This SUERF Policy Brief is based on BIS Working Paper No 1294 “Parsing the pulse: decomposing macroeconomic sentiment with LLMs”. The views expressed reflect those of the authors and are not necessarily those of the Bank for International Settlements.

Abstract

Macroeconomic indicators provide quantitative signals that must be pieced together and interpreted by economists. We propose a reversed approach of parsing press narratives directly using Large Language Models (LLMs) to recover growth and inflation sentiment indices. A key advantage of this LLM-based approach is the ability to decompose aggregate sentiment into its drivers, readily enabling an interpretation of macroeconomic dynamics. Our sentiment indices track hard-data counterparts closely, providing an accurate, near real-time picture of the macroeconomy. Their components–demand, supply, and deeper structural forces–are intuitive and consistent with prior model-based studies. Incorporating sentiment indices improves the forecasting performance of simple statistical models, pointing to information beyond official data.

The emergence of Large Language Models (LLMs) marks a significant advance in textual analysis. Unlike previous generations of tools that rely on frequency-based metrics or word co-occurrence, LLMs can capture complex semantic relationships and subtle sentiment shifts while recognising broader context. The tools have vast potential applications, including in macroeconomics where there is a wealth of information in textual data not least in financial news.

We employ LLMs to extract macroeconomic sentiment from financial news and analyse its drivers. We construct daily macroeconomic sentiment indices, for US growth and inflation, providing near real-time indicators of the business cycle and price pressures based on news. Leveraging LLMs to analyse the narrative, we also decompose the sentiment for underlying drivers, from familiar demand-supply components to their deeper structural factors. We make these sentiment indices available with regular updates to other researchers on https://www.bis.org/publ/work1294.htm.

We draw on a large corpus of financial news articles from the Wall Street Journal as the source data. These encompass US economic and financial market news articles from January 2000 to April 2025. We employ GPT-4.1 mini and GPT-5 mini to classify growth and inflation sentiment of each news article. Articles are parsed individually using a fixed set of instructions. For each piece, the model reports whether the narrative points to stronger or weaker activity and higher or lower inflation. These are then coded as numeric outputs (1, -1 or 0), allowing straightforward aggregation.

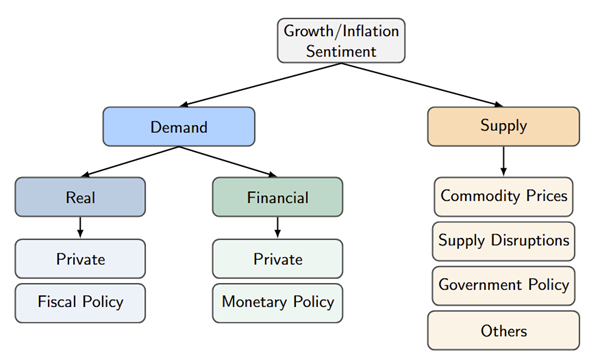

For each directional sentiment, we identify structural drivers of that sentiment using a given hierarchical taxonomy (Figure 1). The top level distinguishes demand from supply forces. For the demand component, we further differentiate financial and non-financial (real) influences, as well as policy-induced and private components. Financial policy drivers pertain to monetary policy, while real policy drivers are related to fiscal policy developments. Financial private drivers reflect financial conditions, while real private drivers capture confidence of households and firms. For the supply component, we divide drivers into commodity prices, supply-chain disruptions, government policy (e.g. tariffs) and others.

Figure 1. Taxonomy of macroeconomic sentiment

Our prompting architecture proceeds in several stages, mirroring the economic taxonomy. We first apply a minimal prompt to filter relevant articles. We then classify the overall sentiment and primary drivers (demand versus supply). The final prompt then examines an in-depth classification of sub-drivers. This multi-stage modular approach divides the complex task into manageable blocks, enabling better process control. See Kwon et al (2025) for detailed prompts and prompt engineering techniques used.

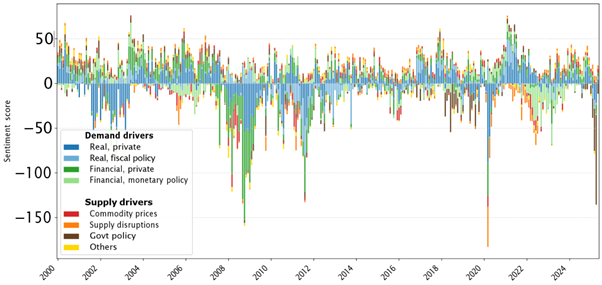

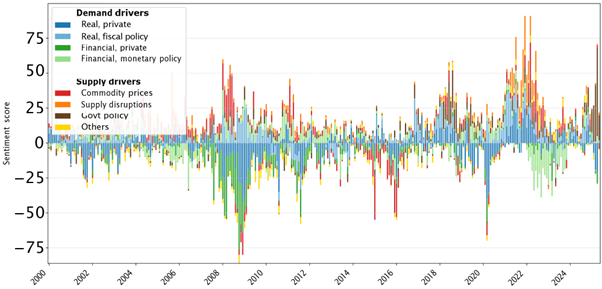

The resulting growth and inflation sentiment indices provide an intuitive description of the US business cycle and inflation evolution. Growth sentiment index fell in all major downturns, including the early-2000s slowdown, the Great Financial Crisis (GFC) and the 2020 pandemic. It softened again during the subsequent tightening cycles. Inflation sentiment index similarly tracks key inflationary episodes, including the inflation swings around the GFC and the post-pandemic inflation surge in 2021-22. Notably, the inflation sentiment also spiked following the recent US tariff increases.

Figure 2. Growth sentiment and drivers

Figure 3. Inflation sentiment and drivers

The demand-supply breakdown reveals what lies behind aggregate sentiment movements, aiding interpretation. For growth sentiment, demand factors are the predominant driver, both in recessions and recoveries. Supply factors are less cyclical, though can occasionally come to the fore as during the pandemic or recent tariff hike. For inflation sentiment, supply factors are just as cyclical as demand and accompany all major inflationary episodes. Demand factors tend to dampen inflation sentiment, except during the post-pandemic period when both demand and supply factors contributed to the inflation surge.

Detailed decomposition of the sentiment indices provides more colour to these breakdowns. Real private demand is the most consistent driver of growth sentiment, with shortfalls characterising all major recessions. Financial factors can also weigh heavily on demand, notably in severe stress episodes such as the GFC or during sharp monetary policy tightening post-pandemic. As for inflation, commodity price swings are consistently important throughout the sample, with supply chain disruptions and trade policy becoming more important recently. The contribution of monetary policy in bringing down inflation after the post-pandemic surge is also noteworthy.

Our sentiment indices and their decomposition find broad validation when compared against official data and other model-based estimates. Growth sentiment lines up well with growth diffusion indices or labour market indicators. Inflation sentiment closely tracks CPI and PCE inflation measures. The demand-supply components are generally consistent with external model estimates such as Eickmeier and Hofmann (2023) or Shapiro (2025). The detailed sentiment drivers comove tightly with their corresponding outside measures — e.g. financial private demand driver tracks financial condition indices, while real private demand component follows personal consumption expenditure. Monetary policy component shares the same pattern with the fed funds rate, while its high-frequency variations are positively correlated with benchmark estimates of monetary policy shocks. Fiscal policy factor captures key events such as stimulus programmes, tax cuts and government shutdowns.

We document robust evidence that incorporating sentiment indicators into simple autoregressive or local projection models improves out-of-sample forecasts. The reduction in root mean square errors (RMSEs) is typically 2-8% for growth forecasts and 12-19% for inflation forecasts at the 6-month horizon. These results suggest that the sentiment indices contain information about underlying macroeconomic dynamics beyond the official statistics.

We apply LLMs to extract information from financial news and construct macroeconomic sentiment relating to US growth and inflation. We decompose these headline indices into underlying structural drivers, providing a near real-time narrative about macroeconomic developments. Though based solely on textual analysis, the headline and sub-indices bear remarkable resemblance to official statistics and external model-based estimates. Our macroeconomic sentiment also exhibits promising leading properties, pointing to their potential use in forecasting.

Eickmeier, S and B Hofmann (2023): “What drives inflation? Disentangling demand and supply factors”, BIS Working Papers No 1047.

Kwon, B, T Park, P Rungcharoenkitkul and F Smets (2025): “Parsing the pulse: decomposing macroeconomic sentiment with LLMs”, BIS Working Papers No 1294.

Shapiro, A H (2025): “Decomposing supply- and demand-driven inflation,” Journal of Money, Credit and Banking, forthcoming.