Authors’ note: The views expressed are those of the authors and do not necessarily reflect those of the Banque de France or the Banca d’Italia.

In recent years, most advanced economies have adopted or tightened their existing foreign investment screening mechanisms (ISMs), which empower national authorities to restrict foreign takeovers in strategic sectors. In 2019, the EU adopted a regional cooperation framework on FDI screening. We fill in a gap in literature by developing a synthetic index suitable for cross-country comparisons. We analyze which countries have the strictest regimes and document how macroeconomic characteristics and geopolitical factors shape the restrictiveness of national ISMs. To assess the impact of screening on transactions, we build a comprehensive database mapping the outcome of screening decisions. Although a large number of transactions is subject to review, the number of blocked transactions is limited, suggesting that ISMs strike a balance between openness to FDI and protection of national interests.

Over the past decade, most advanced economies have adopted or tightened their existing investment screening mechanisms (ISMs), which empower national authorities to review, and potentially condition or prohibit, acquisitions potentially threatening national security.

In assessing the potential risks posed by an FDI, most countries focus on two factors: i) the effects on strategic sectors (eg. critical infrastructure, critical technologies, supply of critical inputs, access to sensitive information, freedom and pluralism of the media…) and ii) whether the foreign investor is controlled by the government of a third country.

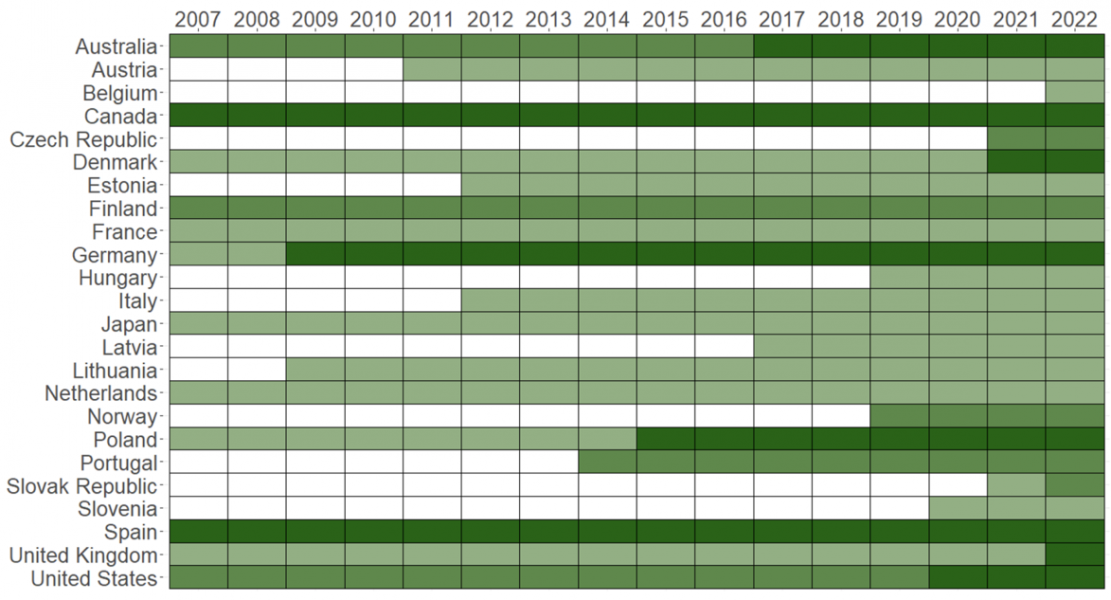

Figure 1 shows that an increasing number of advanced economies, which have traditionally been open to foreign investments, adopted or overhauled their existing ISMs from the early 2010s onward. Alongside these national developments, in 2019 the EU adopted a common FDI screening framework aimed at enhancing cooperation among country members while fostering a single foreign acquisition market.

Literature focuses on ISMs as a response to the rise of Chinese outward investment (Eichenauer et al., 2021), national security threats in Central and Eastern European countries from Russia (Danzman and Meunier, 2023a) and technology transfer associated with foreign acquisitions. For instance, Chan and Meunier (2022) show that EU countries with higher technological levels were more supportive of FDI screening due to concerns over unreciprocated technological transfer. More recently, the Covid-19 pandemic strengthened governments’ commitment to preventing the sale of strategic domestic assets to foreign investors (Evenett, 2021).

Figure 1: The rise of investment screening mechanisms in advanced economies

Note: Most countries that did not have an ISM (white tiles) have adopted such mechanisms over the past decade (green). A number of countries have shifted from sectoral mechanisms (where the government has the authority to review a list of sectors, shown in light green) to a cross-sectoral (green) or mixed mechanism (dark green), where the government can review investments in any sector and subject a specific list of sectors to stricter review requirements.

Source: PRISM database; © 2023b; Sarah Bauerle and Sophie Meunier.

Assessing the impact of ISMs requires a major effort of data collection. Despite the expansion of the literature on ISMs, we are unaware of the existence of any indicator suitable for cross-country comparisons. Existing indexes on capital controls developed in the literature (e.g. the OECD FDI Regulatory Restrictiveness Index) exclude restrictions imposed for security reasons, which are at the core of contemporary investment screening mechanisms.

We make several contributions to the related literature:

The identification of potentially threatening transactions relies on combinations of several criteria and parameters. The ISM restrictiveness index covers five dimensions reflecting the restrictiveness of national laws:

The ISM restrictiveness index ranges from zero (relatively less restrictive ISM) to one (relatively more restrictive ISM). The index highlights several findings:

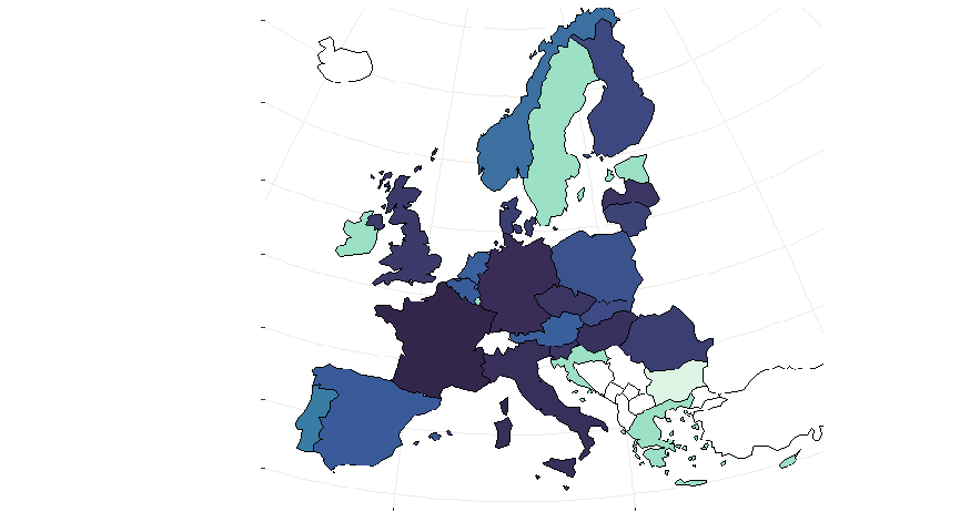

Figure 2: Restrictiveness and heterogeneity of national investment screening mechanisms

Note: Dark (light) blue: relatively more (less) restrictive ISM. Green: consultative or legislative process expected to result in the adoption of a new mechanism.

Assessing the impact of FDI screening on transactions is challenging for a number of reasons, including the lack of publicly available information. To assess the impact of FDI screening on planned transactions, we analyze the outcome of screening decisions. We focus on national governments’ statistics on foreign investment applications and screened foreign investments. We highlight several findings:

We make several contributions to the literature.

Determining whether the recent tightening of ISMs has affected foreign investment flows is challenging. Indeed, foreign investment screening is one of many factors that could influence FDI inflows. Literature suggests that the key determinants of FDI flows are sound macroeconomic conditions (investment returns, access to markets…), together with institutional factors (good governance, low sovereign risk and a stable legal system). In this respect, transparent foreign investment screening regulations might improve the perceived transparency of government regulations.

Bailey, M, A Strezhnev and E Voeten (2017), “Estimating dynamic state preferences from United nations voting data”, Journal of Conflict Resolution 61(2): 430–456.

Bauerle Danzman, S. B. and S. Meunier (2023a), “If you can’t beat them, join them. The rise of investment screening in Europe in comparative perspective”, Revue des affaires européennes, (4):649–656.

Bauerle Danzman, S and S Meunier (2023b), “Naïve no more: Foreign Direct Investment screening in the European Union”, Global Policy (00):1-14.

Bencivelli, L., V. Faubert, F. Le Gallo and P. Négrin (2023), “Who’s afraid of foreign investment screening”, Banque de France Working Paper No. 2023/927.

Chan, Z. and S. Meunier (2022), “Behind the Screen: Understanding National Support for a Foreign Investment Screening Mechanism in the European Union”, The Review of International Organizations 17(3): 309-322.

Eichenauer, V., M. Dorsc and F. Wang (2021), “Investment Screening Mechanisms: the Trend to Control Inward Foreign Investment”, EconPol Policy Reports 34(4).

Evenett, S. J. (2021), “What caused the resurgence in FDI screening”, SUERF Policy Note 240: 1–20.

Garcia-Herrero, A and R Schindowski (2023), “Global trends in countries’ perceptions of the belt and road initiative”, technical report, Bruegel Working Paper.