References

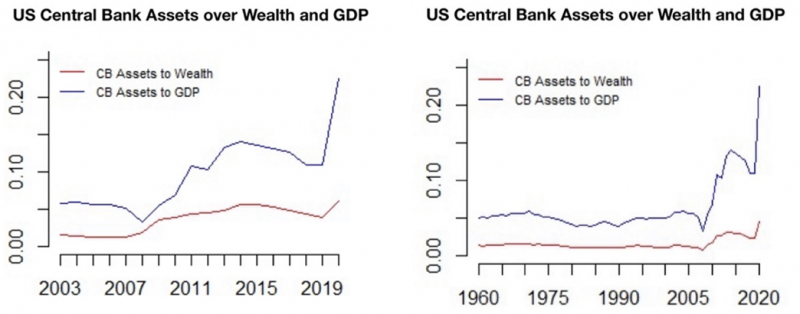

Viral Acharya, Rahul Chauhan, Raghuram Rajan and Sascha Steffen (2022), “Liquidity Dependence: Why Shrinking Central Bank Balance Sheets is an Uphill Task”, October.

Walter Bagehot (1873), A Description of the Money Market, Henry S. King & Co.

Ulrich Bindseil (2014), Monetary Policy Operations and the Financial System, Oxford University Press.

Willem Buiter and Anne Sibert (2007),” The Central Bank as the Market Maker of last Resort: From lender of last resort to market maker of last resort”, VoxEU blog, 13 Aug 2007.

Willem Buiter, Stephen Cecchetti, Kathryn Dominguez and Antonio Sánchez Serrano (2023) “Stabilising financial markets: lending and market making as a last resort”, ESRB Advisory Scientific Committee report no 13, January.

Agostino Capponi, Paul Glasserman and Marko Weber (2020), “Swing Pricing for Mutual Funds: Breaking the Feedback Loop Between Fire Sales and Fund Redemptions”, Management Science Vol 66-8, August

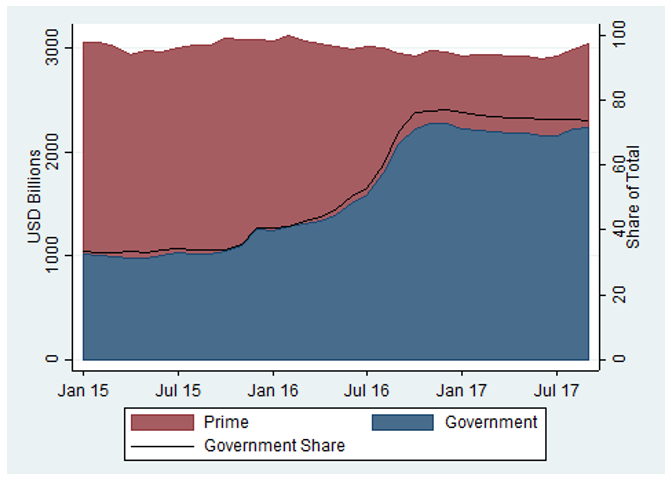

Marco Cipriani, and Gabriele La Spada (2021), “Investors’ appetite for money-like assets: the MMF industry after the 2014 regulatory reform”, Journal of Financial Economics 140 (1), 250-69.

Douglas Diamond and Philip Dybvig (1983), “Bank Runs, Deposit Insurance and Liquidity”, Journal of Political Economics 91, 401-419.

Douglas Diamond (2023), “Nobel Lecture: Financial Intermediaries and Financial Crises”, Journal of Political Economy vol 131-10, October.

Darrell Duffie (2023), Resilience redux in the US Treasury market”, Jackson Hole Symposium September 2, 2023.

Financial Times, June 26 2019, “BoE governor Mark Carney calls for change to investment regulation”.

Charles Goodhart (1999), Myths About the Lender of Last Resort, International Finance, 2(3), 339-360.

Charles Goodhart and Rosa M. Lastra (2022), “Lender of Last Resort and Moral Hazard “, LSE mimeo.

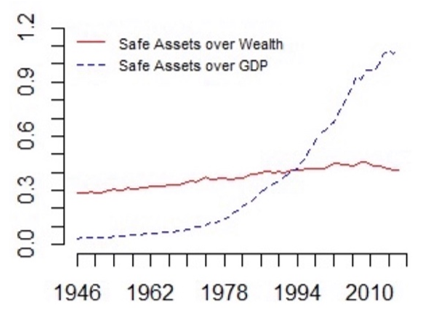

Gorton, Gary and Stefan Lewellen and Andrew Metrick (2012), “The Safe-Asset Share”, American Economic Review: Papers & Proceedings 102 (May), 101-106.

Gary Gorton and Guillermo Ordonez (2016) “Good booms, bad booms”, Journal of the European Economic Association, pp. 19-36.

Gary Gorton (2017) “The history and Economics of Safe Assets, 2017”, Annual Review of Financial Economics 9, 547-586.

Robin Greenwood, Samuel Hanson and Jeremy Stein (2018), “The Federal Reserve’s Balance Sheet as a Financial-Stability Tool”, in Innovative Federal Reserve Policies During The Great Financial Crisis edited by D Evanoff ea, World Scientific Publishers.

Arvind Krishnamurthy and Annette Vissing-Jorgensen (2012), The Aggregate Demand for Treasury Debt, Journal of Political Economy, Vol 120-2, p. 233 – 267.

Enrico Perotti and Spyros Terovitis (2022) “Seeking Safety”, ABS mimeo

David Lopez-Salido and Annette Vissing-Jorgensen (2023) “Reserve Demand, Interest Rate Control, and Quantitative Tightening”, Federal Reserve Board, January 10.

Andrei Shleifer and Edward L Glaeser (2001), “A Reason for Quantity Regulation”, American Economic Review Papers and Proceedings 91 (2): 431-435.

Paul Tucker (2018), “Is the Financial System Sufficiently Resilient: A Research Programme and Policy Agenda.” BIS Working Papers No. 792, June 2019, Bank for International Settlements.