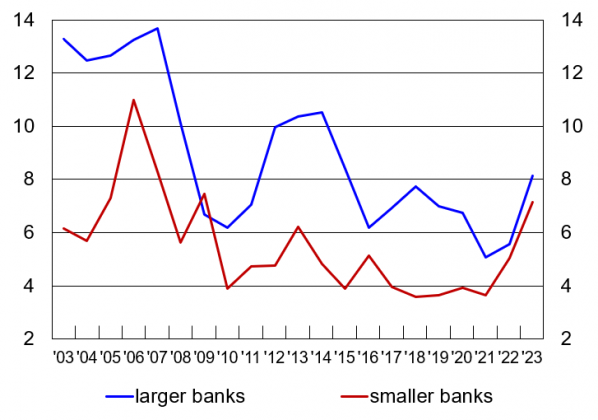

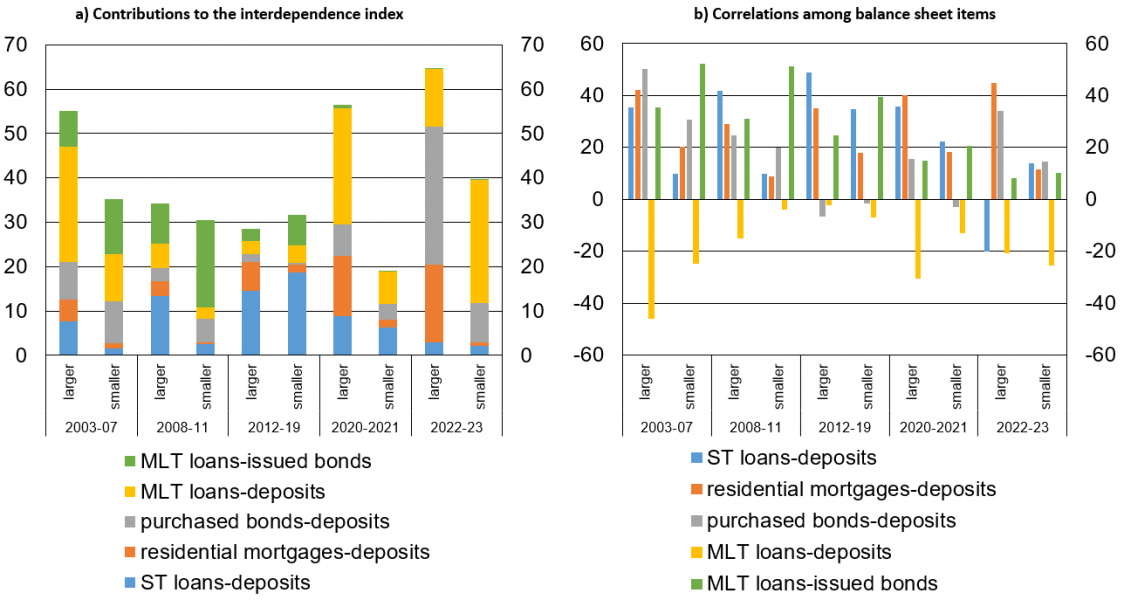

Asset and liability management is a traditional tool used by intermediaries to limit liquidity and interest rate risks. To assess how the intensity of asset-liability linkages evolved over time, Michelangeli and Piersanti (2023) build and decompose an interdependence index, which decreased between the beginning of the century and the onset of the COVID-19 pandemic and started to rise again in 2022 for both larger and smaller Italian banks.

It should be noted that in stressful situations these relationships may not apply to individual intermediaries.