References

Aghion, P. and Howitt, P. (1998). Endogenous Growth Theory. Cambridge, MA: MIT Press.

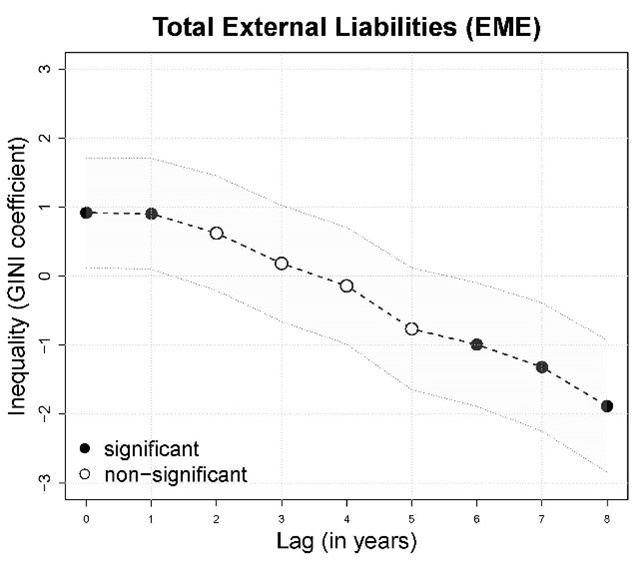

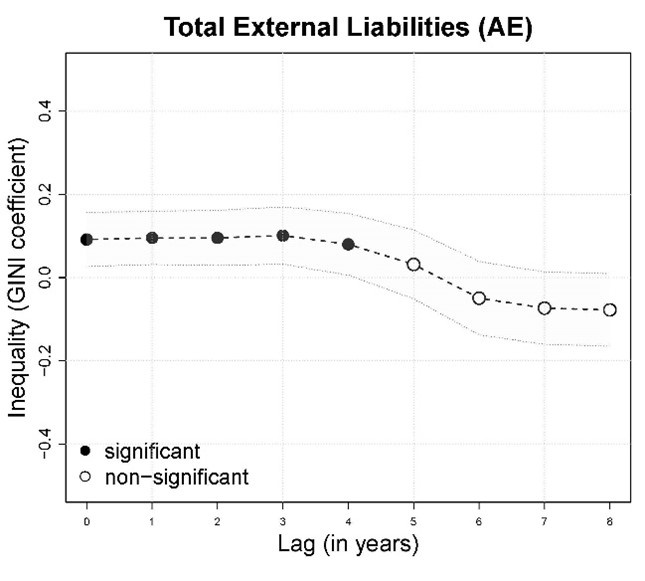

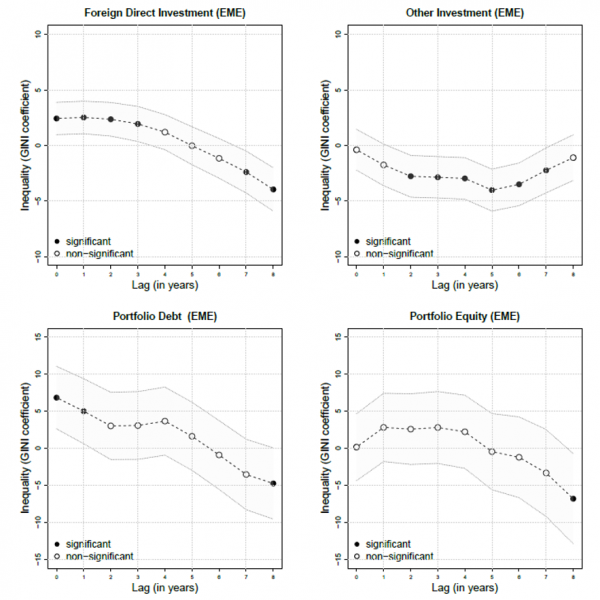

Avdjiev, S. and Spasova, T. (2022). Financial openness and inequality. BIS Working Papers, no 1010.

Beck, T., Demirgüç-Kunt, A., and Levine, R. (2007). Finance, inequality and the poor. Journal of Economic Growth, 12(1), 27-49.

Bruno, V. and Shin, H. S. (2015a). Capital flows and the risk-taking channel of monetary policy. Journal of Monetary Economics, 71, 119-124.

Bruno, V. and Shin, H. S. (2015b). Cross-border banking and global liquidity. Review of Economic Studies, 82(2), 535-564.

Claessens, S. and Perotti, E. (2007). Finance and inequality: channels and evidence. Journal of Comparative Economics, 35(4), 748-73.

Figini, P. and Görg, H. (2011). Does foreign direct investment affect wage inequality? An empirical investigation. The World Economy, Wiley Blackwell, 34(9), 1455-1475.

Firebaugh, G. and Goesling, B. (2004). Accounting for the recent decline in global income inequality. American Journal of Sociology, 110(2), 283-312.

Hilbert, M. (2014). Technological Information Inequality as an Incessantly Moving Target: The Redistribution of Information and Communication Capacities Between 1986 and 2010. Journal of the Association for Information Science and Technology, 65(4), 821-835.

Hofmann, B., Shim, I., and Shin, H. S. (2016). Sovereign yields and the risk-taking channel of currency appreciation. BIS Working Papers, no 538, revised May 2017.