This Policy Brief is based on Bank of England Staff Working Paper No. 1,053. The views expressed are those of the authors and should therefore not be reported as representing the views of of their respective institutions.

At the onset of the Covid‑19 crisis, several regulatory authorities issued a recommendation or request to banks to restrict their dividend and share buyback distributions. This was to increase banks’ resilience by not distributing retained earnings, and help them support the real economy given their unique role in doing so and the singular circumstances brought by Covid‑19. We assess the effectiveness of these distribution restrictions in conserving capital to support lending. We find that restricted banks: i) increased their available capital and resilience, ii) increased their lending volumes on smaller loans to UK small and medium-sized enterprises, and iii) faced an increase in the required rate of return on their capital. The results indicate that distribution restrictions can be an effective crisis tool to increase banks’ resilience and lending capacity.

At the onset of the Covid-19 crisis in March 2020, several authorities issued a temporary distributions restriction recommendation or request, which urged banks to refrain from paying dividends, performing share buybacks and in some cases awarding staff cash bonuses. The purpose of this action was to encourage conservation of capital in these singular circumstances to support lending and in turn economic activity.

Did these restrictions achieve their objective, and did they have unintended consequences for banks? In Acosta-Smith et al. 2023, we empirically tackle this question by assessing the impact of the restrictions along three dimensions: i) banks’ capital and resilience, ii) banks’ lending, and iii) investors’ required rate of return on banks’ capital.

We make the following hypotheses. First, the restrictions should have increased banks’ resilience if they decided to retain at least part of the capital that otherwise would have been distributed. Second, they should have incentivised banks to maintain or increase lending. Third, they could have impacted investors’ required rate of return: on the one hand, since dividends and share buybacks affect investors’ willingness to hold equity (DeAngelo et al., 2009), their restriction could increase shareholders’ required rate of return (i.e. cost of equity); on the other hand, increased capitalisation reduces the riskiness of debt, lowering debtholders’ required rate of return (i.e. cost of debt) (Modigliani & Miller, 1958). The overall impact on the required rate of return on capital (i.e. cost of capital) will depend on which of the two effects dominates.

We conduct our analysis in two phases. First, to evaluate the effects of the policy on banks’ resilience and investors’ required rate of return, we use a bank-level panel dataset comprising 80 European banks in 21 countries (incl. UK), of which 70 restricted their distributions as a result of the policy and 10 did not. The latter group consists of banks that either were not subject to restrictions, or were not planning to make a distribution even though they were formally under restrictions, and serves as a counterfactual to the restricted group.

We then utilise a difference-in-differences (DiD) analysis to compare the outcomes of interest between the two groups of banks. For resilience, we use common equity Tier 1 (CET1) capital and the ratio of CET1 capital as a % of risk-weighted assets (RWAs). For shareholders’ required rate of return, we use the average of four dividend discount model estimates, as is common in the literature (Altavilla et al., 2021, Dick-Nielsen et al., 2022). For debtholders’ required rate of return, we use mid-yields of bank bonds traded in the secondary market, aggregated at the bank level (Arnould et al., 2022). We control for a host of bank and macroeconomic variables which could affect the outcomes of interest and banks’ propensity to make distributions.

Second, to evaluate the effects of the policy on banks’ lending outcomes, we use a proprietary dataset provided to the Bank of England by Experian, which contains the universe of loans issued by 9 UK banking groups to UK small and medium-sized enterprises (SMEs). We focus on this loan segment since SMEs were the most reliant on bank credit during the pandemic. We similarly utilise a DiD analysis and compare lending volumes between banks that were subject to the restrictions (4 banks) and those that were not (5 banks). We control for a host of bank and borrower characteristics, as well as other fiscal, monetary and prudential measures taken to support lending to the real economy during the crisis.

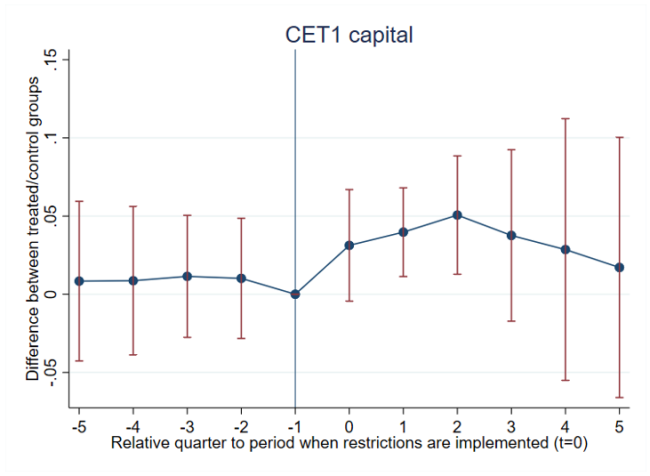

Figure 1 presents the DiD estimates for CET1 capital. The graph plots the DiD estimates for each quarter from the implementation of the restrictions (t = 0) until they are lifted, as well as for the quarters preceding the restrictions, denoted by negative values in the x-axis (pre and post periods are separated by the vertical blue line). The estimates include 95% confidence intervals, so they are significant at the 5% level if the red bands lie completely above or below the horizontal zero line.

We find that restricted banks increased their CET1 capital by up to 5.1% more compared to the unrestricted ones. As can be seen, prior to the introduction of the restrictions there was no significant difference between CET1 capital levels of the two groups of banks. However, after their introduction the difference became positive and gradually increased, peaking at 5.1% higher CET1 capital for the restricted banks compared to the unrestricted ones three quarters after (t = 2 in the graph). Thereafter, the difference decreased and became statistically insignificant. This coincides with the relaxation of the restrictions for most banks, which happened in Q1 2021 (t = 3 in the graph), when banks were allowed to make partial distributions based on their capitalisation and profitability. We find similar results when comparing banks’ CET1 ratios, driven by an increase in CET1 capital since changes in RWAs did not materially differ between the two groups.

Hence, the findings suggest that restricted banks increased their retained capital in every quarter of full restrictions and began to reduce it once distributions were allowed. This translated into higher resilience in nominal terms and relative to their risks.

Figure 1: Difference-in-differences estimation for CET1 capital

We first examined the impact of the restrictions on all non-government guaranteed SME loans, but found no significant effects. This would suggest that restricted banks did not increase lending volumes more relative to unrestricted ones as a result of the policy. However, their decision to retain part of the surplus capital as indicated by our previous results, may have led them to increase volumes only for smaller loans that are less capital-intensive. For this reason, we repeated the analysis by separating the effects of the policy for loans smaller and larger than £100,000 (the median loan value in our sample is c. £47,000).

Distinguishing between loan sizes reveals that restricted banks increased volumes for smaller loans by 34% more on average compared to unrestricted banks. This effect persisted while restrictions were fully in place, and became less significant once they were partly lifted, in line with our previous findings on resilience. We did not find evidence that the restricted banks increased their customer base or their aggregate lending, indicating that the policy worked mainly on existing loans and customer relationships.

We also find that distribution restrictions worked in tandem with government guarantees, with similar increases in loan volumes in the two segments. In addition, banks increased lending by similar amounts irrespective of their capital positions. This is an indication of their ability to support the real economy during stress. Hence, we find affirmative evidence of the success of distribution restrictions in increasing lending for existing borrowers.

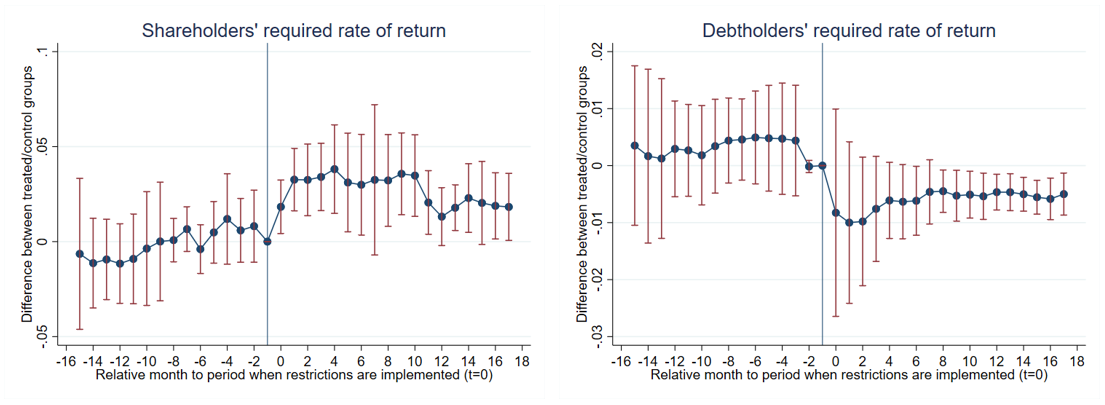

First, we find that distribution restrictions increased shareholders’ required rate of return by 2.7 percentage points (pps) on average throughout the implementation period. The left panel of Figure 2 presents the results. Prior to the introduction of the restrictions, we see no significant difference between the two groups. However, after their introduction, the difference became positive and statistically significant. After 12 months, the difference decreased, coinciding with the time when most banks resumed partial distributions (March 2021). However, the difference remained significant at 1.8 pps by the last month of restrictions.

Second, we find that distribution restrictions decreased debtholders’ required rate of return by -0.6 pps on average throughout the implementation period. As can be seen in the right panel of Figure 2, the difference became negative and significant after the introduction of the restrictions, peaking at -1 pp in the first three months of restrictions, before stabilising at around -0.5 pps thereafter.

The results are line with the theoretical predictions. However, on a weighted average basis, we find that the restrictions increased the required rate of return on banks’ overall capital by 1 pp throughout the implementation period. This indicates that the reduction in debtholders’ required rate of return did not perfectly offset the increase in shareholders’ one.

Figure 2: Difference-in-differences estimation for shareholders’ (left) and debtholders’ (right) required rate of return

Distribution restrictions were introduced at a singular historic period when there was immense uncertainty about the expected impact of Covid-19, and the wide range of outcomes that could unfold. Assessing the effects of this policy is important as policymakers try to evaluate whether it achieved its stated objectives and whether there were unintended consequences.

Our study confirms that distribution restrictions were effective at increasing resilience and incentivising lending. Although, it suggests that they also increased the required rate of return on banks’ capital. Taken together, we believe distribution restrictions were effective in supporting some lending types, and strengthening banks’ capital positions, during the Covid-19 stress. However, we note that the singular circumstances experienced in those times are not likely to occur during normal economic downturns.

Acosta-Smith, J., Barunik, J., Gerba, E., & Katsoulis, P. (2023). Moderation or indulgence? Effects of bank distribution restrictions during stress. Bank of England Staff Working Paper No. 1053.

Altavilla, C., Bochmann, P., De Ryck, J., Dumitru, A.-M., Grodzicki, M., Kick, H., . . . Palligkinis, S. (2021). Measuring the cost of equity of euro area banks. ECB Occasional Paper No. 254.

Arnould, G., Avignone, G., Pancaro, C., & Zochowski, D. (2022). Bank funding costs and solvency. European Journal of Finance, 28(10), 931-963.

DeAngelo, H., DeAngelo, L., & Skinner, D. J. (2009). Corporate Payout Policy. Now Publishers Inc.

Dick-Nielsen, J., Gyntelberg, J., & Thimsen, C. (2022). The Cost of Capital for Banks: Evidence from Analyst Earnings Forecasts. Journal of Finance, 77(5), 2577-2611.

Modigliani, F., & Miller, M. H. (1958). The Cost of Capital, Corporation Finance and the Theory of Investment. American Economic Review, 48(3), 261-297.