References

Abrams, B., (2006): “How Richard Nixon Pressured Arthur Burns: Evidence from the Nixon Tapes,” Journal of Economic Perspectives, Vol. 20, pp. 177–188.

Baldwin, R., and Weder di Mauro, B., (eds.) (2020), “Mitigating the COVID economic crisis: Act fast and do whatever it takes”, VoxEU.org eBook, CEPR.

Bernanke, B. S., Gertler, M., and Watson, M., (1997), “Systematic Monetary Policy and the Effects of Oil Price Shocks,” Brookings Papers on Economic Activity, Vol. 28, No 1, pp. 91-157.

Blinder, A. S., (2022), A Monetary and Fiscal History of the United States, 1961-2021, Princeton University Press.

Chebanova, M., Faryna, O., and Sheremirov, V. (2023), “The Economic Effects of Military Support for Ukraine: Evidence from Fiscal Multipliers in Donor Countries”, VOXEU column, VoxEU.org, 20 June.

Dao, M., Dizioli, A., Jackson. C., Gourinchas, P., and Leigh, D. (2023), “Unconventional Fiscal Policy in Times of High Inflation,” IMF Working Paper Series, No 178.

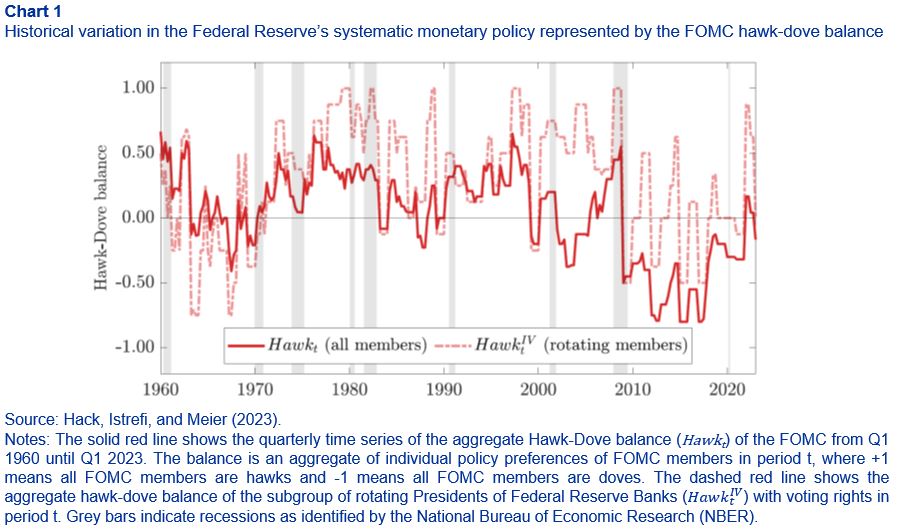

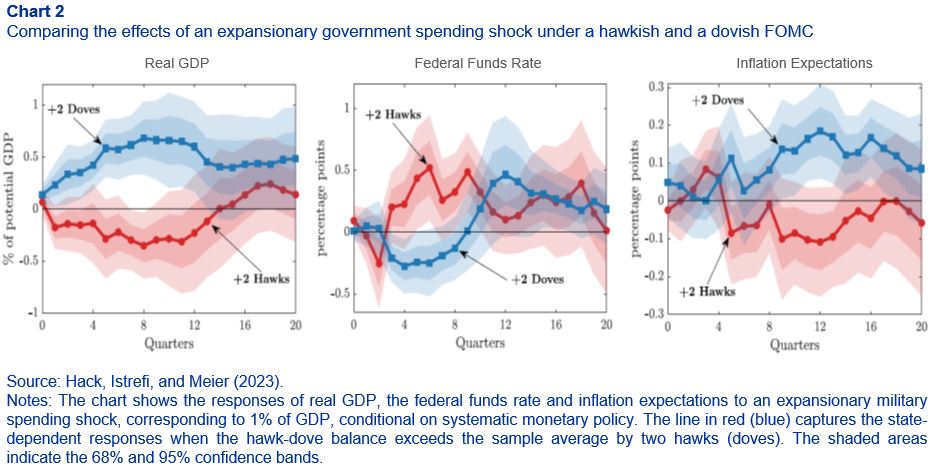

Hack, L., Istrefi, K., and Meier, M. (2023), “Identification of Systematic Monetary Policy”, Working Paper Series, No 2851, ECB, October and CEPR Discussion Paper No. 17999, CEPR Press, Paris & London.

Istrefi, K. (2019), “In Fed Watchers’ Eyes: Hawks, Doves and Monetary Policy,” Working Papers, No 725, Banque de France.

Farhi, E., and Werning, I. (2016), “Fiscal Multipliers: Liquidity Traps and Currency Unions,” Handbook of Macroeconomics, Elsevier, Vol. 2, pp. 2417-2492.

Ramey, V. A. (2011), “Identifying Government Spending Shocks: It’s all in the Timing,” Quarterly Journal of Economics, Vol 126, pp. 1-50.

Ramey, V. A., and Zubairy, S. (2018), “Government Spending Multipliers in Good Times and in Bad: Evidence from U.S. Historical Data,” Journal of Political Economy, Vol. 126, pp. 850-901.

Trebesch, C., Antezza, A., Bushnell, K., Frank, A., & Frank, P., Franz, L., Kharitonov, I., Kumar, B., Rebinskaya, E., and Schramm, S. (2023), “The Ukraine Support Tracker: Which countries help Ukraine and how?,” Kiel Working Papers, No 2218, Kiel Institute for the World Economy (IfW Kiel).

Woodford, M. (2011), “Simple Analytics of the Government Expenditure Multiplier,” American Economic Journal: Macroeconomics, Vol. 3, pp. 1-35.