Based on BIS Bulletin 114, “Financial channel implications of a weaker dollar for emerging market economies”. The views expressed in this publication are those of the authors and do not necessarily reflect the views of the BIS or its member central banks.

Abstract

Emerging market economies (EMEs) have been surprisingly resilient in the face of trade tensions in 2025. This resilience stems partly from a weaker US dollar, which provides a financial tailwind by strengthening the balance sheets of EME borrowers and global investors. The growing role of EME investors as net creditors in international markets, however, introduces a countervailing dynamic that could tighten financial conditions in the future. This policy brief explores the financial channels through which a weaker dollar impacts EMEs.

Economic activity in EMEs has held up well in 2025 despite higher US tariffs and elevated trade-related uncertainty. The depreciation of the US dollar – by approximately 5% against a basket of EME currencies between January and September – made an important contribution to this resilience (Maechler (2025)). While a weaker dollar can reduce trade competitiveness, it also tends to loosen financial conditions in EMEs and thereby support economic activity.

There are several ways in which EMEs may benefit from a depreciating dollar. For one, EME borrowers with unhedged US dollar-denominated debt benefit from a strengthening of their balance sheets as the local currency value of their liabilities decreases. This improves their creditworthiness and increases their demand for credit. For global banks, improvements in the creditworthiness of borrowers, in turn, reduce the banks’ exposure to credit risk, which allows them to expand their supply of dollar credit. This impact is known as the financial channel of the exchange rate (Bruno and Shin (2015)).

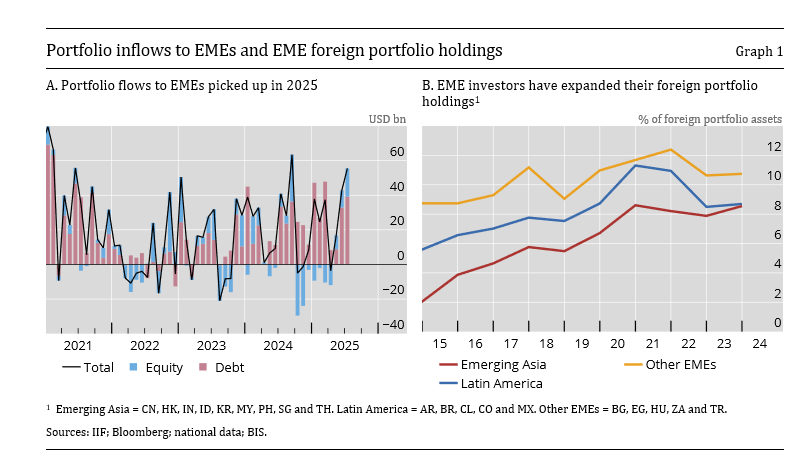

For foreign investors, a weaker dollar increases the dollar value of unhedged EME assets, such as equities and local currency bonds. This often results in stronger portfolio inflows, as was observed in 2025 (Graph 1.A), which loosens domestic financial conditions.

These dynamics have provided a boost to EMEs in 2025, particularly those that are less reliant on exports to the United States and that have significant short-term foreign currency debt, as they benefit most from the resulting reduction in funding costs.

A less explored but increasingly important aspect of the financial channel involves the impact of dollar depreciation on the balance sheets of EME investors (Juselius et al (2025)). As many EMEs transition into net creditor positions in international capital markets, their domestic investors have accumulated significant foreign currency-denominated assets, including US securities (Graph 1.B).

When the dollar depreciates, these investors face valuation losses on the unhedged portion of their foreign assets, which can lead to a tightening of domestic financial conditions. For example, Bagsic et al (2025) document this type of dynamic in the Philippines. Similar headwinds were also evident in April 2025, when shifts in currency hedging behaviour by EME investors amplified exchange rate volatility (Shin et al (2025)).

Exchange rate fluctuations can provide both tailwinds and headwinds for EMEs depending on the relative strength of the various financial channels. This highlights the importance of considering the implications of currency mismatches and hedging behaviour for balance sheets and risk taking. It also points to the influence of FX derivatives markets on financial conditions.

On balance, while dollar depreciation has benefited many EMEs in 2025, its evolving effects on domestic investors’ balance sheets suggest that the financial tailwind could turn into a headwind for economies transitioning to net creditor positions.

Bagsic, C, V Bayangos, R Moreno and H Parcon-Santos (2025): “The impact of currency depreciation and foreign exchange positions on bank lending: evidence from an emerging market”, Emerging Markets Review, vol 66.

Bruno, V and H S Shin (2015): “Cross-border banking and global liquidity“, Review of Economic Studies, vol 82, no 2, pp 535–64.

Juselius, M, P Wooldridge and D Xia (2025): “Financial channel implications of a weaker dollar for emerging market economies”, BIS Bulletin, no 114, October.

Maechler, A M (2025): “Tariffs in a world of large global capital flows – implications for central banks”, speech at Bruegel, Brussels, 23 September.

Shin, H S, P Wooldridge and D Xia (2025): “US dollar’s slide in April 2025: the role of FX hedging”, BIS Bulletin, no 105, June.