References

Altavilla, C., M. Boucinha and Peydro, J. (2018). “Monetary policy and bank profitability in a low interest rate environment”. Economic Policy, Volume 33, Issue 96, pp. 531– 586.

Ampudia M. and S. Van den Heuvel (2018). “Monetary policy and bank equity values in a time of low interest rates”, ECB Working Paper No 2199.586.

Brunnermeier, M.K. and Y. Koby (2018). “The reversal interest rate”. NBER Working Paper No. 25406.

Bats, J., M. Giuliodori, and Houben, A. (2020). “Monetary Policy Effects in Times of Negative Interest Rates: What do Bank Stock Prices Tell Us?”, DNB Working Paper, No. 694.

Chaudron, R. (2018), “Bank’s interest rate risk and profitability in a prolonged environment of low interest rates”, Journal of Banking & Finance, 89(C), pp. 94-104.

Demiralp, S., J. Eisenschmidt, Vlassopoulos, T. (2021). “Negative interest rates, excess liquidity and retail deposits: banks’ reaction to unconventional monetary policy in the euro area”, European Economic Review, Vol. 136 (C).

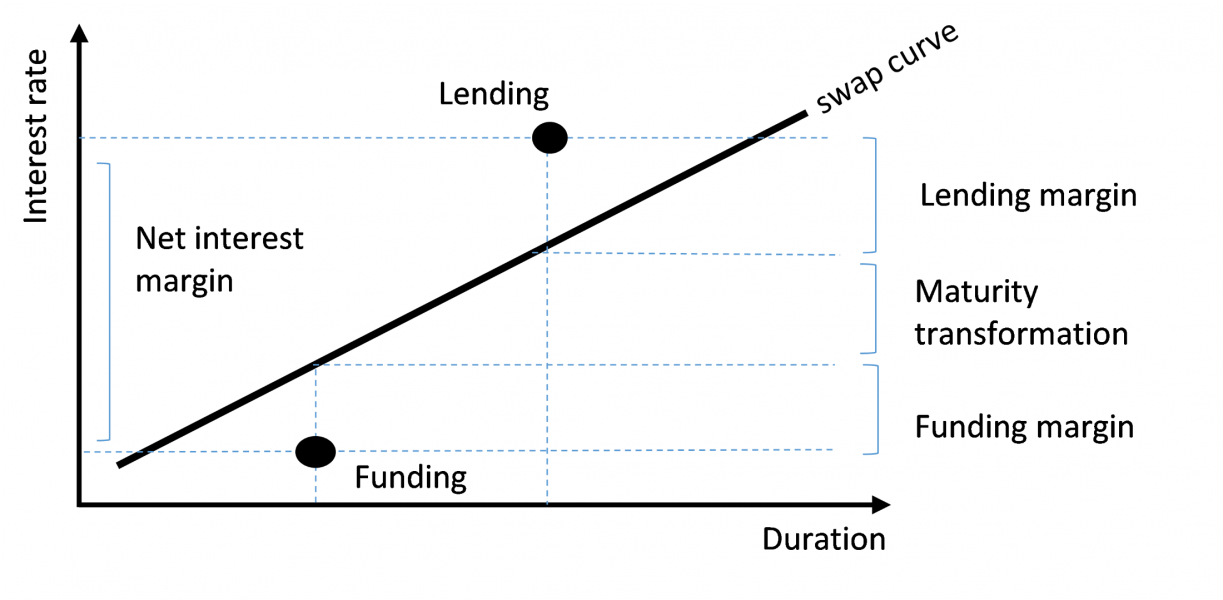

Drechsler, I., A. Savov and P. Schnabl (2021), Banking on deposits: maturity transformation without interest rate risk, Journal of Finance, 76(3), pp. 1091-1143.

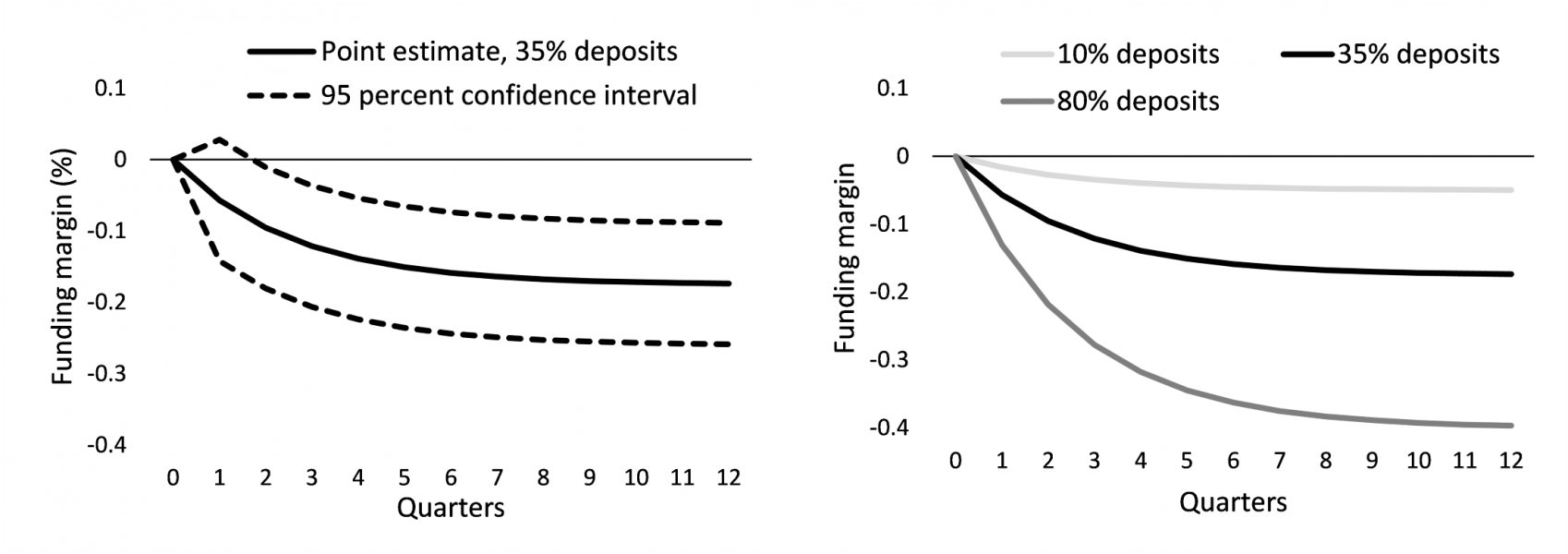

Freriks, J. and J. Kakes (2021), Bank interest rate margins in a negative interest rate environment, DNB Working Paper, No. 721.

Heider, F., F. Saidi and Schepens, G. (2019). “Life below zero: Bank lending under negative policy rates”, The Review of Financial Studies, 32(10), pp. 3728-3761.

Hoffmann, P., Langfield, S., Pierobon, F., & Vuillemey, G. (2019). Who bears interest rate risk?. The Review of Financial Studies, 32(8), pp. 2921-2954.

Schnabel, I. (2020), “Going negative: the ECB’s experience”. ECB Speech.