This policy brief is based on ECB Working Paper, No 3060. This paper should not be reported as representing the views of the European Central Bank (ECB). The views expressed are those of the authors only.

Abstract

Organized crime distorts markets, undermines financial trust, and hampers capital allocation. Using data from 38 anti-Mafia police operations in Italy between 2019 and 2021, we provide causal evidence on the economic effects of dismantling criminal firms. Combining official court records, ECB loan-level data, and firm-level balance sheets, we show that removing Mafia-connected firms increases bank lending to neighbouring legitimate firms by up to 2.1% in high-infiltration areas. However, borrowing costs also rise modestly due to banks’ reassessment of credit risks. Local banks react more moderately than foreign ones, benefiting from superior soft information. We further find that productivity increases in affected municipalities, suggesting that removing criminal distortions revitalizes credit markets and real economic activity.

Organized crime can have pervasive effects on economies, undermining both market competition and institutional integrity. At the macro level, research shows that organized crime reduces electoral competition and raises corruption (Pinotti et al., 2013; Geys & Daniele, 2014; De Feo & De Luca, 2017), while at the firm level, it distorts operations and suppresses growth (Ambrosini et al., 2024; Bianchi et al., 2022; Slutzky & Zeume, 2024). Despite its clear harm, less is known about how organized crime affects the financial sector—particularly bank lending. This is a critical gap, especially in Europe where banks provide the bulk of external finance to firms (De Santis & Surico, 2013). Recent studies suggest that Mafia-connected firms engage in tax evasion, earnings manipulation, and strategic concealment (Ravenda et al., 2015; Chircop et al., 2023), all of which distort banks’ risk assessments. We examine whether eliminating such firms through judicial action affects local credit supply and firm productivity.

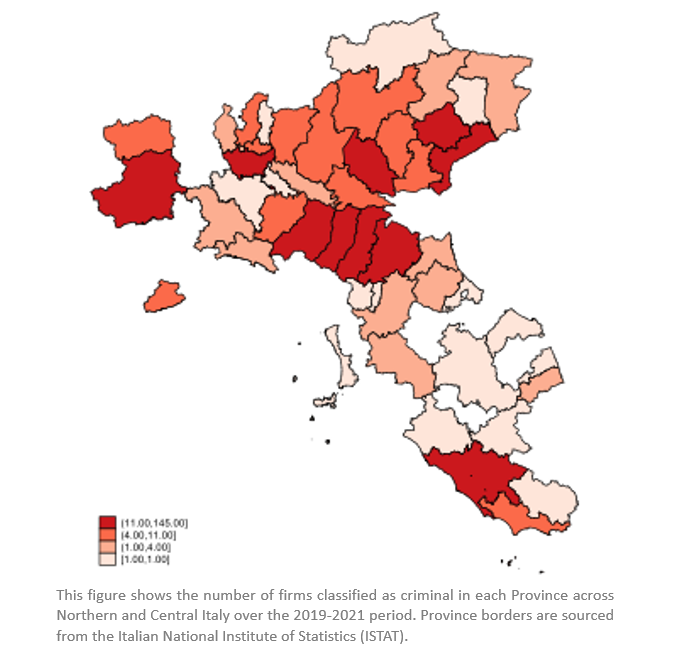

Our study leverages a uniquely robust dataset derived from real-world anti-Mafia police operations, governed by Article 416-bis of the Italian Penal Code—the central legal instrument for prosecuting Mafia-related criminal activity. This provision enables law enforcement and judicial authorities to dismantle organized crime groups through asset seizures, arrests, and public disclosure of firm-level criminal affiliations. We used this legal infrastructure to identify Mafia-connected firms with exceptional precision and transparency. Drawing on official judicial records and the Telemaco corporate registry, we traced the corporate roles (e.g., board members, shareholders) of individuals convicted of Mafia association. In line with established methodologies (Chircop et al., 2023; Ambrosini et al., 2024), we classified a firm as criminal if it was linked to individuals convicted under Article 416-bis. This approach ensures legal certainty, as it excludes speculative or unproven links. Across 111 anti-Mafia operations between 2018 and 2021, we identified 722 such criminal firms across Italy. Importantly, we only considered municipalities where police actions occurred for the first time during our sample period to avoid confounding effects from prior interventions.

To estimate the causal effects of these anti-Mafia operations on credit allocation and economic performance, we employed a stacked difference-in-differences (DiD) methodology. This approach overcomes biases present in traditional staggered DiD frameworks by constructing event-specific comparisons between treated municipalities (and their neighboring areas) and untreated municipalities within the same province. Our identification strategy allows us to exploit both the exogenous timing and localized exposure of anti-Mafia shocks, ensuring credible counterfactuals and isolating the true effect of criminal firm removal. In sum, our study combines highly credible judicial data on real-world Mafia enforcement with a state-of-the-art causal inference strategy, offering a rare opportunity to quantify the financial and economic consequences of disrupting organized crime in practice.

Figure 1. Geographical Distribution of Criminal Firms

We find a significant intermediation effect: bank lending to legitimate peer firms increases by an average of 0.8% after an anti-Mafia operation. This rises to 2.1% in municipalities with intense Mafia presence or rent extraction practices (Ambrosini et al., 2024; Mirenda et al., 2022). These findings align with prior work suggesting that criminal organizations suppress fair competition and investment (Gambetta, 1996; Von Lampe, 2015), and that their removal improves market dynamics (Chircop et al., 2023; Zimmerman & Forrester, 2020). The mechanism is intuitive: as criminal firms exit, legitimate businesses regain confidence and demand more credit to invest in newly competitive environments.

1. Information Effects

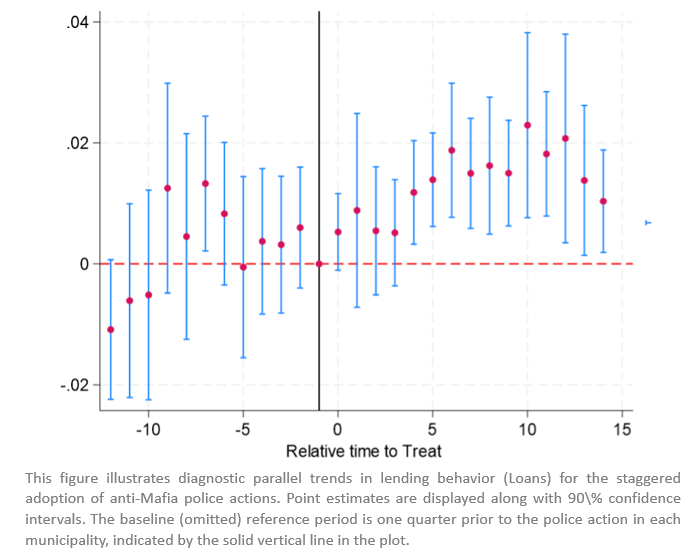

Risk Reassessment and Borrowing Costs: We also identify an information effect: interest rates on new loans rise modestly (≈0.018 percentage points), as banks update their risk models in light of the revealed criminal infiltration. This echoes classic models of credit market asymmetries (Stiglitz & Weiss, 1981; Holmstrom & Tirole, 1997; Akerlof, 1970), where limited borrower transparency elevates perceived risk. The increased probability of default we observe post-intervention (≈0.07 pp) suggests that banks face uncertainty not only about the removed firms but also about others operating in the same area. These “institutional voids” may reflect residual Mafia influence or concerns about regulatory enforcement (Johnson et al., 2002; Dell’Ariccia et al., 2014; Gennaioli et al., 2014). Figure 2 confirms the validity of the parallel trends assumption prior to treatment, as there are no statistically significant deviations from zero before the intervention. Following the anti-Mafia police actions (denoted by time zero), we observe a clear and persistent increase in bank lending to local firms. The post-treatment estimates are positive and grow over time, indicating a sustained credit expansion in treated municipalities. This dynamic response supports the interpretation of a causal effect of Mafia firm removal on financial intermediation, consistent with the hypothesized intermediation channel.

2. The Importance of Soft Information

Our results highlight the role of soft information—qualitative knowledge obtained through proximity and relationships—in credit risk assessment (Petersen & Rajan, 2002; Degryse & Ongena, 2005; Agarwal & Hauswald, 2010). Local and domestic banks that are embedded in the community raise interest rates less than foreign or non-local institutions, who are less familiar with borrowers’ histories and reputations. This distinction is vital. When public shocks reveal hidden risks, banks that rely only on hard data tend to respond with broad caution, while those with established relationships can make finer-grained adjustments (Liberti & Petersen, 2019; Degryse & Van Cayseele, 2000).

3. Productivity Gains and Broader Economic Impact

Beyond credit markets, we find real economic improvements: productivity rises in affected municipalities, especially those where Mafia firms previously engaged in coercive rent extraction. This result aligns with literature showing that the exit of inefficient firms reallocates resources to more productive enterprises (Foster et al., 2008; Baldwin & Gu, 2006). The removal of criminal firms allows legitimate businesses to grow, innovate, and hire—free from fear or unfair competition. Anti-Mafia actions thus yield both financial and real-sector benefits.

Figure 2. Effect of Anti-Mafia Police Action on Lending

Our findings carry important implications for policymakers, financial supervisors, and law enforcement authorities concerned with the intersection of organized crime and financial intermediation.

1. Targeted Law Enforcement Can Improve Financial Development

The dismantling of Mafia-connected firms produces a positive spillover effect on legitimate local businesses by increasing their access to credit. This suggests that criminal infiltration depresses financial activity not only directly through illicit behavior, but also indirectly by crowding out legitimate firms. Effective law enforcement can thus act as a catalyst for restoring fair market conditions and enabling economic expansion.

2. Transparency is a Double-Edged Sword

Anti-Mafia operations introduce greater transparency by revealing previously hidden firm-level connections to organized crime. While this is beneficial in the long run, it also triggers a short-term increase in perceived credit risk—especially for financial institutions without local knowledge. Policymakers must recognize that exposure of criminal risks may temporarily lead to higher borrowing costs and more cautious credit allocation, particularly by non-local or foreign lenders.

3. Local Banks Play a Critical Stabilizing Role: Our findings show that local and domestic banks—those with geographic and relational proximity to borrowers—adjust more moderately to the new risk environment. Their ability to gather and interpret soft information allows them to distinguish between criminal and non-criminal borrowers more effectively, avoiding unnecessary credit tightening. This underscores the importance of maintaining a healthy local banking sector that can mitigate the transitional disruptions caused by enforcement actions.

4. Data Infrastructure Enhances Supervisory Effectiveness

Granular supervisory data, such as the ECB’s AnaCredit loan-level database, was instrumental in uncovering the real effects of anti-Mafia operations on credit and productivity. Such infrastructures are essential for evidence-based policy design and should be further developed and harmonized across jurisdictions. In particular, their integration with enforcement and anti-money laundering systems can provide early-warning indicators of systemic risk from criminal infiltration.

Finally, beyond the financial sector, our study reveals that anti-Mafia interventions increase local productivity by removing inefficient, coercive firms and allowing capital to reallocate toward more competitive businesses. This highlights the macroeconomic value of criminal justice and regulatory coordination, suggesting that crime suppression is not merely a legal necessity but also a lever for boosting economic efficiency and resilience.

Eliminating organized crime yields measurable economic gains. Lending volumes rise, productivity improves, and trust is restored. But the transition comes with temporary frictions, especially for less-informed lenders. Supporting the role of local banks and fostering robust data infrastructures can help mitigate these risks and maximize the long-run benefits of law enforcement. Future research could extend this framework to other criminal threats—such as drug cartels or corruption rings—and explore their effects on financial intermediation and economic outcomes.

Agarwal, S. & Hauswald, R. (2010). Distance and private information in lending. The Review of Financial Studies, 23(7), 2757–2788.

Akerlof, G. A. (1970). The market for ‘lemons’: Quality uncertainty and the market mechanism. The Quarterly Journal of Economics, 84(3), 488–500.

Ambrosini, F., Fabrizi, M., Ipino, E., & Parbonetti, A. (2024). Mafia entrepreneur: Implications for industry peers in non-traditional territories. Available at SSRN 4960619.

Baldwin, J. R., & Gu, W. (2006). Plant turnover and productivity growth in Canadian manufacturing. Industrial and Corporate Change, 15(3), 417–465.

Bianchi, P. A., Marra, A., Masciandaro, D., & Pecchiari, N. (2022). Organized crime and firms’ financial statements: Evidence from criminal investigations in Italy. The Accounting Review, 97(3), 77–106.

Chircop, J., Fabrizi, M., Malaspina, P., & Parbonetti, A. (2023). Anti-mafia police actions, criminal firms, and peer firm tax avoidance. Journal of Accounting Research, 61(1), 243–277.

De Feo, G., & De Luca, G. D. (2017). Mafia in the ballot box. American Economic Journal: Economic Policy, 9(3), 134–167.

Degryse, H., & Ongena, S. (2005). Distance, lending relationships, and competition. The Journal of Finance, 60(1), 231–266.

Degryse, H., & Van Cayseele, P. (2000). Relationship lending within a bank-based system: Evidence from European small business data. Journal of Financial Intermediation, 9(1), 90–109.

Dell’Ariccia, G., Laeven, L., & Marquez, R. (2014). Real interest rates, leverage, and bank risk-taking. Journal of Economic Theory, 149, 65–99.

Foster, L., Haltiwanger, J., & Syverson, C. (2008). Reallocation, firm turnover, and efficiency: Selection on productivity or profitability? American Economic Review, 98(1), 394–425.

Gambetta, D. (1996). The Sicilian Mafia: The business of private protection. Harvard University Press.

Gennaioli, N., Martin, A., & Rossi, S. (2014). Sovereign default, domestic banks, and financial institutions. The Journal of Finance, 69(2), 819–866.

Geys, B., & Daniele, G. (2014). Organized crime, institutions and political quality: Empirical evidence from Italian municipalities. Economic Journal, forthcoming.

Holmstrom, B., & Tirole, J. (1997). Financial intermediation, loanable funds, and the real sector. The Quarterly Journal of Economics, 112(3), 663–691.

Johnson, S., McMillan, J., & Woodruff, C. (2002). Property rights and finance. American Economic Review, 92(5), 1335–1356.

Liberti, J. M., & Petersen, M. A. (2019). Information: Hard and soft. Review of Corporate Finance Studies, 8(1), 1–41.

Mirenda, L., Mocetti, S., & Rizzica, L. (2022). The economic effects of mafia: Firm-level evidence. American Economic Review, 112(8), 2748–2773.

Petersen, M. A., & Rajan, R. G. (2002). Does distance still matter? The information revolution in small business lending. The Journal of Finance, 57(6), 2533–2570.

Pinotti, P., et al. (2013). Organized crime, violence, and the quality of politicians: Evidence from southern Italy. In: Lessons from the Economics of Crime.

Ravenda, D., Argilés-Bosch, J. M., & Valencia-Silva, M. M. (2015). Detection model of legally registered mafia firms in Italy. European Management Review, 12(1), 23–39.

Slutzky, P., & Zeume, S. (2024). Organized crime and firms: Evidence from antimafia enforcement actions. Management Science, 70(10), 6569–6596.

Stiglitz, J. E., & Weiss, A. (1981). Credit rationing in markets with imperfect information. The American Economic Review, 71(3), 393–410.

Von Lampe, K. (2015). Organized crime: Analyzing illegal activities, criminal structures, and extra-legal governance. Sage Publications.

Zimmerman, J. L., & Forrester, D. (2020). The forensics of the American mafia. Available at SSRN 3514247.