References

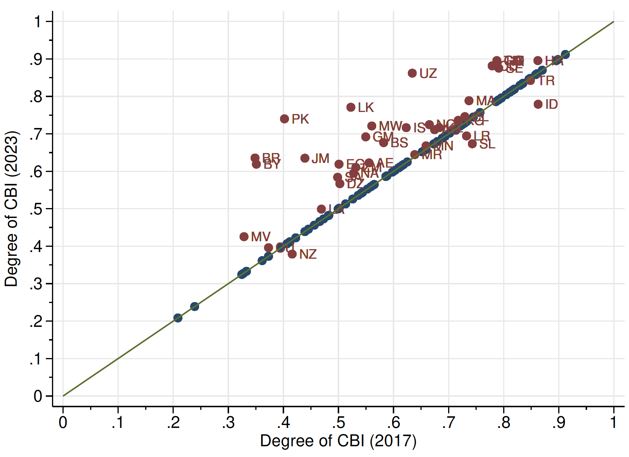

Adrian, T, A Khan and L Menand (2024) “A New Measure of Central Bank Independence”, IMF Working Paper No. 2024/035.

Ari, A, C Mulas-Granados, V Mylonas, L Ratnovski and W Zhao (2023), “One Hundred Inflation Shocks: Seven Stylized Facts”, IMF Working Paper WP/2023/190.

Bianchi, F, R Gómez-Cram, T Kind and H Kung (2023), “Threats to central bank independence: High-frequency identification with Twitter”, Journal of Monetary Economics, 135, 37-54.

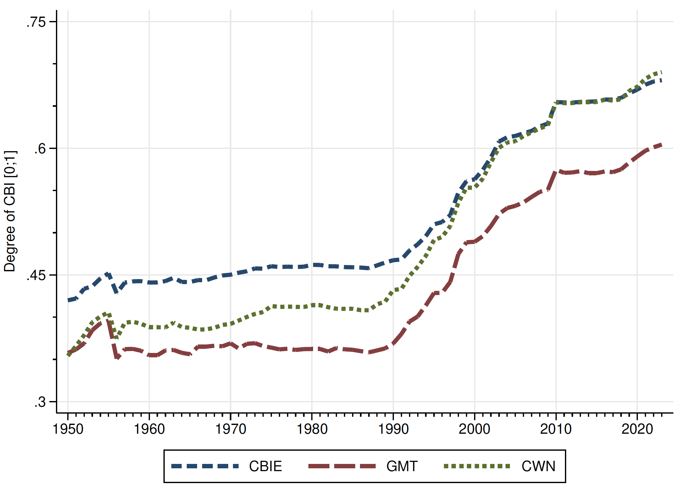

Cukierman, A, S B Webb and B Neyapti (1992), “Measuring the Independence of Central Banks and its Effects on Policy Outcomes”, World Bank Economic Review 6: 353–98.

Dincer, N, B Eichengreen and J Martínez (2023), “Central Bank Independence: Views from History and Machine Learning”, mimeo.

Grilli, V, D Masciandaro and G Tabellini (1991), “Political and Monetary Institutions and Public Financial Policies in the Industrial Countries”, Economic Policy 13: 341-92.

Ioannidou V, S Kokas, T Lambert and A Michaelides (2023), “(In)dependent central banks”, CEPR Discussion Paper No. DP17802.

Masciandaro, D and D Romelli (2023), “Alex Cukierman, a pioneer of central bank independence”, VoxEU.org, 4 November.

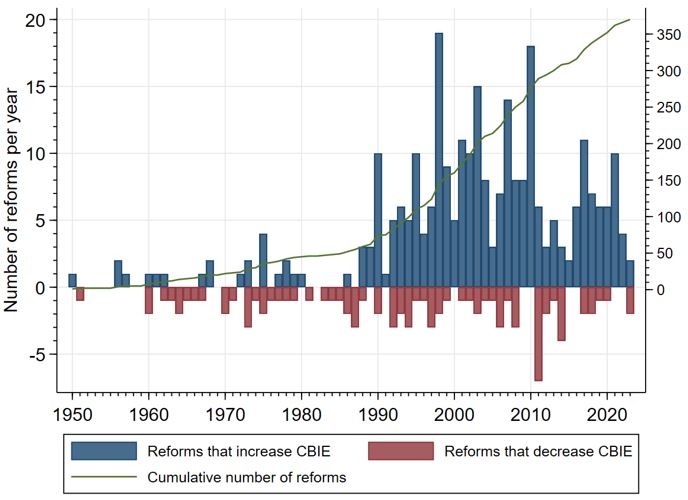

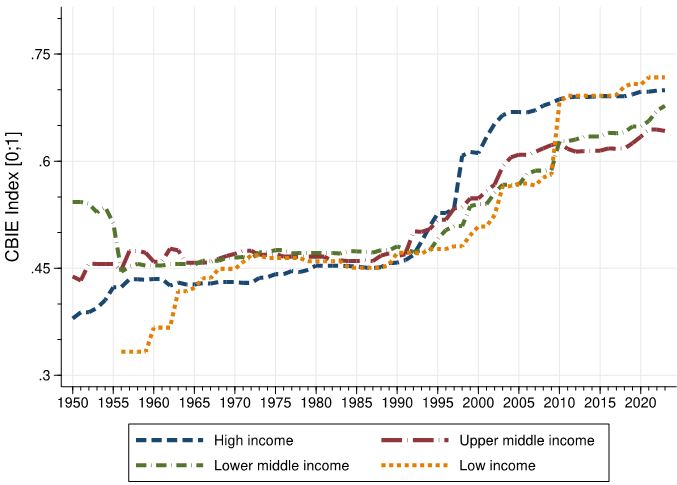

Romelli, D (2022), “The political economy of reforms in central bank design: Evidence from a new dataset”, Economic Policy 37(112): 641-88.

Romelli, D (2024), “Trends in central bank independence: a de-jure perspective”, BAFFI CAREFIN Centre Research Paper No. 217.