The scale and duration of the macroeconomic effects of the transition to carbon neutrality will depend on the strategy chosen. A disorderly transition, caused by abrupt or poorly targeted public policies and by the reaction of the private sector, could lead to high volatility in the economic cycle and inflation. Using a suite-of-model approach, we assess the implications for the dynamics of activity and inflation of a set of short-term scenarios that reflect the diversity of climate transition shocks: increase in carbon and energy prices, increase in public or private investment in the low-carbon transition, increase in the cost of capital due to uncertainty, deterioration of confidence, accelerated obsolescence of part of the installed capital, etc. By considering multiple scenarios, we therefore account for the uncertainty around future political decisions regarding climate change mitigation. While a number of short-term scenarios being inflationary or even stagflationary, there are also factors that could curb inflation and boost economic growth.

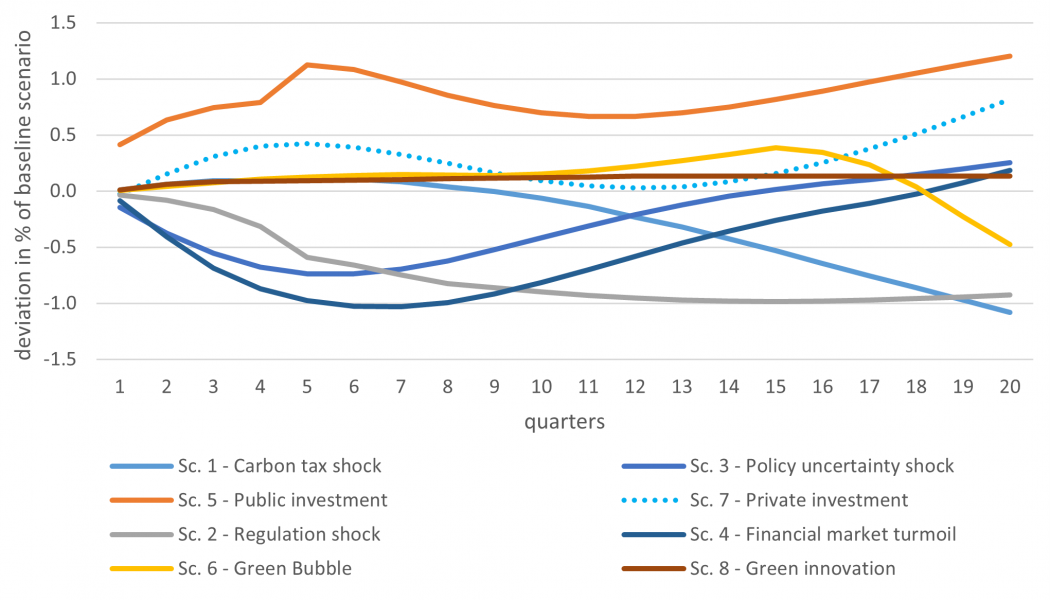

Chart 1: Impact of the eight scenarios on France’s GDP over a 5-year horizon

Note: Deviation of GDP level, as a % of the baseline scenario without transition. For example, in the public investment scenario, GDP would be 1.2% higher after 20 quarters than in the baseline scenario. Source: Authors’ calculations.

There is as yet no consensus on the macroeconomic consequences of transition policies. They will depend on the scale and timing of political decisions, and on the reactions of economic agents. On the one hand, it is difficult to predict the measures that will be implemented: the development of carbon pricing remains uncertain, estimates of the amount of investment needed for the transition vary and there is little consensus on how it will be financed. Furthermore, it remains difficult to anticipate changes in the behaviour of economic agents (consumers, financial players). Given these uncertainties, we have developed eight short-term scenarios (see Allen et al., 2023 for the methodology and the scenario database for the detailed data) to study how the various disruptions associated with the transition may affect growth, inflation and financial stability over a five-year horizon. These disruptions, which take the form of energy policies, investment booms, financial turbulence and innovation, are not mutually exclusive. Nevertheless, distinguishing between them provides a better understanding of the economic mechanisms at work: each scenario can be a simplified aspect of a more complex transition trajectory.

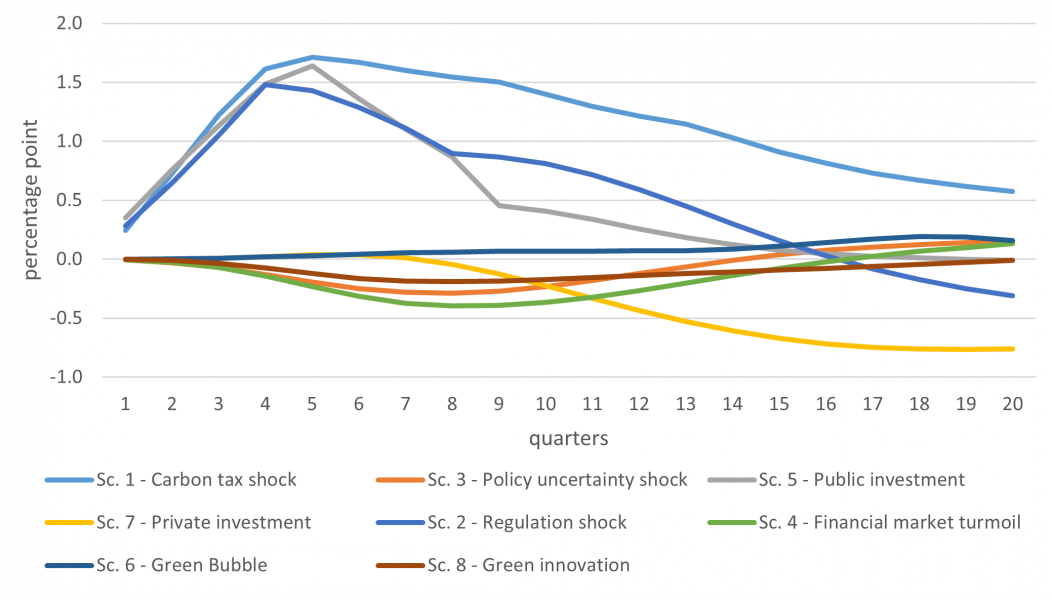

The economic consequences of these scenarios are estimated using a suite of models (see Allen et al., 2020, 2023) that includes New Keynesian macroeconomic models – NiGEM for the international part, FR-BDF for France (see Lemoine et al., 2020) – and a multi-country sectoral model (see Devulder and Lisack, 2020). The calibration of each scenario requires devising assumptions on the evolution of the models’ key variables (fossil fuel tax, cost of capital, credit spreads, productivity, etc.), inspired in part by the NGFS scenarios. The simulations show significant effects over a 5-year horizon, between -1.1% and +1.2% on France’s GDP depending on the scenario, and between -0.8 p.p. and +0.6 p.p. on inflation. The difference between these projections illustrates the volatility and uncertainty that the transition may induce in the short-term cycle.

We present here the results for France of simulations of three types of scenario: i) sudden introduction of environmental regulations, ii) financial turbulence linked to the sudden change in the valuation of carbon assets (“stranded” assets), and iii) investment policies in favour of transition.

A scenario involving the sudden and unanticipated introduction of strict limits on the quantities of fossil fuels consumed (scenario 2, inspired by the “Fit-for-55” European plan, but with targets set five years earlier), accompanied by subsidies for renewable energies, would lead to significant sectoral distortion. The aggregate effect in the short term would be negative, as the sudden restrictions would put an abrupt brake on activity, while the subsidies for renewable energies would take time to change production processes. GDP would fall by 1% over a two-year horizon compared with a scenario without a transition policy, due in particular to the additional effect of the drop in foreign demand. Subsidies would only partially offset these recessionary effects, and more so at the end of the horizon. Inflation would be higher in the short term (up 1.5 p.p. after one year) but would then decline.

The transition could also involve a devaluation of assets depending on their exposure to changes in environmental legislation or technologies (scenario 4). This scenario would lead to a sharp fall in stock market indices (down 23% from the start of the scenario). In addition, GDP would drop by 1% after five quarters, but France would be less affected than countries such as the United States or Canada, which have a higher proportion of stranded assets.

A third scenario could involve a rapid increase in corporate investment, generated here by subsidies to the private sector financed by a rise in household taxes (scenario 7). This scenario is partly based on International Energy Agency projections of the additional annual investment needed to achieve carbon neutrality by 2050 (1.2 GDP points for France), which is lower than the amount estimated by J. Pisani-Ferry and S. Mahfouz in their recent report (2.3 GDP points). This trajectory leads to productivity gains and an increase in production, with no significant crowding-out effect between investments. However, the impact on GDP is weak at the start of the horizon due to the fall in household consumption. At the end of the horizon, on the other hand, productivity gains result in a 0.8% rise in GDP and disinflationary effects.

The five other scenarios offer variants that differ according to the assumptions made about transition policies or economic agents’ behaviour. Presented in detail in Allen et al. (2023), they provide a range of plausible effects on growth and inflation.

Chart 2: Impact of the eight scenarios on French inflation over a 5-year horizon

Note: Impacts on the year-on-year harmonised index of consumer prices, as a percentage point deviation from the baseline scenario without a transition policy. For example, in the carbon tax scenario, inflation in France would be 1.7 p.p. higher after six quarters. Source: Authors’ calculations.

While each scenario produces moderate impacts on GDP compared with recent crises (the 2008 crisis or the Covid-19 crisis), these disruptions are likely to be cumulative or follow one another, thus complicating the implementation of transition policies. Economic decision-makers therefore have a role to play in preventing these disruptions or minimising their consequences.

First, appropriate market incentives are needed. Central banks have a major role to play by greening their operations and thereby sending the right signals to the markets (Villeroy de Galhau, 2023). This will make it possible to limit green bubble or financial stress scenarios that would result from the market’s incorrect assessment of climate risk.

Second, if it puts the right incentives in place, Europe has the capacity to finance its ambitious climate transition. Public and private investment scenarios show orders of magnitude that are achievable without any major adverse impact on inflation and GDP, which stabilise rapidly.

Finally, the scenarios of a disorderly and unanticipated transition could lead to successive shocks and greater price volatility. This context would call for greater vigilance on the part of monetary policy with regard to the risks of inflation or deflation, or the de-anchoring of inflation expectations.