This policy brief is based on EIB Working Paper 2025/06 – Who’s most at risk? A global index of climate risk for countries (the climate scores for individual countries are available at the end of the paper). The views expressed are those of the authors and not necessarily those of the institutions the authors are affiliated with.

Abstract

The interest in country-level climate risks has grown in recent years, in particular since the 2015 Paris Agreement outlined clear decarbonisation pathways. This policy brief presents an index to measure climate risk for more than 170 countries, assessing both physical and transition risk. Emerging and developing economies are found to be most exposed to physical risk, mostly due to acute physical events (hurricanes and storms, floods, and fires), sea level rise and heat. Transition risk is more relevant for fossil fuel producers and wealthier countries. Country climate risk scores can support risk management and help countries, financial institutions and investors in assessing their exposure, setting priorities and planning the financing of climate solutions to enhance countries’ resilience to climate change.

Climate risk has reached ‘code red’ for all of humanity. Policymakers, investors and entrepreneurs are increasingly aware of both the immediate and the long-term threats posed by climate change, as well as the opportunities to mitigate its impacts. At the country level, the exposure to physical climate risk can have negative implications on sovereign debt (Zenios, 2022; Bernhofen et al., 2024), the cost of debt (Beirne et al., 2021; Buhr, 2018; Cevik and Tovar Jalles, 2020; Mallucci, 2020; Kling et al., 2018), sovereign ratings (Standard & Poor’s, 2015; Agarwala et al., 2021; Revoltella et al., 2022), fiscal sustainability (Agarwala et al., 2021), and even on political stability (Moody’s, 2016; Fitch, 2022; Volz, et al., 2020). The potential impact is more evident for some small countries and those with lower capacity to bear climate change costs (Nordhaus, 2010; Mejia, 2016), but advanced economies are not immune to debt sustainability concerns related to climate events. Transition risk, by contrast, is linked to three main factors: policies, shifts in consumer preferences and technological breakthroughs. Reputational effects and legal actions due to failure to comply with environmental standards are also relevant. All these risks can influence economies via depreciation, a higher default probability, a reduced ability to exchange and refinance assets, and under-pricing of financial instruments related to transition-exposed assets (Bolton et al., 2020).

The distinct characteristics of physical and transition risk underscore the importance of assessing them independently. In this policy brief we present an index to measure climate risk for over 170 countries, with separate scores for physical and transition risk, and accounting for adaptation and mitigation capacity.

Climate risk at the national level is typically evaluated using three main approaches: modelling, scenario analysis and (index-based) scores. Multidimensional macroeconomic models aim to evaluate the macro impacts of climate change: the most-widely used are the Integrated Assessment Models (IAM) and the General Circulation models (GCMs). Some institutions – for instance, NGFS (Network for Greening the Financial System) – are regularly developing scenario analyses, often based on model outputs, to sketch plausible and consistent representations of the future under different policies and settings. Such scenarios project the possible future outcomes of climate change over the (very) long run, as the time horizon is normally looking at the years 2050 or 2100. In addition to modelling and scenario analysis, index-based scoring help assess climate risk and rank countries accordingly (among those ND GAIN and Germanwatch). Ratings agencies also started to develop their own assessments of climate risk to complement their rating methodologies (Volz et al., 2020; Gratcheva et al., 2020). Typically, they combine Environmental, Social and Governance (ESG) criteria to support investors in making informed investment decisions.

Our climate risk country scores assess climate risk on a relative basis: relative to other countries and relative to the size of the economy of each country. Importantly, our climate rick scores treat physical and transition risks individually:

To derive our scores, the most relevant risk factors are carefully selected (instead of adding as many indicators as possible), resulting in a parsimonious model with a clear link between the risk factors and outcomes. The contribution of each factor is determined based on the literature and empirical evidence. This approach distinguishes our index from existing rankings which, using numerous equally-weighted indicators (“as many as you can find”), implicitly assign equal importance to a multitude of underlying risk factors. Our approach also accounts for factors that go beyond those typically considered in existing methodologies, including a chronic risk component for physical risk and a mitigation component for transition risk. The time horizon of our analysis is 5-10 years.

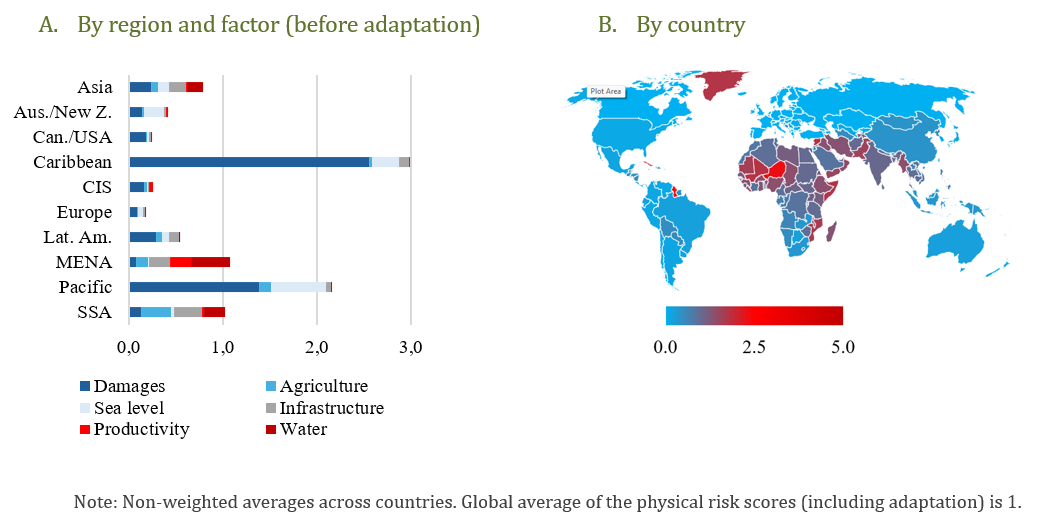

Based on our climate scores, emerging and developing economies are the most exposed to physical risk. The Caribbean and Pacific regions stand out, but also sub-Saharan Africa (SSA) and several countries in the Middle East & Northern Africa (MENA) face considerable risks. Emerging and developing economies are typically more exposed to acute physical events (hurricanes and storms, floods, fires) and sea level rise. They are also more exposed to higher temperatures, as additional increases of temperatures in already hot environments have a profound impact on human activities, while in addition agriculture in these countries remains highly reliant on weather conditions. These countries are also less able to adapt, i.e. to protect themselves from the effects of weather.

Physical risk is relevant for advanced economies as well, in particular for Australia and New Zealand. However, in relative terms – relative to other countries and compared to the size of their economies – most advanced countries are less subject to devastating weather events. Having strong institutions, better fiscal capacity and the ability to put in place protective measures tend to protect them from being exposed to the full economic impact of climate change at country level (despite damages that can be very significant at the city or even regional level).

Figure 1. Physical risk scores

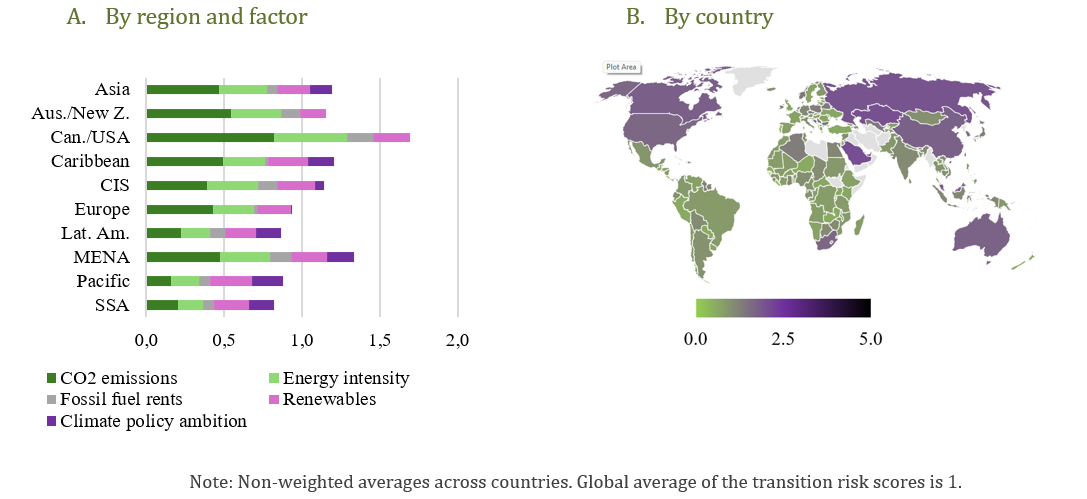

Transition risk scores present a markedly different picture, as they broadly reflect that higher GDP per capita levels are correlated with greater emissions. Indeed, transition risk is more relevant for fossil fuel producers and wealthier countries which need to reduce emissions, and for those countries which are less prepared for the transition to net-zero in terms of energy efficiency and deployment of renewable energy. Across regions, North America is the most exposed to transition risks followed by Asia, Australia/New Zealand and MENA. Latin America, the Pacific and SSA are the least exposed regions.

Figure 2. Transition risk scores

As the effects of climate change become more apparent, investors and policymakers are increasingly aware of the risks but also of the potential of the green transition to spur growth and strengthen resilience.

Our climate risk scores, which are compiled for over 170 countries, reveal a clear imbalance in climate risk exposures globally. Specifically, we observe that emerging and developing economies are particularly susceptible to physical climate risks: in many cases they are more exposed to acute physical risk (like damages from storms, tornadoes, floods), sea level rise and heat (which is impacting particularly agriculture and labour productivity). They also have less adaptation capacity, which lowers their ability to withstand the effects of physical risk and to invest in climate adaptation. In contrast, transition risks tend to be more pronounced in wealthier nations and those that produce fossil fuels.

Our climate change risk scores at a country level have a wide range of uses and implications, in particular as they provide a consistent assessment on a global scale. Firstly, as climate risks intensify and regulatory requirements evolve, banks and international financial institutions can benefit from these scores to support their risk management processes. Indeed, using an earlier vintage of our climate scores, Cappiello, Ferrucci, Maddaloni and Veggente (2025) confirm the relevance of climate risks, in particular physical risk, for sovereign credit ratings. Climate scores can serve as risk management tool for sovereign counterparties but also as a starting point for evaluating climate-related risks faced by firms and banks within a given country. Importantly, climate scores can also support policymakers, investors, and international financial institutions in prioritising mitigation and adaptation efforts, as well as identifying the associated financing needs. We also hope our scores help raise public awareness of climate change and its risks, conveying the urgency of taking immediate action to address the global climate emergency we all face.

Agarwala, M., M. Burke, P. Klusak, M. Kraemer and K. Mohaddes, Rising Temperatures, Falling Ratings: The Effect of Climate Change on Sovereign Creditworthiness, Bennett Institute Working Paper, Cambridge University, March 2021

Beirne, J., N. Renzhi and U. Volz, ‘Feeling the heat: Climate risks and the cost of sovereign

borrowing’, International Review of Economics & Finance 76, 920–936, 2021

Bernhofen, M., M. Burke, A. Puranasamriddhi, N. Ranger, and G. Shrimali, The Impact of Physical Climate Risks and Adaptation on Sovereign Credit Ratings, November 2024

Bolton, P., and M.T. Kacperczyk, Carbon Premium around the World, CEPR Discussion paper DEP14567, 2020

Bolton, P., M. Despres, L.A. Pereira Da Silva, F. Samama and R. Svartzman, The green swan: central banking and financial stability in the age of climate change, Bank for International Settlements, January 2020

Buhr, B., U. Volz, C. Donovan, G. Kling, Y.C. Lo, V. Murinde and N. Pullin, Climate Change and the Cost of Capital in Developing Countries, Imperial College London; SOAS University of London; UN Environment, 2018

Cappiello, L., G. Ferrucci, A. Maddaloni and V. Veggente, Creditworthy: do climate change risks matter for sovereign credit ratings?, Discussion Paper Series, European Central Bank, No 3042, 2025

Cevik, S. and J. Tovar Jalles, This Changes Everything: Climate Shocks and Sovereign Bonds, IMF Working papers, June 2020.

Ferrazzi, M., F. Kalantzis and S. Zwart, Assessing climate risks at the country level: the EIB Climate Risk Country Scores, EIB Working Paper 2021/03

Fitch Ratings, Political Risks and Climate Change: Where Are the Flashpoints?, Special Report, Long Reads, July 2022

Gratcheva, E.M., T. Emery and D. Wang, Demystifying Sovereign ESG, World Bank, 2020

Guterres, A., Climate change is “Code red for humanity”, United Nations, 2021

IPCC, Climate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [Masson-Delmotte, V., P. Zhai, A. Pirani, S.L. Connors, C. Péan, S. Berger, N. Caud, Y. Chen, L. Goldfarb, M.I. Gomis, M. Huang, K. Leitzell, E. Lonnoy, J.B.R. Matthews, T.K. Maycock, T. Waterfield, O. Yelekçi, R. Yu, and B. Zhou (eds.)]. Cambridge University Press, Cambridge, United Kingdom and New York, NY, USA, 2021

Kling, G., Y. C Lo, V. Murinde and U. Volz, Climate Vulnerability and the Cost of Debt, Centre for Global Finance, Working Paper Series No.12 / 2018

Liu, Z., H. Sun and S. Tang, “Assessing the impacts of climate change to financial stability: evidence from China”, International Journal of Climate Change Strategies and Management, Vol. 13 No. 3, 2021

Mallucci, E., Natural Disasters, Climate Change, and Sovereign Risk, Board of Governors of the Federal Reserve System, Washington, International Finance Discussion Papers (IFDP), July 2020

Mejia, S. A., “Gone with the Wind; Estimating Hurricane and Climate Change Costs in the Caribbean,” IMF Working Papers 16/199, International Monetary Fund October 2016

Nordhaus, W. D., “The Economics Of Hurricanes And Implications Of Global Warming,” Climate Change Economics (CCE), 2010, 1 (01), 1–20

Revoltella, D., T. Bending, R. Santos and S. Zwart, Assessing climate risks for long-term investments and the role of multilateral development banks, in: Scaling Up Sustainable Finance and Investment in the Global South. CEPR, 2022

Standard & Poor’s, The Heat Is On: How Climate Change Can Impact Sovereign Ratings, Standard & Poor’s Ratings Services, McGraw Hill, November 2015

Volz, U., J. Beirne, N. Ambrosio Preudhomme, A. Fenton, E. Mazzacurati, N. Renzhi and J. Stampe, Climate Change and Sovereign Risk. London, Tokyo, Singapore, Berkeley: SOAS University of London, Asian Development Bank Institute, World Wide Fund for Nature Singapore, Four Twenty Seven, 2020

Zenios, S.A., Understanding the climate risks to sovereign debt: From data to models, Prepared for the Workshop of the European Fiscal Board Brussels, February 2022