This policy brief is based on Banco de España, Working Paper 2522. The views expressed in this paper are those of the authors and do not necessarily reflect those of the Banco de España, the European Central Bank or the ESCB.

Abstract

Is the source of geopolitical risk relevant from a macroeconomic perspective? This paper reassesses the measurement and interpretation of geopolitical risk (GPR) and its economic implications. Building on the influential work of Caldara and Iacoviello (2022) and Bondarenko et al (2025), which defined GPR using the frequency of geopolitical terms in newspapers, we introduce a novel decomposition of the GPR index by the country or region of risk origin—what we term bilateral GPR indexes. These refined measures diverge from the global benchmark, showing that the macroeconomic impact of GPR shocks varies depending on their geographical source and the structural characteristics of the affected economy.

Geopolitical risk has far-reaching economic consequences, particularly for inflation and economic activity. The war in Ukraine, for example, triggered a sharp increase in energy prices and inflation across Europe. Combined with other pressures—such as supply chain disruptions and post-pandemic demand surges—this contributed to a strong monetary tightening cycle in major economies. However, the precise impact of geopolitical risk varies depending on transmission channels and national characteristics.

Existing GPR indices predominantly rely on English-language media, primarily from the United States, reducing diverse geopolitical risks into a single aggregated measure. In our recent working paper (Alonso-Alvarez, Diakonova, and Pérez, 2025), we argue that GPR is better understood as a network of bilateral relationships, shaped by local narratives. Expanding on Caldara and Iacoviello’s seminal index and Bondarenko et al. (2024), we construct local-language GPR indices for six major economies, using national media sources. We also introduce the concept of bilateral GPR, which traces the source of risk to specific regions. Our findings reveal significant differences in risk perception, offering insights into national exposure and illustrating how the source of a GPR shock influences its macroeconomic impact.

We construct local-language GPR indices for the United States, China, Russia, the United Kingdom, Germany, and France, applying a dictionary-based approach to Factiva’s archive of major national newspapers. This method calculates the monthly share of articles referencing key geopolitical risk terms, creating a time-varying index of media attention to geopolitical tensions. To ensure comparability, sources and languages are tailored to each country and the resulting values are normalised.

To validate our methodology, we replicate the Caldara and Iacoviello (C&I) index using Factiva, achieving a correlation of 0.82, closely mirroring its dynamics and peak detection. Comparing our local-language indices to this benchmark, we find that while the U.S. index remains nearly identical (correlation 0.99), other countries show significant divergence, reflecting the importance of language and perspective—events considered central in one country may be marginal or interpreted differently elsewhere.

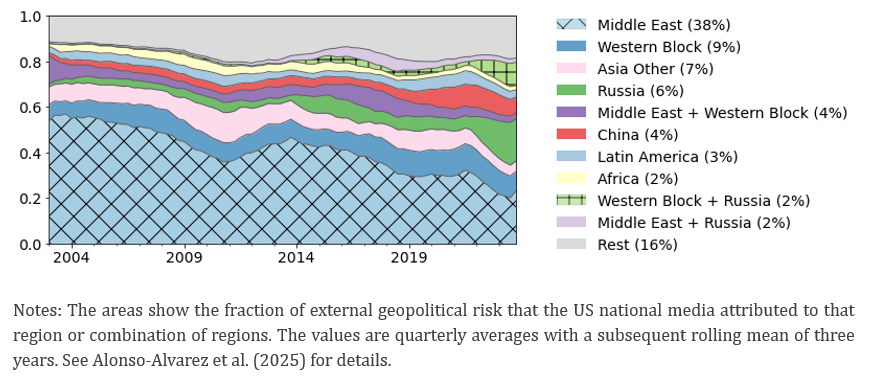

To capture geopolitical narratives more precisely, we introduce bilateral GPR indices, which measure perceived risk in country “i” related to tensions in country or region “j”. Using Factiva’s regional classification (“re” filter), we extract articles mentioning geopolitical risk while focusing on a specific external region, generating directional GPR indices that map the perceived source of risk. For example, U.S. media may attribute risk to China, the Middle East, or Russia, with shifting proportions over time. Additionally, we measure “internal” GPR—articles referencing geopolitical risk without specifying a foreign source—and find this component significant in some countries, sometimes exceeding 50%.

To decompose the external part of the geopolitical risk and thus build a national risk profile, the key technical challenge is overlapping coverage. This refers to articles referencing multiple foreign regions at the same time, and thus contributing to multiple bilateral GPR measures, which might lead one to overestimate the total risk. We address through an exhaustive combinatorial approach, obtaining exclusive bilateral GPR indices that correctly sum to the total external component without duplication.

Figure 1 presents the most significant contributors to geopolitical risk as perceived by the United States. Historically, U.S. geopolitical risk concerns were dominated by the Middle East, accounting for 40% of all discourse. However, this prominence has steadily declined, with references in the 2020s falling to half the levels seen after the Iraq invasion.

Meanwhile, Russia’s role has surged fivefold, now comprising up to 30% of external risk, largely due to key events such as Crimea’s annexation, the Ukraine war, and broader security concerns surrounding US-Russia strategic interactions. China has also gained prominence, with references quadrupling since 2003, though its share of US geopolitical discourse remains smaller than Russia’s. Concerns over China’s global influence, trade tensions, and technological competition have gradually replaced earlier regional security fears.

The Western Bloc—Western-aligned nations excluding the US—has maintained a stable presence, averaging 9% of geopolitical risk mentions, largely linked to financial markets, political events, security concerns, and common foreign policy involvements. However, its references in conjunction with other countries have grown steadily, reflecting its evolving role in geopolitical strategies.

Figure 1. National Risk Profile of the United States

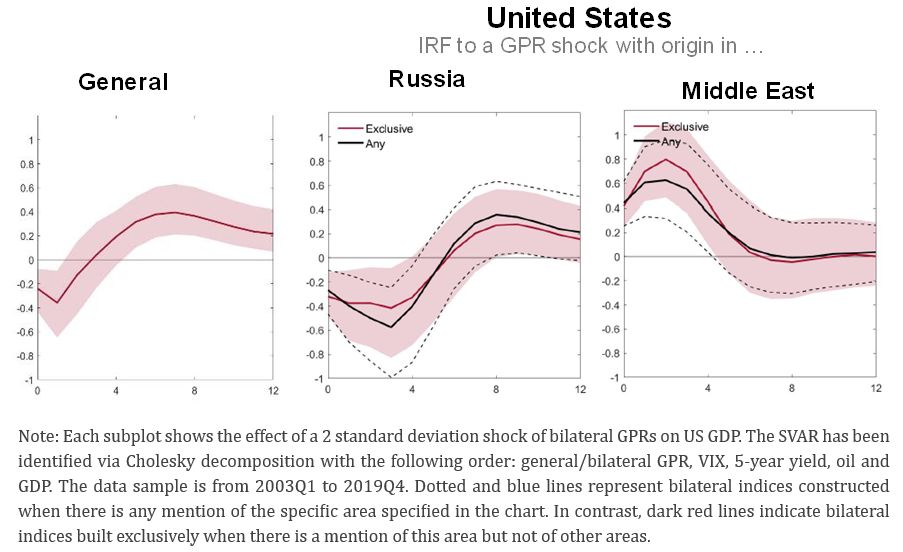

Using our bilateral GPR framework, we assess how the origin of a GPR shock influences macroeconomic outcomes. Employing Structural Vector Autoregressive (SVAR) models for each country, identified via Cholesky decomposition, we examine the impact of bilateral GPR shocks on real GDP.

Our findings, presented in Figure 2, show that general geopolitical risk shocks negatively impact GDP across countries. In the US, a two-standard-deviation GPR shock leads to a 0.4% GDP decline in the first year, consistent with Caldara and Iacoviello’s results. However, when accounting for bilateral indices, effects differ by source—a shock from Russia negatively affects US GDP, while a shock from the Middle East produces a 0.8% increase.1

To explore this unexpected positive effect, we extend our SVAR analyses to other variables, such as value-added in the oil and gas sector, military expenditures, and capital inflows. The results remain robust, highlighting two key transmission channels in the case of the US—commodity markets and safe-haven flows.2 As the US became a net oil exporter in the late 2010s, higher oil prices linked to Middle East-origin GPR shocks drive investment in the shale oil sector, supporting GDP growth. Additionally, heightened geopolitical uncertainty often leads investors to seek refuge in safe assets, reinforcing demand for gold, the US dollar, and Treasury bonds. These mechanisms likely explain why a geopolitical risk shock from the Middle East can have a positive economic effect.

Overall, our findings emphasize the importance of considering not only the presence of geopolitical risk but also its source and how it interacts with the economic structure of the affected country.

Figure 2. Impulse Response Functions of a GPR shock in the US

This paper reconceptualises geopolitical risk as a network of bilateral perceptions, rather than a single global index. By constructing national and bilateral GPR indices using local-language news sources, we capture heterogeneity in geopolitical narratives and risk exposure.

Crucially, we show that macroeconomic impacts depend not only on the intensity of geopolitical shocks but also on their geographic origin. As the global order becomes increasingly fragmented, policymakers must utilise tools that account for both the geography and directionality of GPR, ensuring more effective risk assessment and economic forecasting.

Caldara and Iacoviello (2022): Caldara, Dario, and Matteo Iacoviello. (2022). “Measuring geopolitical risk”. American Economic Review, 112(4), pp. 1194–1225.

Bondarenko et al (2024): Bondarenko, Yevheniia, Vivien Lewis, Matthias Rottner and Yves Schüler. (2024). “Geopolitical risk perceptions”. Journal of International Economics, 152, p. 104005.

Alonso-Alvarez et al. (2025): Alonso-Alvarez, Irma, Marina Diakonova and Javier J. Pérez (2025). “Rethinking GPR: The sources of Geopolitical Risk”, Bank of Spain Working Paper 2522.

Our working paper identifies additional cases where geopolitical risk (GPR) shocks are associated with a positive impact on GDP. For China, a GPR shock originating in its neighbouring countries leads to an increase in GDP. In Russia’s case, two distinct instances emerge: a GPR shock from the Western Bloc is associated with a 2.5% rise in GDP after one year, with effects that remain persistent. Additionally, a geopolitical risk shock originating in the Middle East also contributes to an increase in Russia’s GDP.

In Russia’s case, increased military spending could also serve as a significant transmission channel through which geopolitical risk affects economic growth.