Employing a multi-country, multi-sector general equilibrium modeling framework with imperfect competition and heterogeneous firms, we perform qualitative and quantitative analyses of protectionist semiconductor measures. Our paper offers two innovations in assessing the impact of current trade restrictions. First, our model of the semiconductor industry takes into account semiconductor varieties at different technological levels with different substitutability. Second, we model trade restrictions as export bans on semiconductor varieties consistent with US policy. Our simulation results suggest that the trade restrictions imposed by the US and its allies consistently lead to a decline in Chinese GDP and welfare. The US also loses, but to a lesser extent. The effect of trade diversion favors the rest of the world. Our simulations further confirm that the US semiconductor industry is likely to be harmed by the restrictions, while China’s could be strengthened.

Over recent years, technology and complex policy questions at the nexus of technology and security have gained increasing importance in US-China trade. The US introduced a series of policies to slow the pace at which China acquires new technology and, as a side effect, promote technological disengagement or “decoupling”.

Developments in recent years have taken place against the backdrop of numerous trade policy escalations involving semiconductors. To implement semiconductor policy, the US Export Control Reform Act (ECRA) gives the president authority to control dual-use exports for national security. The US Department of Commerce Bureau of Industry and Security (BIS) administers export controls on dual-use items through the Export Administration Regulations (EAR), a set of regulations that include the Commerce Control List (CCL) of dual-use technologies subject to controls. The EAR establishes licensing policies for specific destinations, end uses, and end-user controls (Sutter and Casey, 2022). Huawei and its affiliates, which were among the many targets of these export control measures, ended up on the BIS Entity List (EL) in May 2019. The EL identifies entities that are or may be engaged in activities contrary to US national security or foreign policy interests. The BIS generally requires approval for any US export of EAR goods to entities on the list. In 2019, BIS reviewed licenses of software and technology exports to China worth USD 6.8 billion. This number increased to USD 106.1 billion in 2020 and to USD 544.9 billion in 2021. In the years 2019, 2020 and 2021, 64.7 % (1.5 %), 27.4 % (0.5 %) and 42.1 % (53.4 %) were approved (denied), respectively. The remaining license applications were returned due to incomplete application documents.

In October 2022, the BIS announced the most far-reaching export restrictions so far. Businesses will no longer be allowed to supply China with advanced computing chips, chipmaking equipment or related products. The new rules appear to outright ban the sale of the most powerful semiconductors, and the software and manufacturing equipment needed to produce them, to Chinese firms. Furthermore, the restrictions apply the foreign direct product rule which restricts sales of items based on American technology even if they are designed and manufactured abroad, on an unprecedented scale. However, the US government may grant temporary waivers. The Taiwanese manufacturer TSMC and the South Korean manufacturer SK Hynix have recently been granted such exemptions for a period of one year upon request. Edward Luce of the “Financial Times” has appropriately called the export restrictions a full-blown economic war on China (https://www.ft.com/content/398f0d4e-906e-479b-a9a7-e4023c298f39).

Against this background, Funke and Wende (2022) provide a model-based evaluation of the trade dispute providing a quantitative assessment of the medium-term macroeconomic impact and an understanding of the underlying mechanisms.

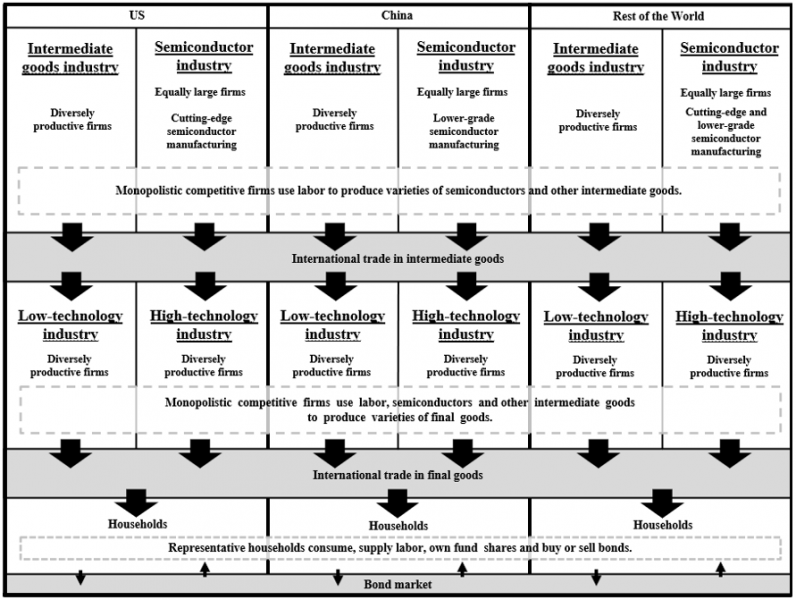

Our open economy macro model is reminiscent of the approaches by Melitz (2003), Chaney (2008) and Ghironi and Melitz (2005). Rather than merely conducting a comparative-static analysis, this dynamic approach allows us to look at the medium-term adjustment path. The structure of the model is shown graphically in Figure 1. It consists of three countries or regions, namely the US, China, and the Rest of the World (RW), and five industrial sectors. The latter represent cutting-edge semiconductor manufacturing, lower-grade semiconductor manufacturing, other intermediate manufacturing goods, low-tech final good manufacturing, and high-tech final good manufacturing. Final and intermediate goods firms are monopolistically competitive and heterogeneous in terms of productivity. This introduces asymmetries between firms and leads to trade-driven reallocations and selection: it shifts employment towards firms with the best attributes and forces marginal firms to exit. Only the most productive firms find it profitable to export. Conversely, all monopolistically competitive semiconductor firms are equally productive, but heterogeneous with respect to the substitutability of their products. We thus distinguish between lower-grade semiconductors which are readily easy to substitute and cutting-edge semiconductors that are difficult to substitute. Due to equal productivity, all semiconductor firms would export in the absence of policy restrictions on exports. We simulate the effects of an export ban to China of a certain percentage of semiconductor varieties enacted by the US and possibly its allies. And we compare it to the effects of an export tariff on semiconductors.

Figure 1: Schematic drawing of the model structure

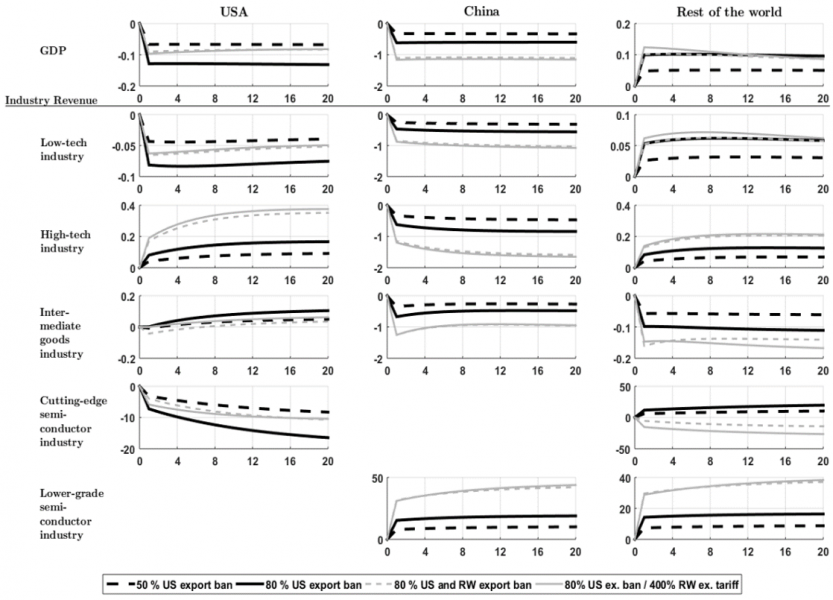

Figure 1 shows the impulse responses of the targeted export restrictions on GDP and total revenue on the different model industries. Thereby, quarters are drawn on the horizontal axis. The four cases considered here include (i) an unilateral export restriction that lead to a ban of 50 % of US semiconductor products exported to China (black dashed line), (ii) an unilateral export ban of 80 % of US semiconductor products exported to China (black solid line), (iii) an internationally coordinated export ban of 80 % of US and RW cutting-edge semiconductor varieties exported to China (gray dotted line), and (iv) an internationally coordinated US export ban of 80 % of US semiconductor varieties combined with an 400 % export trade tariff on RW semiconductors (gray solid line). This combined approach arises because of the export tariff prohibitions in the US Constitution. For a given import budget, an export tariff of 400 % implies an import decline of 80 %.

Unsurprisingly, Chinese GDP falls in all cases, with the effect being greatest in the case of internationally coordinated semiconductor trade restrictions. If the US and RW countries introduce trade restrictions on 80% of cutting-edge semiconductor varieties, Chinese GDP falls by almost 1.1% in the year after introduction. If only the US were to introduce trade restrictions on 80% (50%) of semiconductor varieties, Chinese GDP falls by just over 0.6% (0.3%). The alternative export restraint assumptions bound the uncertainty about the actual enforcement of the export restrictions described above.

Figure 2: The impact of cutting-edge semiconductor export bans and tariffs on GDP and total sectoral industry revenue

Notes: Shown are the percentage deviations of the variables from their initial steady state, with the variables denominated in domestic currency.

Moreover, both policy measures also have a counteracting labor demand effect lowering prices of producers affected by the protectionist policy measure, which lead to different sector specific impacts. The cheaper availability of US semiconductors leads to a revenue increase in the American final goods producing high-tech industry, while the Chinese high-tech industry shrinks due to the limited access to semiconductors. Among the losers is also the American semiconductor industry. Production volumes fall over time due to the lower number of semiconductor varieties produced in the US. This is shown by the fact that total revenue of the semiconductor industry falls by about the same amount as its average prices immediately after the introduction of the export bans (see our paper for detailed results regarding average prices). Fewer cutting-edge semiconductor varieties are produced in the US, while cutting-edge semiconductor production in the rest of the world increases (if only US semiconductors are affected by the protectionist policy). The revenues of Chinese lower-grade semiconductor producers rise.

However, there are also impact channels in which the two policy measures differ fundamentally. Only the export restrictions lead to a negative variety effect on the import price for buyers. This variety effect is the additional negative impact of the lower number of varieties available on the Chinese market. This is larger the more difficult it is to substitute individual cutting-edge semiconductor varieties. Only export tariffs, on the other hand, lead to positive (negative) income effects for the country imposing the tariff (destination country) due to tariff revenues. According to our simulation, the negative variety effect and the negative income effect for China roughly balance out, so the GDP loss is about the same whether RW imposes a tariff or an export ban on cutting-edge semiconductors.

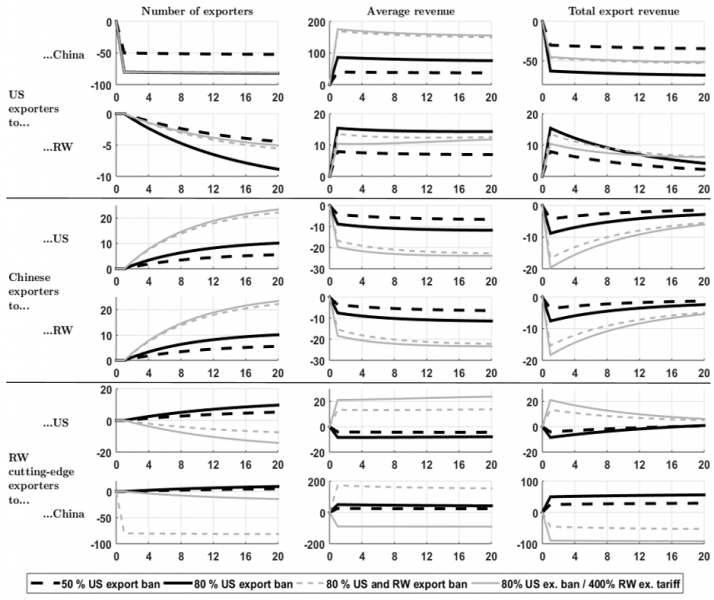

Figure 3: The impact of cutting-edge semiconductor export bans and tariffs on the number of semiconductor exporters and their average revenue

Notes: Shown are the percentage deviations of the variables from their initial steady state, with the revenues denominated in domestic currency.

Figure 2 explores the adjustment processes from a different viewpoint by looking at the intensive margin (average revenue) and the extensive margin (number of exporters and thus the number of varieties exported). The first two rows illustrate the loss of competition in the US cutting-edge semiconductor industry, where the number of exporting businesses is declining, as is the number of varieties. This also applies to their revenues, although rising prices have a stabilizing impact. The third and fourth rows describe the evolution of the Chinese lower-grade semiconductor industry. This industry benefits from a partial substitution towards lower-grade semiconductors. The number of corresponding exporters and varieties increases, while average revenues and thus total export revenues decrease. The last two rows describe the adjustment dynamics in the RW countries. If the US only imposes a unilateral export ban (black lines), cutting-edge trade diversion occurs. In the case of a coordinated export ban (gray dashed lines), semiconductor profits decrease and thus the number of semiconductor firms or varieties in the rest of the world also shrink. Finally, the last two rows allow a direct comparison of an export tariff and an export ban. The export tariff has an indirectly operating effect on the number of exporters as it becomes less lucrative to produce domestically. This reduces the number of domestic semiconductor varieties (or firms) over time. At the same time, the export tariff directly causes a sharp decline on the average revenues of exporters, i.e. the intensive margin of exports. Since the tariff is applied on all semiconductors in a specific country, there is only substitution between countries and no substitution within a country of origin and since the number of exporters is also constant, this effect only takes place at the intensive margin. Thus, if RW levies an import tariff, all RW semiconductor varieties stay available on the Chinese market.

In the case of export restrictions, the opposite is true. They have a direct effect on the extensive margin and an indirect opposite effect on the intensive margin. The affected varieties may no longer be exported, but the average sales revenue of the remaining, unaffected exporters increases strongly. Thus, export restrictions also lead to intensive margin substitution effects, but their direction depends on the assumed elasticities. Either an intensive margin trade diversion effect to other countries or a substitution effect to the varieties not affected by the export restriction can prevail. However, an unambiguous effect of export restrictions is the extensive margin reduction of producer revenues. This simply means that, all else equal, banning exports of a given percentage of varieties leads to a direct reduction in industry revenue by the same percentage.

In the paper by Funke and Adrian (2022), these baseline results are complemented and augmented by various further model evaluations and extensive robustness tests.

Chaney, T. (2008). “Distorted Gravity: The Intensive and Extensive Margins of International Trade,” American Economic Review, 98 (4), 1707-21.

Funke, M. and A. Wende (2022). „Modeling Semiconductor Export Restrictions and the US-China Trade Conflict,” Bank of Finland, BOFIT Discussion Paper No. 13/2022, https://publications.bof.fi/handle/10024/52282.

Ghironi, F., and M.J. Melitz (2005). “International Trade and Macroeconomic Dynamics with Heterogeneous Firms,” Quarterly Journal of Economics, 120, 865–915.

Melitz, M.J. (2003). “The Impact of Trade on Intra‐Industry Reallocations and Aggregate Industry Productivity,” Econometrica, 71, 1695-1725.

Sutter, K.M., and C.A. Casey (2022). “U.S. Export Controls and China,” Congressional Research Service, Washington DC