We assess the impact of a central bank digital currency (CBDC) on the balance sheets of banks and the central bank. To do so, we build a constraint optimisation model in which banks minimize their funding costs subject to their own liquidity risk preference, reserve holdings and collateral availability as well as those of all other banks in the banking sector. We quantify the impact of a fictitious digital euro introduction in 2021 using actual balance sheet data of over 2,000 banks and find that a hypothetical €3,000 holding limit would have contained the impact on banks’ balance sheets and the Eurosystem balance sheet. With our simulation and for a given digital euro demand or holding limit, we can identify those banks which would experience an extraordinary increase in wholesale or central bank funding reliance and those banks which would be short of eligible collateral. In our sample, the few identified banks primarily belong to the group of banks classified as less significant institutions, diversified and retail lenders. Those banks might need special attention by prudential supervisors. For central bankers, primarily the model’s mapping between CBDC demand and additional reserves that central banks would need to provide under our assumptions is of interest.

Central banks throughout the world are investigating the potential benefits and risks of introducing a retail central bank digital currency (CBDC). A retail CBDC is a digital form of public money, issued by the central bank and accessible to individuals. Just as banknotes, it can be used as means of payment and store of value, with the benefit of being digital. These features also make a retail CBDC a close substitute for (overnight) bank deposits. However, a CBDC differs from bank deposits in that it is a direct liability of the central bank rather than a commercial bank.

Due to their high degree of substitutability, a successful retail CBDC would lead to retail customers shifting part of their deposits away from their bank to their central bank, possibly at a very high speed. Often-cited financial stability concerns in this regard are the possibility of a bank run or a subsequent increase in banks’ liquidity risk if banks replace the outflowing stable retail deposits with more flighty wholesale funding or drain their central bank reserves (Eurosystem, 2020). With this in mind, and to facilitate a smooth CBDC introduction, central banks debate about CBDC design features, such as holding limits, to control CBDC demand.

In our paper Meller and Soons (2023) we model and simulate a CDBC introduction to inform the debate on holding limits and the impact of CBDC on banks’ funding structure, collateral availability and the central bank balance sheet. Pioneering work by Brunnermeier and Niepelt (2019) explains that banks are unaffected by a deposit outflow into CBDC if the central bank redirects liquidity back into the banking system under favourable conditions (an “equivalence result”). In practice, however, we expect banks to be impacted, for instance because of liquidity regulation and collateral requirements. Hence, our contribution is twofold. First, compared to existing impact assessments of CBDC on the banking sector, our model more accurately reflects the complex interactions between bank balance sheets, the central banks balance sheet and regulatory liquidity and collateral constraints.1

Our second contribution is our empirical application and the policy relevance of our results. Using our model and proprietary bank-level data from more than 2,000 euro area banks, we simulate the impact of a fictitious digital euro introduction in 2021. Our results indicate at what amount of deposit outflows the impact on liquidity risk and bank balance sheets would have been concerning. We find that with a hypothetical €3,000 digital euro holding limit per person, the changes to banks’ funding structures and their liquidity risks would have been moderate, and no additional central bank funding would have been needed. Our model can also be applied to other jurisdictions.

We model how each bank would optimally respond to a retail deposit outflow while minimising costs and allowing for liquidity, collateral, and reserve constraints. Banks can intermediate CBDC demand in three ways. To start, a bank could accommodate its retail deposit outflows by using its existing central bank reserve holdings. Should a bank not have sufficient reserves, it could obtain additional central bank reserves on the interbank market or it could increase its central bank borrowing. In those latter cases the bank would replace retail deposits with wholesale or central bank borrowing, where its assets would be encumbered if it engaged in secured borrowing. To note, we focus on the short-term impact, assuming that bank lending remains constant. Further, we do not consider asset purchases by the central bank from non-banks due to a lack of data.2

Not all adjustment options are equally feasible or desirable, given that they would have an impact on banks’ profitability, liquidity risk, and collateral availability. While the relative prices and therefore the relative attractiveness of each funding option is the same for all banks, the preferred adjustment of each bank differs and is determined by its own constraints in terms of the liquidity risk the bank is willing to accept, the collateral and reserves it would like or is able to mobilize and use, as well as the availability of reserves at the banking-system level. In detail, we impose the following three constraints.

First, a liquidity risk constraint imposes that banks are willing to use at most 50% of their current voluntary liquidity buffers on top of the mandatory liquidity requirements. The liquidity requirements are the Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR). We include a relative rather than an absolute liquidity risk constraint due to the observed liquidity risk preference heterogeneity in our sample. Second, banks face a collateral constraint which reflects that a bank cannot obtain more secured funding than it has appropriate collateral. Third, a reserve constraint ensures that each bank can only draw down the central bank reserves it actually holds.

Additionally, banks can only obtain reserves from other banks if there is another bank that is willing to provide reserves. If a bank uses reserves to meet a demand for CBDC, irrespective of whether they are its own reserves or those borrowed from another bank on the interbank market, there is a decline in the available reserves in the system as a whole. Furthermore, the liquidity ratios of banks on both sides of the transaction are affected; depending on the type of funding, this may result in a decrease in unencumbered high quality liquid assets (HQLA), and/or an increase in expected outflows and/or in the required stable funding. In other words, in our model the supply of liquidity on the interbank market is endogenously determined and depends on the deposit outflow.

We simulate our model using regulatory data to illustrate how a hypothetical introduction of a digital euro would have impacted the balance sheets of banks and the Eurosystem. In our main analysis, we used data on 2,319 euro area banks for the third quarter of 2021. Our sample represents 95% of the euro area banking system in terms of total assets.

Our main results are structured around three questions: For a given demand for CBDC,

In this brief we present results for our baseline liquidity risk tolerance scenario, Scenario B: banks want to keep half of their current bank-specific voluntary liquidity buffer held above the regulatory minimum (this is in line with the median change in voluntary buffers since 2016). When presenting our results, we focus on the most extreme outflows compatible with a digital euro holding limit of €3,000 per person, as suggested by Bindseil (2020) and Bindseil and Panetta (2020). Using a rule of thumb approach, we multiply the hypothetical €3,000 limit by the euro area population of 340 million which gives a maximum aggregate outflow of €1.0 trillion. This would be reached if each bank had converted 15% of its retail deposits into digital euros in the third quarter of 2021, as represented by the shaded area in the charts.

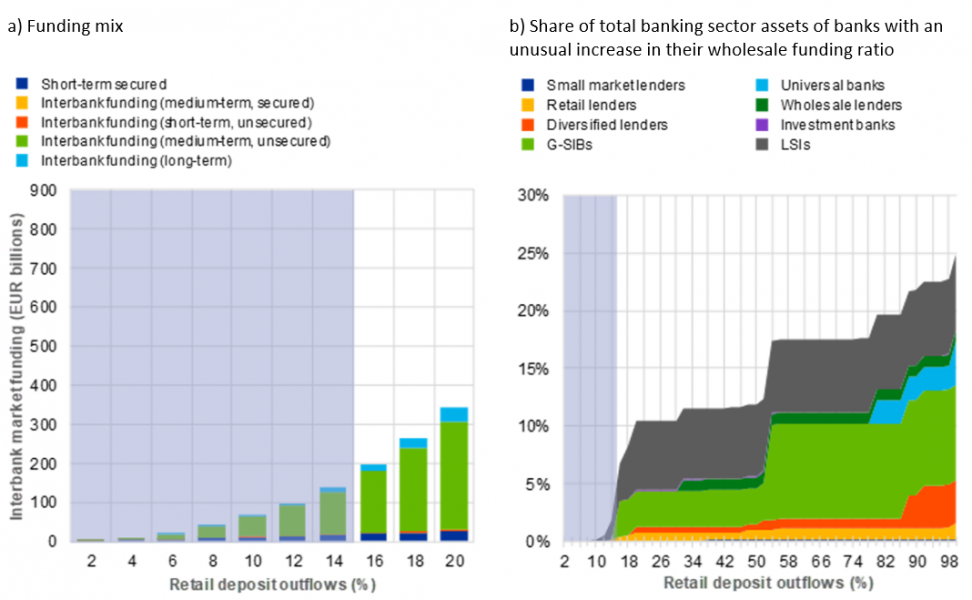

Focusing on the most extreme outflows in case of a €3,000 holding limit, Panel (a) of Figure 1 shows that, on aggregate, 82% of the outflowing deposits would not have been replaced but resulted in a reduction of own reserves, while 14% of the outflowing deposits would have been replaced by medium-term unsecured interbank funding and only 2% by short-term secured funding and 1% by long-term unsecured funding. This also means that, under our baseline scenario and with a hypothetical €3,000 holding limit, the Eurosystem would not have had to supply additional reserves, since all banks either had enough excess reserves themselves or were able to obtain sufficient liquidity on the interbank market. Moreover, the bulk of wholesale funding replacing banks’ deposits is medium-term unsecured funding, meaning that banks’ short-term liquidity risk would not materially increase, although their funding structures would become less stable over a longer time-horizon. That banks are not choosing the less costly short-term or secured funding, is a consequence of their liquidity risk constraint.

Due to regulation, the shift from retail to wholesale funding will not result in exuberant liquidity risk taking. However, an unusually high increase in wholesale funding reliance could be seen as disruptive. For example, banks which are usually not very active on the interbank or bond market might not be prepared to obtain sufficient market funding. Panel (b) of Figure 1 shows the asset share of banks that would experience exceptionally high increases in their wholesale funding ratio under Scenario B as compared with the 90th percentile of quarterly increases in wholesale funding ratios of their peers observed since 2016. With a hypothetical €3,000 holding limit, we find that a number of LSIs could experience an unusual increase in their wholesale funding ratio. Although these banks would account for just a small proportion of total banking sector assets, it could be prudent to assess the preparedness of these banks before a digital euro introduction.

Figure 1: Wholesale funding type and dependence

Notes: The shaded area represents the possible share of deposit outflows in the event of a €3,000 holding limit. In Meller and Soons (2023) these figures appear in Chart 8 and B.4 respectively.

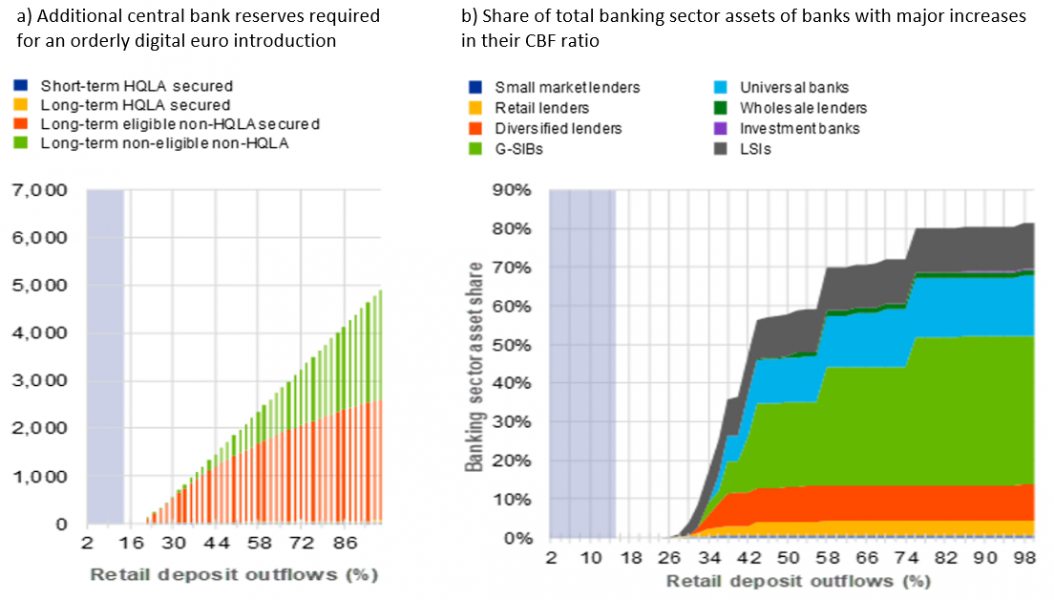

What if there had been no holding limit and a high CBDC demand? Our simulation suggests that when outflows are much larger than possible with a €3,000 holding limit, banks would have required additional reserves from the central bank. For example, if all overnight household deposits had been swapped into digital euro, the central bank would have had to provide almost €5 trillion worth of reserves if banks were to keep to their preferred liquidity buffers. This compares with an Eurosystem balance sheet in the third quarter of 2021 of around €8.5 trillion in assets and liabilities. It should be stressed that this is an extremely unrealistic scenario. In such a scenario, some of the central bank lending would have to be done against currently non-eligible collateral (light green part in panel (a) of Figure 2). In our sample, some of the less significant institutions (LSIs) would be the first to run out of currently eligible collateral, followed by diversified and retail lenders.

While a temporary high reliance on central bank funding is not necessarily a problem from a financial stability perspective, excessive structural reliance could undermine market discipline. Also, banks might (technologically) not be prepared to increase their central bank reliance rapidly. Panel (b) of Figure 2 shows that LSIs would be the first to experience an unusually high increase in central bank funding ratio, followed by diversified and retail lenders. Although central bank funding reliance may not be a concern in view of a hypothetical €3,000 holding limit, it might still be prudent to follow up with the identified banks before a digital euro introduction.

Figure 2: Additional central bank funding need

Notes: The shaded area represents the possible share of deposit outflows in the event of a €3,000 holding limit. In Meller and Soons (2023), these figures appear in Chart 4 and 7 respectively.

We develop a constraint optimisation model to quantitatively study the impact of a CBDC on banks’ funding structures and their demand for central bank reserves. Applying our model to the proprietary data, we find that a fictitious digital euro introduction in 2021 with a hypothetical €3,000 digital euro holding limit per person would not have led to extraordinary changes in balance sheets of banks or the Eurosystem. With our simulation and for a given digital euro demand/holding limit, we are able to identify those banks which would experience an extraordinary increase in wholesale/central bank funding reliance or banks which would be short of eligible collateral. Prudential supervisors might want to engage with these banks prior to a digital euro introduction. For central bankers our model might be particular interesting as it provides a mapping between CBDC demand/holding limits and the additional reserves that central banks would need to provide. Further results are presented in our paper, Meller and Soons (2023), including the impact in case banks have very high or very low liquidity risk tolerance (banks are willing to draw down their entire/none of their liquidity buffers held above the regulatory minimum), a scenario where banks hold lower excess reserves to start with, a scenario with fragmented interbank markets, and a bank run scenario.

Bank for International Settlements (2021): “Central bank digital currencies: financial stability implications”, Report no 4, Bank for International Settlements, Basel, September.

Bindseil, U. (2020): “Tiered CBDC and the financial system”, Working Paper Series, No 2351, European Central Bank, Frankfurt am Main, January.

Bindseil, U., and Panetta, F. (2020): “Central bank digital currency remuneration in a world with low or negative nominal interest rates”, VoxEU, Centre for Economic Policy Research, London, 5 October.

Brunnermeier, M. K., and Niepelt, D. (2019): “On the equivalence of private and public money”, Journal of Monetary Economics, Vol. 106, October, pp. 27-41.

Castrén, O., Kavonius, I. K., and Rancan, M. (2022): “Digital currencies in financial networks”, Journal of Financial Stability, Vol. 60, June.

Eurosystem (2020): “Report on a digital euro”, Eurosystem, October.

Gorelova, A., Lands, B., and teNyenhuis, M. (2022): “Resilience of bank liquidity ratios in the presence of a central bank digital currency”, Staff Analytical Note, Bank of Canada.

Meller B. and Soons, O. (2023): “Know your (holding) limits: CBDC, financial stability and central bank reliance”, Occasional Paper Series, No 326, European Central Bank, Frankfurt am Main.

Petracco Giudici, M., & Di Girolamo, F. (2023): “Central bank digital currency and European banks’ balance sheets”, No. JRC132239, Joint Research Centre.

Other relevant impact assessments of CBDC for banks include Petracco Giudici and Di Girolamo (2023), Castrén et al. (2022), Bank for International Settlements (2021), Gorelova et al. (2022).

We also do not consider explicitly the purchase of assets from banks, but its impact on banks in our model is very similar to the one of central bank lending. In both cases, sold or encumbered, assets do not qualify anymore as unencumbered HQLA for the purpose of the LCR. Moreover, in both cases, reserve holdings of the banking sector increase on aggregate.