Euro area central banks are reporting losses as they pay banks 4% but collect only 1% on trillions of euros of bonds bought to spur growth with lower yields. Once central banks exhaust their capital, they may need to go cap in hand to their governments. Recently, the ECB ceased to pay interest on commercial banks’ 1% required reserve against deposits. Now some propose jacking this up tenfold to stanch central bank losses. With fat profits and rich, dividends, commercial banks can easily pay, it is said.

Foisting central bank losses onto euro area commercial banks by not paying interest on banks’ reserves with the Eurosystem would be an own goal. If large unremunerated reserves are required, banks and depositors would respond by shifting euro deposits offshore. Only immobile depositors would pay the tax, and the tax base and revenue would fall short. Undercapitalized domestic shadow banks would gain an edge over banks. Financial stability in the euro area would suffer.

An alternative approach would shrink the Eurosystem’s footprint without offshoring the euro or driving business out of regulated banks. Governments could book gains on their central banks’ holding of government bonds. Government debt as usually measured would fall.

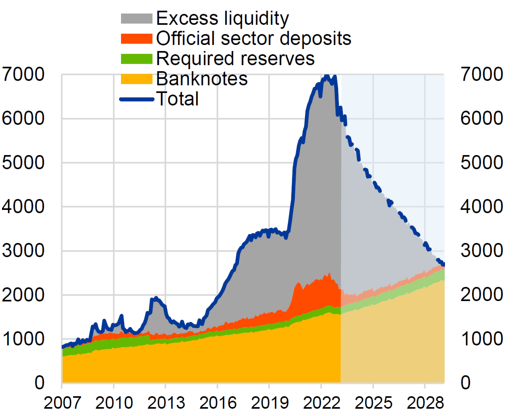

The Eurosystem’s almost €4 trillion of excess bank reserves,1 the liabilities corresponding to large-scale bond purchases, have begun to produce large central bank losses. Losses arise from the payment of 4% interest on these excess reserves, given that the corresponding assets are bonds yielding something like 1%. A negative 3% net interest margin on a €3.6 trillion portfolio makes for a €108 billion negative cash flow. This is distributed unevenly around the Eurosystem, since each national central bank bought its own government’s bonds to avoid debt mutualisation (arising, for example, from Bundesbank buying Republic of Italy bonds), which was much dreaded in places. Ironically, the Bundesbank’s cash flow is suffering from the particularly low German bund yields in its portfolio, reflecting bunds’ benchmark status. The Bank of Italy is in relatively better shape since Italian bonds yielded more.

Graph 1: Eurosystem’s liabilities in billions of euro

Source: Schnabel, “Back to normal? Balance sheet size and interest rate control,” 2023.

Foisting these central bank losses onto commercial banks in the euro area by not paying interest on banks’ claims on the Eurosystem would lead to harmful unintended consequences. If large unremunerated reserves are required, banks and depositors would respond to the implied cost by shifting euro deposits offshore, out of the euro area. The cost would also allow undercapitalized and illiquid domestic shadow banks with no lender of last resort to outcompete well-regulated and well-backstopped banks. Both unintended consequences would undermine financial stability in the euro area.

An alternative approach outlined in this SUERF Policy Note would shrink the Eurosystem’s footprint without offshoring the euro or driving intermediation away from well-regulated banks. Governments could book gains on their central banks’ holding of government bonds, thereby reducing conventionally measured government debt.

Let it be clear what the proposed bond swap does and does not do.2

All in all, precipitating offsetting gains and losses within the public sector makes sense. It requires no revenue to be raised from the private sector. It leaves no unintended consequences to be discovered. It would deepen the euro area’s capital markets and enrich the menu of euro investments for official reserve managers.

Elsewhere, large central bank losses on large bond portfolios looks different. The Bank of England bought bonds with a government indemnity and the government is now stumping up large transfers to make good the central bank’s losses.4 The Federal Reserve employs the ingenious accounting of writing up future profit as a deferred asset that offsets its cumulated losses from a negative interest margin. When Fed profits return, they will be retained to reduce the asset. The Fed thereby can show positive capital and its Reserve Banks can continue to pay dividends to member commercial banks while not making payments to the US Treasury.5 In a private communication, Peter Stella, former head of the Central Banking Division of the International Monetary Fund, terms this device unoriginal, disingenuous, and disgraceful accounting worthy of a Banana Republic.

In Britain, the issue was broached ten years ago somewhat obliquely when then Financial Services Authority head Adair Turner urged the government to cancel the gilts that the Bank of England had bought.6 He went on to make the argument at the 2015 Jacques Polak research conference at the IMF (!), and to publish a full-length book, Between debt and the devil.7In his initial proposals, Lord Turner was coy about the role of unremunerated reserve requirements, but by 2015 he was clear that not remunerating required reserves (although perhaps remunerating excess reserves to maintain control over short-term rates) was implied by the proposed cancellation. He recognized unremunerated required reserves as a tax on intermediation, which he took to be justified by negative externalities of credit growth.8

The discussion has continued in Britain. Lord Turner has not changed his position and former Bank of England economist Charles Goodhart has testified in favour of unremunerated reserves. Former Deputy Governor Sir Paul Tucker told the House of Lords, “there must be a chance at some point that the Government will say to the Bank of England, ‘For God’s sake, can you not stop paying interest on reserves?’” No consensus holds on whether the Bank of England or the Treasury would appropriately decide on such a course. Bank of England Governor Andrew Bailey testified that unremunerated reserves “would complicate and weaken the implementation of monetary policy” and, with more force, that “it is a tax on the banking system. It is not monetary policy; it is fiscal policy.”9

Since the materialisation of central bank losses in the euro area, distinguished Belgian economist Paul De Grauwe has called for eliminating them by raising unremunerated reserve requirements to as high as 15%. De Grauwe and Yuemei Ji have argued this in various fora, but most significant was his lecture in September at the Bundesbank, with President Joachim Nagel serving as the principal interlocutor.10 Nagel gave a robust account of the evolution of the anti-deflationary policy that led to the result that De Grauwe deplores. But Nagel suggested that the ECB Governing Council’s decision in July11 to cease remunerating the 1% required reserve as of September 20 was “maybe not the end of the story”: the thin end of the wedge.12

Elsewhere in the Eurosystem, the Bundesbank position finds support, but not uniform support. The head of the Austrian National Bank, Robert Holzmann, suggested a range of 5-10% unremunerated required reserves, citing the benefits that banks derived from unconventional monetary policy during the crisis.13 Each 1% rise is said to save the Eurosystem €6 billion—assuming that depositors sit still for the cost imposed. Reuters reported that at least 9 of the 26 Governing Council members were in favor of hiking unremunerated required reserves. The heads of the French, Spanish and Belgian central banks have been cited as opposing a hike.14 Pierre Wunsch, Governor of the National Bank of Belgium, suggested that lifting the required reserves amounted to “exercising quasi-fiscal powers.”15 President Klaus Knot of the Netherlands Bank called for a “broader cost-benefit analysis.”16 For her part, the ECB Executive Board member with responsibility for operations, Isabel Schnabel, is reported to be leading the Board’s opposition, insisting that consideration of higher required reserves be folded into the wider review of the monetary policy framework that likely will only conclude in 2024.17 She has drawn attention to a complication: excess reserves are not evenly distributed around the euro area. Banks in Germany and France hold more than half.18 In answer to the first question posed at the press conference following the ECB’s monetary policy decision on October 26, Christine Lagarde reported that increasing required reserves had not been discussed by the ECB Governing Council.

A concern is that central bank losses may eventually force a government recapitalization of the central bank and that in the process central bank autonomy be compromised. A case in point is that of Bank Indonesia that emerged with losses from the 1997-98 Asian Financial Crisis. When the Indonesian government legislated a recapitalisation of the central bank, it claimed the right to set the inflation target, formerly chosen by Bank Indonesia. The treaty securing the legal position of the Eurosystem protects the national central banks from some power grabs but not all. To paraphrase freely Ulrich Bindseil’s magisterial book, Monetary policy operations and the financial system:

central banks in emerging [advanced] economies may have an income generation problem if they hold large foreign reserves [domestic bond portfolios], and need to conduct liquidity-absorbing monetary policy operations at rates above the remuneration rate of foreign reserves, while at the same time facing appreciation pressures of their own currency [yield on the bond portfolio]. To preserve central bank independence, it may be wise in these circumstances to increase the structural profitability of the central bank by absorbing a part of the excess liquidity through non-remunerated reserve requirements [strikeouts added].19

This concern is a far cry, however, from the standard macroeconomist’s view that central bank losses and negative capital need not impair the central bank’s ability to acquit its monetary policy and supervisory mandates.20 Perhaps the Bundesbank’s negative capital that resulted from Deutsche mark appreciation against the dollar two generations ago was easier to explain than recent losses from massive buying of bonds at negative yields. After all, in the 1970s and 1980s, a German tourist in anywhere but Switzerland or Japan could experience the flip side of the Bundesbank’s unrealised losses on foreign exchange holdings in the form of a strong Deutsche mark against the local currency. Vast unrealized gains on gold may also have helped. But today, it is not clear that President Axel Weber’s 2005 dictum still applies: “The Bundesbank profit is a residual issue for me and my colleagues…I don’t enter into any strategic considerations about Bundesbank profits, neither in the morning, afternoon or evening.”21

Stepping back, the large-scale bond-buying that has resulted in central bank losses formed part and parcel of a strategy to lower bond yields. The strategy, which included negative short-term policy rates, forward guidance and bond-buying, succeeded in a manner Keynes would never have imagined. It delivered to ministries of finance the benefit of very low bond funding costs, as well as the macroeconomic stimulus from low cost of debt for the household and corporate sectors. Losses in the central bank portion of the government’s balance sheet represent just a partial, endogenous offset to huge gains in the government debt portfolio.

True, with rising short-term policy rates, euro area central banks have losses that may accumulate into capital deficiencies. But a key observation is that governments have larger balance sheets than central banks, even after repeated rounds of so-called quantitative easing or QE. In flow terms, ministries of finance continue to benefit from low bond yields. In stock terms, governments have enjoyed huge mark-to-market capital losses on their liabilities, the equivalent of massive capital gains. Properly viewed, the central bank losses amount to no more than a partial offset to improvement in governments’ debt position at market prices.

De Grauwe’s proposal has the appeal of a fix for central bank losses that central banks can do on their own. No one argues that the Eurosystem does not have the authority to increase the required reserves that now are not remunerated. And De Grauwe is technically correct that interest on excess reserves can be structured or tiered for marginal reserves so that the central bank can acceptably guide the market short-term rate with large unremunerated required reserves. Monetary policy, narrowly conceived, need not suffer from high unremunerated required reserves.

However, De Grauwe’s claim that bankers are immorally taking the government’s profits from the monopoly of money creation and handing them out to shareholders is debatable. De Grauwe invites his listeners to imagine that bank shareholders would pay the cost of the unremunerated reserve. Suvi Kosonen, a credit analyst of financial institutions at ING, agrees: “higher required reserves would represent a drag on net interest income.”22 By contrast, in a prominent article almost 40 years ago, Eugene Fama at the University of Chicago argued that bank borrowers pay this cost.23 At the Federal Reserve Bank of New York in the 1980s, an economist who called unremunerated reserves a tax risked getting fired. But the usual question of the incidence of the tax arises: whose ox is gored?

In a recent SUERF Policy Brief, a monetary economist at the Austrian National Bank, Claudia Kwapil, advances the current debate by suggesting that the banks will not necessarily pay this tax. Instead, they might pass it onto borrowers in the form of higher loan rates, as suggested by Fama, or onto depositors in the form of lower deposit rates. In considering the latter, Kwapil writes:

Bindseil …argues that an unremunerated system of minimum-reserve requirements “can imply large outflows of the relevant types of deposits”… and can lead to international dislocations. It is, however, not to be expected that retail deposits will leave a big monetary union such as the euro area on a large scale.24

Or maybe they will. The evidence of the eurodollar market from the 1970s until the Fed lowered the reserve requirement on large domestic certificates of deposit to zero in 1990 strongly points to a different conclusion: the domestic depositor pays. That is, immobile depositors pay the tax imposed by required reserves, not shareholders or bank borrowers. US and foreign banks arbitraged the onshore and offshore dollar markets to equalise the all-in costs of eurodollars and domestic certificates of deposit. As a result, the benchmark 3-month dollar Libor typically exceeded domestic US certificate of deposit yields by the cost of the reserve requirement plus the cost of deposit insurance.25

Would euro area bank depositors sit still for large, unremunerated required reserves? Or will they massively shift euro deposits to banks outside the euro area? What would prevent ING, Ltd, in London from marketing euro denominated deposits over the internet to households and firms in the euro area? Depositors could command a higher yield without taking any foreign exchange risk and taking only negligible country risk. At an interest rate of 4% and with a 15% (or 10%) unremunerated reserve, ING could offer its internet customers 60 (or 40) basis points more on a UK euro deposit than on one booked in the euro area. True, Europeans are not as keen on electronic banking as the Californians that staged lightning bank runs last March, but they could learn fast with large enough incentives. Failing such direct marketing of offshore deposits, what would prevent euro SICAVs in France and euro money market funds in Luxembourg from losing their home bias, as did US “prime” money market mutual funds a generation or two ago?26

Sixty basis points, or 40 basis points with a 10% required reserve, may seem like small change. However, after the Dodd-Frank Act widened the base for the Federal Deposit Insurance Corporation charge of just 8-10 basis points, a half trillion dollars of US deposits moved from offshore to onshore within months in 2011-12.27 Firms in the United States stopped using daily late-afternoon transactions to “sweep” deposits into Caribbean branches (which round-tripped into head office as non-deposit funding), because they no longer offered relief from the FDIC charge. A similar response to the larger wedge from a 15% unremunerated required reserve in the euro area could see €3-4 trillion of the €15 trillion in reservable deposits move across the Channel, to Scandinavia, to Switzerland or even to Dubai.

London would welcome the Eurosystem’s imposition of large unremunerated required reserves, even if euro-area-headquartered banks capture most of the business. As an implication of the shrinkage in deposits in euro area banks subject to the reserve requirement, the boost to euro area central banks’ net income—the tax collected from the unremunerated reserves—would fall short of projections that presume that depositors will sit still.

The comprehensiveness and timeliness of euro area money and credit statistics would suffer, but greater damage would be to financial stability. The 60 basis-point wedge would favor not only offshore euro deposits but also onshore nonbank financial intermediation. Banks would lose business to shadow bank competitors with inadequate capital, fair-weather liquidity and no lender of last resort. While large unremunerated required reserves may be intended to stick it to the banks, the public interest in financial stability could prove to be the big loser.

As an alternative, each euro area government could take profits on its bonds held by its respective central bank. What follows sets the stage by setting out large-scale bond purchases, or QE, with a minimal set of three balance sheets. Then two transactions are proposed to substitute short-duration government debt for zero-duration central bank reserves. This would crystallize gains for the government on the government’s bonds that were sold at very low interest rates and are now held by the central bank. These immediate gains would provide the wherewithal for an eventual recapitalization of the central bank if needed.

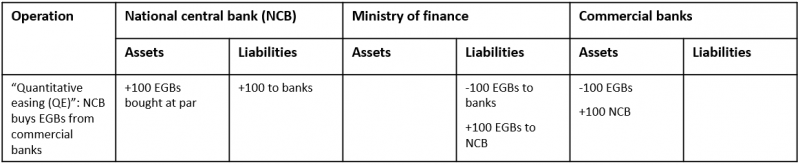

In QE, the euro area central banks bought their own respective government’s bonds under the control of the ECB Governing Council (Table 1). The central bank used its own reserves as the means of payment for European government bonds, EGBs. The effect was to shorten the duration of the private sector’s claims on the public sector. This was in essence a debt management operation that used central bank reserves instead of European treasury bills (ETBs) to reduce the duration of the public sector debt.28

Table 1: Central bank buys government bonds from banks

Note: EGB = European government bond.

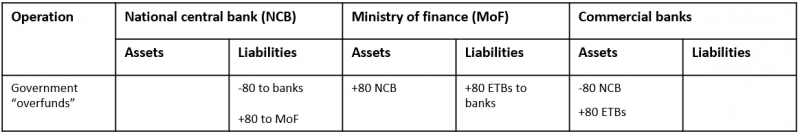

Then policy rates and bond yields rose, and government bond prices fell, leading to a negative interest margin and mark-to-market losses on the central bank portfolio of government bonds. To harvest the gains on the devaluation of its liabilities, the government could buy its bonds back from the central bank at a price below par, say 80 cents on the euro. Thus, to buy the €100 par bond held by the central bank, the government needs only to raise €80 by selling bills or floating-rate notes. The latter might be preferred to limit roll-over risk. Accordingly, the ministry of finance “overfunds” the public sector borrowing requirement by selling €80 in ETBs. Table 2 shows this market debt operation.

Table 2: Government “overfunds” in the bond market

Note: EGB = European government bond; ETB = European treasury bill.

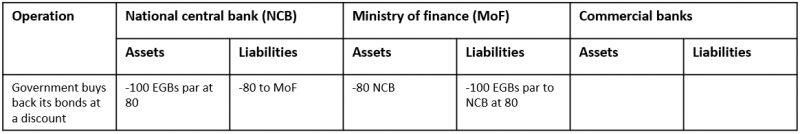

In an off-market transaction, the ministry of finance could then buy its par value €100 bond back from the national central bank at €80, crystallizing a gain (Table 3). This purchase at market prices does not change the present value of the government debt but does allow the government to record a gain of €20 (a capital loss on its liability). Its debt as conventionally measured would decline. To be sure, the government interest payments would rise since short-term rates exceed the yield on the repurchased bonds. But the immediate capital gain would dominate the added interest expense for several years. (Note that the Maastricht Treaty’s Article 123 prohibition on national central bank direct purchases of government bonds does not apply: the national central bank is selling at market prices not buying bonds or providing an overdraft to the government.)

Table 3: Government buys back its debt from its NCB at a discount

Note: EGB = European government bond.

For its part, the central bank would crystallize a loss, but would avoid ongoing losses. If necessary, the ministry of finance could recapitalise the central bank over time, leaving the ministry with lower debt as an immediate result of the operation.

The result is that the ministry of finance would harvest a €20 gain, the NCB would book a €20 loss and the banking system would exchange a non-tradeable €80 claim on the national central bank for €80 in tradeable treasury bills or floating-rate notes. Unlike active quantitative tightening (QT) that involves market sales of bonds, the duration of the private sector’s claims on the public sector would not lengthen materially (eg, only from overnight to three months). This might be a desirable feature in the current environment of sharply higher bond yields that might lead to financial instability. Even a large operation in bills or floating-rate notes should be readily absorbed by the money market in view of the corresponding decline in excess reserves of banks. The bills might even carry a lower yield than the ECB policy rate that applies to excess reserves.29 Any central bank recapitalization could be phased in, so the ministry of finance would benefit from an immediate strengthening in its financial position from extinguishing debt.

The proposed cooperation between the central bank and the ministry of finance strikes many central bankers as something to be avoided. Yet with their large-scale bond purchases, central banks have assumed a role in debt management in which they do not enjoy a monopoly of the instrument as they do in setting short-term interest rates.30 QE happened with little cooperation,31 but QT would be smoother with cooperation.

The proposed bond swap would avoid the adverse unintended consequences of large unremunerated reserve requirements. It would reduce the Eurosystem’s footprint in financial markets without offshoring the euro or favoring intermediation by shadow banks. While higher unremunerated reserves would drain bank liquidity,32 the bond swap would free up bank capital (constrained by the simple leverage ratio) for lending to the real economy.33 It would shrink the Eurosystem’s balance sheet without an immediate lengthening of the duration of the private sector’s claim on the public sector, reducing the current pressure on the global bond market. It would thereby allow monetary policy-making to “get up from the floor,” to tweak Claudio Borio’s phrase, without increasing the odds of a bond market crisis requiring bond buying of last resort to maintain market functioning.34

Isabel Schnabel, “Back to normal? Balance sheet size and interest rate control,” speech at Columbia University, March 27, 2023.

This paragraph responds to a suggestion by Claudio Borio.

“[U]unremunerated minimum-reserve requirements can dilute the restrictive monetary policy effect for bank-dependent depositors,” as noted by Claudia Kwapil, “A two-tier system of minimum reserve requirements by De Grauwe and Ji (2023): A closer look,” SUERF Policy Brief, no 702, October 2023.

See Alain Chaboud and Mike Leahy, “Foreign central bank remittance practices,” Division of International Finance, Board of Governors memorandum, March 8, 2013; Robin Wigglesworth, “The growing fiscal drag of the BoE’s QE indemnity,” Financial Times Alphaville, August 28, 2023.

Marc Labonte, “Why is the Federal Reserve operating at a loss?” Congressional Research Service, January 23, 2023. “Positive net income in future years would be directed to eliminating this deferred asset instead of being remitted to Treasury. Thus, positive net income will resume before remittances.” See also William English and Donald Kohn, “What if the Federal Reserve books losses because of quantitative easing?”, Brookings Institution Commentary, June 1, 2022, and Alex Pollack and Daniel Semelsberger, “The Fed is losing tens of billions: how are individual Federal Reserve banks doing?” Mises Institute Mises Wire, August 22, 2023 https://mises.org/wire/fed-losing-tens-billions-how-are-individual-federal-reserve-banks-doing.

Gavyn Davies, “Will central banks cancel government debt?” Financial Times, October 14, 2012.

Adair Turner, “The case for monetary finance – an essentially political issue,” November 5-6, 2015; Between debt and the devil, Princeton University Press, 2015.

See chapter 12 of Between debt and the devil.

House of Lords, Select Committee on Economic Affairs, Quantitative easing: a dangerous addiction?, Chapter 4, “The future of quantitative easing”, https://publications.parliament.uk/pa/ld5802/ldselect/ldeconaf/42/4207.htm. 1st Report of Session 2019-21, HL Paper 42, July 16, 2021.

Paul De Grauwe and Yuemei Ji, “Tame inflation without subsidizing banks,” Project Syndicate, February 27, 2023; “Central banks can fight inflation without massive handouts to banks,” OMFIF blog, September 15, 2023. Paul De Grauwe, “The role of central bank reserves in monetary policy,” Bundesbank Invited Speakers Series, September 5, 2023 https://www.bundesbank.de/en/service/dates/professor-paul-de-grauwe-visits-the-bun-desbank-913968.

“ECB adjusts remuneration of minimum reserves,” July 27, 2023, https://www.ecb.europa.eu/press/pr/date/2023/html/ecb.pr230727~7206e9aa48.en.html#:~:text=The%20Governing%20Council%20of%20the,starting%20on%2020%20September%202023. Francesco Canepa, Balazs Koranyi and Valentina Za, “ECB mulled raising banks’ mandatory reserves in inflation fight,” Reuters, July 27, 2023, reports that the Governing Council considered raising the required reserve from 1% to 2% of deposits.

Zoe Schneeweiss, “Nagel says ECB should be open to do more on reserves,” Bloomberg, September 4, 2023; Peter Stella’s characterisation in a private communication.

In an interview with WirtschaftsWoche magazine, according to Alexander Weber, “ECB’s Holzmann floats tenfold hike in minimum reserves,” Bloomberg, September 27, 2023.

Balazs Koranyi, “ECB policymakers eye springtime push to cut payments on banks’ deposits, sources say,” Reuters, October 13, 2023; Weber, “ECB’s Holzmann floats tenfold hike in minimum reserves.”

Izabella Kaminska, “In the Blind Spot (Central bank funding models, Japan FX risk, Iron beams),” The Blind Spot, October 23, 2023.

April Roach and Alexander Weber, “ECB’s Knot says more analysis needed on banks’ minimum reserves,” Bloomberg, October 9, 2023. Foreseeing losses through 2028, “’What we’re going to do about the situation, we still have to discuss with the ministry [sic] of Finance, but in principle we could operate for a while with negative equity,’ Knot told reporters. ‘We don’t have depositors that could start a run on us.’” Toby Sterling and Bart H. Meijer, “Dutch central bank sees years of losses, negative equity -President Knot,” Reuters, March 23, 2023.

Zoe Schneeweiss, “New ECB interest rate hikes remain possible, Schnabel says,” Bloomberg, October 6, 2023.

Isabel Schnabel, “Back to normal? Balance sheet size and interest rate control,” slide 15, right-hand side. See also Claudia Kwapil, “A two-tier system of minimum reserve requirements by De Grauwe and Ji (2023): A closer look,” SUERF Policy Brief, no 702, October 2023.

Ulrich Bindseil, Monetary policy operations and the financial system, Oxford: Oxford University Press, 2014, p 107. See Claudio Borio and Piti Disyatat, “Unconventional monetary policies: an appraisal,” BIS Working Papers no 292, November 2009, for an analysis of “balance sheet policies” that include holding large foreign exchange reserves and large portfolio of domestic bonds.

See Chabboud and Leahy and English and Kohn, op cit.

Peter Stella, “Central bank financial strength, policy constraints and inflation,” IMF Working Paper 2008/49, February 1, 2008.

Suvi Kosonen, “Increase in minimum reserves would hit bank liquidity at crucial moment,” ING THINK, September 23, 2023.

Eugene Fama, “What’s special about banks?” Journal of Monetary Economics, vol 15 (1985), pp 29-39.

Citing Bindseil, Monetary policy operations and the financial system, p 107; Kwapil, “A two-tier system of minimum reserve requirements by De Grauwe and Ji (2023): A closer look.”

Lawrence Kreicher, “Eurodollar arbitrage,” Federal Reserve Bank of New York Quarterly Review, vol 7, Summer 1982, pp 10-22; Robert McCauley and Rama Seth, ”Foreign bank credit to US corporations: the implications of offshore loans,” Federal Reserve Bank of New York Quarterly Review, vol 17, Spring 1992, pp 52–65.

Naohiko Baba, Robert McCauley and Srichander Ramaswamy, “US dollar money market funds and non-US banks,” BIS Quarterly Review, March 2009, pp 59-81.

Lawrence Kreicher, Robert McCauley and Patrick McGuire, “The 2011 FDIC assessment on banks managed liabilities: interest rate and balance-sheet responses,” in R de Mooij and G Nicodeme (eds), Taxation of the financial sector, Cambridge: MIT Press, 2014; Robert McCauley and Patrick McGuire, “Non-US banks claims on the Federal Reserve,” BIS Quarterly Review, March 2014, pp 89-97.

Robert McCauley and Kazuo Ueda, “Government debt management at low interest rates,” BIS Quarterly Review, June 2009, pp 35-51.

Isabel Schnabel, “Back to normal? Balance sheet size and interest rate control,” slide 18, “Recently marketable HQLA was often more profitable to hold than reserves”; for the US case, see Robert McCauley, “Unstuffing banks with Fed deposits: Why and how?” VoxEU, March 21, 2021, Figure 6, “Fed pays more overnight than Treasury pays for a month.”

Borio and Disyatat, “Unconventional monetary policies: an appraisal”; Charles Goodhart, “Monetary policy and public debt”, in Banque de France Financial Stability Review, no 16, April 2012, pp 123-147.

Robin Greenwood, Samuel Hanson, Joshua Rudolph, and Lawrence Summers “Government debt management at the zero lower bound,” Hutchins Center on Fiscal and Monetary Policy, Brookings Institution Working Paper no 5, September 30, 2014, argued that US Treasury debt managers had worked at cross-purposes with the Fed by extending the maturity of the Treasury’s debt, thereby offsetting about a third of the Fed’s QE. In the UK case in 2009, “The Bank of England acted before the Debt Management Office announced its provisional plan of gilt sales for the new fiscal year. The Governor [Mervyn King] asked for and obtained a promise from the Chancellor that the Office would not alter its plan in the light of central bank decisions on the size, scope and timing of gilt purchases” (McCauley and Ueda, “Government debt management at low interest rates”, p 47). Did this deal stick?

Kosonen, “Increase in minimum reserves would hit bank liquidity at crucial moment,” notes that excess reserves count in the calculation of the 100% liquidity coverage ratio, but required reserves do not.

See McCauley, “Unstuffing banks with Fed deposits: Why and how?”