This policy brief is based on BIS Working Paper, No 1257. The views do not necessarily represent those of the European Central Bank or the Bank for International Settlements.

Abstract

We investigate the interaction between monetary and macroprudential policy in shaping banks’ lending and risk-taking behaviour. We use a rich euro area credit registry dataset and exploit a unique setting that combines a sharp monetary tightening with a wave of macroprudential tightening initiated before. While, on average, increases in required capital buffers did not significantly reduce lending during the monetary tightening, banks that were more likely to become capital-constrained reduced lending by about 1.3-1.8 percentage points more for existing credit relationships. Furthermore, new bank-firm relationships were 2.5-4.4 percentage points less likely to be established, compared to better-capitalized banks. These constrained banks were also more reluctant to pass higher policy interest rate on to their borrowers and took fewer risks, lowering the LTV ratio more for newly originated loans, and relying less on risky collateral, such as commercial real estate. Our findings underscore the importance of accounting for policy and bank heterogeneity when calibrating monetary and macroprudential policies.

The interaction between monetary and macroprudential policy has become a central topic in both policy debates and academic research. According to the Tinbergen principle, each policy instrument should target the specific objective it addresses most effectively: monetary policy aims to ensure price and macroeconomic stability, while macroprudential policy is geared towards safeguarding financial stability. In theory, even when these policies interact or produce spillovers, they can be independently adjusted to achieve their respective goals. In practice, however, market imperfections and institutional frictions often mean that the two policies are not fully separable. Their interaction may produce reinforcing or offsetting effects, requiring careful coordination and recalibration. Despite its importance, this area remains insufficiently explored with few empirical studies.

Based on Behn et al. (2025), this policy brief investigates the combined effects of monetary and macroprudential policy tightening on bank lending and risk-taking using granular micro-data from AnaCredit, the euro area credit register. The analysis merges these data with supervisory and financial information for around 2,000 banks, including detailed information on bank-specific capital requirements. We explore the effects on banks’ lending and risk-taking by leveraging a unique empirical setting, combining a significant wave of macroprudential policy tightening across euro area countries in the form of higher bank capital buffer requirements that occurred before a sharp monetary policy tightening with the steepest interest rate increase ever for the euro area. We then analyse how these macroprudential adjustments affected the bank lending and risk-taking channels of monetary policy transmission, and whether the effect differed across banks.

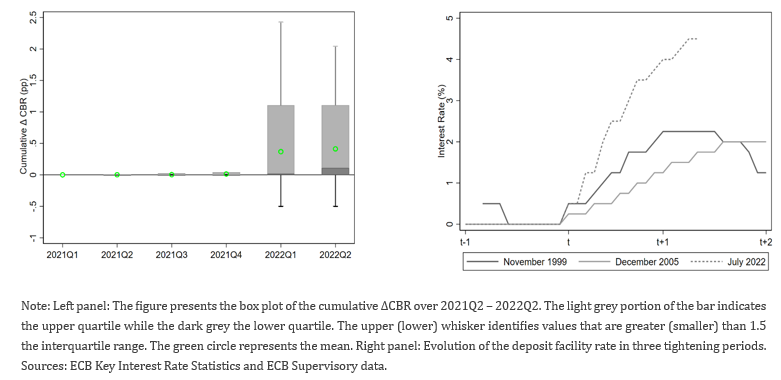

The tightening of bank capital buffer requirements after the pandemic reflected a paradigm shift in the conduct of macroprudential policy. Many countries increased bank capital buffer requirements not in response to changes in the business or financial cycle – as envisioned when the policy was originally designed, but rather mainly as a precaution against the effects of exogenous shocks (such as a pandemic or war) that can occur at any stage of the cycle (see Behn et al. 2024). Figure 1 (left) shows the cumulative change in the announced combined buffer requirement before the monetary policy tightening. It shows that the bulk of the increase – approximately 40 basis points on average – occurred in the first and second quarter of 2022, thus immediately before the start of the monetary policy tightening. The monetary policy tightening took place from July 2022 to September 2023, when the European Central Bank raised its main policy rate by more than 400 basis points, the largest increase in policy rates since the creation of the euro (Figure 1, right). The jump in rates was mostly unanticipated, particularly in its magnitude. Since this surprisingly fast tightening occurred immediately after a significant wave of macroprudential policy tightening, it provides a unique empirical setting, as macroprudential authorities did not anticipate these rate hikes when the buffer increases were calibrated and announced.

Figure 1. Evolution of capital buffer requirements and key policy rates across different monetary policy tightening cycles

Studying both intensive and extensive lending margins, as well as measures of the riskiness of (new) loans, Behn et al. (2025) find that for the average bank capital buffer requirement increases do not have a statistically significant effect on lending when monetary policy tightened. However, when accounting for cross-sectional heterogeneity in banks’ capital headroom (i.e., the distance between a bank’s capital ratio and its regulatory requirement), statistically significant contractionary effects were observed for banks with the smallest capital buffers – those in the bottom tercile of the capital headroom distribution. Following a 1 percentage point increase in capital buffer requirements, these more capital constrained banks reduced lending by about 1.3 to 1.8 percentage points for existing credit relationships more compared to their better-capitalized peers and were 2.5-4.4 percentage points less likely to establish new bank-firm relationships during the monetary policy tightening cycle.1 This reduction in lending volume also affected firms’ overall borrowing, indicating that firms could not easily offset reductions by borrowing from less capital-constrained banks.

Furthermore, we find that the tercile of banks with the smallest buffers were much more reluctant to pass higher policy interest rates on to their borrowers during the period of double tightening, possibly reflecting relationship-based (Berger and Udell, 1992; Petersen and Rajan, 1994) or zombie lending (Albuquerque and Mao, 2023). In addition, in a fast-rising interest rate environment, capital-constrained banks reduced risk-taking. Specifically, a 1 percentage point increase in capital buffer requirements resulted in a 4.5 percentage point reduction in the LTV ratios for newly originated loans following the monetary policy tightening. Finally, banks shifted away from loans secured by commercial real estate –reducing these loans by 1.3-2.1 percentage point for each percentage point increase in the combined buffer requirement – and toward those backed by liquid collateral such as securities or deposits – increasing these by about 6-8 percentage point for each percentage point increase in the combined buffer requirement.

Overall, our analysis shows that when considering and calibrating the combination of monetary and macroprudential policies as to their anticipated effects on the volume, cost, and riskiness of lending, it is crucial to account for the interaction between the two policies as well as for bank heterogeneity.

Albuquerque, B., Mao, C. 2023. The zombie lending channel of monetary policy. IMF Working Paper, No 2023/192. International Monetary Fund.

Behn, M., Pereira, A., Pirovano, M., Testa, A. 2024. A positive neutral rate for the countercyclical capital buffer – state of play in the Banking Union. Macroprudential Bulletin No 21. European Central Bank.

Behn, M., Claessens, S., Gambacorta, L., Reghezza, A. 2025. Macroprudential and monetary policy tightening: more than a double whammy? ECB Working Paper No. 3043.

Berger, A. N., Udell, G. F. 1992. Some evidence on the empirical significance of credit rationing. Journal of Political economy, 100(5): 1047 – 1077.

Petersen, M. A., Rajan, R. G. 1994. The benefits of lending relationships: Evidence from small business data. Journal of Finance, 49(1): 3-37.

These effects are economically meaningful, with the interaction between monetary and macroprudential policies for less capitalized banks accounting for about one-quarter of the combined contractionary impact on lending of the interest rate hikes and buffer requirement increases for the capital constrained banks.