This policy brief draws on ECB Working Paper Nr. 3005 “Why do we need to strengthen climate adaptations? Scenarios and financial lines of defence”, see also “Euro foreign exchange reference rates”. The authors wish to thank Hans-Martin Füssel, Marguerite O’Connell, Irene Heemskerk, Giuseppe Barillà, Christian Buelens, Jolien Noels, Sophie Lavaud, and Ariana Gilbert-Mongelli for their comments. The views expressed are those of the authors and do not necessarily reflect those of the ECB.

Abstract

Unabated climate change is exacerbating climate-related extreme events generating rising damages and losses. Geophysical estimates are critical to gauge the need for mitigation and adaptation strategies. Mitigation attracts the lion share of climate efforts. Yet growing damages from costly wildfires, storms, floods, droughts, and rising sea level rise are exposing the inadequacy of current adaptation measures. Scientists warn that, due to climate inertias in the geophysical system, additional warming in the coming decades is already locked in. Further warming exacerbates non-linearities. Adapting to compounded and concurrent climate extremes, polycrises and socioeconomic vulnerabilities is complex and could result in rapidly escalating damages and losses. Adaptation measures therefore are rapidly needed to make society more resilient to increasingly severe climate extremes. The economic, social, and environmental benefits of early adaptation are widely established. Yet, current adaptation financing is in a dreadful state. However, mitigation through market-based support for the green energy transition might reduce prospective adaptation needs.

Global observational data indicate that mean surface temperatures are rising, driven by the cumulative accumulation of greenhouse gas emissions. We are close to breaching the objectives set in the 2015 Paris Agreement, to limit global warming to well below 2 °C, and preferably below 1.5 °C, compared with preindustrial levels (1850-1900). Recent data from the Global Carbon Project confirms a worrying trend: carbon emissions from fossil fuels are still increasing globally, albeit at a declining pace. Crucially, this upward trajectory in emissions coincided in 2023 with a near-complete collapse in land-carbon uptake: forests, vegetation, and soils collectively removed almost no CO₂ from the atmosphere. Because terrestrial ecosystems currently absorb roughly a quarter of our annual emissions, their sudden loss of sink capacity not only accelerates atmospheric CO₂ accumulation but also severely undermines our primary natural mitigation pathway. Thus, terrestrial ecosystems are losing their carbon store and uptake capacity, and oceans are also showing signs of instability (Ke et al. (2024)).1

Climate projections consistently show a rise in global temperatures; however, the exact magnitude and variability of future warming will depend on the trajectory of greenhouse-gas emissions. The current trajectory suggests an inevitable progression towards exceeding 1.5°C -2.0°C because yearly flows of GHGs emissions are declining too slowly. Decarbonization policies are not ambitious enough and are underdelivered (Mongelli (2023)).2 Without a substantial acceleration of climate policies, global temperatures could surpass 1.5°C threshold as soon as the early 2030s. Projected climate pathways based on current nationally determined contributions until 2030, and assuming no further increase in climate mitigation strategies thereafter, predict a global warming trajectory of about 3.2 °C by the end of the century, with an uncertainty range spanning between 2.2°C and 3.5 °C (IPCC (2023) and UNEP (2024)).

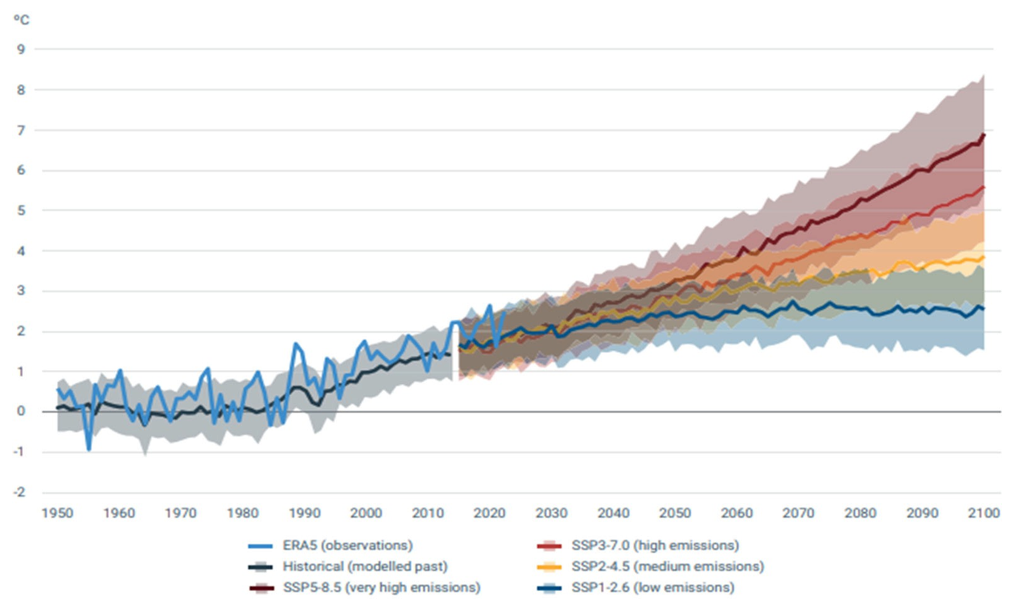

Figure 1. Historical and future European warming trends under different future SSPs

Source: Copernicus Climate Change Service and EEA (2024). Note: the low emission SSP1-2.6 is considered as Paris aligned scenario, while currently we are on a pathway of the high-emission scenario SSP3-7.0.

Europe is warming disproportionately faster than the global average. Under existing policies and GHG emissions trajectories, recent projections suggest that temperatures across Europe could surge by 5 °C and beyond by 2100 (Figure 1).3 The most pronounced temperature increases are anticipated in Eastern and Northern Europe (EEA (2024)). Critically, extreme climate events such as droughts, heatwaves and floods are expected to become more frequent and intense under global warming, with significant impacts on ecosystems, food security, health, infrastructure, and the economy (Feyen et al. (2020)).4

Due to climate inertias in the geophysical system, additional warming in coming decades is already locked in. Climate change inertia is the phenomenon by which a planet’s climate system is slow to deviate away from a given dynamic path (IPCC (2021)).5 Mitigation policies, such as the green transition, impact the net flow of GHGs whereas the climate is steered by the stock of GHGs that take longer to stabilize and reduce. While some additional intensification of extreme events is already locked in by climate-system inertia, rapid and sustained mitigation will still substantially curb the frequency and severity of future climate extremes compared to high-emission scenarios.

Increased warming exacerbates climate hazards resulting in rising damages and losses. Data on past damages and losses attributable to climate-related extreme events is heterogeneous and fragmented. Yet, it points towards an increasing trend in the frequency and intensity of extremes weather events. In the case of low-income countries, according to Newman and Noy (2023), the cost of extreme weather events attributable to climate change already represented about 1% of GDP per year, on average, between 2000 and 2019.6 Worldwide, natural disasters in 2022 and 2023 resulted in losses of around US$ 250bn per year (UNDRR (2024).7

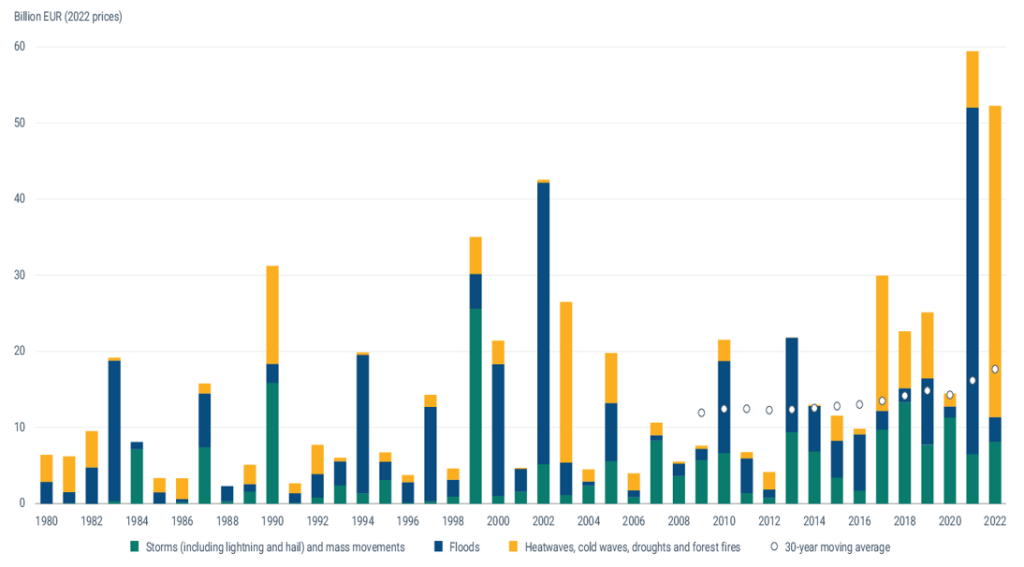

Between 1980 and 2022, climate-related extremes—floods, storms, heatwaves and droughts—caused approximately EUR 650 billion in asset-related economic losses across EU Member States (Figure 2). Although year-to-year losses have fluctuated, there has been a clear upward trend: between 2009 and 2022, annual damages grew by 41 %, an average compounded increase of 2.5 % per year. In 2021 alone, losses reached EUR 59.4 billion, and in 2022 they amounted to EUR 52.3 billion (roughly 0.3 % of EU GDP). These figures exclude a range of non-asset impacts—such as ecosystem degradation, health costs and social disruption—which would push the true cost even higher (UNDRR 2024).8

Figure 2. Annual Economic Losses in EU Caused by Climate-Related Extreme Events

Source: EEA (2023).

Past damages and losses from climate hazards might be considerably underestimated. Bilal and Kaenzig (2024) assemble a novel global dataset of the climate as well as the economy spanning the last 120 years.9 They estimate that the macroeconomic damages from climate change have been six times larger than previously thought. A 1°C increase in global temperature has led to a 12% decline in world GDP and a business-as-usual warming scenario leads to losses equivalent to a present welfare loss of 31%.

One major obstacle in climate-economy research is the scarcity of comprehensive historical data on damages and losses. We face uneven and inadequate data coverage concerning past and current damages and losses considering, amongst others, actual damages, financial needs, financing options, and so forth. On the other hand, we have considerable amount of new granular weather data and projections. Effective adaptation, is specific for countries and regions, requiring coordination between central and economy-wide measures, and local or sector-specific actions. Pooling administrative costs for monitoring climate risks, sharing best practices, and building expertise (World Bank (2024)) will facilitate preparedness and awareness.10

Assessing the state of climate adaptation is also crucial for central banks and financial institutions. Inadequate adaptation increases exposure to climate hazards, disrupting economic activity, price stability, and financial systems. This can heighten inflation volatility, impair monetary policy transmission, and amplify financial risks. Adaptation gaps also affect sovereign credit ratings, the sovereign-bank nexus, and the stability of the financial sector. Tailored, region-specific strategies and risk-sharing mechanisms are essential to mitigate these systemic impacts.

Summing up, data suggest an upward trend in economic damages and losses from extreme climate events, globally and in Europe. Systematically collecting data on climate hazards and natural disasters while simultaneously pursuing “green budgeting” practices is vital. Nevertheless, future damages and losses could rise rapidly, as we discuss next. We argue that adaptation strategies must be both dynamic (continually updated to reflect the latest observations) and responsive (able to scale up or down as risk projections evolve).

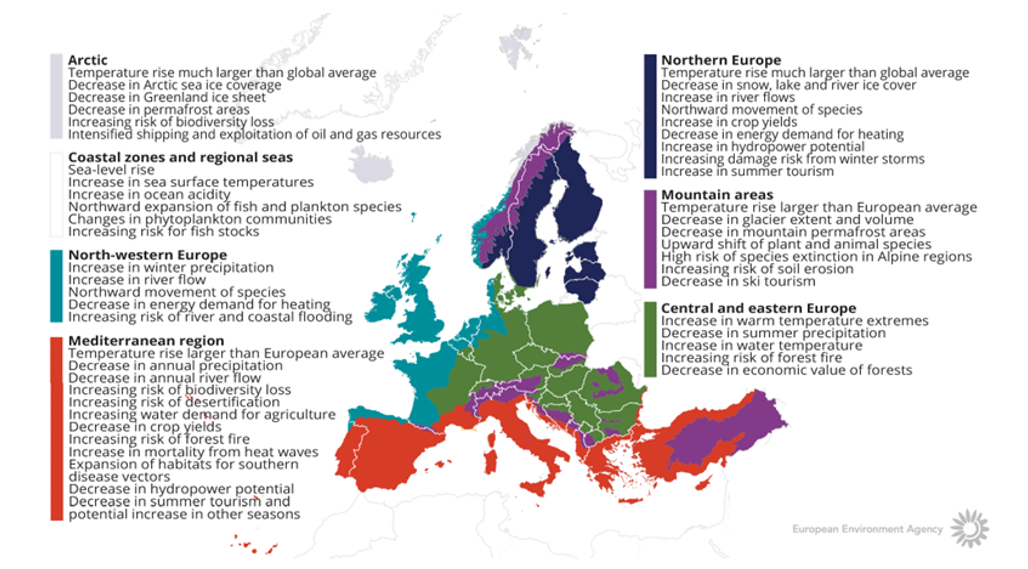

Climate hazards are likely to continue increasing at an even faster pace: the question is, how fast? Europe will likely be faced with more frequent and intense climate events, that stretch preparedness and response capacity and will need to promote structural changes to deal with systemic impacts on all economic sectors (EEA (2024)).11 Such climate change effects might impact macro-regions differently meaning that adaptation must be context-specific, i.e., there is adaptation specificity (Figure 3).

Rising climate hazards disrupt both the supply and demand sides of the economy. On the supply side, climate shocks disrupt output, affect physical capital, and hamper future growth. In addition to negative supply shocks in the decades to come, climate change has the potential to lead to widespread disruption of the economic and financial system and have demand-side implications. Temperature shocks mainly impact consumer demand. The World Bank estimates that the economic impact of major floods, but also earthquakes, might range between 7 to 17 percent of GDP in some European countries (World Bank (2021)).12

Figure 3. Climate change impacts in Europe (EEA (2020))

Financial damages from climate hazards to households, firms, and governments already cause financial distress, and may continue rising at a potentially faster pace. Climate change could severely threaten livelihoods and livability of large regions through extreme events. Bova et al. (2019) analyze contingent liability realizations in 80 advanced and emerging economies for the period 1990–2014 showing that natural disasters, including geophysical events, are one of the most important sources of contingent liabilities, the realization of which can be a substantial source of fiscal distress.13 Government budget are indirectly affected by changes in the tax base and tax revenues. Nascent literature shows the adverse relationship between climate risks and cost of sovereign debt. Using a model of sovereign default, Mallucci (2022) shows that natural disasters reduce governments’ ability to borrow from abroad, depress welfare and, moreover, that climate change will further restrict governments’ access to financial markets.14

Climate hazards pose growing financial and operational risks for companies, impacting revenue, expenses, and long-term strategies. These risks can manifest in various manners including through physical damage to assets, disruptions to supply chains, increased insurance costs, and changes in customer demand, ultimately affecting profitability and market valuation. Inadequate climate adaptation might also expose companies to reputational damages, regulatory penalties, and lower investor confidence (Nuñez Ramos et al. (2024)).15

Adverse financial feedback loops might ensue. Escalating risks may ultimately lead to the breakdown of governance systems, heighten regional tensions, and pose threats to regional and global security, with implications for the financial system (UNEP Adaptation Gap Report (2023)).16 A growing body of research shows that climate-related hazards are increasingly affecting the financial sector. Climate risks could cause the financial system to spiral out of control “just as fast and with even greater impact than the [global] financial crisis” (Bateson et al. (2024)).17

Climate change can non-linearly amplify multiple impacts. Every uptick in global warming is expected to magnify concurrent changes in multiple climatic impact drivers in a non-linear manner (Burke et al (2015)). This might increasingly undermine food, water, energy, and financial security, as well as public health, ultimately eroding social cohesion and stability (EUCRA (2024) and NGFS (2023)). Additionally, rising temperatures are increasing the risk of crossing Earth System tipping points (McKay et al. (2022)), such as the potential collapse of the Atlantic Meridional Overturning Circulation (AMOC).

Compound shocks present rising threats to the economic and financial system. For example, the frequency of compound hazards such as droughts and heatwaves are projected to escalate, including the occurrence of concurrent shocks spanning multiple geographical locations (EEA (2024) and Toreti et al. (2021))).18 Concurrent shocks, deeply interconnected risks, and diminishing resilience can lead to the emergence of polycrises, where multiple crises interact in ways that amplify the overall impact, making it far greater than the sum of its individual parts (NGFS (2023).19 Understanding the effects of non-linearities on the macroeconomy and financial system and managing risks is essential, especially for governments and central banks.

Socio-economic factors play a critical role in assessing the impacts of compound climate extremes on the economy and financial stability. High population density is identified as a significant determinant of regions susceptible to multi-hazards, while the economic dimension-reflecting both the local economic activity and structural complexity of urban and rural areas-emerges as the primary driver of risk status. Therefore, the socioeconomic vulnerability not only contributes to the spatial variability of hazard exposure but also influences the potential economic and financial repercussions of compound climate extremes. Incorporating these socioeconomic dimensions into financial risk assessments is essential for reducing uncertainty and enhancing the effectiveness of risk management strategies.

Summing up, forecasting impacts of rising climate hazards is challenging. A first step is to grasp what world we need to adapt to, as a wide spectrum of climate scenarios and risks exist. These scenarios range from significantly higher damages and losses to extremely severe damages, all the way to catastrophic outcomes by the end of the forecast horizon (EEA (2024)). Due to inertias in the geophysical system, awareness and preparedness are critical. Alongside managing current damages and losses, stakeholders must simultaneously work toward implementing actions to address rising climate risk and damages that are likely to unfold over the coming decades.

We embrace the Sendai Framework for Disaster Risk Reduction (“Sendai”). “Sendai” comprises a non-binding set of guidelines formulated by the United Nations’ Office for Disaster Risk Reduction (UNDRR) which embrace both adaptation and resilience (UNDRR (2015)).20 The goal is to reduce vulnerabilities and enhance the capacity of social, economic, and environmental systems to deal with the impacts of natural hazards and climate change. Sendai has two interconnected pillars.

Overlaps, but also differences, exist between mitigation and adaptation. In terms of time horizon, mitigation impacts unfold with lags, whereas adaptation measures are needed sooner to make society more resilient to climate extremes, i.e., to live with a warming planet. In terms of verifiability, advancements in mitigation can be assessed with respect to quantifiable reductions in GHG emissions as well as slowing down further increases in global average temperatures. In contrast, adaptation needs to be adjusted to the specificities of national and local levels. In terms of its management, climate adaptation needs to be dynamic, as it will be driven by shifting climate risks. In terms of intertemporal policy choices, adaptation presents society and decision makers with a need to choose between how much to invest in it versus how much residual risk they are prepared to accept.

By reducing systemic risks, adaptation is expected to avoid losses and damages, as well as generate economic, social and environmental benefits.22 The materialization of climate risks affects public finances, both directly and indirectly. Responding to climate change implies disaster relief or reconstruction of damaged public infrastructure relief payments for agriculturalists affected by drought or flooding, etc. Thus, fiscal space for contingency planning is required. Bachner et al. (2019) developed a modelling framework to assess cost and benefits, showing the budgetary implications of adaptation with data from Austria. Public adaptation involves considerable costs for the Austrian federal budget (15% of the budget is adaptation-relevant). However, it is difficult to quantify avoided damages and losses due to a need for either counterfactual analyses or panel studies.

Economic benefits are the accrued dividends through investments in adaptations that decrease risks or improve outcomes. Some examples include reduced risk of flooding, lower costs of insurance, lower maintenance and repair costs, and increased income (WRI (2022)). As such, some adaptation investments may translate into revenue for governments’ budgets. Interestingly, Bachner et al. (2019) find that public adaptation in Austria has the potential to increase government revenues because of higher economic activity compared to a scenario with only the impacts of climate change and lower disaster relief expenditures.23 The most systematic study of the benefits from mitigation and adaptation are in the Projection of Economic impacts of climate change in Sectors of the European Union based on bottom-up Analysis (JRC (2021)), better known as PESETA IV.24

The PESETA IV, based on a biophysical impact model, shows how inadequate mitigation and adaptation efforts impacts ecosystems, societies, and the economy. Two scenarios are compared in the report. In a malign scenario, no additional climate policy actions are pursued, and global warming reaches 3° C by 2100 with no adaptation measures. Conversely, in a benign scenario outlined in the Paris Agreement, global warming levels of 1.5°-2 °C are achieved with early adaptation. The “net benefits” from climate mitigation and adaptation are then assessed in terms of avoided negative impacts. The PESETA IV Report demonstrates that climate mitigation measures can substantially attenuate the adverse effects of climate change across the EU. Additionally, the implementation of climate adaptation strategies effectively reduces impacts in a cost-efficient manner. Yet, even under scenarios in which global warming is constrained to well below 2 °C, Europe will still face significant climate impacts. A discernible European North-South disparity emerges, with southern European regions bearing a disproportionate burden from heightened heat stress and constrained water availability (EEA (2024)).

How effective might adaptation strategies be? Under the malign scenario of 3 °C global warming, the projected river flood damage in the EU and UK would amplify sixfold compared to current losses, amounting to an estimated €48 billion annually, and posing a threat to nearly 500,000 individuals annually, compared to the current 170,000 individuals affected. However, limiting global warming to 1.5 °C could halve adverse economic impacts and reduce the number of people exposed by an estimated 230,000. Adaptation strategies can significantly curtail future flood impacts in a cost-effective manner, with associated co-benefits. For example, implementing retention reservoirs to diminish river flood peaks could slash projected damages by nearly €40 billion annually by 2100, while concurrently enhancing ecosystem quality. Furthermore, in the absence of mitigation and adaptation measures, annual damage from coastal flooding in the EU and UK could surge from the current €1.4 billion annually to nearly €240 billion by 2100. Around 95% of these impacts could be averted through moderate mitigation efforts and strategic bolstering of dykes in areas of human settlement and along coastlines.

Summing up, the cost-benefit analysis in the PESETA IV report supports rapidly stepping up both mitigation and adaptation efforts. Yet, the approach to adaptation in the PESETA IV report is reliant on a “general understanding” of adaptation in the various EU Treaties and Directives. A unified understanding of what climate adaptation encompasses is critical to minimize unavoidable impacts from climate change in a cost-effective manner.

Against the background of a dire need to step up climate adaptation and overwhelming evidence about its benefits, what is the actual state of adaptation financing? Regrettably data on the various sources of adaptation financing is fragmented and less systematic than data on mitigation financing. Adaptation financing represents a small share of total finance flows, the public sector is currently its principal source, and it is not advancing in tandem. Adaptation financing intended as real-economy investments rather than financial flows in the financial system might actually be receding.

When considering all publicly known climate investments, the share of adaptation fundings is relatively small. According to the UNDRR less than 10 % of all climate finance is currently allocated for adaptation (UNDRR (2024)). According to CPI estimates, total adaptation financing amounted to around US$63 billion (annual average over 2021 and 2022). Although this represents an increase of over 29 percent from US$49 billion in 2019/2020, at about 5.3% it pales in comparison with mitigation financing, which amounted to over US$1.2 trillion over the same period.

The public sector is presently the principal source of very modest adaptation finance. According to the World Resource Institute (WRI) current adaptation investment projects are overwhelmingly financed by the public sector (98%), with development finance institutions accounting for almost 80 % total adaptation financing (World Resource Institute (2022)).25 Thus, development investments, that are largely public, and adaptation are closely related, according to the World Resources Institute (2022). “Building a road may enhance resilience for a community by making it easier for people to access markets, hospitals, and other sources of assistance during extreme weather and other times of trouble. To count as adaptation finance, however, the road needs to be deliberately built with climate impacts and the needs of vulnerable people in mind (WRI (2022)).”

Known private sector financing of adaptation is inadequate. Private adaptation finance flows, as recorded by the Climate Policy Initiative (CPI) demonstrates that, on average, around US$ 300 billion is invested in climate mitigation and only US$ 1 billion in adaptation.26

Even in the EU, we know little about the allocation and timing of future funding for mitigation and adaptation. For example, the Multiannual Financial Framework 2014-2020 mandates that at least 20% of the European budget be allocated to climate-related expenditure, encompassing both adaptation and mitigation efforts. But clear distinctions or attributions are missing. Concerning the timing of investments in mitigation and adaptation there is also a lack of specificity. The framework merely states that they should advance jointly until 2050.

Is adaptation in fact advancing jointly with mitigation? The scant empirical evidence suggests not. Yet there is paucity of data to plot the trends and components in the case of European countries. In the case of developing countries, when correcting for inflation, adaptation investments have barely changed over the last 30 years (UNEP (2023)).

Summing up, the dreadful state of current climate adaptation financing clashes with evidence of rising climate damages and losses in recent years which are expected to escalate further in the future. Due to built-in geophysical lags, climate adaptation must be stepped up rapidly, on a scale commensurate to rising climate risks. What might explain such a contrast between the urgent need for adaptation and the lack of attention in the public debate and inadequate level of financing? We argue that climate adaptation might be hindered by three limitations.

We are witnessing rapid technological advancements, rises in the deployment of renewables and sharp declines in sustainable energy prices. Progress in the green-transition reduces net emissions and need for future adaptation. It partly counterbalances slow mitigation progress in other areas (IEA World Energy Investment (2024) and (IEA Global EV Outlook (2024)).27 The remarkable growth in clean energy investments supports the transition to green energy. It partly counterbalances slow mitigation progress in other areas. In 2024, solar energy alone is expected to attract US$ 500 billion in investments, surpassing all other energy sources combined (IEA World Energy Investment (2024) and Mongelli (2023)). In addition, the electrification in transportation is progressing rapidly, with global electric car sales reaching nearly 14 million in 2023—18% of all cars sold, up from 14% in 2022. This means that over 250,000 electric cars were sold every week in 2023, more than the number sold in a year just a decade ago (IEA Global EV Outlook (2024)).

There are signs that long-term investors might remain committed to addressing climate risks. In this they might be split with strategies by asset managers (seeking faster returns). Institutional investors managing $1.5 trillion in funds are urging asset managers to prioritize climate action, threatening to withdraw funds if they fail to engage companies on climate risk, highlighting a division in the investment industry over addressing global warming’s financial risks (FT (2025)).28 Moreover, diverse surveys reveal a growing awareness by the public and policy makers about the stringent needs for mitigation and increasingly adaptation.

Summing up, we are witnessing some favorable dynamics supporting the green-transition, possibly partially compensating for slow progress in other areas of mitigation. Might such marked based dynamics rapidly acquire increasing prominence to meaningfully reduce GHGs emissions and prospective adaptation needs in decades ahead?

Unabated climate change confronts us with various paradigm shifts. A wide spectrum of climate scenarios as well as expected paths of future damages and losses exists. Predictions range from significant but manageable damages by 2100, all the way to catastrophic outcomes. The latter might result from compounded hazards, concurrent events and risk multipliers that might become increasingly unmanageable (especially in more vulnerable exposed climate zones (EEA (2024)). As significant damages are uncertain but highly probable, it would be prudent to immediately frontload climate adaptation.

Awareness of evolving geophysical processes – which drive rising temperatures, intensify extreme-weather events, and amplify their associated damages – must be central to the design and calibration of climate policy. This involves two complementary dimensions. First, we now have rapidly improving empirical datasets documenting unabated warming and mounting losses from extreme climate events. Second, climate models remind us that, because of system inertia and nonlinear feedback, both mean temperatures and the frequency or severity of extremes are likely to worsen, although the exact trajectory depends critically on the strength of the mitigation actions we take today.

Climate adaptation presents us with difficult choices each with intertemporal consequences. Tackling the barriers and political economy challenges is essential. While the concept of adaptation is intuitive, deciding where to adapt, how, to what extent given residual risks, and when over long time periods is complex. Quantifiable targets and steps, a shared classification system, and effective approaches to climate adaptation must embrace trade-offs, share best practices, and learn by doing. Part II of this series addresses these issues.

Ke et al. (2024) “Low latency carbon budget analysis reveals a large decline of the land carbon sink in 2023,” National Science Review, https://doi.org/10.1093/nsr/nwae367

Mongelli, F P (2023) “The green energy transition, part 1: Background and hurdles”, CEPR Press, see: https://cepr.org/system/files/publication-files/187222-peace_not_pollution_how_going_green_can_tackle_climate_change_and_toxic_politics.pdf

Shared Socioeconomic Pathways (SSPs) look at five different ways in which the world might evolve in the absence of climate policy and how different levels of climate change mitigation could be achieved when the mitigation targets of Representative Concentration Pathways are combined with the SSPs.

Feyen et al. (2020) “Macro-Financial Aspects of Climate Change,” Policy Research Working Paper; No. 9109. World Bank, Washington, DC. http://hdl.handle.net/10986/33193 License: CC BY 3.0 IGO.

IPCC (2021) “Inertia in Climate Systems,” See: https://archive.ipcc.ch/ipccreports/tar/vol4/011.htm

Newman, R., and I. Noy (2023) “The global costs of extreme weather that are attributable to climate change”, Nature Communications 14, 6103 (2023) see: https://doi.org/10.1038/s41467-023-41888-1

See: https://www.munichre.com/en/company/media-relations/media-information-and-corporate-news/media-information/2024/natural-disaster-figures-2023.html

UNDRR (2024) “Guide for adaptation and resilience finance”, United Nation Office for Disaster Risk Reduction.

Bilal A. and D. R. Känzig (2024) “The Macroeconomic Impact of Climate Change: Global vs. Local Temperature”, NBER Working Paper 32450 see: http://www.nber.org/papers/w32450

World Bank (2024) “Climate Adaptation Costing in a Changing World”, a Report funded by the European Union.

EEA (2024) “European Climate Risk Assessment 2024”, Report 1.2024, see: https://www.eea.europa.eu/en/analysis/publications/european-climate-risk-assessment

World Bank (2021) “Economics for Disaster Prevention and Preparedness in Europe,”

Bova E., M. Ruiz-Arranz, and F. Toscani (2019) “The impact of contingent liability realizations on public finances,” IMF, International Tax and Public Finance 26(79).

Mallucci, E. (2022) “Natural disasters, climate change, and sovereign risk”, Journal of International Economics, Elsevier, vol. 139(C).

Nuñez Ramos et al. (2024) “Here’s why companies must address physical climate risks,” Rabobank: Research.

UNEP (2023) “Adaptation Gap Report”, see: https://www.unep.org/resources/adaptation-gap-report-2023

Bateson B. and S. Rothstein (2024) “Will climate risk trigger the next great financial crisis?”, Green Central Banking

Toreti A., S. Bassu, S. Asseng, M. Zampieri, A. Ceglar, and C. Royo (2021) “Climate service driven adaptation may alleviate the impacts of climate change in agriculture,” Communications Biology 5 (1), 1235.

NGFS (2023) “Compound risks: implications for physical climate scenarios analysis”, see: https://www.ngfs.net/en/press-release/ngfs-publishes-latest-long-term-climate-macro-financial-scenarios-climate-risks-assessment-0

UNDRR (2015) “Sendai Framework for Disaster Risk Reduction 2015-2030”, UN Office for Disaster Risk Reduction.

IPCC (2022) “Climate Change 2022: Impacts, Adaptation and Vulnerability. Contribution of Working Group II to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change”, Cambridge University Press.

Socio-environmental (non-market) benefits are described in Allan et al. (2019) and Report for Global Commission on Adaptation (CGA, 2019)). The PESETA IV study (2021) mentions triple-dividends.

However, Bachner et al. (2019) note that their framework is hard to implement broadly as it requires considerable time and effort with respect to data collection, preparation, and stakeholder consultation.

JRC (2021) “JRC PESETA IV. Climate Change: what will happen if we do nothing?,” https://joint-research-centre.ec.europa.eu/scientific-activities-z/peseta-climate-change-projects/jrc-peseta-iv_en

WRI (2022) Power a sustainable future, see: https://www.wri.org/insights/adaptation-finance-explained

See: https://www.iea.org/reports/world-energy-investment-2024 and https://www.iea.org/reports/global-ev-outlook-2024

FT (2025) ‘’Long-term investors split with asset managers over climate risk.’’