The views expressed in this brief are the sole responsibility of the authors and do not necessarily reflect the views of the Federal Reserve Bank of San Francisco or the Federal Reserve System. Schularick acknowledges funding by the European Research Council (ERC-2017-CÒG 772332) and wishes to thank, without implicating, Nina Boyarchenko, Anna Kovner, Giovanni Favara and Andrea Tambalotti. Support by the Deutsche Forschungsgemeinschaft (DFG, German Research Foundation) under Germany’s Excellence Strategy – EXC 2126/1 – 390838866 is gratefully acknowledged. Grimm gratefully acknowledges support from the Deutsche Forschungsgemeinschaft – AÒBJ:664086.

Do periods of persistently loose monetary policy increase financial fragility and the likelihood of a financial crisis? This is a central question for policymakers, yet the literature does not provide systematic empirical evidence about this link at the aggregate level. We fill this gap by analyzing long-run historical data. This policy brief shows that when the stance of monetary policy is accommodative over an extended period, the likelihood of financial turmoil down the line increases considerably. We will investigate the causal pathways that lead to this result and argue that credit creation and asset price overheating are important intermediating channels.

Does persistently loose monetary policy breed financial fragility? And if so, why? Scholars and policymakers alike blamed loose monetary policy for the boom-bust that culminated in the Global Financial Crisis (Geithner, 2009; Taylor, 2011) and warned again in its aftermath “that a long period of low interest rates…could undermine financial stability” (Bernanke, 2013; Stein, 2013). However, there is no systematic empirical study that analyzes the link between the stance of monetary policy and macro-level financial stability (Boyarchenko et al., 2022). Our study fills this gap in the literature using macro-financial data for 18 advanced economies over the past 150 years (Grimm et al., 2023). This policy brief shows that, as a causal matter, a loose stance increases the risk of medium-term financial instability and of overheated credit and housing markets.

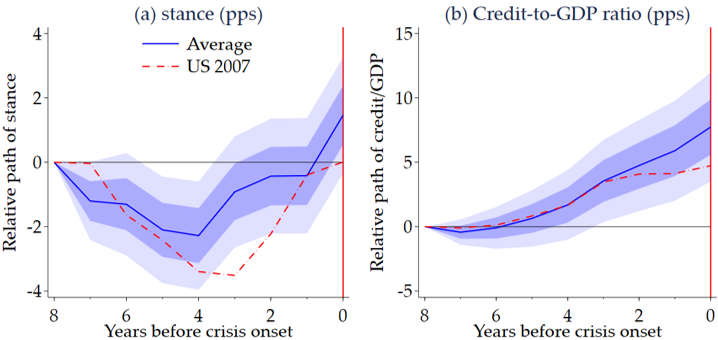

Figure 1: The stance of monetary policy and credit growth before financial crises

Notes: The blue lines show the paths of the stance and the credit-to-GDP ratio before the onset of financial crises relative to normal times. Shaded areas indicate 95% (light) and 68% (dark) confidence intervals. The dashed red line shows demeaned changes in the two variables before the U.S. Great Recession. As for the other figures, the data source is the Macrohistory Database (Jordà et al., 2017).

How do we know if monetary policy is too loose? Ever since Wicksell (1898), macroeconomists have generally understood the equilibrium or natural real rate to be that which leaves a fully flexible economy at full employment with stable inflation. Thus, as in the literature on policy rules, deviations of the real policy rate from the natural rate are a measure of monetary policy stance, or stance = r – r*. A loose monetary policy is when stance < 0.

Using an event study approach we can show preliminary evidence to motivate our work. Panel (a) of figure 1 shows the path of stance as defined above before financial crises vis-à-vis normal times. The stance measure falls in the medium term and rises again in the immediate years before crisis events. For example, stance is on average 3.5 percentage points (pps) lower 5 years before a crisis compared to at the time of the crisis itself. Panel (b) illustrates the well-established evidence that credit booms are a precursor of financial busts (e.g., Schularick and Taylor, 2012). The dynamics illustrated in this figure form the starting point for our empirical analysis. Panel (a) uncovers a correlation between a loose stance and future financial fragility. Figure 1 as a whole gives rise to the possibility that credit booms, which are highly predictive of crises, are triggered by too accommodative a stance of monetary policy. In the rest of this policy brief, we go beyond these unconditional means.

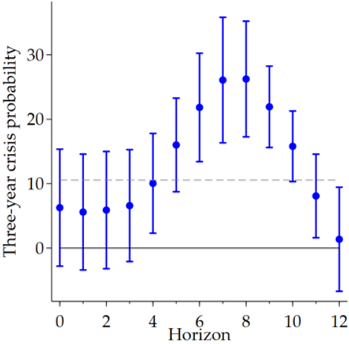

Figure 2: The effect of loose monetary policy on financial crisis risk

Notes: The figure shows estimated coefficients of interest from an LP-IV setting. The binary dependent variable is a crisis indicator that equals 1 if a crisis occurs within a three-year window and 0 else. The independent variable of interest is the (negative) five-year moving-averaged stance. Bars indicate 95% confidence intervals.

Are periods of persistently loose monetary policy more crisis-prone? We are the first to show that being in a low stance environment has strong implications for medium-term financial crisis risk. We do this by exploiting the exogenous variation in policy rates from the trilemma IV, as described in our working paper, and estimating local projections (Jordà, 2005).

Figure 2 presents our main result. It shows the measured three-year crisis probability at different horizons when the stance, averaged over five years, equals -1%. The horizontal dashed line indicates the unconditional three-year crisis probability in our sample which is 10.5%. The estimates are above this dashed line at statistically significant levels in the medium term, that is around horizons of 5 to 10 years. A loose stance of monetary policy implies a higher probability of entering a financial crisis several years ahead, and it does so at economically relevant scales. For instance, the likelihood of entering a financial crisis 5 to 7 years ahead is higher by 5.5 pps when our measure for the stance of monetary policy is looser by 1 pp. As shown in figure 2, this implies a three-year crisis risk of 16% when the stance over the last five years equals -1%. At higher horizons, crisis risk more than doubles from 10.5% to over 20%.

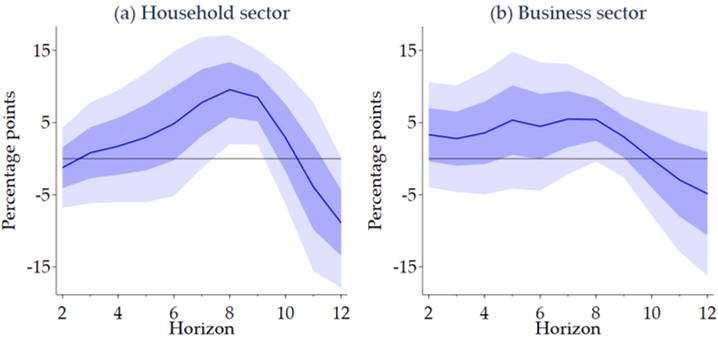

Figure 3: The effect of loose monetary policy on credit market overheating

Notes: The figure shows estimated coefficients of interest from an LP-IV setting. The binary dependent variable denotes household-sector or business sector R-zones as defined in Greenwood et al. (2022). The independent variable of interest is the (negative) five-year moving-averaged stance. Bars indicate 95% confidence intervals.

We now go one step back and ask: how does excessively loose monetary policy trigger financial instability? We find that when interest rates remain below the natural rate for an extended period of time, there is a buildup in asset prices and in credit growth, both of which have been shown to be associated with greater financial fragility (e.g., Schularick and Taylor, 2012; Jordà et al., 2015a,b, 2016; Greenwood et al., 2022).

More precisely, we build on the recent findings of Greenwood et al. (2022). They define Red-zone indicators or R-zones in which both credit and asset price growth—either in the household sector (household credit & real house prices) or in the business sector (business credit & real equity prices)—is elevated from a historical point of view. The authors show that R-zone signals have a high degree of predictability for financial crises that goes far beyond the predictive power inherent in credit growth alone. Is a loose stance of monetary policy a source of such R-zones? Our empirical evidence strongly suggests that the answer to this question is in the affirmative. Our main findings are summarized in figure 3, which shows the measured change in the likelihood of entering an R-zone when the stance of monetary policy is looser by 1 pp.

Recall that when central banks keep the policy rate below the natural rate for an extended period, the likelihood of financial turmoil rises at statistically significant levels starting at a horizon of around five years (figure 2). Figure 3 shows that, at this point, it is likely that the country has already experienced financial fragility by entering an R-zone. A loose stance of monetary policy raises the likelihood of credit market overheating in advanced economies both in the household and in the business sector. When our measure of the stance is looser by 1 pp, the likelihood of entering a household- or business-sector R-zone in five years is higher by 3 and 5.3 pps, respectively.

We provide the first evidence that the stance of monetary policy has implications for the stability of the financial system. A loose stance over an extended period of time leads to increased financial fragility several years down the line. The source of this fragility is associated with swings in those financial variables that have been identified by the literature as harbingers of financial turmoil. Policymakers should take the dangers imposed by keeping policy rates low for long seriously, and thus weigh the potential short-run gains of loose monetary policy against potentially adverse medium-term consequences. Such policies increase the risk of financial crises and thus the risk of high social, political, and economic costs.

Bernanke, Ben S. 2013. The Economic Outlook. Testimony before the Joint Economic Committee, U.S. Congress, Washington, D.C.

Boyarchenko, Nina, Giovanni Favara, and Moritz Schularick. 2022. Financial Stability Considerations for Monetary Policy: Empirical Evidence and Challenges. Federal Reserve Board Finance and Economics Discussion Series 2022-006.

Geithner, Timothy. 2009. Charlie Rose Show on PBS.

Greenwood, Robin, Samuel G. Hanson, Andrei Shleifer, and Jakob Ahm Sørensen. 2022. Predictable Financial Crises. Journal of Finance 77(2): 863–921.

Grimm, Maximilian, Òscar Jordà, Moritz Schularick, and Alan M. Taylor. 2023. Loose Monetary Policy and Financial Instability. NBER Working Paper Series No. 30958.

Jordà, Òscar. 2005. Estimation and Inference of Impulse Responses by Local Projections. American Economic Review 95(1): 161–182.

Jordà, Òscar, Moritz Schularick, and Alan M. Taylor. 2015a. Betting the house. 37th Annual NBER International Seminar on Macroeconomics 96: S2–S18.

Jordà, Òscar, Moritz Schularick, and Alan M. Taylor. 2015b. Leveraged bubbles. Journal of Monetary Economics 76: S1–S20.

Jordà, Òscar, Moritz Schularick, and Alan M. Taylor. 2016. The great mortgaging: housing finance, crises and business cycles. Economic Policy 31(85): 107–152.

Jordà, Òscar, Moritz Schularick, and Alan M. Taylor. 2017. Macrofinancial History and the New Business Cycle Facts. NBER Macroeconomics Annual 2016 31: 213–263.

Schularick, Moritz, and Alan M. Taylor. 2012. Credit Booms Gone Bust: Monetary Policy, Leverage Cycles, and Financial Crises, 1870–2008. American Economic Review 102(2): 1029–1061.

Stein, Jeremy C. 2013. Overheating in Credit Markets: Origins, Measurement, and Policy Responses. Speech at the “Restoring Household Financial Stability after the Great Recession: Why Household Balance Sheets Matter” research symposium sponsored by the Federal Reserve Bank of St. Louis, St. Louis, Missouri.

Taylor, John B. 2011. Macroeconomic Lessons from the Great Deviation. NBER Macroeconomics Annual 25: 387–395.

Wicksell, Knut. 1898. Geldzins und Güterpreise. Eine Studie über die den Tauschwert des Geldes bestimmenden Ursachen. Jena: Verlag von Gustav Fischer.