This policy brief summarizes the main findings of the research described in D’Orazio, Hertel, Kasbrink, 2022. The study focuses on the German banking sector and estimates its exposure to climate risks from transitioning to a carbon-neutral economy. The analysis identifies the energy, transportation, and manufacturing sectors as the most sensitive to transition risks and shows that the German banking sector’s direct exposure to climate transition risks is non-negligible. Moreover, it identifies an amplified exposure to transition risks for large private banks. These findings are comparable to other countries’ exposures and relevant to financial supervision and regulation, calling for increased engagement to assess, measure, and manage climate-related financial risks.

It is now widely acknowledged that climate-related financial risks can be understood through traditional risk categories, namely credit, liquidity, market, operational, and reputational risk (NGFS 2019; BCBS 2021). The existing literature focuses on the impacts of climate risk drivers on credit risk, with quantification efforts mainly aimed at addressing risks to corporate lending and real estate.

In the case of transition risk, methods usually entail mapping its drivers into specific counterparty and portfolio exposures to assess credit risk. Existing literature has focused on capturing the carbon intensity of portfolio-specific and sectoral exposures, providing internal climate risk ratings or scores, estimating the effects of more stringent climate regulation, or considering how to improve conventional risk management tools (see for a discussion Svartzman et al. 2020; D’Orazio 2021). Supervisors can then use the results for microprudential supervision and apply macroprudential policies (D’Orazio and Popoyan 2019; D’Orazio 2021).

While there are few experiences in assessing the exposure of the financial sector to climate risks at the country or EU level (see, e.g., Vermeulen et al. 2019; Battiston et al. 2020; Faiella and Lavecchia 2020; Roncoroni et al. 2021), the German case has been hardly studied yet. The study conducted by D’Orazio, Hertel, Kasbrink, 2022 aims to fill this gap by evaluating the carbon intensity of financial assets of the country’s banking sector, thus quantifying transition risks, and estimating the banking sector’s vulnerability to the transition to a low-carbon economy. Considering the structure of the German banking system, we pay specific attention to the different banking and size groups.

The study described in D’Orazio, Hertel, Kasbrink, 2022 offers a quantification of the exposure of the German banking sector to transition risks. It relies on the approaches developed by Battiston et al. (2017) and Faiella and Lavecchia (2020), namely the Climate-Policy Relevant Sectors (CPRS), the Loan Carbon Intensity (LCI) and the Carbon-Critical Sectors (CCrS); to clarify the direct exposure of German banks to climate-vulnerable assets. The empirical analyses rely on sectoral and aggregate data covering the corporate lending of German banks and GHG emissions data and shows that the exposure of the German banking sector to climate transition risks is non-negligible.

The bank data was obtained during multiple research visits at the Bundesbank (Project-Number: 2021/0016) and is based on the following datasets: Monthly Balance Sheet Statistics (BISTA, see Gomolka, Schaefer, and Stahl 2022), Quarterly Borrowers Statistics (QBS, see Krodel, Krueger, and Schaefer 2022), Selected Master Data for MFIs (MaMFI, see Stahl 2022). For further information see the data disclosure statement.

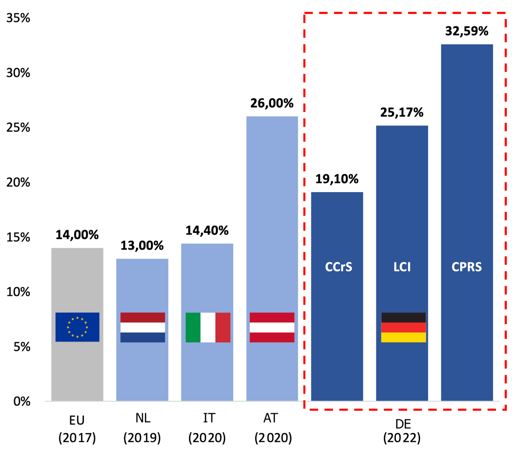

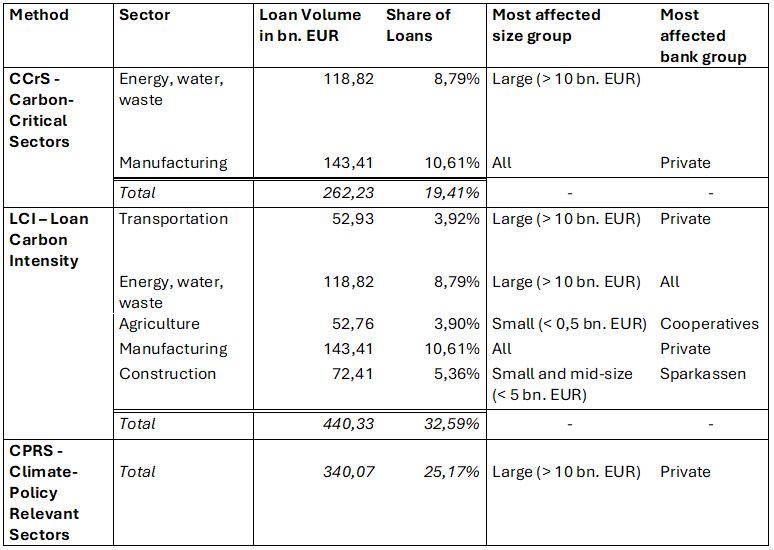

Depending on the estimation method used, the study identifies 19.41% (CCrS), 32.56% (LCI), and 25.17% (CRPS) of the total loan volume to be significantly exposed to transition risks, as summarized in Table 1 and Figure 1. In addition, certain banks face an amplified risk from a possible transformation in climate policies, technological change, or preference shocks because of the concentration of risks in certain sectors.

Figure 1: Transition risks’ exposure of the banking sector in Germany and selected EU countries

Note: Estimates depend on the methods used. Year of publication of the corresponding studies in brackets.

Sources: Battiston et al. (2017), Vermeulen et al. (2019), Battiston et al. (2020), Faiella and Lavecchia (2020), D’Orazio, Hertel, Kasbrink (2022).

The analysis indicates that a higher share of big private banks’ portfolios tends to be exposed to CCrS. In particular, when relying on the CCrS method, we find that 8.79% of all credit exposures refer to the sector Energy, water, and waste; while large banks are most exposed (10.4% of their exposure). Loans given to the Manufacturing sector account for 10.61% of the overall exposures, with private banks presenting the most exposed bank group (10.9% of their exposure). Resorting to the LCI method, we find that the sector that accounts for the highest exposure is Energy, water, and waste (120), followed by Transportation (160). Large and private banks are again the most affected size (bank) groups. We observe the same pattern of pronounced exposure for large and private banks when applying the CPRS method. Based on this approach, 25.17% of all credit exposures are likely to be highly affected by transition risks.

The analysis highlights that the Energy, Transportation, and Manufacturing sectors are particularly exposed to transition risks. Thus, sustainable policy measures such as renewable energy policies, coal and gas exit strategies, and the electrification of the transportation sector could have significant implications for the financial sector in Germany. If these measures are introduced too late or without coordination across countries (thus leading to carbon leakage), financial investors cannot fully anticipate their impact, which could significantly affect financial stability in Germany.

Because the country’s emissions targets are far from being met and still are not aligned with the 1.5° target, decisive policy efforts are needed for Germany to undertake a low-carbon transition and achieve net-zero emissions. Indeed, climate change and the transformation to a carbon-neutral economy currently dominate German political debate and agenda, and several actions are already in progress. Our investigation identifies non-negligible financial stability risk for the low-carbon transition of the German economy, especially in the case of a disorderly transition.

Table 1: Quantification of transition risks of the German banking system according to alternative methods

Source: Research Data and Service Centre (RDSC) Deutsche Bundesbank, datasets: BISTA, MaMFI, QBS, data period: 01.01.2008-31.12.2018, own elaborations.

Recognizing the potential impact of climate risks on the stability of the German banking sector, we aimed to study its exposure to climate-related transition risks and identify its vulnerabilities in the case of a low-carbon transition, as this analysis is currently lacking in the existing literature. Our study represents the first contribution to assess the exposure of the banking sector to transition risks considering the German case and provides a quantification of both the aggregate and sectoral exposures. Regarding the former, although using different evaluation methods does not allow for a conclusive comparison, our findings identify moderate but non-negligible exposure aligning with other countries’ experiences. Regarding the latter, the highest exposures are recorded for the Energy, Manufacturing, and Transportation sectors. Moreover, the study highlights that some banks – especially the largest ones – will face a heightened risk in the case of a disorderly low-carbon transition.

Our findings could be integrated into broader macro stress test exercises to understand the effects of climate and/or green fiscal policies, changes in economic agents’ preferences, and technological changes on the financial system’s resilience. The results of this exercise could then be used to activate specific supervisory instruments and adequately calibrate them (D’Orazio and Popoyan 2019). Schober et al. (2021) have recently provided the first contribution in this direction, considering the NGFS (2020) scenarios and focusing on the implementation of a climate policy (i.e., increase of the carbon tax) as a source of transition risk. The results of this exercise are reported in the latest Financial Stability Review, which highlights a moderate effect of transition risks on financial institutions’ portfolios (Deutsche Bundesbank 2021). This result is in line with the findings of our study, although the two analyses rely on different data sources.

Battiston, S., M. Guth, I. Monasterolo, B. Neudorfer, W. Pointner, et al. (2020). Austrian banks’ exposure to climate-related transition risk. Financial Stability Report 40, 31–44.

Battiston, S., A. Mandel, I. Monasterolo, F. Schuetze, and G. Visentin (2017). A climate stress-test of the financial system. Nature Climate Change 7(4), 283–288.

BCBS (2021). Climate-related risk drivers and their transmission channels. Technical report, BCBS – Basel Committee on Banking Supervision – Bank for International Settlements.

Deutsche Bundesbank (2021). Financial Stability Review 2021. Deutsche Bundesbank November 2021.

D’Orazio, P. and L. Popoyan (2019). Fostering green investments and tackling climate-related financial risks: Which role for macroprudential policies? Ecological Economics 160, 25 – 37.

D’Orazio, P., Hertel, T., & Kasbrink, F. (2022). No need to worry? Estimating the exposure of the German banking sector to climate-related transition risks (No. 946). Ruhr Economic Papers.

Faiella, I. and L. Lavecchia (2020). The carbon content of Italian loans. Journal of Sustainable Finance & Investment 12(3), 1–19.

Gomolka, M., M. Schaefer, and H. Stahl (2021). Monthly Balance Sheet Statistics (BISTA). Data Report 2021-10 – Metadata Version BISTA-Doc-v3-0, Deutsche Bundesbank Research Data and Service Centre (RDSC).

NGFS (2019). A call for action – climate change as a source of financial risk, first comprehensive report. Network for Greening the Financial System. Report.

Roncoroni, A., S. Battiston, L. O. Escobar-Farfán, and S. Martinez-Jaramillo (2021). Climate risk and financial stability in the network of banks and investment funds. Journal of Financial Stability 54, 100870.

Schober, D., T. Etzel, A. Falter, I. Frankovic, C. Gross, A. Kablau, P. Lauscher, J. Ohls, L. Strobel, and H. Wilke (2021). Sensitivitätsanalyse klimabezogener Transitionsrisiken des deutschen Finanzsektors. Deutsche Bundesbank Technical Paper, 13/2021.

Stahl, H. (2021). Selected master data for MFIs (MaMFI). Data Report 2021-17 – Metadata version MaMFI-Doc-v5, Deutsche Bundesbank Research Data and Service Centre (RDSC).

Svartzman, R., P. Bolton, M. Despres, L. A. Pereira Da Silva, and F. Samama (2020). Central banks, financial stability, and policy coordination in the age of climate uncertainty: A three-layered analytical and operational framework. Climate Policy 21(4), 1–18.

Vermeulen, R., E. Schets, M. Lohuis, B. Koelbl, D.-J. Jansen, and W. Heeringa (2019). The heat is on: A framework for measuring financial stress under disruptive energy transition scenarios. Ecological Economics 190, 107205.