The views expressed in this paper are those of the authors and do not necessarily reflect those of the Bank for International Settlements, European University Institute or University of Zurich.

We investigate the relation between regulation and venture capital (VC) funding. We construct a detailed U.S. regulatory index tracking the shifts in regulatory attitudes toward crypto between 2010 and 2022. We find a positive link between regulatory stringency, as measured by our index, and venture capital raised. We trace the source for the increase in VC funding to the reduction in information asymmetries. Consistently, we find that younger firms with less tangible assets benefit more, and foreign investors, investors that are not specialized in the crypto sector and those with fewer investment professionals invest more capital. Overall, our results emphasize the broader implications of regulation and highlight that regulation can act as a catalyst for venture financing and the development of a new industry.

Venture Capital (VC) plays a pivotal role in fostering the development of innovative firms by bridging the gap between startups, typically facing funding constraints, and more established firms that can rely on traditional funding to a larger extent (Kortum and Lerner, 2001). Understanding how changes in regulation influence VC funding is crucial for comprehending the dynamics of innovation in different sectors.

The connection between regulation and the financing of innovation is a longstanding question in the literature. If there is an effect, the interest is on the economic channels through which regulation can impact innovation. This is important because two different jurisdictions that introduce the same regulation can potentially experience very different outcomes.

This study (Aquilina et al., 2024) explores the nexus between regulatory changes and the flow of VC funding into the crypto sector. In our paper, we look at different types of regulation implemented in different states in the U.S. and assess how the funding of new firms in the sector is impacted. We focus on the crypto sector for two compelling reasons.

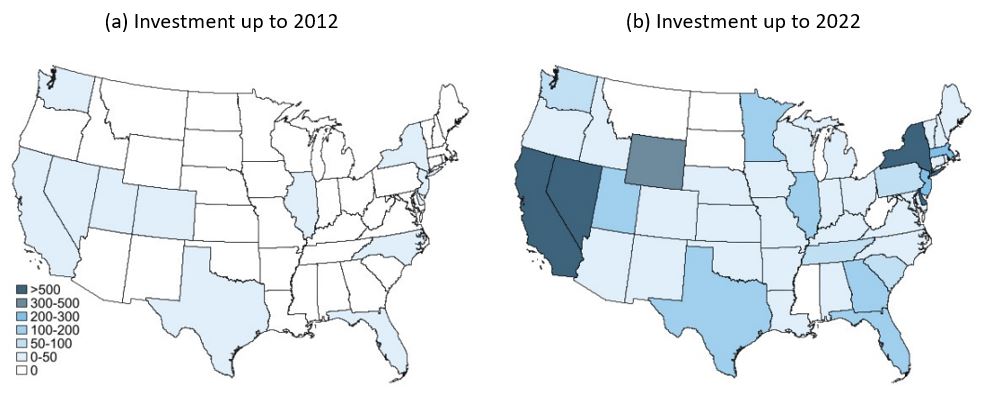

Figure 1 displays VC funding per capita in the crypto sector between 2012 and 2022. Early in the period, there were few states that received VC funding, like New York or Utah. However, by 2022 some states pulled ahead, like California, some emerged, like Georgia, and others clearly lagged behind, like North Carolina. In our paper, we study whether regulatory attitudes towards crypto are behind these patterns.

Figure 1: Investment in crypto firms increased remarkably from 2012 to 2022

Note: The graph shows the cumulative capital invested in crypto deals since 2010, in millions of U.S. dollars, excluding Alaska and Hawaii, in 2012 (left) and 2022 (right). Source: PitchBook Data Inc; U.S. Census Bureau; authors’ calculations.

Our initial step involves constructing a comprehensive U.S. crypto-related state regulation database, designed to encompass overall regulatory stances toward crypto in each state. We retrieve from the relevant passed bills the date when a law on any on seven wide-ranging topics came into effect, covering:

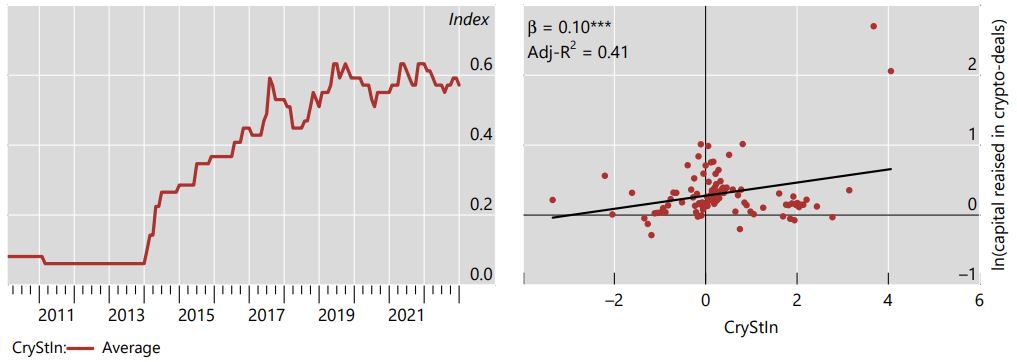

The outcome is a monthly panel spanning from January 2010 to December 2022 for each state. Each item represents a categorical variable, taking the value of one in months where the corresponding law was in effect.1 We aggregate across all items to derive an index for each month in each state, presenting the regulatory landscape comprehensively. The left-hand panel of Figure 2 visualizes the evolution of CryStIn, our regulatory index. Overall, regulatory stringency increased across states over time.

Figure 2: The Crypto Stringency Index (CryStIn)

Note: The left-hand panel shows the cross-state simple average of the CryStIn. The right-hand panel shows a binned scatter plot of the variables reported along the axes. Based on monthly data from 2010 to 2022. Includes state– and time fixed effects.

Source: PitchBook Data Inc; authors’ calculations.

To understand the relationship between our index and VC funding we leverage data from Pitchbook, a leading source for VC deal-level data. We examine deals from 2012 to 2022, aligning with the evolution of our regulatory index. The right-hand panel of Figure 2 shows that regulatory stringency is positively associated with capital raised in crypto deals.

However, it’s essential to address the possibility that regulators may enact laws in response to increased VC funding, challenging our premise that the laws themselves drive VC funding. To deal with this challenge and provide causal evidence, we exploit the time and geographic dimension of our index and employ an instrumental variable. The instrument exploits past exogenous changes in national regulatory attitudes towards crypto to explain current regulatory attitudes in a state.

We confirm the positive relationship in a regression analysis with this set up. The positive effect, however, is exclusively present in states that have a sufficiently developed financial sector. Specifically, a one standard deviation increase in the index roughly triples the amount of capital raised in financial hubs.

To understand the mechanisms behind the rise in VC funding amid tightening regulatory attitudes, we turn to a more granular analysis at the deal level. We zoom in on a particular type of regulation in the “financial hub” state of New York: the commonly known as BitLicense, which went into effect at the end of June in 2015. The BitLicense mandates specific business licenses for cryptocurrency-related activities in New York, imposing disclosure and capital requirements on relevant firms. These requirements mandate firms to disclose detailed business plans and specifics of virtual currency transactions or services.

We hypothesize that the regulatory tightening, as seen with BitLicense, reduces information asymmetries in VC deals. If in fact the assessment of the quality of a start-up is facilitated by regulation, we would expect that those firms for which information asymmetries are more important would benefit the most. Extensive literature indicates that information asymmetries are more pronounced for young start-ups and firms with less tangible assets that could be pledged as collateral like, for example, software firms. On the investor side, we expect that those investors located abroad, smaller ones, and those less specialised in the crypto sector, would benefit the most from decreases of information asymmetry.

We compare the cumulative capital raised by crypto firms in New York to that raised by similar firms outside of the state. Our analysis suggests that, post-BitLicense, younger and less collateralized firms in New York attracted more VC funding compared to the control group. Foreign and smaller VCs also increased their investments compared to domestic and larger investors.

Overall, our findings indicate that reduced information asymmetries, driven by regulatory tightening, contribute to the surge in VC funding.

Our work contributes to a broad strand of the academic literature that studies the effect of public policies aimed at promoting innovation, like the effect of receiving a grant (Howell, 2017), or the effectiveness of business accelerators (Gonzalez-Uribe and Reyes, 2021; Yu, 2020) or regulatory sandboxes (Cornelli et al., 2024). Our unique approach directly assesses the impact of regulation on VC funding, contributing new insights where previous research has yielded inconclusive outcomes. Additionally, our findings underscore how improved regulation can fortify VC function as a filter for promising projects.

Aquilina, Matteo, Cornelli, Giulio, and Marina Sanchez Del Villar (2024). “Regulation, information asymmetries and the funding of new ventures”. BIS Working Papers, no 1162.

Cornelli, Giulio, Sebastian Doerr, Leonardo Gambacorta, and Ouarda Merrouche (2024). “Regulatory sandboxes and fintech funding: evidence from the UK”. Review of Finance 28.1, pp. 203–233.

Gonzalez-Uribe, Juanita and Santiago Reyes (2021). “Identifying and Boosting “Gazelles”: Evidence from Business Accelerators”. Journal of Financial Economics 139.1, pp. 260–287.

Howell, Sabrina T (2017). “Financing innovation: Evidence from R&D grants”. American Economic Review 107.4, pp. 1136–1164.

Yu, Sandy (2020). “How do accelerators impact the performance of high-technology ventures?” Management Science 66.2, pp. 530–552.

Kortum, S. and Lerner, J. (2001). Does venture capital spur innovation? In Entrepreneurial inputs and outcomes: New studies of entrepreneurship in the United States, pages 1–44. Emerald Group Publishing Limited.

The variable can take the value –1 if the law is permissive rather than restrictive.