References

CAT. (2022). Warming Projections Global Update – November 2022. Climate Action Tracker.

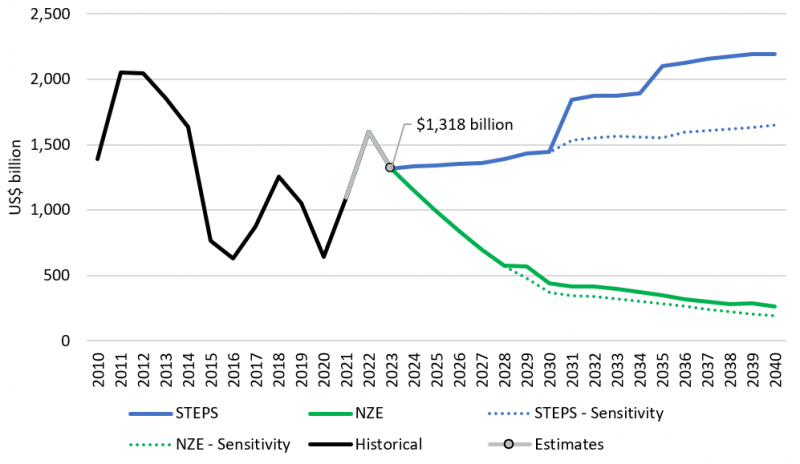

IEA. (2021). Net Zero by 2050 – A Roadmap for the Global Energy Sector. International Energy Agency.

IPCC. (2021). Climate Change 2021 – The Physical Science Basis. United Nations Intergovernmental Panel on Climate Change (IPCC).

IPCC. (2023). Synthesis Report of the IPCC Sixth Assessment Report – Summary for Policymakers. United Nations Intergovernmental Panel on Climate Change (IPCC).

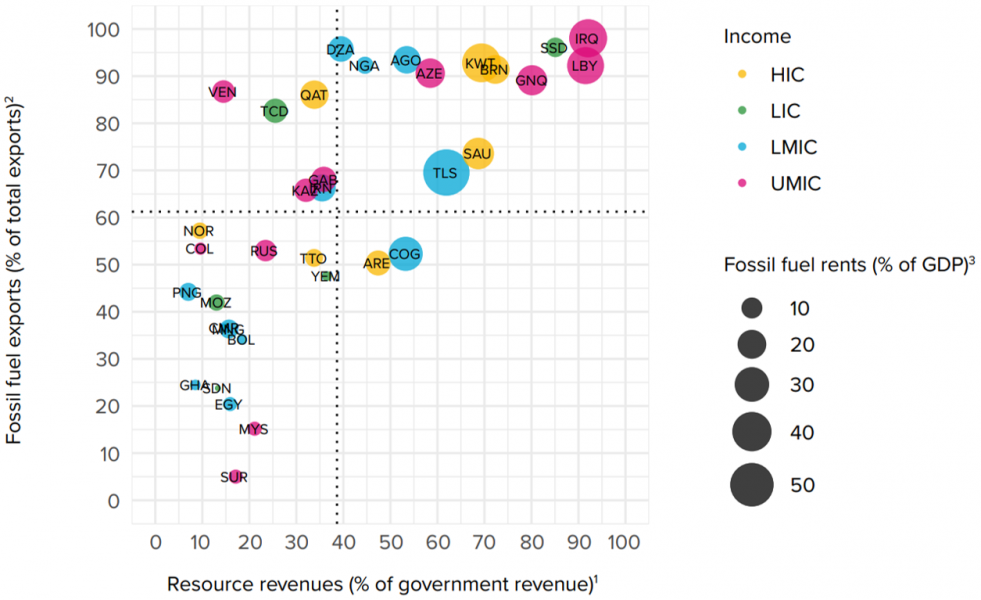

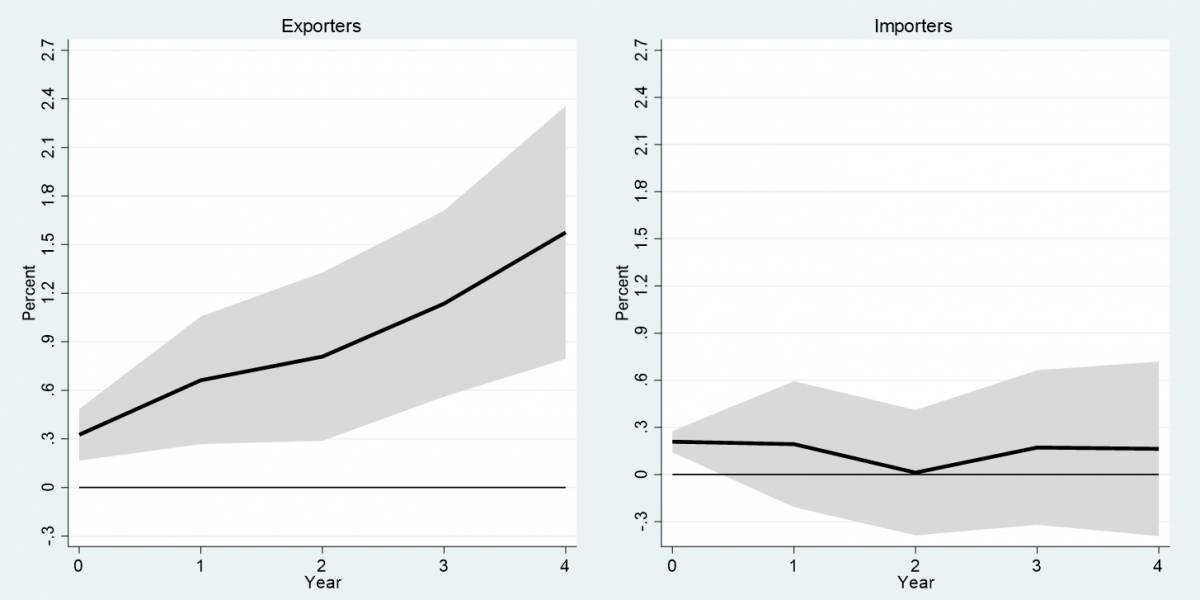

Jensen, L. (2023). Global Decarbonization in Fossil Fuel Export-Dependent Economies – Fiscal and economic transition costs. United Nations Development Programme (UNDP) Development Futures Series Working Paper.

Jordà, O. (2005). Estimation and Inference of Impulse Responses by Local Projections. American Economic Review.

United Nations. (2015). Paris Agreement.