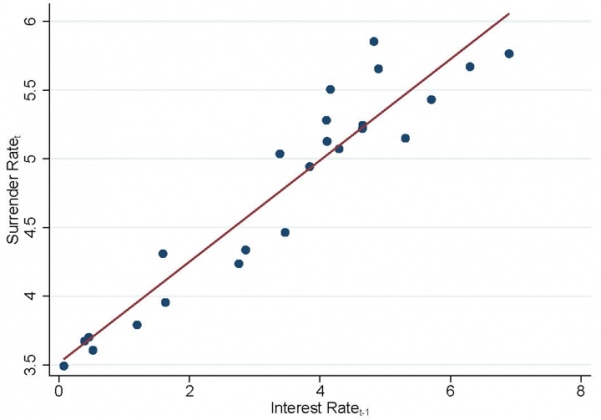

To empirically investigate the effects of interest rates on surrender rates, we use data on annual insurer-level surrender rates covering all German life insurers since 1996. Surrender rates are highly correlated with 10-year German government bond rates, as we show in Figure 1. In the empirical analysis, we regress surrender rates on the bond rate, controlling for macro-economic conditions. The estimate implies that a 1 percentage point increase in the interest rate is associated with a 25bps increase in the surrender rate. The result is robust to using monetary policy surprises as an instrumental variable for government bond rates, alleviating concerns that surrender behavior and government bond rates may be conflated by unobserved economic conditions.

Figure 1: Correlation between surrender rates and bond rates

Notes: Figure 1 represents a binscatter plot of surrender rates and the 10-year German government bond rate in the previous year. For each realization of the 10-year German government bond rate, the conditional mean of insurer-level surrender rates is plotted as a scatter point. The figure also includes the line of best fit from a univariate OLS regression.

Thus, surrender options contribute to the interest rate convexity of life insurance contracts, i.e., their duration declines when interest rates increase. The economic magnitude is large: a one standard deviation interest rate increase corresponds to an increase in total German surrender payouts of roughly EUR 2.3 billion.

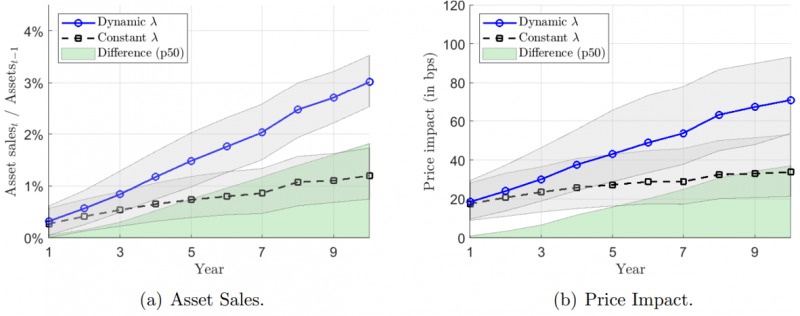

Armed with this empirical evidence, we develop a structural model of policyholders’ surrender decisions and embed it into a granular model of a representative life insurer’s cash flows. Numerical simulations of the calibrated model show that elevated surrender rates during a sustained interest rate rise of 25 bps per year would force insurers to sell close to 2% of their assets annually. These surrender-driven asset sales are in addition to close to 1% of assets being sold in case surrender rates would not react to interest rate changes. Following Greenwood et al. (2015) in calibrating insurers’ price impact, surrender-driven asset sales can have a significant price impact of about 40 bps after 10 years of rising interest rates. This magnitude is plausible compared to empirical studies of fire sales, and it is economically significant, especially in the bond market.

Figure 2: Asset sales and price impact during an interest rate rise of 25 bps per year

Notes: Figure 2 depicts (a) the insurer’s asset sales relative to previous year’s total assets and (b) their average price impact. The average price impact is calculated as the price impact per EUR 1 sold. Both figures depict the median and 25th/75th percentile for each year for the baseline calibration, under which the surrender rate is endogenously determined depending on the market environment (circles, “Dynamic λ”), and for a counterfactual calibration, under which λ is constant over time (squares, “Constant λ”), as well as the difference between the respective median values (green area).

In addition, we use counterfactual calibrations to explore the determinants of forced asset sales. Important determinants are the long duration of insurers’ investments, which boosts the exercise value of surrender options when interest rates rise, and the guarantee on surrender values, which amplifies the interest rate sensitivity of surrender incentives. Instead, differences in an insurer’s investment strategy, e.g., using asset-liability duration matching, has a small effect on the total volume of asset sales.

Large surrender-induced asset sales during monetary policy tightening can have an adverse impact on financial stability. Several policy instruments may reduce the interest rate sensitivity of surrender rates. For example, the European Insurance and Occupational Pensions Authority (EIOPA, 2020) considers surrender penalties and the suspension of surrender payouts as the main tools to tackle surrender-induced fragility. However, as surrender penalties reduce the average level of surrender payouts, they are also costly for policyholders when there is no risk of forced asset sales, and they do not necessarily reduce the correlation of surrenders with the financial cycle. Whereas limits on surrender payouts in times of stress can reduce asset sales, they would also strengthen strategic complementarities in the actions of policyholders giving rise to non-fundamental surrender incentives: Policyholders may try to front-run policymakers’ actions by surrendering in anticipation of limits on surrender payouts. Moreover, limiting surrender payouts can impose significant costs on policyholders with high liquidity needs.

We therefore propose market value adjustments (MVAs) of surrender payouts as an alternative policy instrument. MVAs, typically found in the U.S., adjust surrender values for interest rate changes: an increase in interest rates reduces market-value-adjusted surrender values, everything else being equal. Our simulations show that MVAs reduce surrender rates during an interest rate rise, which translates into a lower volume of asset sales and lower price impact: the peak price impact in our simulations is roughly 25% lower with MVAs. Thus, an MVA can significantly reduce the price pressure resulting from interest-rate-driven surrenders and, therefore, serve as a viable policy instrument.

ECB (2017). Financial Stability Review 2017.

ECB (2022). Insurers’ Balance Sheets Amid Rising Interest Rates: Transmission and Risk-Taking in Financial Stability Review, November 2022.

EIOPA (2019). Report on Insurers’ Asset and Liability Management in Relation to the Illiquidity of Their Liabilities.

EIOPA (2020). Opinion on the 2020 Review of Solvency II.

Fitch Wire (2023). Eurovita Woes Show Rising Rates Can Hurt Weaker Life Insurers. Available at https://www.fitchratings.com/research/banks/eurovita-woes-show-rising-rates-can-hurt-weaker-life-insurers-02-03-2023.

Gilchrist, S. and Zakrajšek, E. (2012). Credit Spreads and Business Cycle Fluctuations. American Economic Review, 102(4):1692–1720.

Greenwood, R., Landier, A., and Thesmar, D. (2015). Vulnerable Banks. Journal of Financial Economics, 115(3):471–485.

IMF (2021). Global Financial Stability Report – COVID-19, Crypto, and Climate: Navigating Challenging Transitions. World Economic and Financial Surveys. International Monetary Fund.

Kubitza, C. (2023). Investor-Driven Corporate Finance: Evidence from Insurance Markets. Working Paper.

Kubitza, C., Grochola, N., Gründl, H. (2023). Life Insurance Convexity. ECB Working Paper Series No. 2829.

NAIC (2021). NAIC 2020 Liquidity Stress Test Framework.

Life insurance and annuities account for 14.8% and 5.1% of U.S. households’ assets, respectively (Source: U.S. Census Wealth and Asset Ownership for Households: 2018). Life insurance and pension funds account for more than 30% of European households’ financial assets (Source: ECB Statistical Data Warehouse).

Surrender is closely related to lapse in life insurance. Lapses are contract terminations upon policyholders’ failure to pay premiums, whereas surrenders typically refer to active terminations in exchange for a positive surrender value (e.g., see https://www.newyorklife.com/articles/glossary).

For example, Mario Draghi, then president of the ECB, emphasizes in his introductory statement to the European Parliament on November 26, 2018, that ”[…] there might be times when policyholders want to terminate their insurance policies in large numbers, thereby putting liquidity strain on insurers. Authorities should be able to protect financial markets […] from the adverse impact of such an exceptional run on insurers.”