Disclaimer: This policy brief is based on ECB Working Paper No. 3078. This paper is part of the ChaMP Research Network. The views expressed in this policy brief are exclusively those of the authors and do not necessarily reflect those of the Eurosystem.

Abstract

The euro area credit markets display significant heterogeneity along various dimensions. Cross-country differences in the prevalence of fixed- and floating-rate loans are well documented, but a substantial variation also exists in rate fixation periods and reference rates. This variation results in bank lending rates being exposed to different segments of the risk-free rate yield curve which, in turn, influence their sensitivity to monetary policy changes. Countries where bank loans are tied to short-maturity benchmarks experienced larger rate increases during the ECB’s tightening cycle, though not purely mechanically, as banks partly offset this through lower premia. From a monetary policy perspective, these results reveal a previously less-explored source of heterogeneity in the pass-through of monetary policy decisions to bank lending rates that depends on variation in lending practices across euro area.

Although it is well known that credit markets across euro area member states are highly heterogeneous, the consequences of this diversity for monetary policy have been less clear. Our recent research (Vilerts et al., 2025) shows that the way loans are priced is central to understanding how policy changes are transmitted. Simply labelling contracts as fixed or floating is not enough: What matters is which part of the risk-free yield curve actually anchors the lending rate. For fixed-rate loans, this is the maturity of the contract at origination; for floating-rate loans, it is the maturity of the reference rate to which loan interest rate is tied.

This distinction matters because loans linked to shorter-maturity benchmarks respond far more strongly to policy rate changes than those tied to longer-term rates. In practice, this means that changes in key monetary policy interest rates can have very different effects across euro area countries, depending on their prevailing loan structures. Understanding these details is therefore crucial for policymakers who seek to assess the strength of monetary transmission across euro area countries.

To uncover how loan pricing shapes monetary transmission, we used the ECB’s AnaCredit dataset, which provides detailed information on loans to non-financial corporations (NFCs) across the euro area. The level of granularity allows us to look beyond crude aggregates and focus on the exact benchmarks that underpin lending rates of individual loans. We decompose the interest rate of each loan into two parts: the relevant risk-free rate, and a premium. For each loan we define the relevant risk-free rate as an OIS rate with a specific maturity derived from its characteristics: for fixed-rate loans – the loan’s maturity at origination, and for floating-rate loans – the maturity of the reference rate to which the loan is indexed.

By doing so, we can separate movements in lending rates that come “mechanically” from shifts in the risk-free rates from those that reflect banks’ own pricing decisions. This approach enables us to compare how the same policy decision translates into different outcomes across countries, depending on whether lending is tied to short- or long-maturity benchmarks.

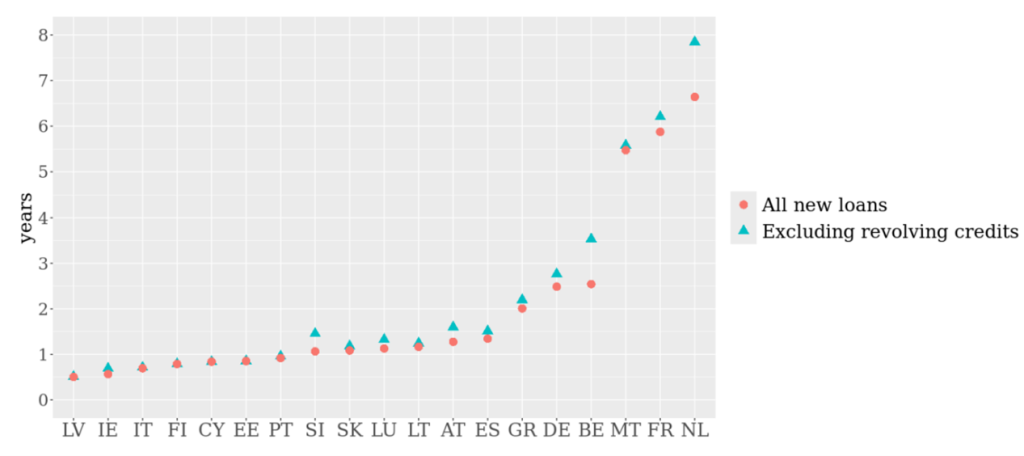

The AnaCredit evidence makes clear that the “euro area credit market” is not homogeneous. Lending practices differ markedly across member states. In countries such as Latvia, Lithuania, Cyprus, Finland, Estonia and Ireland, corporate borrowing is predominantly at floating rates, with interest rates tied to very short-term benchmarks, such as one- to six-month EURIBOR rates. By contrast, in the Netherlands, Belgium and Germany, most new loans are fixed-rate, often with a maturity of five years or longer. This divergence is also visible in the implied maturity of the risk-free rate that underpins loan pricing, which ranges from around six months in Latvia and Ireland to more than six years in France and the Netherlands (Figure 1). These structural differences mean that a common monetary policy decision transmits with varying strength across the euro area, depending on which segment of the risk-free yield curve dominates local lending.

Figure 1. Weighted average maturity of the relevant risk-free rate for the newly issued loans

to NFCs in euro area countries, 2022–2023

The ECB’s rapid policy tightening in 2022–2023 lifted short-term risk-free rates by nearly 450 basis points, while longer maturities moved by far less. As a result, in countries where lending rates are linked to short-term benchmarks, such as in Estonia or Italy, borrowing costs rose sharply. In contrast, in countries where longer-term benchmarks dominate, such as France or the Netherlands, the increase in corporate loan rates was more modest.

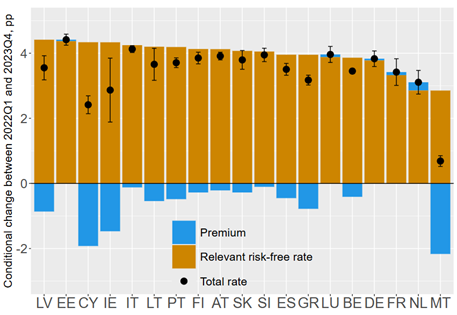

A closer look at the decomposition of lending rates into the two key components – the relevant risk-free rate and a premium – reveals that most of the rise in borrowing costs came from higher risk-free rates (Figure 2). Eleven countries experienced an increase in relevant risk-free rates exceeding 4pp, with Latvia and Estonia experiencing the highest increases at 4.37–4.41pp. In contrast, the Netherlands and Malta saw risk-free rates rising by only 2.85pp. It is important to note that these differences stem only from the varying maturities of the risk-free rates relevant for each country, as all euro area members share the same underlying risk-free rates.

Figure 2. Conditional changes in lending rates (first quarter of 2022 to fourth quarter of 2023) with 95% confidence bands and contributions from relevant risk-free rates and the premium

Another important observation is that the distinction between fixed- and floating-rate loans does not always provide a clear explanation for the observed patterns. For instance, the contribution of relevant risk-free rates was particularly pronounced in countries like Latvia and Ireland, where floating-rate loans with short fixation periods are more prevalent. However,, a strong contribution of risk-free rates was also observed in Italy, despite its higher reliance on fixed-rate loans, as these loans tend to have shorter maturities.

Yet, banks did not pass these shifts through mechanically. In several countries, the rise in relevant risk-free rates was offset by a decline in the premium, which moderated the overall increase in lending rates. This compensatory effect was particularly evident in countries where the relevant risk-free rates have very short maturities.

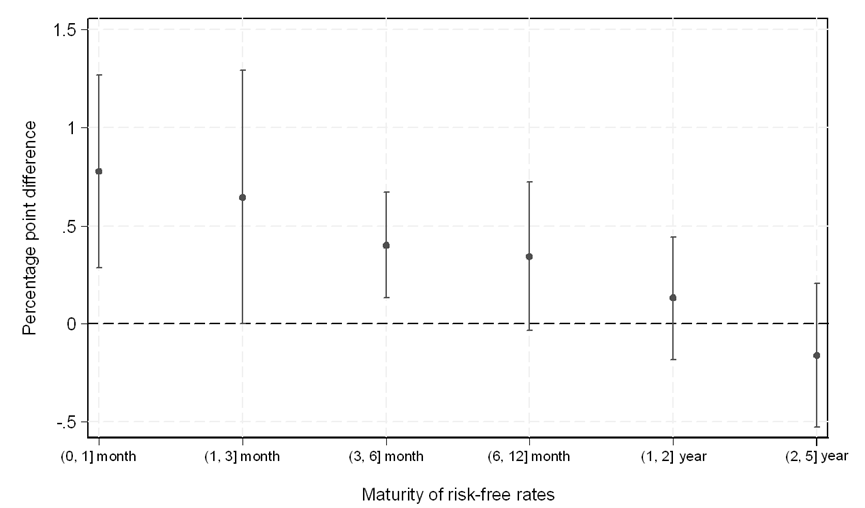

The analysis of lending rates around ECB Governing Council meetings, using high-frequency market surprises as instruments, reinforces these messages. Loans linked to very short-term benchmarks, such as overnight or one-month rates, reacted more strongly to unexpected policy measures than loans tied to five-year or longer maturities. In other words, the maturity of the relevant risk-free rate directly conditions how monetary surprises feed into corporate borrowing costs (Figure 3).

Figure 3. The figure shows the effect of a one percentage point increase in the deposit facility rate on lending rates of loans issued within 6 weeks before and 7-12 weeks after ECB GovC meetings relative to loans for which the relevant risk-free rates have maturities over five years

However, the difference in the strength of pass-through was less pronounced than it would have been under a purely “mechanical” pass-through of changes in the relevant risk-free rate. Even when the risk-free component surged after a policy surprise, premia often moved in the opposite direction, shielding borrowers from the full effect. This suggests that factors other than the maturity of the relevant risk-free rate might have helped to moderate – though not eliminate – the influence of the relevant risk-free rate on the transmission of monetary policy to lending rates.

The findings show that assessing monetary transmission requires more than distinguishing between fixed and floating loans. What matters is a set of characteristics that accounts for the maturity of the risk-free rate that is relevant for each loan. This, in turn, serves as a link between the impact of monetary policy on the shape of the risk-free yield curve and its effect on lending rates.

From a monetary policy perspective, these results are important as they reveal previously less-explored heterogeneity in the pass-through of monetary policy to lending rates within the single monetary union that depends on how monetary policy affects the shape of the yield curve.

Vilerts, K, S Anyfantaki, K Beᶇkovskis, S Bredl, M Giovannini, F M Horky, V Kunzmann, T Lalinský, A Lampousis, E Lukmanova, F Petroulakis and K. Zutis (2025), Details Matter: Loan Pricing and Transmission of Monetary Policy in the Euro Area, ECB Working Paper 3078.