The views expressed are those of the authors and not necessarily those of the institutions the authors are affiliated with. Acknowledgments: We would like to express our gratitude to all presenters and discussants whose contributions made this conference an outstanding academic experience. We are especially grateful to the panelists of the two opening policy sessions. In particular, we thank Governors Peter Kažimír, Klaas Knot, Gediminas Šimkus, Boštjan Vasle, and György Matolcsy Varga for sharing their valuable perspectives on the role of central banks in promoting financial deepening. We also extend our heartfelt thanks to our fabulous keynote speakers, Mariassunta Giannetti and Steven Ongena, for their thought-provoking presentations and engaging discussions. Moreover, we want to thank Karel Lannoo and Apostolos Thomadakis for their valuable input in planning the conference and its topics. Finally, we thank Dragana Popovic for her outstanding contribution in organizing the conference and maintaining its online presence. The conference presentations can be found under the following link.

Abstract

On 1-2 October 2025, ECMI, CEPS, NBS and SUERF1 joined forces for a Research Conference on “Financial Deepening – How Can We Finance Productivity Growth and Transition in Small and Medium-Sized Economies?”, hosted by NBS in Bratislava. The conference brought together policymakers, researchers and practitioners to discuss how Europe can mobilize finance to support productivity growth, innovation, and structural transformation in a changing global environment. It featured two high-level policy panels, one focusing on the role of monetary authorities in fostering stability and financial development, and another addressing market integration, regulation, and access to finance. In addition, two keynote speeches and five thematic sessions provided empirical evidence on banking developments, firms’ financing behavior, and the interaction between finance, climate policy, and geopolitics. This brief distills the main themes and policy messages emerging from the discussions, embedding them in a broader perspective on Europe’s financial integration and its role in supporting sustainable growth. The discussion is framed around three key topics: the need for deepening and diversifying financial systems in Europe, understanding SMEs’ financing needs and constraints, and dealing with green transformation and bolstering geopolitical resilience.

Europe’s financial architecture remains fragmented, with uneven progress in financial deepening and integration across member states. Despite two decades of efforts to build a genuine European capital market, access to finance and the depth of financial markets in Europe is still unsatisfactory, although the situation varies substantially between countries. In particular small and medium-sized economies in Central, Eastern and South Eastern European (CESEE) region continue to rely heavily on bank-based financing. In an environment of fiscal constraints paired with geopolitical tensions, and given the mounting costs of the green transition and improved defense, mobilizing private capital and strengthening financial intermediation has become a key policy challenge.

The 2025 ECMI | CEPS | NBS | SUERF Conference brought together academics, policymakers, and financial practitioners to discuss how financial systems can better support productivity growth, innovation, and transition in small and medium-sized economies, in particular but not exclusively in the CESEE region. The discussions revolved around three key topics: How can financial systems become deeper and more resilient? How can firms, especially SMEs, gain better access to finance for innovation and growth? And how can the region mobilize sufficient capital to navigate climate change and geopolitical tensions?

Deep and diversified financial systems are a prerequisite for economic resilience, convergence among EU member countries and Europe’s global competitiveness. The conference discussions revealed that financial deepening in the CESEE region must be pursued not as an abstract goal but through pragmatic, coordinated reforms that strengthen the link between financial markets and the real economy. Participants agreed that Europe’s financial future depends on a renewed partnership between public institutions and private capital. Neither side can tackle the core challenges alone. Only by combining policy guidance, regulatory simplification, the market’s innovative capacity, and a widespread increase of financial literacy can financial systems become more efficient and inclusive. Building deeper and more diversified financial systems will therefore hinge on targeted reforms. At the same time, closing the persistent financing gap for small and medium-sized firms demands smart frameworks that mobilize private equity and venture capital alongside traditional banking. Finally, to finance the green transition, long-term investment must be channeled towards sustainability and resilience. A core issue lies in ensuring that financial resources reach the areas where they are most productive. This policy brief is therefore organized around three key themes: financial deepening, firm financing, and the global challenges of climate change and geopolitical tensions.

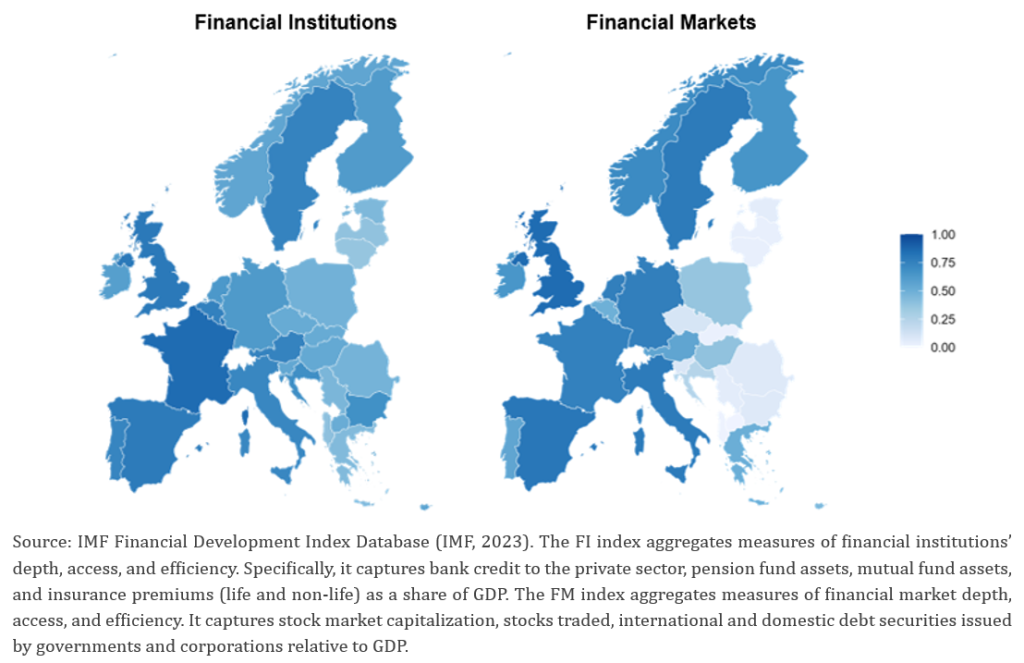

Europe’s financial landscape remains uneven, with a strong banking base but fragmented and shallow capital markets in many parts of the continent. Figure 1 illustrates this pattern. While financial institutions show a relatively balanced development across EU countries, financial markets are markedly less advanced in large parts of Central, Eastern and Southeastern Europe. Despite years of policy efforts to build a Capital Markets Union, Europe’s financial integration remains incomplete, and cross-border investment is still constrained by differing legal frameworks, tax systems, regulatory practices, etc. Panelists highlighted that this fragmentation limits private investments substantially. As a result, financial systems in many member states remain predominantly bank-based. Firms and households are limited in their access to alternative sources of long-term funding and are exposed to cyclical credit conditions.

Figure 1. Financial Institutions and Financial Markets Development across Europe

Financial deepening strengthens resilience as it improves financial access and diversification. Research presented at the conference indicates that when credit growth is broad-based and prudential standards are applied consistently, financial inclusion contributes to systemic stability rather than fragility (Mugrabi et al., 2025). Yet, when expansion is driven by competitive pressure from non-bank intermediaries or weak regulatory oversight, it can increase systemic risk, especially in less diversified markets. The changing geography of banking in Europe also provides an important case of investigation. While bank branch closures may improve efficiency, they may also reinforce regional disparities in access to financial services and financial inclusion (Weinel & Beckmann, 2025). Moreover, specialization patterns within the European banking sector show that narrowly focused lending can dampen monetary policy transmission. This means that certain borrower groups are insulated from changes in interest rates and can access more favorable credit terms at specialized banks (Kuhmann, 2025). The success of financial deepening therefore crucially depends on its structure, inclusiveness, and the institutional environment in which it develops.

Europe’s financial deepening is more likely to advance through coordinated reform and regional experimentation rather than grand institutional design. Policy panel discussions converged on the idea that progress at the EU level remains essential but too slow to meet pressing financing needs. Regional initiatives can therefore act as laboratories for integration, provided they avoid new barriers and remain consistent with the broader European framework. Fintech ecosystems, crowdfunding platforms, and co-funding arrangements between public and private investors were highlighted as promising tools to broaden access to capital and mobilize risk-bearing investment. The presented research illustrated that specialization among financial actors can improve access to favorable conditions for certain borrower groups. Participants emphasized that fragmented corporate and insolvency laws, as well as uneven tax treatment of equity instruments, continue to discourage cross-border activity. Streamlining these frameworks and aligning also non-financial regulation, such as consumer protection will be important. As several speakers underlined, continuous financial development requires a stable policy environment and informed participation. Central banks, while not having a “financial development mandate”, play an important supporting role by promoting financial literacy and analytical capacity. The combined message from policy debate and academic research is clear: Europe’s financial systems will deepen not through expansion alone, but through smarter coordination.

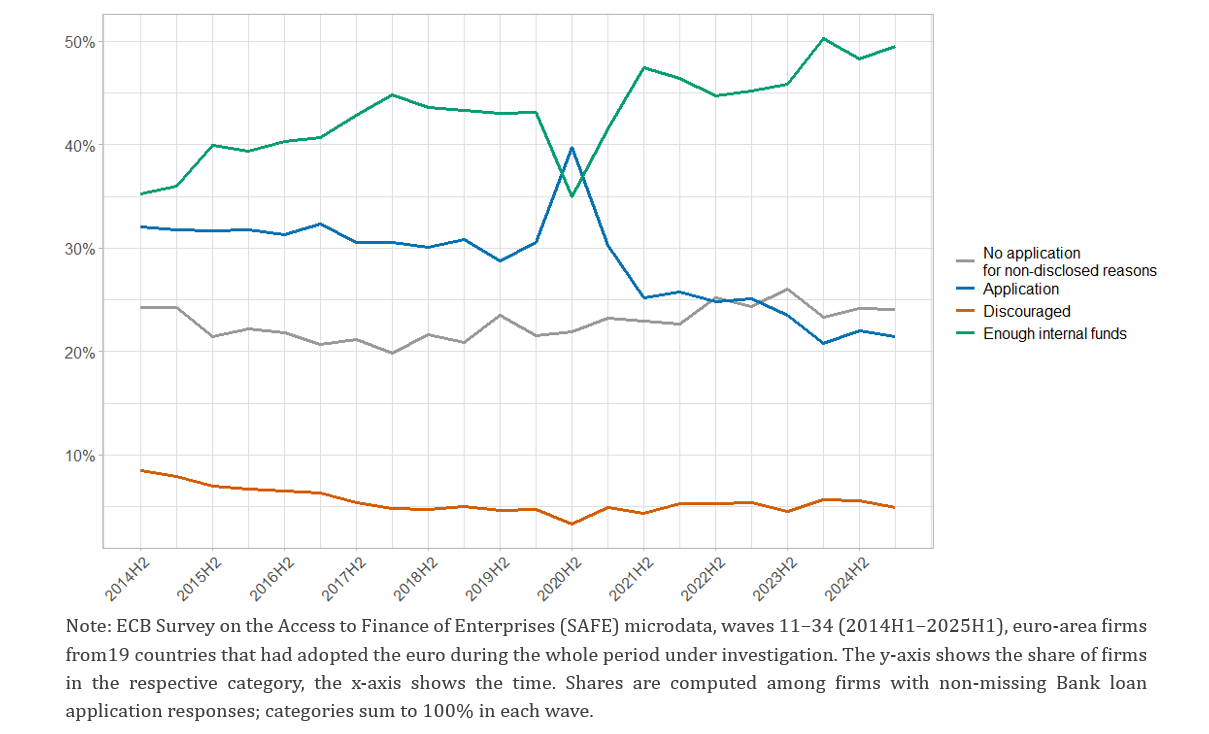

For most European SMEs, access to finance still depends almost exclusively on bank lending and retained earnings. Capital market instruments remain out of reach for the majority of smaller firms, leaving them exposed to changing risk appetites in the banking sector. This structural dependence was underlined by several policy panelists, who noted that different SMEs have different financing needs with traditional financing channels continuing to dominate the landscape. Even as credit conditions have normalized, a large share of SMEs continue to refrain from applying for bank loans and rely on internal funding or remain discouraged, as depicted in Figure 2. Horky et al. (2025) explain this pattern as a rational outcome of firms’ expectations. Their results indicate that smaller, younger, and less profitable firms are especially prone to discouragement, whereas tighter post-pandemic credit standards shifted firms into non-application linked to higher perceived costs and constrained supply. Such behavior implies a self-reinforcing mechanism, weakening the transmission of supportive monetary or policy measures. Anastasiou & Giannoulakis (2025) highlight a complementary mechanism from the macroprudential side. Well-calibrated tightening of regulatory tools can strengthen confidence and stabilize firm investment, especially when liquidity and corporate credit-based measures are used. In this view, predictable and credible financial regulation secures stability and supports firms’ willingness to invest.

Figure 2. Bank Loan Application Behavior over Time

Closing the SME financing gap requires targeted interventions that improve access to finance. Policy panel discussions emphasized that co-funding mechanisms between public and private investors can help to crowd-in risk capital. Also here, regulatory simplification such as harmonized insolvency frameworks would reduce uncertainty for lenders and borrowers alike. Beyond broad market reforms, narrowly designed policies on a regional level can be highly effective. Ferrando & Mulier (2022) show that the Belgian law concerning SME financing, addressing discouraged borrowers by reducing firms’ loan application costs, improved financing access of SMEs. Similar approaches could be potentially replicated across Europe to lower informational barriers without imposing excessive administrative burdens. In parallel, the expansion of venture-capital and crowdfunding initiatives must complement bank lending and widen the spectrum of available financing sources, especially for high-growth, high-risk startups.

Global challenges such as climate change and rising geopolitical tensions are redefining how finance can and needs to support Europe’s sustainable economic growth and economic resilience. Achieving climate neutrality requires an unprecedented reallocation of capital toward sustainable technologies. At the same time, we need to ensure that the transition remains socially and economically balanced. Meanwhile, heightened geopolitical uncertainty and the reorganization of global value chains have revived the question of how to safeguard Europe’s strategic autonomy. These transformations place financial systems at the center of adaptation. Deep and liquid capital markets are essential to mobilize long-term private investment. Sound fiscal and prudential frameworks must contain the risks that come with large-scale structural changes. In this environment, the ability of financial institutions and markets to direct savings efficiently toward productive and sustainable uses will determine Europe’s capacity to withstand external shocks.

Climate change and geopolitical fragmentation are reshaping the risk landscape for European finance. Conference discussions revealed that environmental and geopolitical disruptions expose how financial structures shape economic resilience. Financial deepening tends to raise the carbon intensity of economies as banks prefer financing investments in traditional, more carbon-intensive investments and consumption (Fisera et al., 2025). Stronger regulation, a rules-based environment, and more market-based finance mitigate this effect by incentivizing greener investment. On the regulatory side, borrower-based measures (BBMs) can support energy-efficient housing if designed to reflect lower risk and higher collateral value from renovation (Monnin et al., 2025). These findings resonated with policy panel calls for frameworks that align prudential and sustainability goals, rather than treating them as trade-offs. However, such frameworks must be kept simple not to increase regulatory complexity. On the geopolitical side, Fecht et al. (2025) and Sanders & Vander Vennet (2025) illustrated how financial globalization amplifies vulnerability to geopolitical shocks. Euro-area banks with higher exposure to Russia and Belarus experienced tighter refinancing conditions and reduced lending. They also showed that the monetary tightening by the ECB led to higher funding costs for these banks, leading to even lower credit growth. Such risk exposures can depress investment, especially in regionally closer CESEE countries, at a time when Europe needs deeper capital mobility.

Financing productivity growth and transition in small and medium-sized economies requires a deeper and more unified European financial system. The conference made clear that no European country can meet the financing demands of structural transformation in isolation. Even the largest economies depend on cross-border capital flows, integrated markets and coordinated regulation to mobilize the scale of investment needed. Participants agreed that Europe’s financial landscape must evolve from a collection of nationally segmented systems into a genuinely interconnected network that can channel funds efficiently across borders. Throughout the discussions, the three topics of this policy brief where highlighted as major challenges along which Europe’s financial future is being shaped.

Completing Europe’s financial integration requires credible risk-sharing mechanisms. Promoting capital market development and encouraging cross-border capital flows are essential steps toward a more integrated financial system. However, the absence of a common deposit insurance scheme and a truly aligned fiscal framework continues to limit depth of financial integration. As long as the costs of potential bank failures and financial distress are borne primarily at the national level, the incentives for full cross-border integration remain muted. This asymmetry also weakens public trust in the resilience of the system. A genuine European Savings and Investment Union will therefore require deeper, more diversified markets, but also the establishment of common risk-sharing mechanisms.

Achieving concrete results requires a comprehensive yet step-wise approach. The conference made clear that Europe’s financial integration is progressing too slowly to deliver the scale of investment needed. Regional cooperation (‘coalitions of the willing’) can help bridge this gap. Aligning legal frameworks, such as insolvency rules, collateral requirements, and the treatment of collateral, would reduce uncertainty for investors and ease cross-border financing. Policy efforts should also focus on easing the financing constraints of smaller firms through targeted measures that improve credit access and transparency. Supporting fintech initiatives and crowdfunding platforms can further diversify funding channels and connect firms with new investor groups. Over time, Europe must also mobilize its large pool of domestic savings for productive purposes. Strengthening pension systems and long-term investment vehicles would help channel these resources to address the big challenges Europe is facing.

Delivering on Europe’s financial transformation will require a clarification of roles and shared responsibility. Central banks can support the process through research-based policy-relevant analysis, data provision, financial stability oversight and support for financial literacy, but they do not have a “financial development mandate”. The responsibility for advancing integration and harmonization of Europe’s financial market lies with political decision-makers who must find the necessary unity and compromises across jurisdictions. Ultimately, a more resilient and inclusive financial system also depends on citizens’ ability to understand and embrace it. Strengthening financial literacy is thus essential to ensure that people can participate in, and benefit from, an evolving financial landscape.

Anastasiou, D., & Giannoulakis, S. (2025). From Financial Stability to Real Investment: The Confidence Channel of Macroprudential Policy. Presentation given at ECMI | NBS | CEPS | SUERF Research Conference “Financial deepening – how can we finance productivity growth and transition in small and medium sized economies?”, Bratislava, 1–2 October 2025.

Fecht, F., Imbierowicz, B., & Greppmair, S. (2025). A Geopolitical Shock to Bank Assets and Monetary Policy Transmission. Presentation given at ECMI | NBS | CEPS | SUERF Research Conference “Financial deepening – how can we finance productivity growth and transition in small and medium sized economies?”, Bratislava, 1–2 October 2025.

Ferrando, A., & Mulier, K. (2022). The real effects of credit constraints: Evidence from discouraged borrowers. Journal of Corporate Finance, 73, 102171.

Fišera, B., Melecky, M., & Singer, D. (2025). Financial Deepening and Carbon Emissions Intensity: Evidence from a Global Sample of Countries. Presentation given at ECMI | NBS | CEPS | SUERF Research Conference “Financial deepening – how can we finance productivity growth and transition in small and medium sized economies?”, Bratislava, 1–2 October 2025.

Horky, F., Klacso, J., Martin, R., & Fidrmuc, J. (2025). Bank Loan Application and Access to Finance by European SMEs. Presentation given at ECMI | NBS | CEPS | SUERF Research Conference “Financial deepening – how can we finance productivity growth and transition in small and medium sized economies?”, Bratislava, 1–2 October 2025.

Monin, P., Banai, A., Bojare, K., Klacso, J., Martin, R., & Szakacs, J. (2025). Upgrading Housing: The Potential and Limits of Borrower-Based Measures. Presentation given at ECMI | NBS | CEPS | SUERF Research Conference “Financial deepening – how can we finance productivity growth and transition in small and medium sized economies?”, Bratislava, 1–2 October 2025.

Kuhmann, K. (2025). Bank Specialization and the Transmission of Euro Area Monetary Policy. Presentation given at ECMI | NBS | CEPS | SUERF Research Conference “Financial deepening – how can we finance productivity growth and transition in small and medium sized economies?”, Bratislava, 1–2 October 2025.

IMF (2023). Financial development index database. International Monetary Fund.

Mugrabi, F., Ben Naceur, S., & Candelon, B. (2025). Systemic Implications of Financial Inclusion. Presentation given at ECMI | NBS | CEPS | SUERF Research Conference “Financial deepening – how can we finance productivity growth and transition in small and medium sized economies?”, Bratislava, 1–2 October 2025.

Sanders, E., & Vander Vennet, R. (2025). Geopolitical Risk, Cost of Equity, and Lending: Evidence from the Ukrainian War. Presentation given at ECMI | NBS | CEPS | SUERF Research Conference “Financial deepening – how can we finance productivity growth and transition in small and medium sized economies?”, Bratislava, 1–2 October 2025.

Weinel, J. L., Beckmann, E., & Allinger, K. (2025). The Changing Geography of Banking in CESEE: Branch Openings and Closures. Presentation given at ECMI | NBS | CEPS | SUERF Research Conference “Financial deepening – how can we finance productivity growth and transition in small and medium sized economies?”, Bratislava, 1–2 October 2025.

European Capital Markets Initiative (ECMI), Centre for European Policy Studies (CEPS), Narodna Banka Slovenska / National Bank of Slovakia (NBS) and European Money and Finance Forum (SUERF).