This policy brief is based on “Mapping the space of central bankers’ ideas,” BIS Working Paper, No 1299/2025. This paper does not necessarily represent the views of the Bank for International Settlements.

Abstract

Central banks increasingly rely on communication as a policy tool, yet systematic analysis of global communication patterns remains limited. This brief presents a novel approach using artificial intelligence to analyse central bank speeches on scale. By imposing a mathematical structure on unstructured text data, we quantify 20,000 speeches for over 100 central banks and visualise them, revealing distinct regional communication patterns, institutional signatures and the evolution of policy discourse.

“Monetary policy is 98 per cent talk and 2 per cent action,” former Federal Reserve (Fed) Chair Ben Bernanke once quipped (Bernanke, 2015). This insight captures a fundamental reality of modern central banking: what policymakers say shapes market expectations and economic outcomes. Researchers have been increasingly turning to natural language processing to analyse central bank communications (eg Hartmann and Smets (2018)). Recent breakthroughs in large language models (LLMs) now open unprecedented opportunities to analyse central bank discourse at a global scale with greater nuance and depth.

This brief introduces a novel approach using artificial intelligence (AI) to map “the space of central bankers’ ideas.” By analysing 19,742 speeches from nearly 1,000 officials across more than 100 central banks since 1997, we reveal patterns invisible to traditional analysis. Our methodology leverages recent advances in LLMs and contextual embeddings to transform speeches into quantifiable data, enabling us to track how economic ideas evolve and spread globally.

Traditional analysis of central bank communication relied on manual coding, simple word counts or dictionary-based sentiment analysis. These approaches miss nuance and struggle with evolving policy vocabulary. Our approach uses context-aware AI techniques:

The central bank speeches can be explored through these dashboards.

Our analysis reveals that central bank speeches cluster primarily by geography and institution. The European Central Bank (ECB) and Fed each form multiple distinct, but connected clusters, reflecting their extensive communication strategies and diverse mandates. Emerging-market central banks concentrate in a single region of the semantic space, indicating shared policy priorities and communication patterns among central banks operating in similar economic contexts.

This regional clustering has two interpretations. On one hand, central banks globally may discuss similar themes due to comparable objectives and mandates, with regional identifiers serving primarily as distinctive labels. On the other hand, despite increasing international coordination, communication patterns remain significantly influenced by regional economic conditions and institutional contexts. Our evidence suggests both forces are at work: whilst core central banking topics appear universally, their treatment differs markedly across regions.

A closer examination of the topic representation within each cluster reveals that regional clustering reflects genuine differences in policy priorities shaped by distinct economic contexts. For example, the ECB’s communications emphasise fiscal policy, structural reforms and eurozone integration, themes reflecting its unique supranational mandate. The Bank of Japan’s discourse concentrates heavily on quantitative easing and deflation management, mirroring Japan’s prolonged battle with low inflation. Central banks in smaller open economies, such as Denmark and Switzerland, show a heightened focus on exchange rate stability.

Amid regional clustering, specific topics occupy a central position in the communication landscape: banking regulation, global economic conditions and financial stability. This centrality likely reflects their role as convergence points for international cooperation, particularly following the 2008 financial crisis and subsequent regulatory harmonisation efforts.

New policy concerns form distinct clusters at the periphery of the semantic space. Climate change represents the most prominent example, emerging as a separate cluster as climate-related financial risks gained prominence in central bank agendas. Similarly, benchmark reforms (eg, LIBOR transition, FX Global Code) and payment systems occupy distinct regions.

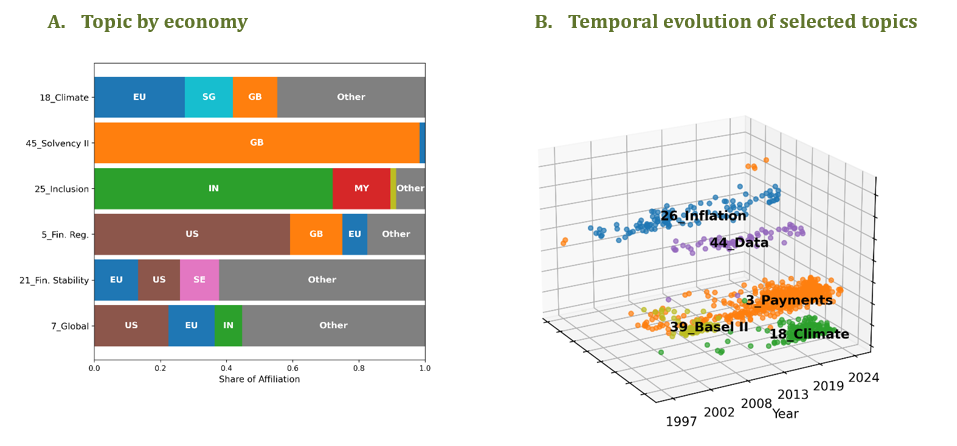

Analysis of who discusses which topics reveals distinctive institutional patterns. As expected, the largest central banks —the Fed and the ECB —account for the majority of speeches on globally relevant themes such as financial stability and the global economy. However, institution-specific mandates shape communication priorities in revealing ways.

In financial regulation, central banks with large financial sectors —such as the Fed and the Bank of England (BoE)—feature prominently. Interestingly, the BoE delivers disproportionately more speeches on Solvency II (EU insurance regulation) than the ECB, reflecting institutional differences: the BoE directly supervises insurance firms, while the ECB does not. Emerging themes show similar institutional specialisation: financial inclusion discussions concentrate among the Reserve Bank of India and Bank Negara Malaysia, reflecting their explicit developmental mandates.

Incorporating time as a third dimension reveals how central bank discourse responds to evolving policy challenges. Some topics, such as inflation expectations, appear consistently across our sample, underscoring their enduring centrality to central banking. Others show pronounced temporal patterns:

More interesting are topics that maintain a consistent presence but undergo substantive evolution in content. Payment systems discussions exemplify this pattern, appearing consistently throughout our sample but showing dramatic shifts in content—from traditional infrastructure to digital innovation—demonstrating how central banks continuously reinterpret conventional responsibility domains in response to technological and market developments.

This methodology offers central banks and policymakers several practical applications:

Our approach offers several advantages over traditional text analysis: it captures contextual nuance that dictionary methods miss; it accommodates evolving vocabulary without manual updating; it reveals patterns across multiple dimensions simultaneously; and it scales efficiently to large datasets spanning various institutions and decades.

However, essential limitations deserve mention. The two-dimensional visualisations necessarily compress information from much higher-dimensional spaces, potentially obscuring some relationships. Topic boundaries may appear blurred in visualisations even when clearly separated in the whole embedding space. The methodology identifies patterns but cannot determine causality. Additionally, our analysis focuses on English-language speeches, potentially underrepresenting communication in other languages or through alternative channels.

By applying AI to central bank communications, we have created a comprehensive quantitative map of global monetary policy discourse—the “space of central bankers’ ideas.” As central bank communication continues to evolve as a critical policy instrument, quantitative methods like these will become increasingly valuable for understanding and evaluating monetary policy discourse. The framework presented here provides both researchers and practitioners with powerful new tools for navigating the complex landscape of central bank communication. As large language models continue advancing, such AI-assisted analysis will become a standard tool for monitoring and understanding policy communication worldwide.

Bernanke, B. S. (2015): “Inaugurating a new blog,” Ben Bernanke’s Blog, March 30.

Hartmann, P and F Smets (2018): “The European Central Bank’s Monetary Policy during Its First 20 Years”, Brookings Papers on Economic Activity, 2018(2).