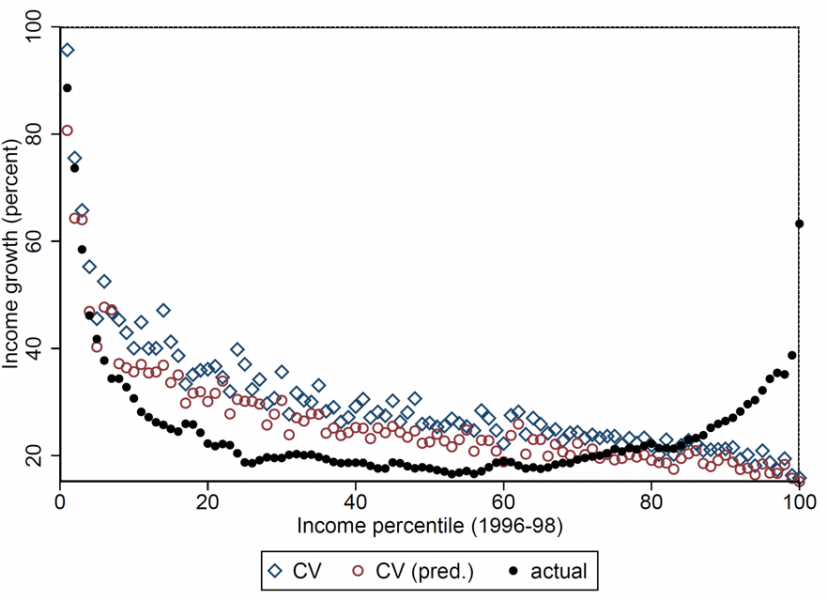

The data analysis is simplified in many ways, for example we cannot establish what share of income polarization is actually due to digitalization. Therefore, in the paper we go one step further: we build a model in which digitalization affects both the prices of consumer goods and the income that households receive. Calibrating the model to match key features of the US economy, we are able to quantify the welfare effects of digitalization. We find that rich households benefit substantially from digitalization, as their consumption has increased by almost 30% over the last 60 years, whereas poor households are hardly any better off. Changes in consumer prices accounts for about one fourth of the effect. It is therefore important to take price changes into account when thinking about welfare effects of digitalization.