This policy brief is based on Banque de France Working Paper Series no. 988. The views expressed are those of the authors and not necessarily those of the institutions the authors are affiliated with.

Abstract

The Basel III agreement strengthened banking regulations after the 2008 crisis by introducing new solvency and liquidity requirements. An estimate based on 54 French banks since 2014 shows that these requirements have not restricted credit supply. Their interactions mitigated credit growth only in the case of the weakest banks during periods of financial stress. Based on a simple theoretical model of bank lending decision, we empirically analyse the interactions between these various regulatory requirements and the conditions under which some constraints may bind while others may not. Our results indicate a significant relationship of partial substitutability between the leverage ratio, the LCR and the NSFR but only for banks with lower regulatory ratios and only in periods of financial stress, resulting from the positive effect of bank own funds on their liquidity.

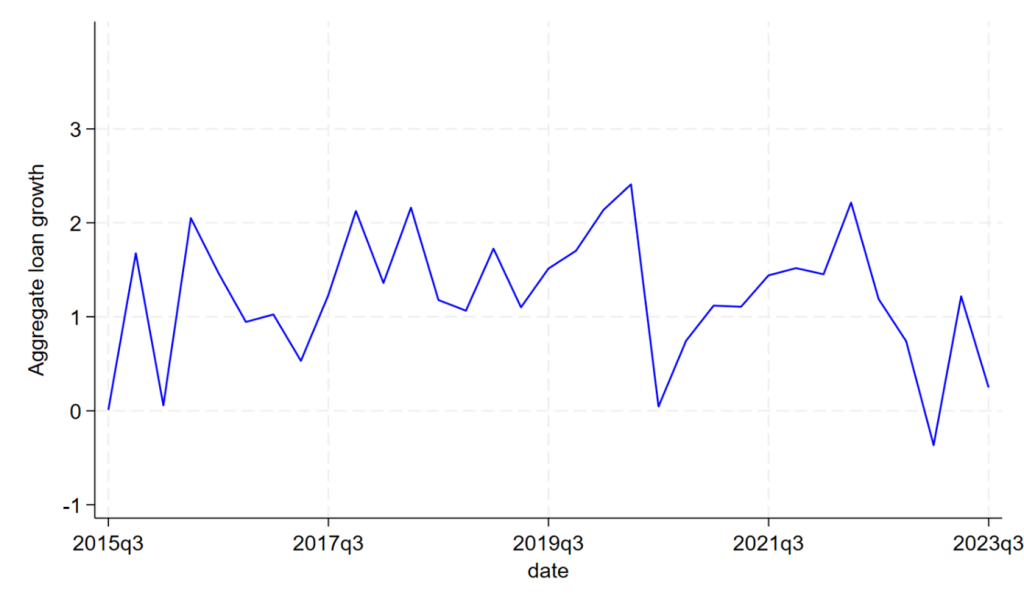

Chart 1. Growth in loans to the non-financial private sector since 2015 in France

Source: ACPR (54 French banks); authors’ calculations

Note: Loans to households and non-financial corporations granted by French banks (in %, quarterly growth).

The Basel III agreement, whose broad outlines were agreed upon in 2010 following the 2008 financial crisis, gradually implemented from 2012, has introduced a combination of bank solvency and liquidity standards for the first time at the international level. In addition to the pre-existing risk-weighted solvency ratio, for which the requirements have been tightened both quantitively and qualitatively, it includes a leverage ratio aimed at preventing an excessive increase in banks’ balance sheets relative to their equity, a short-term liquidity ratio aimed at ensuring that banks have sufficient liquid assets at 30 days to cover modeled cash outflows in stress situations (the Liquidity Coverage Ratio, LCR) and a one-year liquidity ratio (Net Stable Funding Ratio, NSFR), aimed at mitigating the transformation risk.

The banking industry has expressed fears about the potentially overly restrictive nature of these standards on banks’ credit supply and about the risks of activity fleeing to less regulated sectors. The individual impact of the various ratios has been the subject of several studies (notably De Nicolo et al. (2014), Behn et al. (2019) and Covas and Driscoll (2014)) which, on the whole, concluded that the current calibration of the ratios does not appear excessive. However, the economic literature has paid little attention to the combined effects of solvency and liquidity standards, due to the limited historical depth of the data, the time lags and anticipation effects associated with the gradual implementation and the conceptual difficulty of capturing interactions that come in addition to the individual effects of each ratio. By way of illustration, the solvency ratio, which weights bank exposures according to risk, encourages banks to increase their capital when they hold riskier assets. But it can also incentivize banks to hold more assets with less capital-intensive risk-weights, such as real estate financing, thus diverting them from financing the most productive activities. The leverage ratio, which does not take into account assets’ degree of risk, limits the excessive expansion of banks’ balance sheets but also encourages banks to hold relatively riskier assets for a given amount of capital. This is why the leverage ratio is a complementary ratio to the solvency ratio (a “backstop”); applying the two ratios simultaneously therefore eliminates their counterproductive effects compared to a situation where they would be applied individually.

Therefore, an exhaustive analysis requires the assessment of the compounded effect of both requirements as compared to the sum of the effects when each requirement is considered individually. The recent literature provides unconclusive elements and highlights conditional factors on the nature of the relationship (complementarity vs. substitutability) between the different regulatory ratios.

Torchiani et al. (2017) and Birn et al. (2017) both concluded that capital regulation and NSFR are substitutes because they all include capital at the numerator. Torchiani et al. (2017) found small interdependencies between Basel III ratios when analysing the capital and liquidity shortfalls of a sample of German banks. On their side, Birn et al. (2017) found that the Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR) are complements. Moreover, they showed that banks adjusted their balance sheets between 2011 and 2014 to reduce the size of their capital and liquidity shortfalls by disengaging from market assets while increasing credit to the non-financial sector.

Xing et al. (2020) stated that, among multiple regulations, which one binds for credit creation depends on banks’ balance sheet structure and business models. Kim and Sohn (2017) found that the effect of an increase in bank capital on credit growth is positively associated with the level of bank liquidity only for large banks and that the effect was larger during the global financial crisis period. Van den Heuvel (2019) quantified the effects of the two requirements on the liquidity provisions of banks, providing a useful indication of the relative macroeconomic costs, although requirements are taken separately rather than in interaction.

Empirical papers using Quantitative Impact Studies data provide mixed results. The results found by the BCBS Task Force on Evaluation (BCBS (2022)) from the analysis of the impact of Basel III reforms on banks’ capital and liquidity revealed few significant effects of their interactions on banks’ lending growth. Using proxy data, Buckmann et al. (2023) found that different requirements act in complementary ways to capture different sources of risk (namely riskiness, leverage and liquidity) and that a combination of a leverage ratio, a risk-weighted capital ratio and the NSFR correctly identifies a high proportion of failed banks during the global financial crisis or the European sovereign debt crisis. Finally, a more recent paper (Haq et al., 2025) emphasized a conflicting effect between capital an liquidity ratios as the authors find that higher capital increases idiosyncratic liquidity risk by decreasing cash and near-cash assets, raising fed funds sold, and reducing fed funds purchased, during crisis periods for US banks.

In a recent working paper (Clerc et al., 2025), we propose a joint model of the regulatory constraints introduced by Basel III and an estimation of the effect of the interactions of these standards on banks’ credit supply.

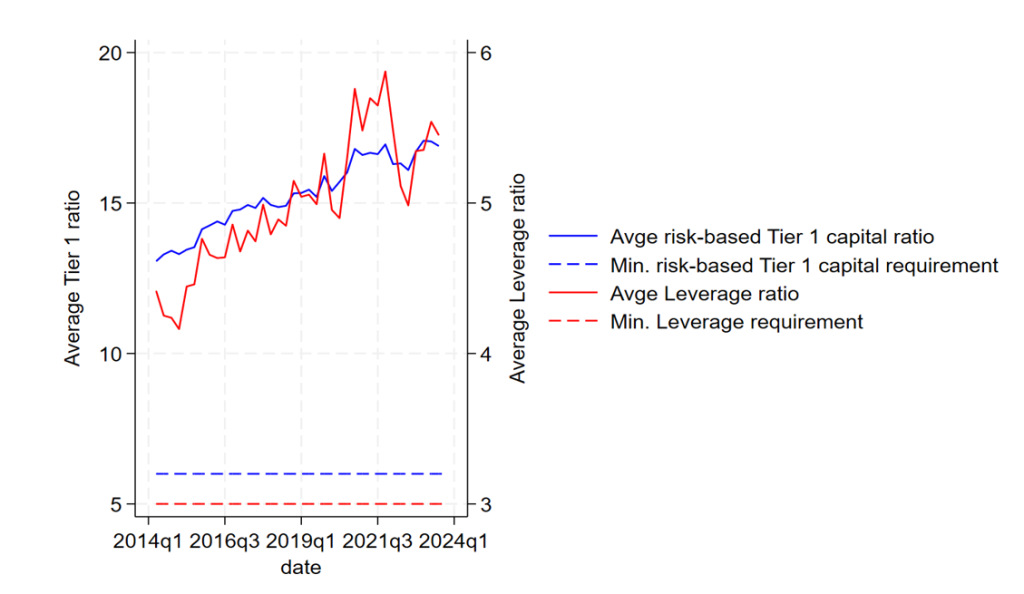

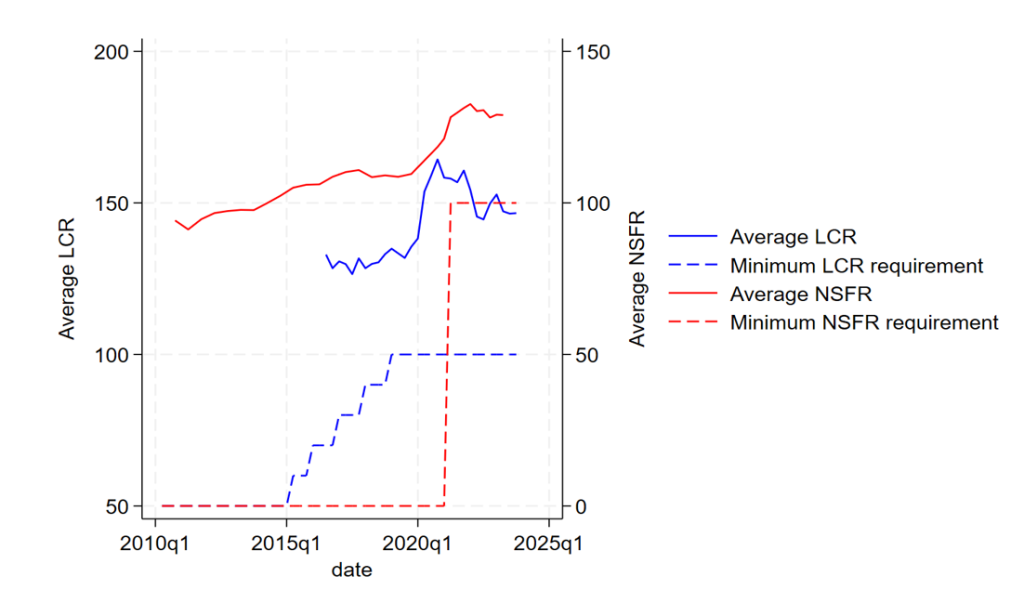

The idea that the implementation of Basel III would have led to significant credit rationing in France seems unlikely: except for a few exogenous shocks such as the Covid-19 pandemic, the growth of credit to the private sector has been consistently positive since the start of the implementation of Basel III (Chart 1). In addition, at the aggregate level, the requirements have not proven excessively restrictive for French banks, since on average the observed solvency and leverage ratios have consistently been at levels well above the regulatory minimums, even at the start of the period (Chart 2), since banks maintain a “management buffer” in order to permanently comply with the regulatory constraints. The same observation can be made for the two liquidity ratios (Chart 3). This finding shows that banks were granted a long enough phase-in period to adjust their balance sheets in response to Basel III new constraints.

Chart 2. Risk-weighted solvency ratio and leverage ratio since 2014 (%)

Source: ACPR (54 French banks); authors’ calculations

Chart 3. LCR and NSFR liquidity ratios since 2010 (%)

Source: ACPR (54 French banks); authors’ calculations

However, the degree of constraint may vary depending on the bank’s business model, the distance to the regulatory minimums and its position in the financial cycle. Based on a theoretical approach, we attempt to highlight the conditions under which one ratio would be more restrictive than another on the supply of credit.

As regards the interactions between the risk-weighted solvency ratio and the leverage ratio, our approach shows that the relative influence of these two ratios on credit supply depends on the average weighting of credit risks. Below a threshold value of the average risk weighting, the leverage ratio becomes more restrictive than the risk-based solvency ratio. Based on regulatory parameters, this threshold value is estimated at 35.3% (taking into account the capital conservation buffer of 2.5%, but not the Pillar 2 requirements, which vary according to each bank and over time), while the average risk weighting of French banks since 2014 has fluctuated between 28% and 34%. This result suggests that the leverage ratio is on average more restrictive than the risk-based capital ratio for French banks over the period. In the recent period, an analysis of the data on the distance of the observed ratios from the regulatory minimums shows that the risk-weighted solvency ratio (with its buffers) is more restrictive for certain French banks, especially when we take into account the bank-specific Pillar 2 requirements, and that the leverage ratio is more restrictive for others. The same exercise can be carried out to compare the effects of the LCR and the NSFR.

Based on this theoretical framework, we estimated an empirical model with fixed effects to analyse the joint effect of ratios taken two by two on banks’ credit supply. Our data cover the panel of 54 French banks providing consolidated reportings on a quarterly basis for the period 2014-2023, i.e. 570 observations. We seek to explain the impact on the growth of loans to the non-financial private sector (households + non-financial corporations) of the Basel III ratios taken two by two and their interactions by controlling for a number of economic and financial variables (in particular variables specific to each bank – other regulatory ratios, size of the bank, share of loans in the balance sheet, non-performing loan ratio, profitability, macroeconomic variables, and individual and time fixed effects). We define two ratios to be complementary when the combined effect of the two ratios, which considers their interaction, is greater than the sum of the individual effects. In this case, the coefficient of the interaction term is of the same sign as the coefficients of these same ratios taken individually. These ratios are considered (partially) substitutable otherwise. Given the expected positive effect of individual ratios on credit growth, it can be deduced that a positive effect of the interaction between two ratios reflects a complementarity relationship, while a negative effect of this interaction reflects a substitutability relationship between ratios.

Our results show that the interactions between the different Basel III ratios did not affect credit growth, except in the very specific periods of financial stress and only for the most fragile banks (i.e. the least capitalised and the least liquid). Indeed, these banks have lower management buffers above the minimum regulatory standards and are therefore more constrained by the combined effect of the various ratios. As a result, they display less dynamic credit growth during periods of financial stress. Our results are consistent with Behn et al. (2019), who also found that multiple regulatory constraints lead to a larger reduction in bank lending to non-financial agents, for the least liquid and least capitalized banks. However, our results do not support evidence on negative short-run effects of higher capital requirements on bank lending outside periods of financial stress.

In addition to the ratios considered in our study, the Basel III agreement has also introduced an “output floor”, which limits relative capital gains of banks using the internal model approach for the computation of their risk weighted assets. The implementation of this measure started in Europe in 2025. It could potentially interact with the leverage ratio since it consists in increasing the capital requirements of certain banks by limiting the effect of risk weighting.

Basel Committee on Banking Supervision (2022), Evaluating the impact and efficacy of the Basel III reforms, Basel committee report.

Behn, M., C. Daminato, and C. Salleo (2019). A dynamic model of bank behaviour under multiple regulatory constraints. European Central Bank Working Paper 2233.

Birn, M., M. Dietsch, and D. Durand (2017). How to reach all Basel requirements at the same time?, Autorité de Contrôle Prudentiel et de Résolution Débats économiques et financiers 28.

Buckmann, M., P. Gallego Marquez, M. Gimpelewicz, S. Kapadia, and K. Rismanchi (2023), The more the merrier? Evidence on the value of multiple requirements in bank regulation, Journal of Banking and Finance 149.

Clerc, L., S. Lecarpentier and C. Pouvelle (2025), Basel III joint regulatory constraints: interactions and implications for the financing of the economy, Banque de France Working Paper Series no. 988, July.

Covas, F. and J. Driscoll (2014). Bank liquidity and capital regulation in general equilibrium. Finance and economics discussion series.

De Nicolo, G., A. Gamba, and M. Lucchetta (2014). Microprudential regulation in a dynamic model of banking. Review of Financial Studies 27 (7).

Haq, M., N. Srivastava and Z. Wang (2025) Bank capital and liquidity risk: Influence of crisis and regulatory intervention, Review of Quantitative Finance and Accounting, https://doi.org/10.1007/s11156-025-01433-1

Kim, D. and W. Sohn (2017). The effect of bank capital on lending: Does liquidity matter?, Journal of Banking and Finance 77, 95–107.

Torchiani, I., T. Heidorn, and C. Schmaltz (2017). An integrated shortfall measure for Basel III, Deutsche Bundesbank Working Paper 26/2017.

Van den Heuvel, S. (2019). The welfare effects of bank liquidity and capital requirements, 2019 Meeting Papers from Society for Economic Dynamics 325.

Xing, X., M. Wang, Y. Wang, and H. Stanley (2020). Credit creation under multiple banking regulations constraints: The impact of balance sheet diversity on money supply, Economic Modelling 91, 720–735.