The results, as well as a more detailed methodology were published in NBS Working Paper No. 3/2022 and OeNB Working Paper No. 243 (Ciaian et al., 2022a, b). The authors are solely responsible for the content of the paper. The views expressed are purely those of the authors and may not in any circumstances be regarded as stating an official position of the European Commission, National Bank of Slovakia, and the Oesterreichische Nationalbank. Any remaining errors are solely ours.

Recent data show that crypto-assets increasingly become part of retail investors’ portfolios. Therefore, it is important to understand what groups are interested in these type of assets and what determines the demand for them. Based on individual finances data from the Austrian Financial Literacy Survey, we seek to understand the impact of non-pecuniary factors, i.e., environmental, and social (E&S) preferences on the financial behaviour of retail investors. The results indicate that, on average, individuals with stronger E&S preferences have a higher tendency to invest in crypto-assets, rather than investors who show lower E&S engagement.

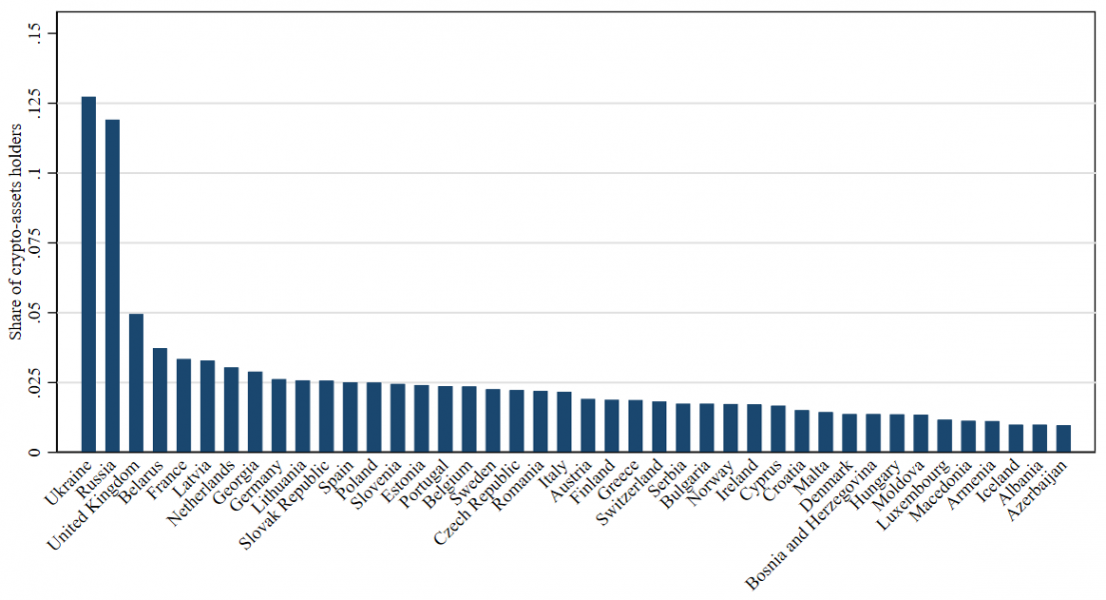

While household asset portfolios are mostly dominated by real estate and to a lesser extent by financial instruments such as shares, pension funds, or bonds, it appears that non-standard financial instruments, such as crypto-assets have become an increasingly popular investment vehicle (see Figure 1), even among small retail investors.

Figure 1: Share of crypto-assets owners across countries

Source: Based on data from https://triple-a.io/crypto-ownership

A block-chain, which represents the underlying technology of crypto-assets, contains a large amount of information in a digital format and makes it available to researchers in adjacent real time. However, the block-chain provides a limited view on the socio-economic and demographic characteristics of crypto-asset owners, because in most cases the owners of crypto-assets are not known. Hence, previous empirical research on crypto-assets owners typically uses representative survey data to get a better understanding of what determines household demand for crypto-assets (see, e.g., Fujiki, 2021; Stix, 2021, Bonaparte 2022). Generally, younger individuals / households who are more educated, financially literate, self-confident, risk-loving (males) tend to hold crypto-assets more frequently.

However, recent theoretical (e.g., Ahmed et al., 2021; Pastor et al., 2021) and empirical literature (e.g., Anderson and Robinson, 2021) stresses the fact, that investors invest not only because of (higher) expected returns of assets, but also due the non-pecuniary considerations, such as environmental and ethical.

Controversies surrounding the environmental footprint of certain crypto-asset classes and illegal activities (e.g., Krause and Tolaymat, 2018; Foley et al., 2019), but also growth of sustainable and inclusive cryptocurrencies (e.g., Chapron, 2017) offer a potentially informative object of inquiry on uncovering information about the perceived ESG footprint of crypto-assets by retail investors.

We use unique data on individual finances from the Austrian Survey of Financial Literacy (ASFL) for the year 2019 – the Austrian contribution to the OECD/INFE (International Network for Financial Education) survey on the financial literacy of adults. Generally, OECD/INFE contains questions about financial knowledge, attitudes, and behaviours that the OECD uses to calculate the respective financial literacy scores and various other indicators (see OECD, 2018). The ASFL survey was conducted with 1,418 respondents through computer-assisted personal interviews (CAPIs) between April and May 2019. After verifying individual responses and cleaning the data, the final working sample consists of 1,016 individual-level observations.

In our study we estimate the relationship between stated investors’ E&S preferences and the probability that individuals hold crypto-assets (non-pecuniary effect hypothesis), which we compare to traditional financial asset holdings. In particular, we estimate a linear probability model and probit separately for each of the three asset classes (crypto-assets, bonds, shares) using the ASFL data. In addition to our main explanatory variables of interest, we can control for a large set of variables that have been identified in the previous research as important drivers of individual financial choices such as financial literacy, self-confidence, risk aversion, income, age, education, gender, etc. To reduce the bias due to possible endogeneity of E&S preferences, we employ a version of 2SLS instrumental variables framework proposed by Lewbel (2012).

Our results show that around 3% of the Austrian adult population holds crypto-assets (a result in line with Figure 1). Results on the determinants of crypto-assets are conventional: individuals with higher levels of financial literacy, higher self-confidence and higher risk tolerance are more likely to participate in cryptocurrency markets. A new discovery is the significance of non-pecuniary factors, especially environmental and social preferences (Environmental and Social, E&S)1, for the financial behaviour of small investors. We found that E&S preferences could explain the different nature of individuals’ investment in crypto-assets, whereas additionally considering the influence of investors’ relevant individual characteristics. We also compare our results with the estimates on the effects of E&S preferences on other types of financial assets (e.g., stocks and bonds). For all considered assets (i.e., cryptos, stocks and bonds) we do not account to what extent they are either green (in other words sustainable) or socially responsible.

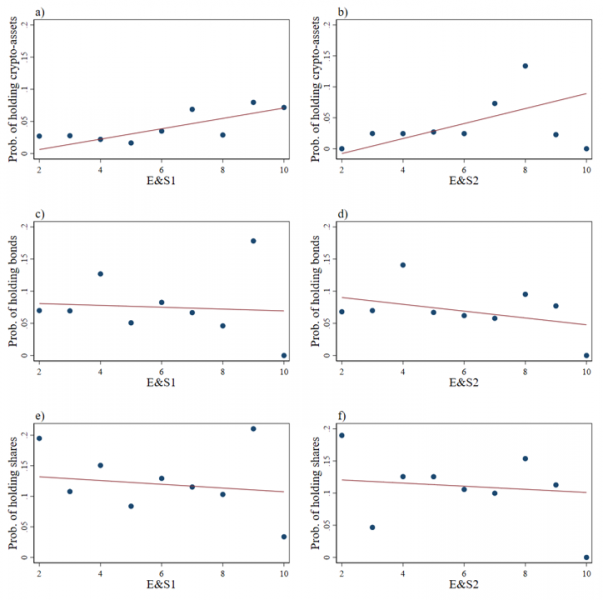

Our results suggest that, on average, individuals with stronger E&S preferences tend to invest in crypto-assets more frequently, rather than investors who show lower E&S engagement. On the other hand, E&S preferences do not provide any informational value for investing in stocks or bonds (Figure 2). In the context of crypto-assets’ possible use for illegal activities, or their negative environmental impacts due to deployed energy-intensive crypto mining (“Proof-of-Work” consensus mechanism), the connection of E&S preferences with a higher probability of holding crypto-assets may seem surprising.

Figure 2: Correlation between environmental and social preferences and ownership of financial assets

Notes: the graph shows the estimated relationship between investors’ E&S preferences and the probability of holding various assets. Asset holding probabilities are shown on the vertical axis, while E&S scores are shown on the horizontal axis. We measure environmental preferences (E) through the survey question: “I think it is more important for investors to choose companies that make a profit than to choose companies that want to minimize their impact on the environment.” We measure social preferences (S1) through the survey question: “I prefer to use financial companies that have a strong ethical stance.” Finally, we measure alternative social preferences (S2) through the survey question: “I am honest, even if it puts me at a financial disadvantage.” Answers to E, S1 and S2 questions take values from 1 to 5, with 5 meaning the strongest environmental / social attitude. The final E&S1 and E&S2 scores are calculated as the sums of E, S1 and S2. Source: ASFL 2019.

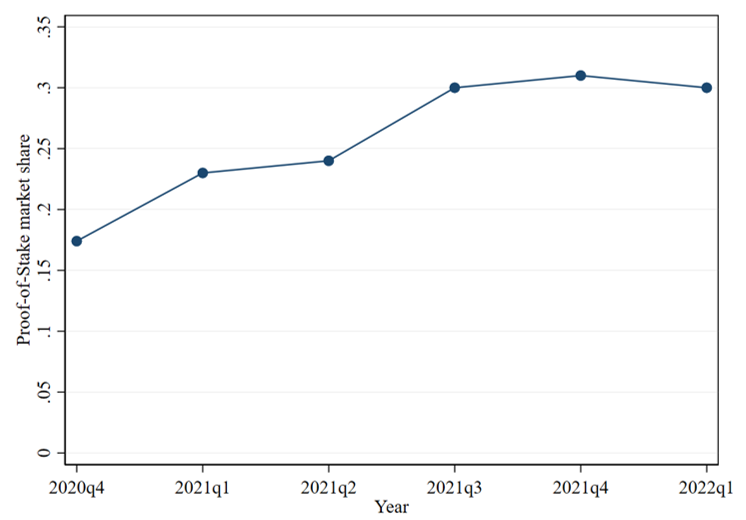

Previous literature on individuals’ ESG attitudes and financial portfolio choices could provide some explanation. For example, corresponded socially “desirable” preferences do not always coincide with household/individual preferences when choosing an investment portfolio (e.g., Anderson and Robinson, 2021). On the supply side, this result could be explained by the growing development of the “Proof-of-Stake” crypto-asset consensus mechanism (Figure 3), which is explicitly designed to be more energy efficient and have a minimal impact on the environment, while still generating consensus within blockchains protocols (see Saleh, 2021).

Figure 3: Development of the market share of the “Proof-of-Stake” consensus mechanism

Source: Based on https://staking.staked.us/state-of-staking.

With these findings, we contribute to expanding the knowledge about the connection between revealed E&S preferences and holding financial assets. Perceived “E&S Footprint” is clearly an important factor in crypto-asset investment decisions made by retail investors. Furthermore, our results point to the need of increasing the collection of information on crypto-assets, for example in common household finance surveys.

This area requires further research using larger data sets on household finances, so that a more thorough socio-economic (causal) analysis of the relationship between ESG preferences and investing in various financial instruments, including other non-traditional financial market products, could be made. For this reason, we consider that, it is necessary to consistently include questions about crypto-assets in regular surveys about household finances. Data from representative surveys (which include extensive information on crypto-asset holdings along with the rest of household assets), as well as a wide variety of socio-economic characteristics and preferences can provide a deeper and wider understanding of household portfolio choices. The knowledge based on micro-data could also be valuable for observing the financial behaviour of households and the emergence of possible risks for financial stability.

Ahmed, M. F., Gao, Y., and Satchell, S. (2021). Modeling demand for ESG. The European Journal of Finance, 27(16), 1669-1683.

Anderson, A., Robinson, D.T. (2021): Financial Literacy in the Age of Green Investment. Review of Finance, 63,1572–3097.

Chapron, G. (2017). The environment needs cryptogovernance. Nature, 545(7655), 403-405.

Ciaian, P., Cupak, A., Fessler, P., and Kancs, A. (2022a). Environmental and Social Preferences and Investments in Crypto-Assets. National Bank of Slovakia, Working Paper No. 3/2022.

Ciaian, P., Cupak, A., Fessler, P., and Kancs, A. (2022b). Environmental-Social-Governance Preferences and Investments in Crypto-Assets. Oesterreichische Nationalbank, Working Paper No. 243.

Foley, S., Karlsen, J. R., & Putniņš, T. J. (2019). Sex, drugs, and bitcoin: How much illegal activity is financed through cryptocurrencies?. The Review of Financial Studies, 32(5), 1798-1853.

Fujiki, H. (2021). Crypto asset ownership, financial literacy, and investment experience. Applied Economics, 53(39), 4560-4581.

Krause, M. J., & Tolaymat, T. (2018). Quantification of energy and carbon costs for mining cryptocurrencies. Nature Sustainability, 1(11), 711-718.

Lewbel, A. (2012). Using heteroscedasticity to identify and estimate mismeasured and endogenous regressor models. Journal of Business & Economic Statistics, 30(1), 67-80.

OECD (2018): OECD/INFE toolkit for measuring financial literacy and financial inclusion. Tech. rep., OECD Publishing, Paris.

Pastor, L., Stambaugh, R. F., and Taylor, L. A. (2021). Sustainable investing in equilibrium. Journal of Financial Economics, 142(2), 550-571.

Saleh, F. (2021). Blockchain without waste: Proof-of-stake. The Review of Financial Studies, 34(3), 1156-1190.

Stix, H. (2021). Ownership and purchase intention of crypto-assets: survey results. Empirica, 48(1), 65-99.

Through the paper we use term “E&S” since we can observe and measure only the environmental (E) and social (S) attitudes of individuals.