The opinions expressed in this article are the sole responsibility of the authors and should not be interpreted as reflecting the views of Sveriges Riksbank or the ECB.

See also Furlanetto and Robstad (2019) that finds that immigration is an important driver of aggregate fluctuations.

See Brell et al. (2020) and Busch et al. (2020).

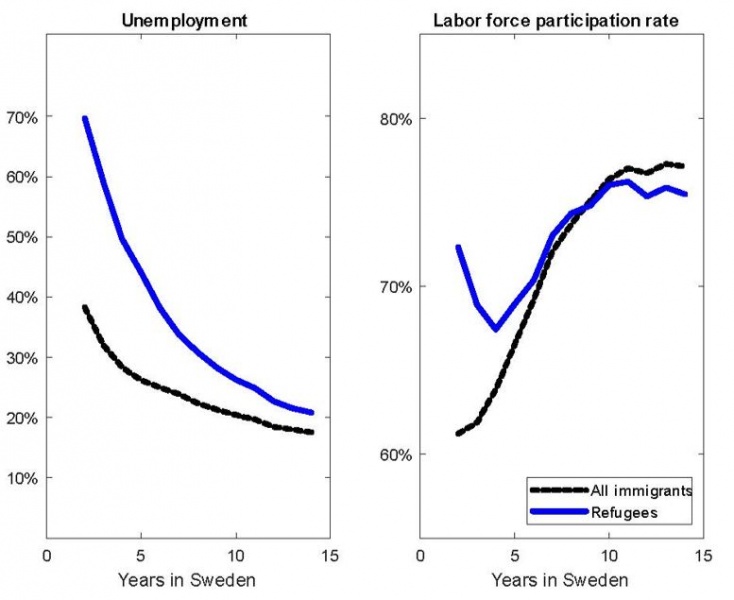

The initial fall in LFP for refugees is due to their substantial participation in labor market programs (and thereby classified as unemployed and in the labor force) right after residence is established.

The assumption that economic immigrants’ productivity is equal to natives’ is motivated by the immigration into Sweden during the post-war period up to the 1970’s. Ekberg (2009) describes data for wages and the employment rate in 1978 for immigrants, controlling for age and sex, and finds that the average wage for immigrants was 98% of the native wage and the employment rate was the same as for natives. This indicates that immigrants were fairly similar to natives in that period, when economic migration dominated.