The views expressed are those of the authors and do not necessarily reflect those of the Deutsche Bundesbank.

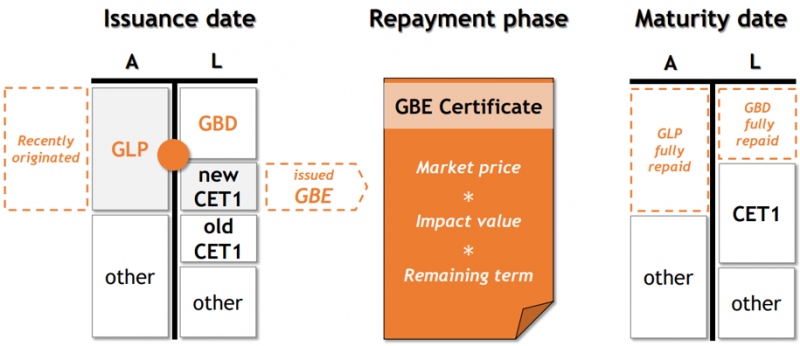

Having demonstrated the rationale for a GBE certificate and outlined its basic architecture, the following section briefly summarises its main features and demonstrates that it is compatible with the interests of major stakeholders.

Central bankers may support GBE and green lending by helping to decrease audit costs. Currently, the application of the Green Bond Principles (GBP) issued by the International Capital Market Association (ICMA) is the most widely used mechanism to ensure environmental integrity on international green bond markets. The GBP provide a guideline that issuers may use to structure their own frameworks that govern green bond programmes. It is common practice that external reviewers verify adherence to such frameworks. Such private standards and auditing solutions may be subject to incentive problems that limit the integrity of the certification (v. Wangenheim, 2019). At the same time, in cases where private certifiers have to invest in separate technical audit infrastructures and processes, the average cost of reviews may be unnecessarily high even in a competitive market environment. However, GLP audit costs could be reduced by making use of centralized credit registers that are already in place and have a wide coverage, as for example the analytical credit datasets (AnaCredit) used by central banks of the Eurosystem.