This policy brief is based on ECB Working Paper Series, No 3506. The opinions expressed in this article are those of the author and do not necessarily coincide with those of the ECB, the Banco de Portugal or the Eurosystem.

Abstract

To what extent the significant liquidity injections by the ECB over the past 15 years may have created a dependency by banks on central bank liquidity itself? This study follows Acharya et al. (2024) examining whether the ECB’s liquidity provision changed banks’ incentives to increase liquid deposits, potentially heightening their susceptibility to liquidity shocks. Using both aggregate and bank-level data, I find that euro area banks tend to increase demand deposits and decrease time deposits with their holdings of excess reserves over the liquidity expansion phase and do not revert when aggregate liquidity starts to shrink. However, this is contained to specific periods, when interest rates were low and stable. The differences relative to the US could be related to distinct sources of liquidity and regulatory frameworks governing liquidity.

Over the past decade and a half, the ECB, similarly to other major central banks, has conducted substantial liquidity injections via asset purchases and refinancing operations, particularly in response to the successive economic crisis. With the reduction of the central banks’ balance sheet, a key question emerges: Have these injections altered banks’ behaviour in ways that increase their reliance on central bank reserves? The mechanism behind this change relates to banks’ preference for short-term demandable debt when funding the reserves issued by the central bank. When faced with a liquidity shock, banks hoard reserves (because of speculation, regulation or the convenience yield of reserves) and the “effective” reserves available are not enough to cover the shock, despite the ample aggregate liquidity. The demand for reserves increases and the central bank needs to step in to limit the propagation of the shock, creating then the liquidity dependencies (Acharya and Rajan, 2024).

Drawing from the work by Acharya et al. (2024) for the U.S., Soares (2025) contributes to this research question by analysing whether euro area banks increased their exposure to more liquid deposits, especially relatively to time deposits, in response to rising central bank reserves.

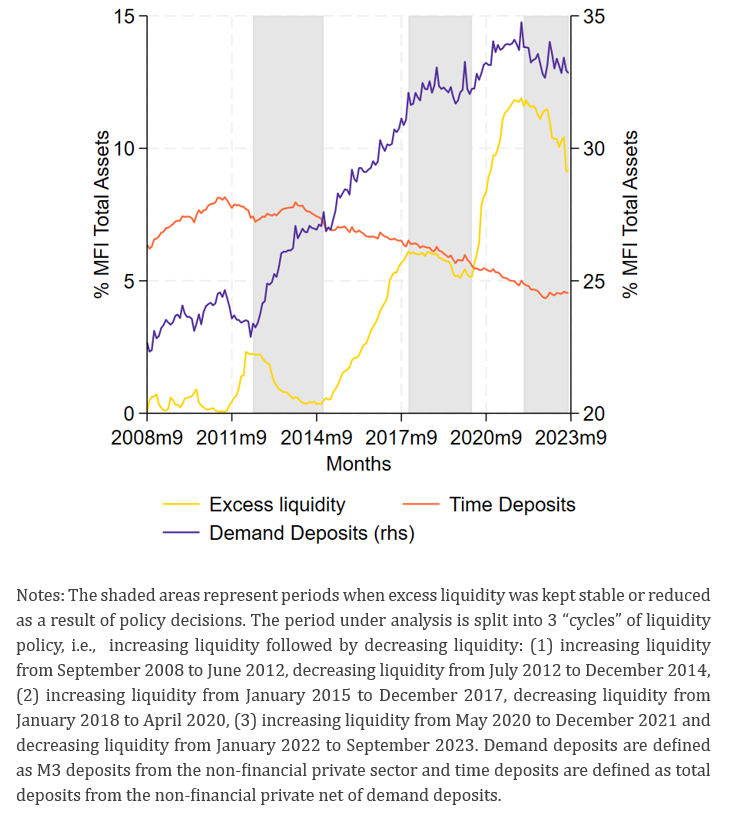

Figure 1 shows that the increase in Eurosystem excess liquidity was mirrored by a strong rise in deposits from the non-financial private sector. This relationship was especially pronounced during the 2015–2017 Asset Purchase Programme (APP) period. Part of the increase in deposits reflected the balance sheet identity. However, the increase seems confined to demand deposits and no clear reversal was observed when excess liquidity decreases.

A time series regression analysis confirms the positive correlation between deposits and excess liquidity. A 10% rise in excess liquidity was associated with approximately a 0.1% increase in demand deposits, while there was no correlation with time deposits. The relationship weakens when I include the slope of the yield curve to capture for the relative demand for short-term deposits. The estimated elasticity is notably lower than that found in comparable U.S. studies and, more importantly, there is no evidence of a shift from time to demand deposits (Acharya et al., 2024).

Figure 1. Euro area excess liquidity and deposits as a percentage of banks’ total assets

To isolate causality between reserves and deposits, I follow a methodology that explores the heterogeneity across banks in the euro area. While in the aggregate excess liquidity is a decision of the central bank, at the bank level reserves and deposits are decided simultaneously by the bank. The endogeneity problem is overcome with an instrumental variable approach that accounts for exogenous shifts in reserves due to aggregate liquidity changes, assuming banks maintain their historical shares of total liquidity (Acharya et al., 2024; Goldsmith-Pinkham et al., 2020).

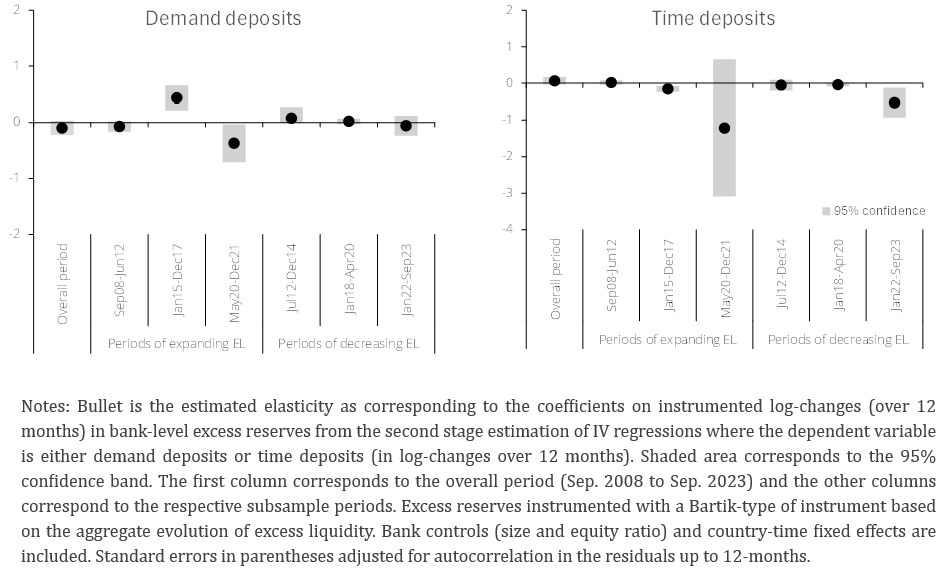

While for the overall sample period exogenous changes in reserves had no statistically significant effect on banks’ supply of demand deposits or time deposits, the effect differs between periods of expanding or contracting excess liquidity (Figure 2). During the APP-led liquidity expansion period (2015–2017), a 10% exogenous increase in non-borrowed reserves (from asset purchases) resulted in a 4.3% increase in demand deposits and a 1.6% decline in time deposits—signalling a deliberate shift in the liability structure of the banks. When excess liquidity fell, banks did not react in symmetry and kept the greater exposure to more liquid deposits. No similar effect was found during the other cycles of liquidity policy, indicating that liquidity dependencies may be period- and context-specific.

Figure 2. Estimated “elasticities” of deposits to excess reserves

There are two main characteristics from the APP period that could help explaining the results: it was a prolonged period of negative policy interest rates and liquidity expansion was driven almost exclusively by asset purchases. In order to understand better the effect of the liquidity source, excess reserves are split between borrowed and non-borrowed reserves, where borrowed reserves come mostly from temporary operations and non-borrowed from outright asset purchases (Altavilla et al., 2023). Results suggest an interaction between the two types of reserves: demand deposits increase seemed to be due to the expansion in non-borrowed reserves while borrowed reserves induced the fall in time deposits. Banks expanded demand deposits as they had a “permanent” source of liquidity, but only did so at the expense of time deposits with the insurance of liquidity from refinancing operations.

Assessing the effects by type of banks shows that more constrained or more prone to risk-taking banks may be driving observed liquidity dependencies. The expansion in demand deposits came mostly from banks less reliant on deposit funding, with lower equity ratios, smaller and that did not participate in TLTRO.

If banks would really change their supply of deposits in tandem with their excess reserves, one could also expect an effect on the pricing of deposits. Banks could increase the interest rate in demand deposits relative to time deposits in order to attract relatively more demand deposits or even to incentivize the shift from time to demand deposits. The IV regression analysis is then extended to the spread between interest rates on new deposits with agreed maturity over two years (the proxy for time deposits) and the interest rate on overnight deposits, i.e., the most liquid type of deposits that banks can offer. Banks tended to decrease the interest rates on time deposits relative to overnight deposits, which would be consistent with banks trying to attract more demand deposits with increases in excess reserves. However, this effect is only statistically significant for the period of 2020-21, after the APP.

The Eurosystem liquidity injections have shaped euro area banks’ deposit behaviour, with evidence in favour of the build-up of liquidity dependencies in the euro area banking system. However, this seems to be limited in time, when the ECB expanded liquidity via the APP. Liquidity dependencies may then be only relevant when the ECB injects liquidity “permanently” and/or when interest rates are low and stable for a prolonged period. Moreover, liquidity dependencies appear more muted than in the U.S., likely due to differences in liquidity provision methods, regulatory frameworks, and market structure. Nonetheless, understanding how central bank actions influence bank incentives remains crucial for both monetary policy effectiveness and financial stability.

The findings have several policy implications. In the short term, it is relevant for the Eurosystem to better understand the demand for reserves, as the balance sheet continues to reduce. In the medium term, if banks’ preferences for liquidity may have indeed increased relative to the past when aggregate liquidity was balanced, this may pose greater risks to the banking sector when faced with liquidity shocks. The market stress in the U.S. in 2019 is one example of such vulnerabilities. In the long-term, central banks may need to take into account the side effects of balance sheet policies discussed in the paper when designing these policies in the future in case of need.

Acharya, V. V., Chauhan, R. S., Rajan, R. G., and Steffen, S. (2024). Liquidity dependence and the waxing and waning of central bank balance sheets. Working paper.

Acharya, V. V. and Rajan, R. (2024). Liquidity, liquidity everywhere, not a drop to use: Why flooding banks with central bank reserves may not expand liquidity. The Journal of Finance, 79(5):2943–2991.

Altavilla, C., Rostagno, M., and Schumacher, J. (2023). Anchoring QT: Liquidity, credit and monetary policy implementation. CEPR Discussion Papers 18581, C.E.P.R. Discussion Papers.

Goldsmith-Pinkham, P., Sorkin, I., and Swift, H. (2020). Bartik instruments: What, when, why, and how. American Economic Review, 110(8):2586–2624.

Soares, C. (2025). Liquidity dependencies in the euro area. ECB Working paper nº 3056.