This policy brief is based on the Bank of Italy working paper n. 1476 and the Bank for International Settlements working paper n. 1244. The views expressed in this brief are those of the authors and do not necessarily reflect the position of the Bank of Italy or the Bank for International Settlements.

Abstract

We study the interaction between banks’ adoption of artificial intelligence (AI) in credit scoring and relationship lending. Using a unique dataset on Italian banks’ investments in AI for the purpose of integrating their credit scoring techniques, matched with credit register data from one year before and one year after the outbreak of the Covid-19 crisis, we find that AI investments help banks mitigate the typical countercyclical effects of relationship lending on firms’ credit supply and their investment and employment decisions.

The global financial crisis and technological advancements have significantly transformed the banking system (Beck et al., 2016; Carletti et al., 2020). Following the financial crisis of 2007–2009, the banking sector has faced compressed interest rate margins, which negatively impacted profitability (Scott et al., 2017). In response, many banks have reduced traditional brick-and-mortar branches and invested in data gathering and processing, leveraging the use of artificial intelligence (AI). AI technology, with its enhanced ability to analyse hard, verifiable and codifiable data, can coexist with more traditional methods of reducing asymmetric information between banks and firms, such as the acquisition of soft information through close relationships between intermediaries and clients.

Using data on Italian banks’ investments in AI to integrate their credit scoring techniques, matched with credit register data from one year before and one year after the outbreak of the Covid-19 crisis, we investigate whether relationship-based lending and new technology-driven financial intermediation complement or substitute each other, in both normal periods and during the Covid-19 crisis.

To measure banks’ investments in AI, we use the results of the Regional Bank Lending Survey (RBLS) conducted by the Bank of Italy in 2021, which tracks Italian banks’ technology adoption over the recent years, as well as the specific technologies used and their applications. We match this information with loan-level data on volumes and interest rates on loans to non-financial corporations in Italy, obtained from the proprietary AnaCredit dataset.

In particular, the RBLS reports Italian banks’ investments in AI, the year in which these investments started and their purpose. We use this information to define AI banks in a given year as those credit institutions that have invested in AI with the purpose of integrating their assessment of the creditworthiness of borrowers in that year or in a previous one. This allows us to precisely track the evolution of AI adoption for credit scoring in each bank.1 Our definition of AI banks differs from previous proxies for technology adoption used in the literature, which typically consider the overall level of IT adoption by banks without distinguishing the specific technology or its intended purpose.

We examine how the interaction between AI-based credit scoring and the duration of bank-firm relationship (a proxy for relationship lending) affects firms’ loan volumes and interest rates. We follow Khwaja and Mian (2008) in using time-varying firm and bank fixed effects to account for observable and unobservable factors affecting firms’ demand and banks’ supply. This approach allows us to estimate how the interaction of AI technology and relationship length correlates with loan volumes and interest rates. Second, we examine how firms’ investment and employment decisions vary depending on their exposure to these factors.

In line with previous literature, our results confirm that, on average, the length of relationships is associated with a protection of borrowers during the Covid-19 crisis by increasing credit supply and reducing lending rates (see Sette and Gobbi, 2015; Bolton et al., 2016; Banerjee et al., 2021). At the same time, we document that for a given duration of the lending relationship with a given firm, the application of AI techniques aimed at integrating the evaluation of borrowers’ creditworthiness is associated to a mitigation of the “rent extraction” effects of relationship lending in normal times. However, during the crisis, the adoption of AI does not exert further protection on quantities and interest rates for borrowers with longer relationships.

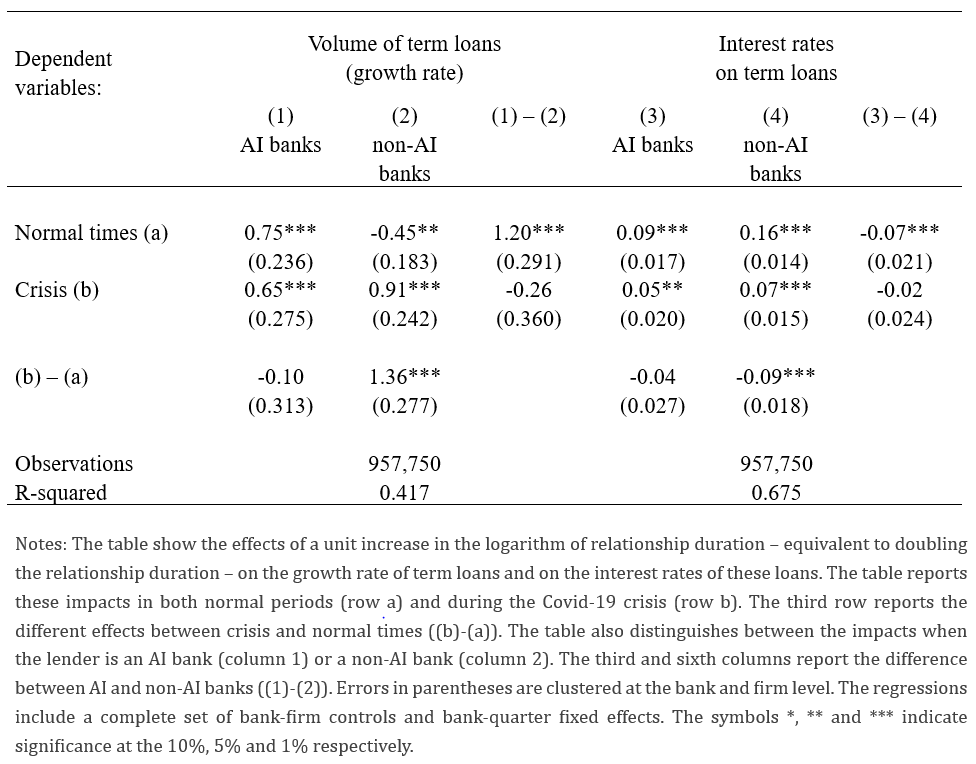

Table 1. Effects of doubling the duration of a credit relationship on credit volumes and interest rates

Table 1 shows the impact of a doubling of the duration of the relationship on the growth rate of loans (columns 1 and 2) and on the cost of term loans (columns 3 and 4), all else being equal. These effects are broken down by type of bank (AI and non-AI) and by period (normal times and crisis). The table shows that banks that adopt AI technologies do not change significantly their lending stance in the two periods, both in terms of volumes of credit and in terms of lending rates: indeed, in columns 1 and 3 the coefficients in normal time are not statistically different from those in crisis time. In contrast, for non-AI banks the differences in the coefficients in columns 2 and 4 are statistically different from zero. These intermediaries tend to increase the effect of relationship duration on the growth rate of loans by 1.36% and to reduce its impact on interest rates by 9 basis points. These results suggest that these credit intermediaries behave in a countercyclical way, extracting rents from borrowers and limiting credit in normal times, while providing higher lending volumes at cheaper prices in crisis times. As a result, while credit conditions offered by AI banks are better than those offered by non-AI banks in normal times, both in terms of volumes and prices, they are not statistically different between the two types of banks during the pandemic period.

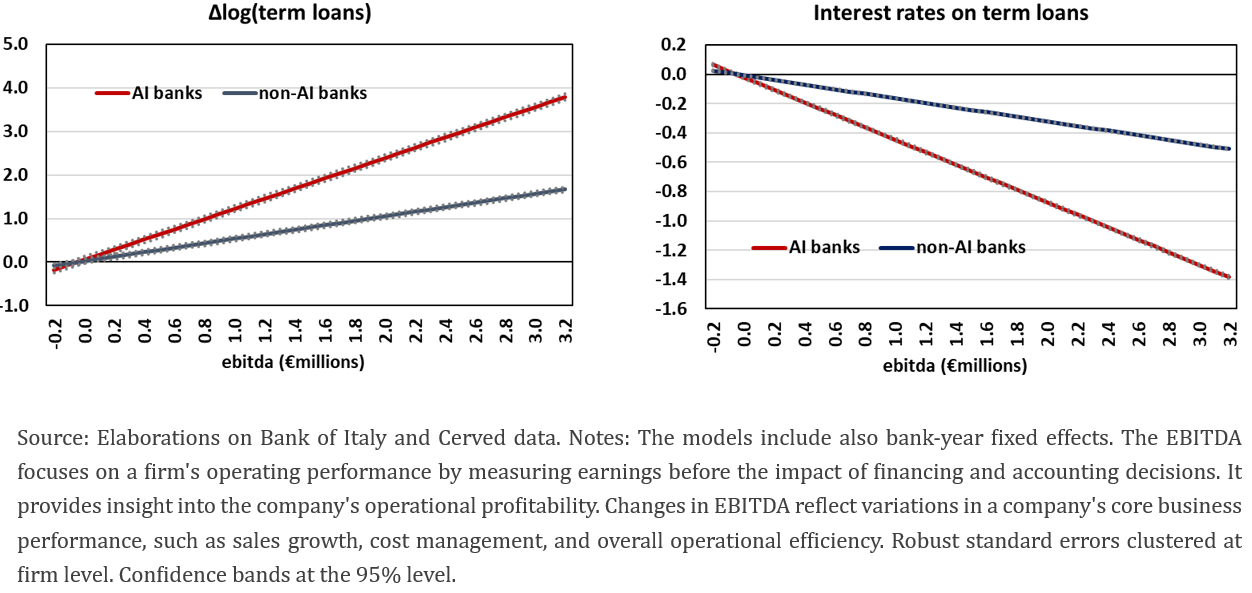

These findings are consistent with non-AI banks behaving akin to traditional relationship banks (Gobbi and Sette, 2015; Bolton et al.,2016; Banerjee et al., 2021). On the other hand, while we document that lending by AI banks to relationship firms tends to be acyclical, we find that it is more reactive to firm-specific conditions (Figure 1). For example, an increase of earnings before interest, taxes, depreciation and amortization (EBITDA) by 1 standard deviation (0.8 million euros), other things being equal, is associated with an increase in the quarterly growth rate of term loans by 1.0% for AI banks and 0.4% for non-AI banks, and a corresponding reduction in the interest rate on term loans by 35 basis points for AI banks and 13 basis points for non-AI banks. These results are in line with a recent strand of literature that analyses the cyclical characteristics of credit provided by large technological companies (so-called big techs) and finds that big tech credit does not respond to changes in collateral values (asset prices) and in GDP at the provincial level, while it responds strongly to changes in firm-specific conditions, such as transaction volumes and profits (Frost et al., 2019; Gambacorta et al., 2023).

Figure 1. Different reactivity of AI and non-AI banks to changes in EBIDTA

Our research makes an additional contribution by identifying how the interaction between AI for credit scoring and relationship lending is associated with firms’ real activity, in terms of investment and employment. We find that during the Covid-19 crisis firms with a longer average relationship with their creditors received more credit and, all else equal, increased investments and employment (Jiménez et al., 2012). However, the use of AI by the firms’ main lender is associated with a dampening of these effects during the crisis, although the magnitude appears to be limited.

During the crisis, a one interquartile-range increase in the credit-weighted relationship duration corresponds, ceteris paribus, to an increase in investments and in employment (proxied by costs) for firms that do not borrow from AI banks. These increases are not negligible, about 24 and 2 percentage points as a share of total assets, respectively.2 The positive effects of relationship lending on investment and employment costs during the crisis are reduced when the firm receives lending also from AI banks. In this case, the increases in investment and employment reach a minimum of 15 and 1 percentage points, for investment and employment respectively, when the firm receives all credit from AI banks. Overall, our results suggest that AI adoption by banks reduces not only the smoothing effects of relationship lending on credit supply during crises, but it also had similar, although somewhat more limited, effects on firms’ investment and employment decisions.

This policy brief examines the interplay between relationship-based lending and AI-enhanced financial intermediation. We find that AI banks mitigate the “rent extraction” problem, which is typical of longer lending relationships in normal times, but they do not improve lending conditions comparable to those of non-AI banks during the Covid-19 crisis. While lending by non-AI banks to relationship firms is countercyclical, lending by AI banks to relationship firms does not seem to be affected by macroeconomic shocks but rather responds strongly to firm-specific conditions. Looking ahead, the increasing use of AI for credit scoring by banks may make aggregate credit supply policies less dependent on general macroeconomic conditions; moreover, they could become less influenced by the “collateral channel” and more responsive to firm-specific conditions such as transaction volumes and profitability, with important and policy-relevant implications for the conduct of monetary policy and financial stability.

Bolton, P., X. Freixas, L. Gambacorta and P.E. Mistrulli, 2016. Relationship and transaction lending in a crisis. Review of Financial Studies, 29(10), 2643-2676.

Beck, T., T. Chen, C. Lin and F. Song, 2016. Financial Innovation: The Bright and the Dark Sides. Journal of Banking & Finance, 72.

Carletti, E., S. Claessens, A. Fatas and X. Vives, 2020. The Bank Business Model in the post-Covid-19 World, The Future of Banking 2, CEPR Press.

Frost, J., L. Gambacorta, Y. Huang, H. S. Shin and P. Zbinden, 2019. BigTech and the changing structure of financial intermediation, Economic Policy, 34(100), 761-799.

Gambacorta, L., Y. Huang, Z. Li, H. Qiu and S. Chen, 2023. Data vs collateral, Review of Finance, 27(2), 369–398.

Jimenez, G, S. Ongena, J.-L. Peydro and J. Saurina, 2012. “Credit Supply and Monetary Policy: Identifying the Bank Balance-Sheet Channel with Loan Applications,” American Economic Review, American Economic Association, 102(5), 2301-2326.

Scott, S., J. Van Reenen and M. Zachariadis, 2017. The Long-Term Effect of Digital Innovation on Bank Performance: An Empirical Study of Swift Adoption in Financial Services, Research Policy, 46(5).

Sette, E and G. Gobbi, 2015. Relationship Lending During a Financial Crisis, Journal of the European Economic Association, 13(3), 453–481.

The adoption of AI does not preclude the use of other means to reduce asymmetric information between lenders and borrowers, such as the collection of soft information through long-term lending relationships. As definition of relationship lending, we use the duration of the bank-firm relation since 2008 (in quarters).

The average of investment share and employment costs are equal to 55 and 23 percentage points of total assets, respectively.